This version of the form is not currently in use and is provided for reference only. Download this version of

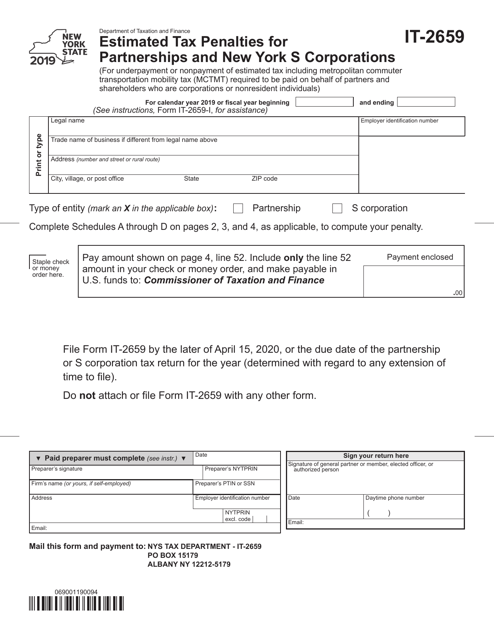

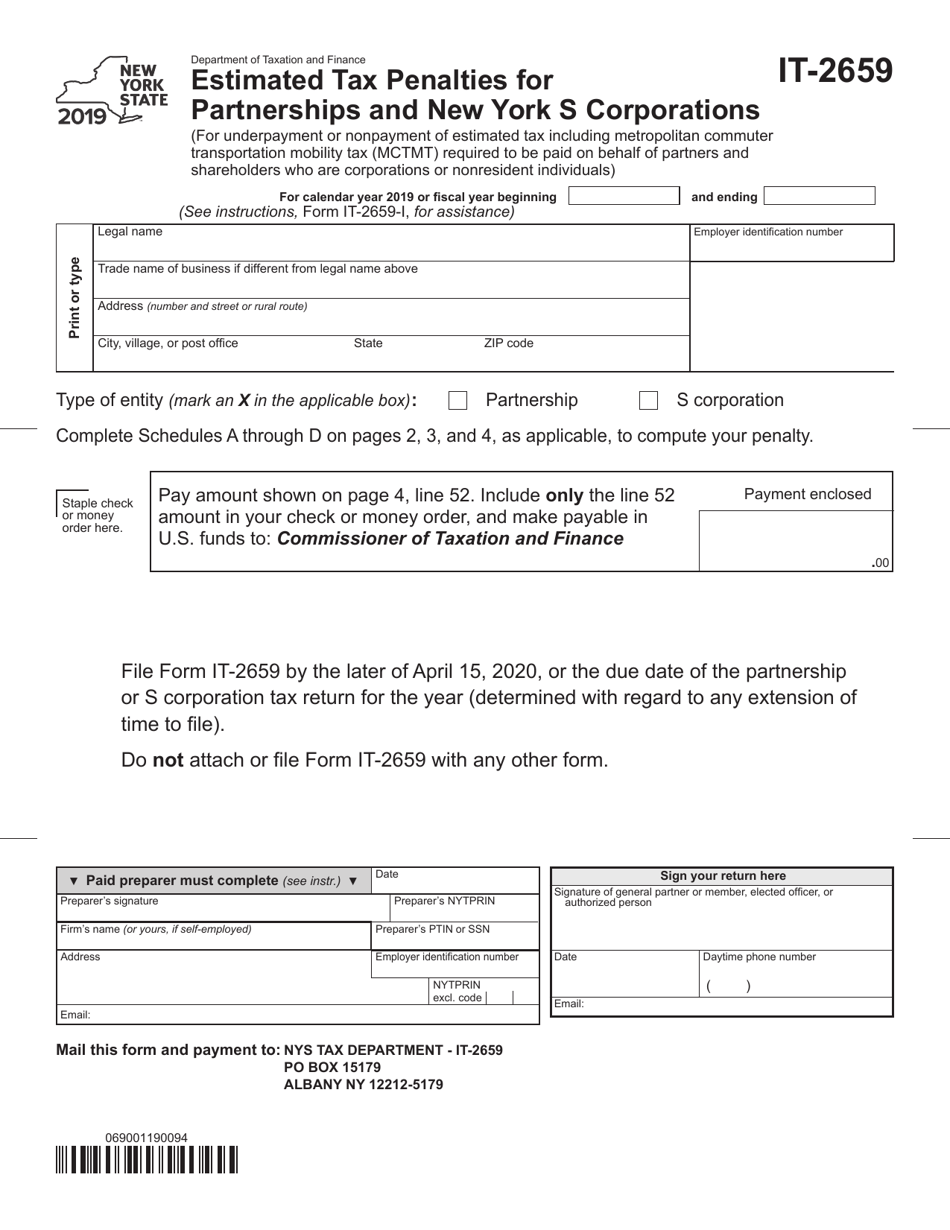

Form IT-2659

for the current year.

