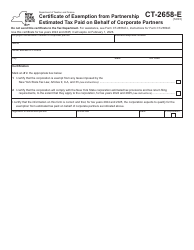

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-2658-E

for the current year.

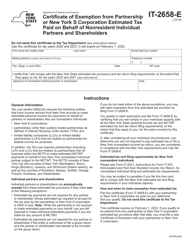

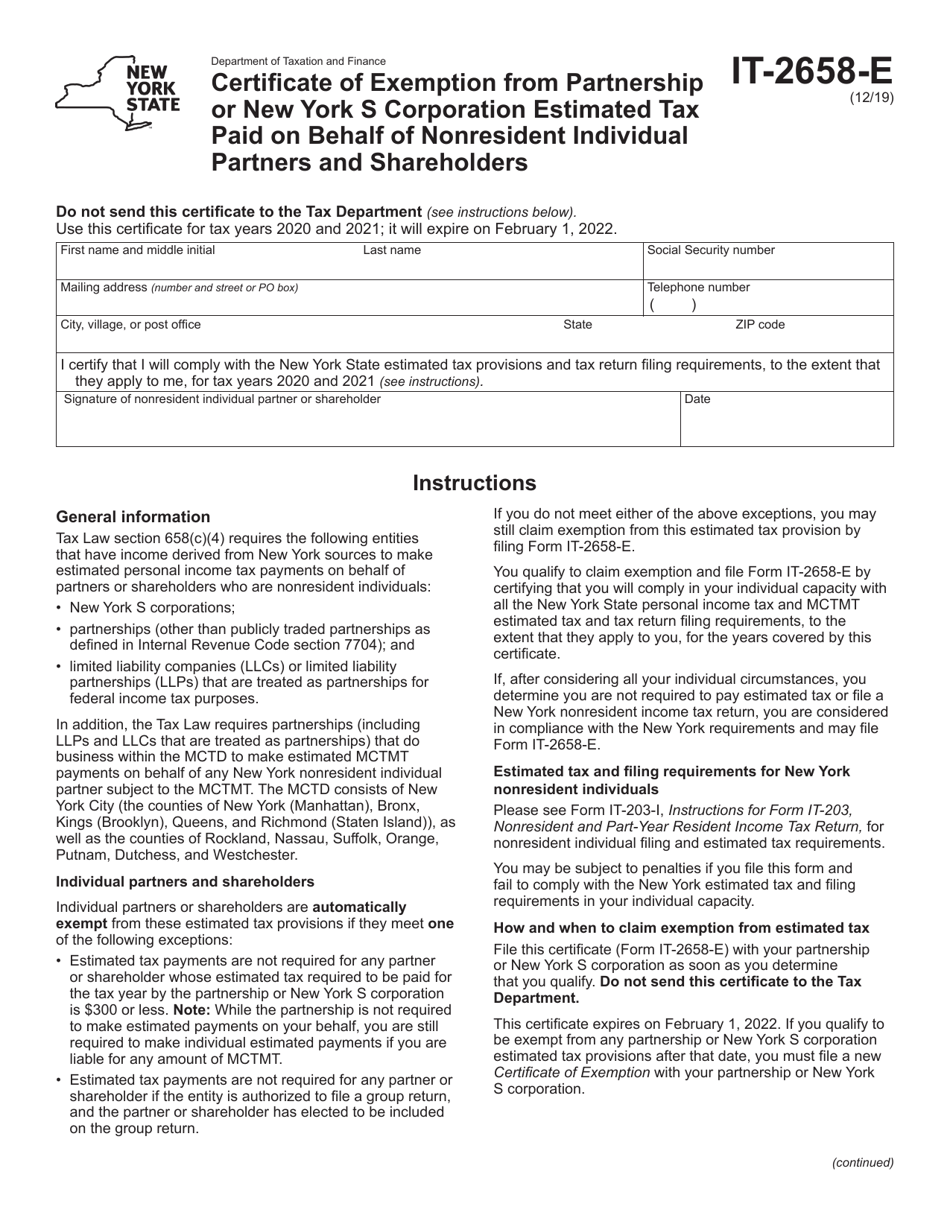

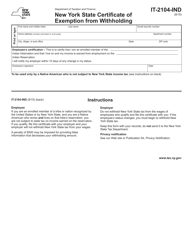

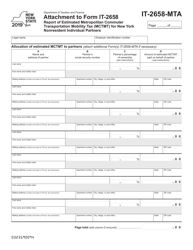

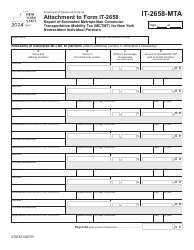

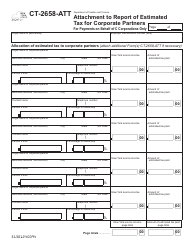

Form IT-2658-E Certificate of Exemption From Partnership or New York S Corporation Estimated Tax Paid on Behalf of Nonresident Individual Partners and Shareholders - New York

What Is Form IT-2658-E?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-2658-E?

A: Form IT-2658-E is a Certificate of Exemption From Partnership or New York S Corporation Estimated Tax Paid on Behalf of Nonresident Individual Partners and Shareholders.

Q: Who needs to file Form IT-2658-E?

A: Partnerships or S corporations in New York may need to file Form IT-2658-E if they have nonresident individual partners or shareholders.

Q: What is the purpose of Form IT-2658-E?

A: The purpose of Form IT-2658-E is to certify that the partnership or S corporation has paid estimated tax on behalf of its nonresident individual partners or shareholders.

Q: Is Form IT-2658-E for individuals or businesses?

A: Form IT-2658-E is for businesses (partnerships or S corporations) that have nonresident individual partners or shareholders.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2658-E by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.