This version of the form is not currently in use and is provided for reference only. Download this version of

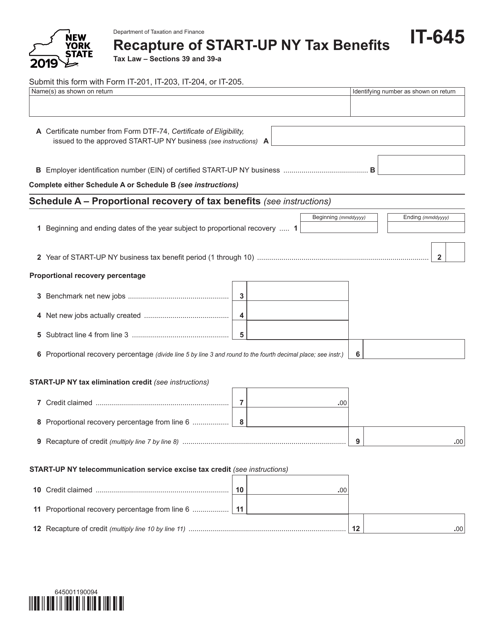

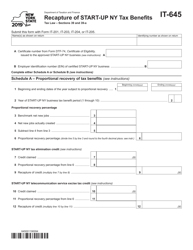

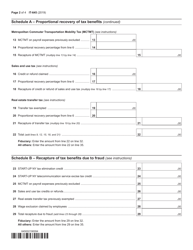

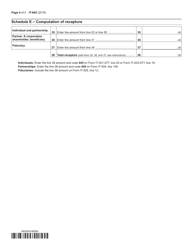

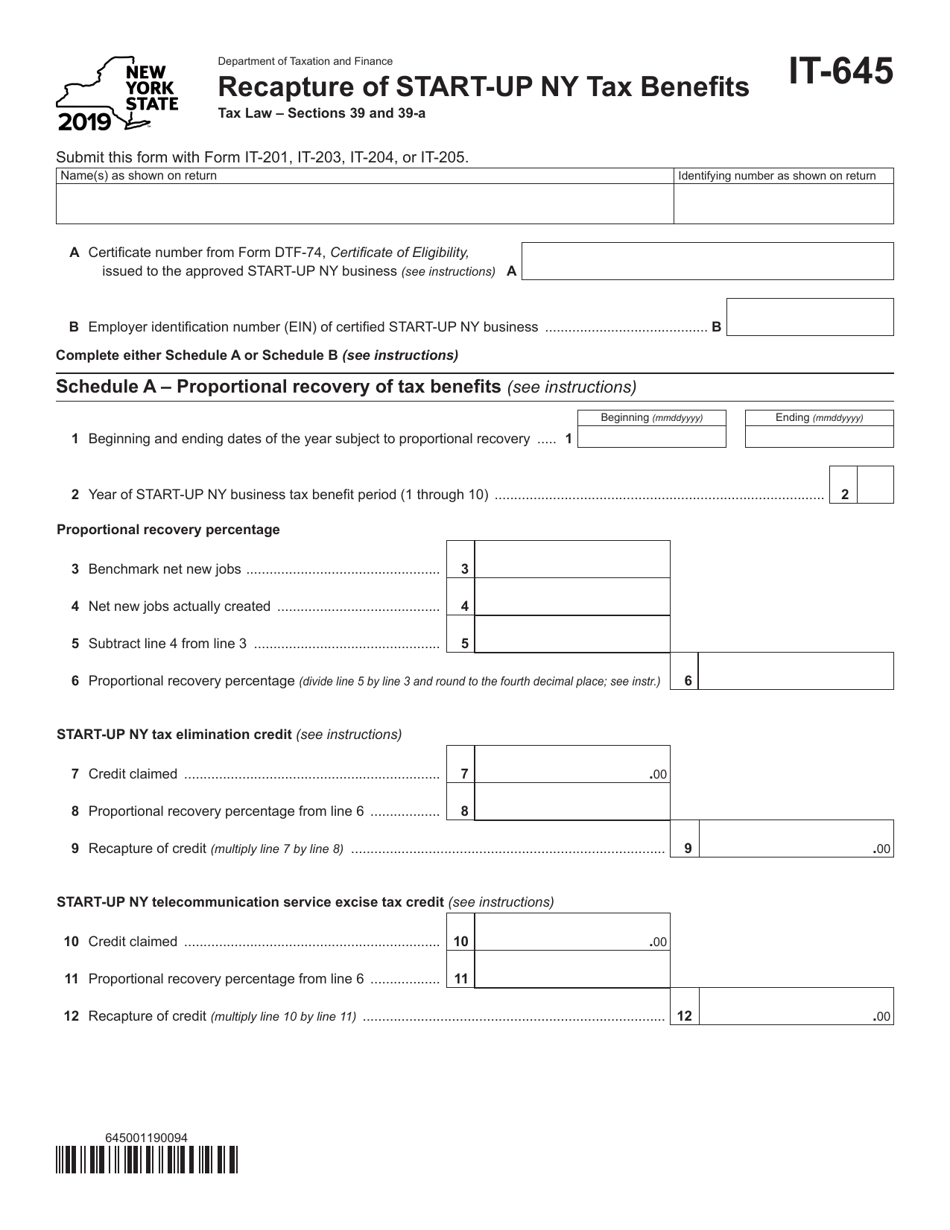

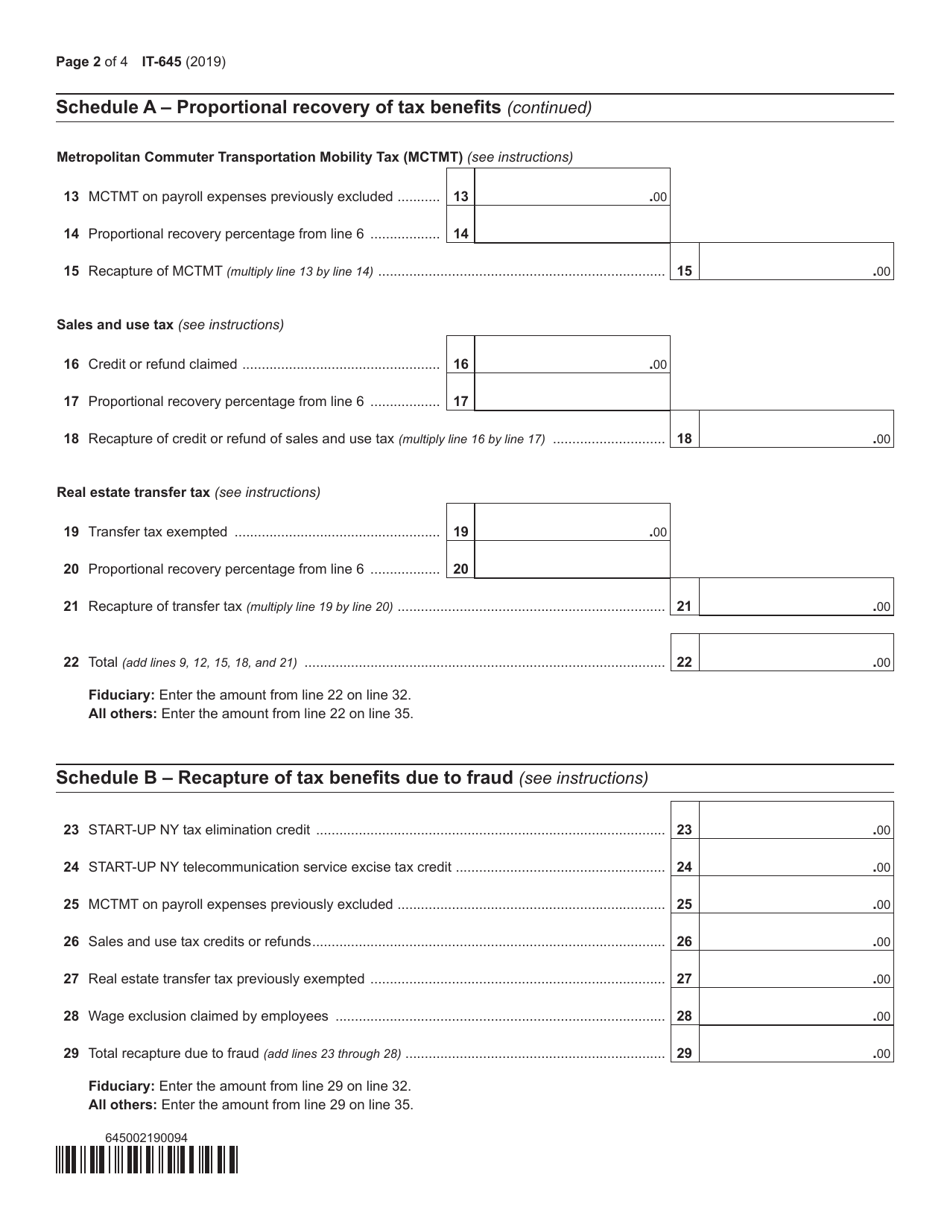

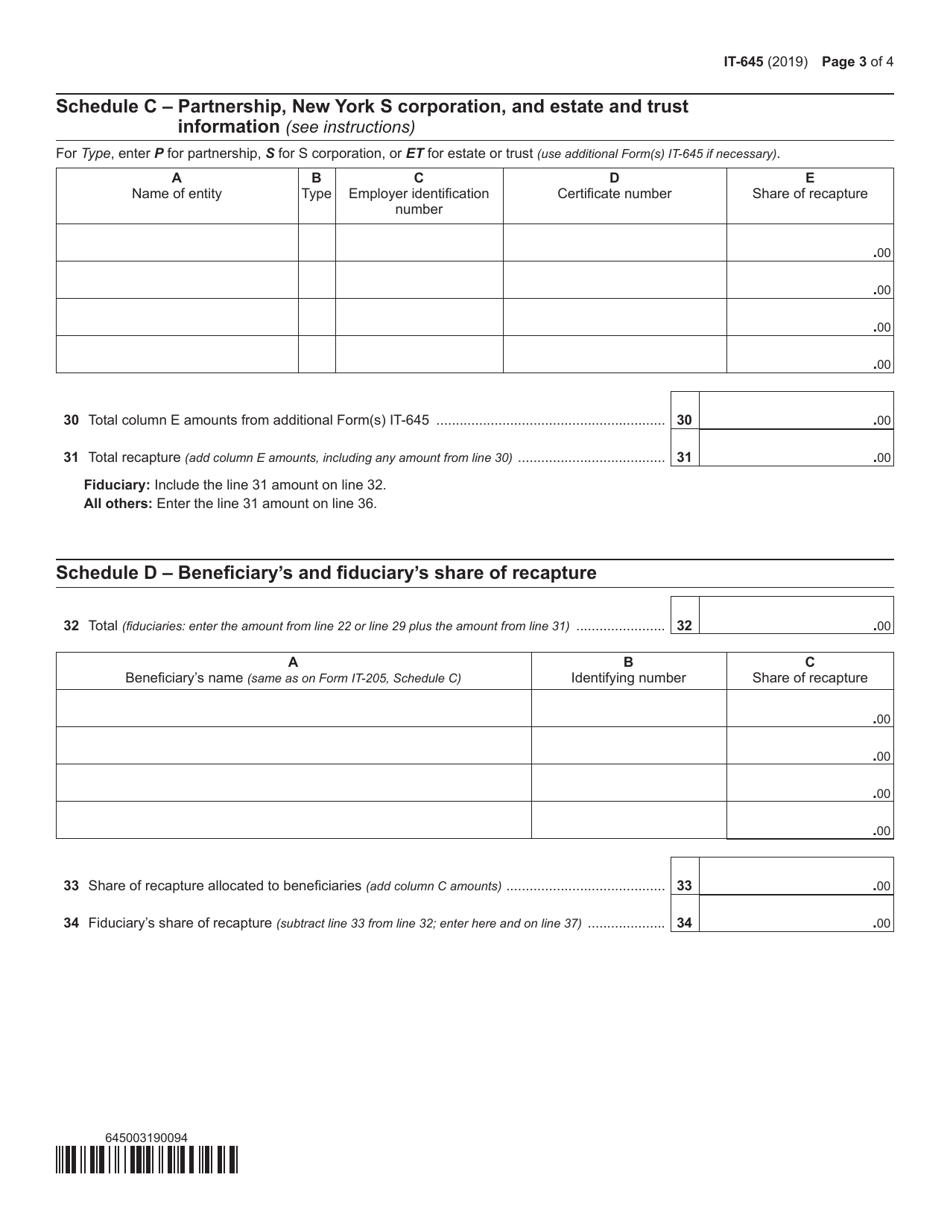