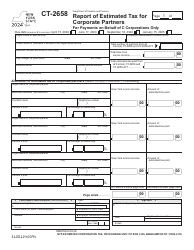

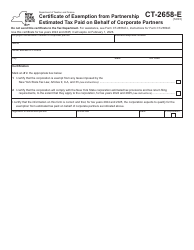

Form IT-2659 Estimated Tax Penalties for Partnerships and New York S Corporations - New York

What Is Form IT-2659?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-2659?

A: Form IT-2659 is the form used by partnerships and New York S corporations to report and pay estimated tax penalties in New York.

Q: Who needs to file Form IT-2659?

A: Partnerships and New York S corporations are required to file Form IT-2659 if they owe estimated tax penalties in New York.

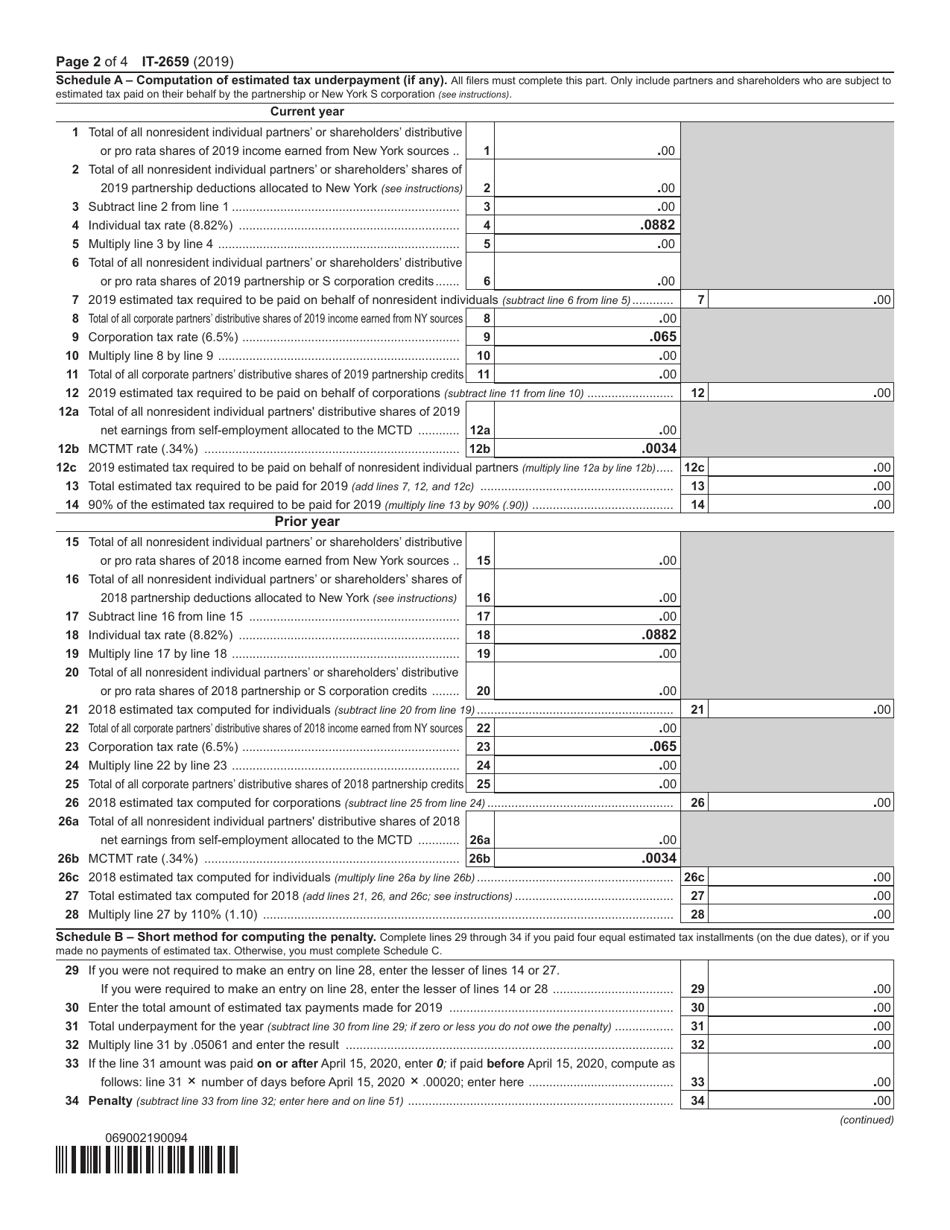

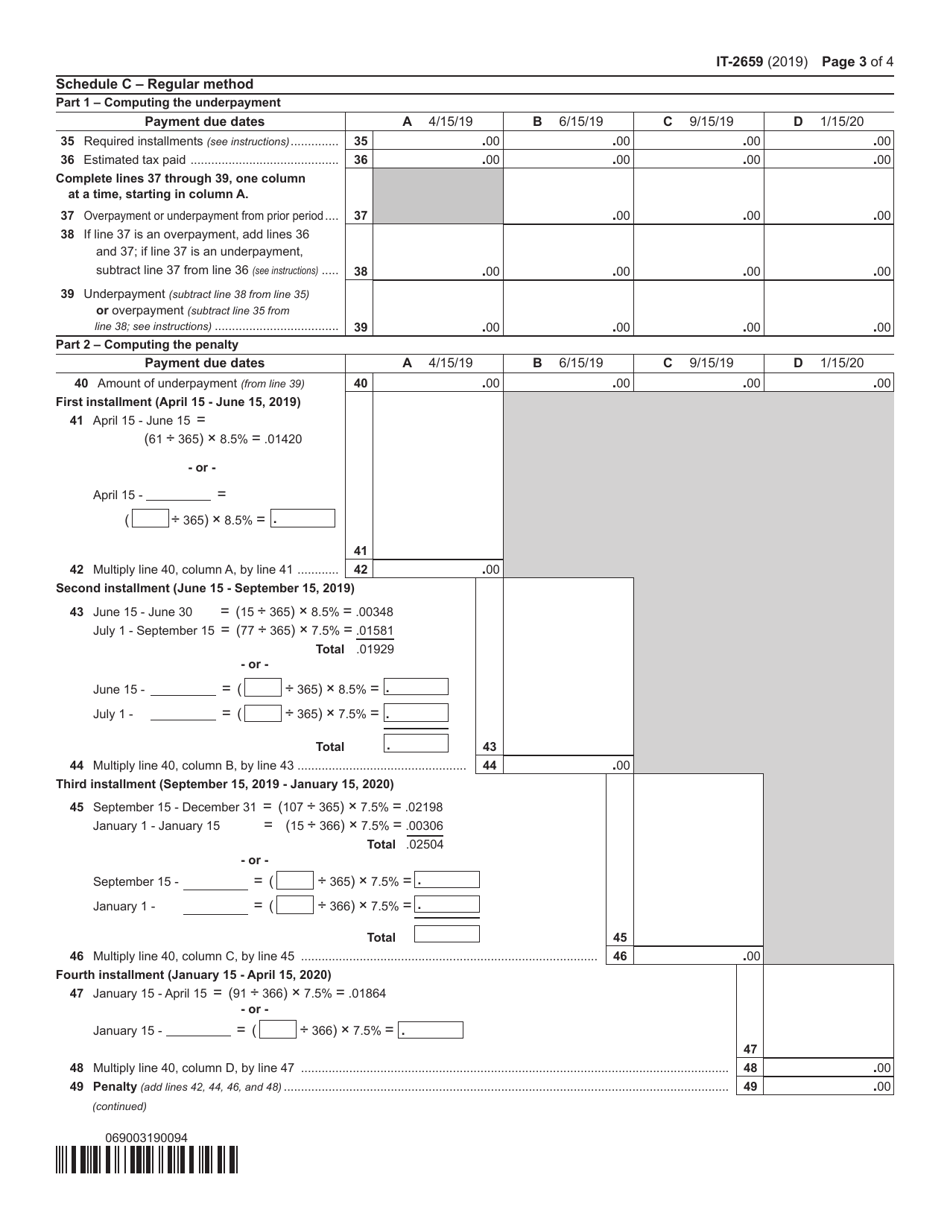

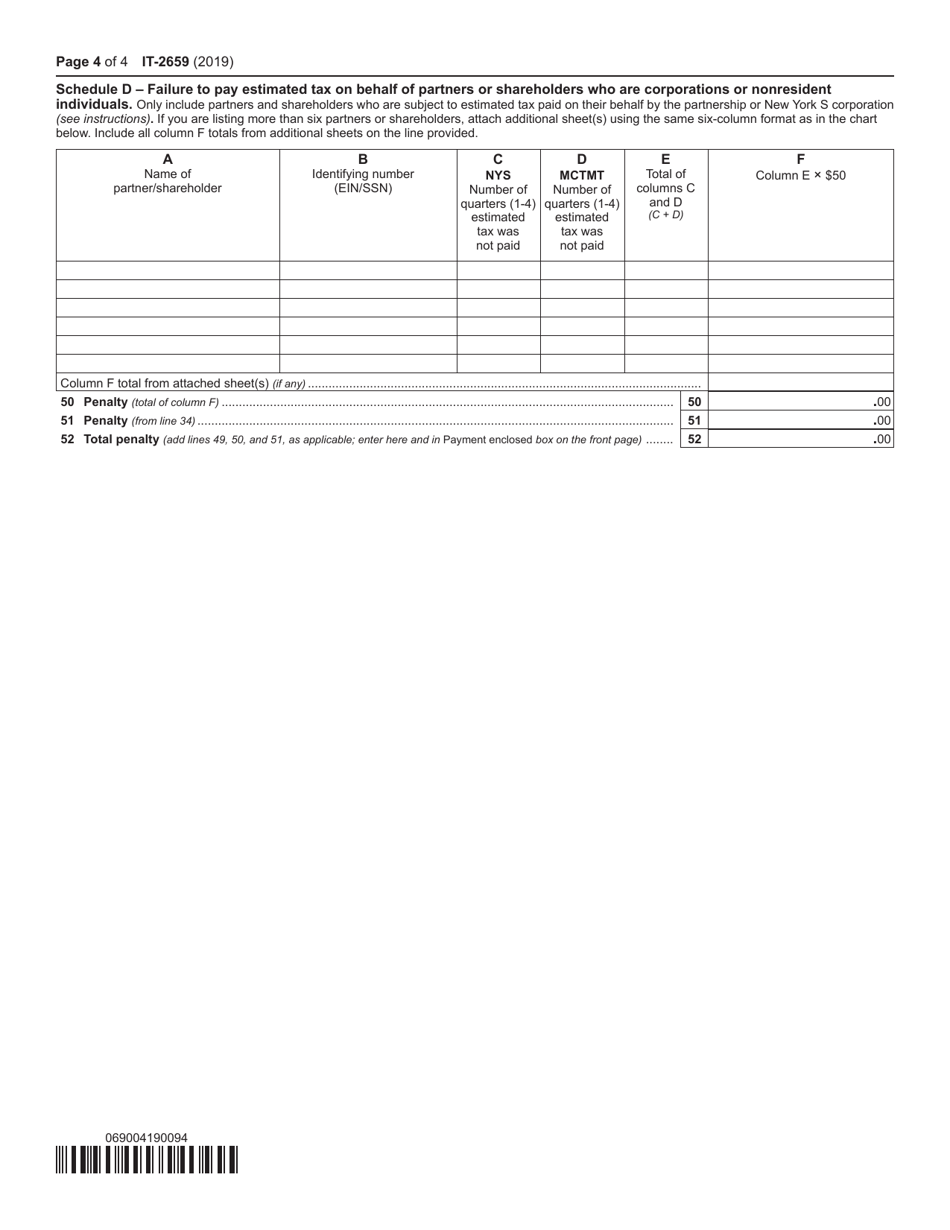

Q: What are estimated tax penalties?

A: Estimated tax penalties are additional payments that partnerships and New York S corporations must make if they underpaid their estimated tax throughout the year.

Q: How often should Form IT-2659 be filed?

A: Form IT-2659 should be filed annually, along with the partnership or New York S corporation's tax return.

Q: What happens if Form IT-2659 is not filed?

A: If Form IT-2659 is not filed, partnerships and New York S corporations may be subject to penalties and interest on the underpaid estimated tax.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2659 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.