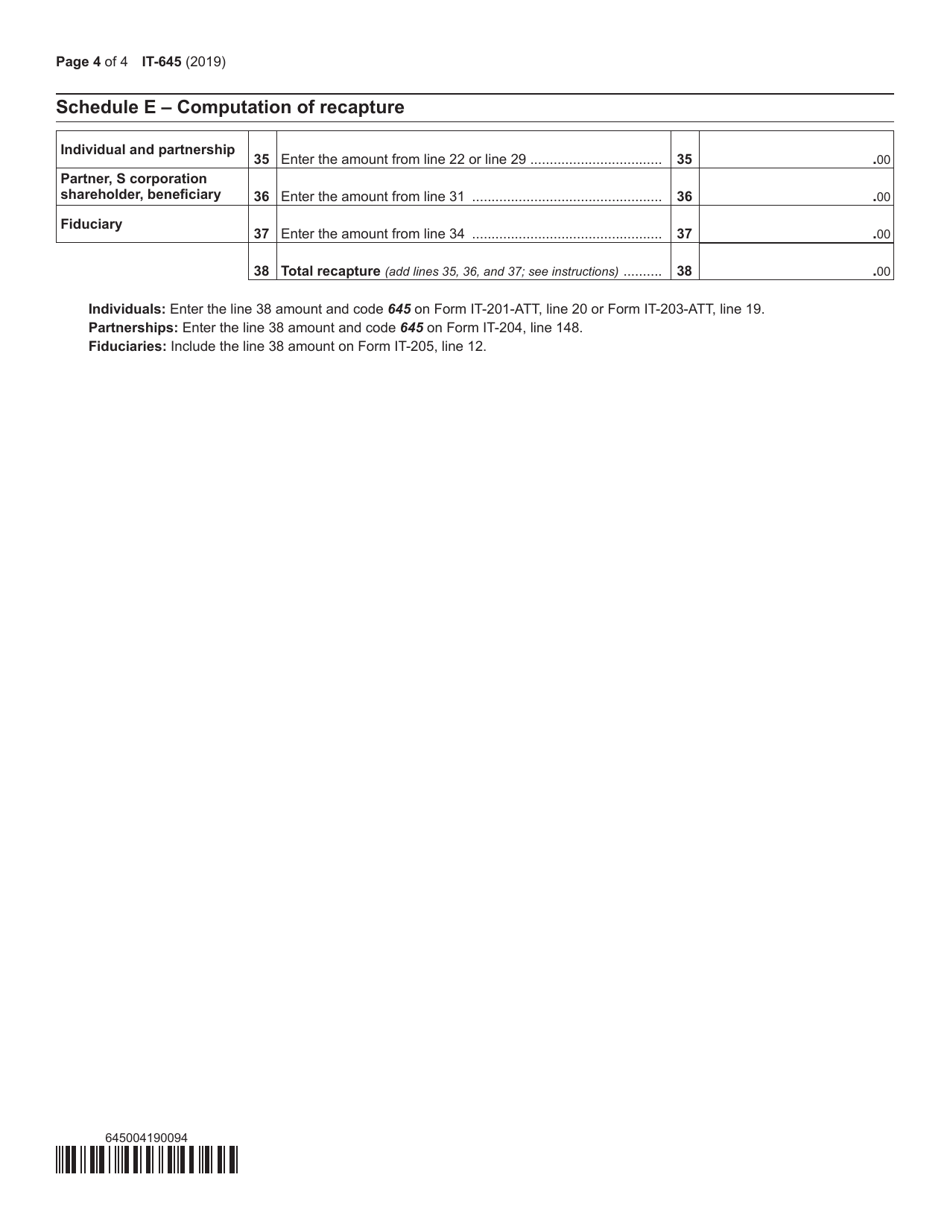

Form IT-645

for the current year.

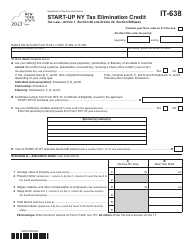

Form IT-645 Recapture of Start-Up Ny Tax Benefits - New York

What Is Form IT-645?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-645?

A: Form IT-645 is a tax form used in New York to recapture start-up NY tax benefits.

Q: What are start-up NY tax benefits?

A: Start-up NY tax benefits are tax incentives provided by the state of New York to eligible businesses.

Q: Who needs to use Form IT-645?

A: Businesses that have claimed start-up NY tax benefits and need to recapture those benefits must use Form IT-645.

Q: What is the purpose of Form IT-645?

A: The purpose of Form IT-645 is to calculate and recapture any start-up NY tax benefits that may need to be reversed.

Q: How do I fill out Form IT-645?

A: You will need to provide information about your business and calculate the amount of start-up NY tax benefits that need to be recaptured.

Q: When is Form IT-645 due?

A: Form IT-645 is usually due on or before the due date of the business tax return for the tax year in which the start-up NY tax benefits were claimed.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-645 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.