This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-611.1

for the current year.

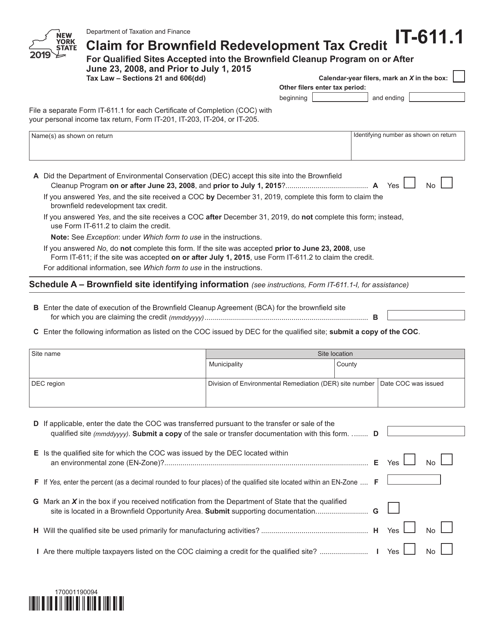

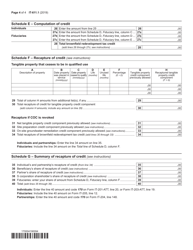

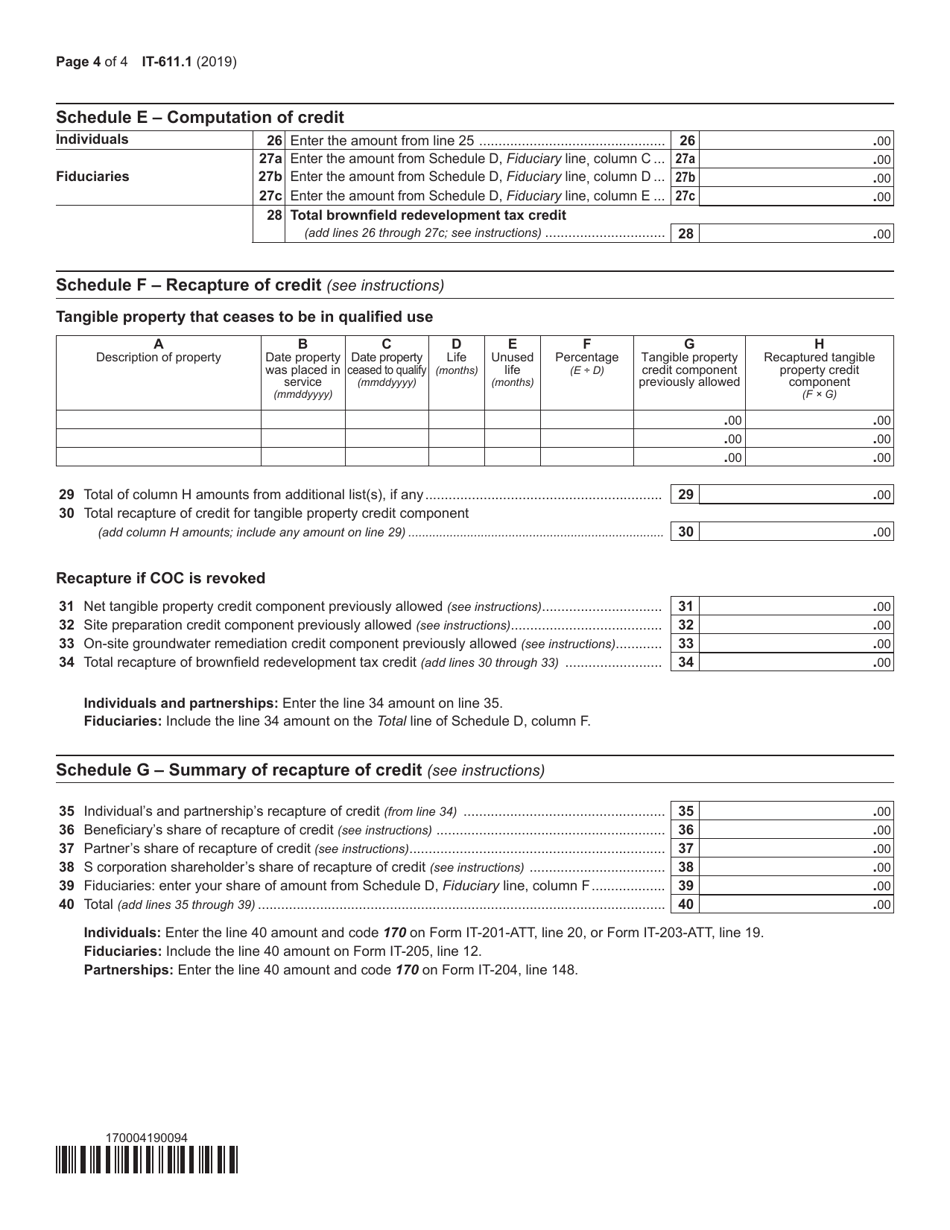

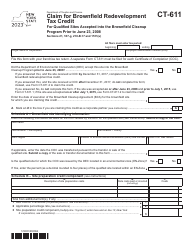

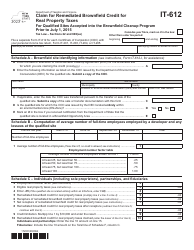

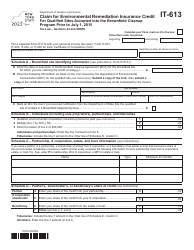

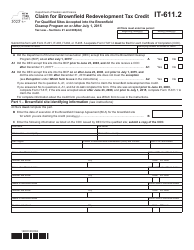

Form IT-611.1 Claim for Brownfield Redevelopment Tax Credit for Qualified Sites Accepted Into the Brownfield Cleanup Program on or After June 23, 2008, and Prior to July 1, 2015 - New York

What Is Form IT-611.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-611.1?

A: Form IT-611.1 is a claim for Brownfield RedevelopmentTax Credit for Qualified Sites Accepted Into the Brownfield Cleanup Program on or After June 23, 2008, and Prior to July 1, 2015 in New York.

Q: What is the purpose of Form IT-611.1?

A: The purpose of Form IT-611.1 is to claim the Brownfield Redevelopment Tax Credit for qualified sites accepted into the Brownfield Cleanup Program in New York.

Q: Who can use Form IT-611.1?

A: Form IT-611.1 can be used by individuals or entities who have qualified sites accepted into the Brownfield Cleanup Program in New York.

Q: What is the qualifying period for Form IT-611.1?

A: The qualifying period for Form IT-611.1 is on or after June 23, 2008, and prior to July 1, 2015.

Q: Can I claim the Brownfield Redevelopment Tax Credit for sites accepted into the Brownfield Cleanup Program after July 1, 2015?

A: No, Form IT-611.1 is specifically for sites accepted into the Brownfield Cleanup Program prior to July 1, 2015.

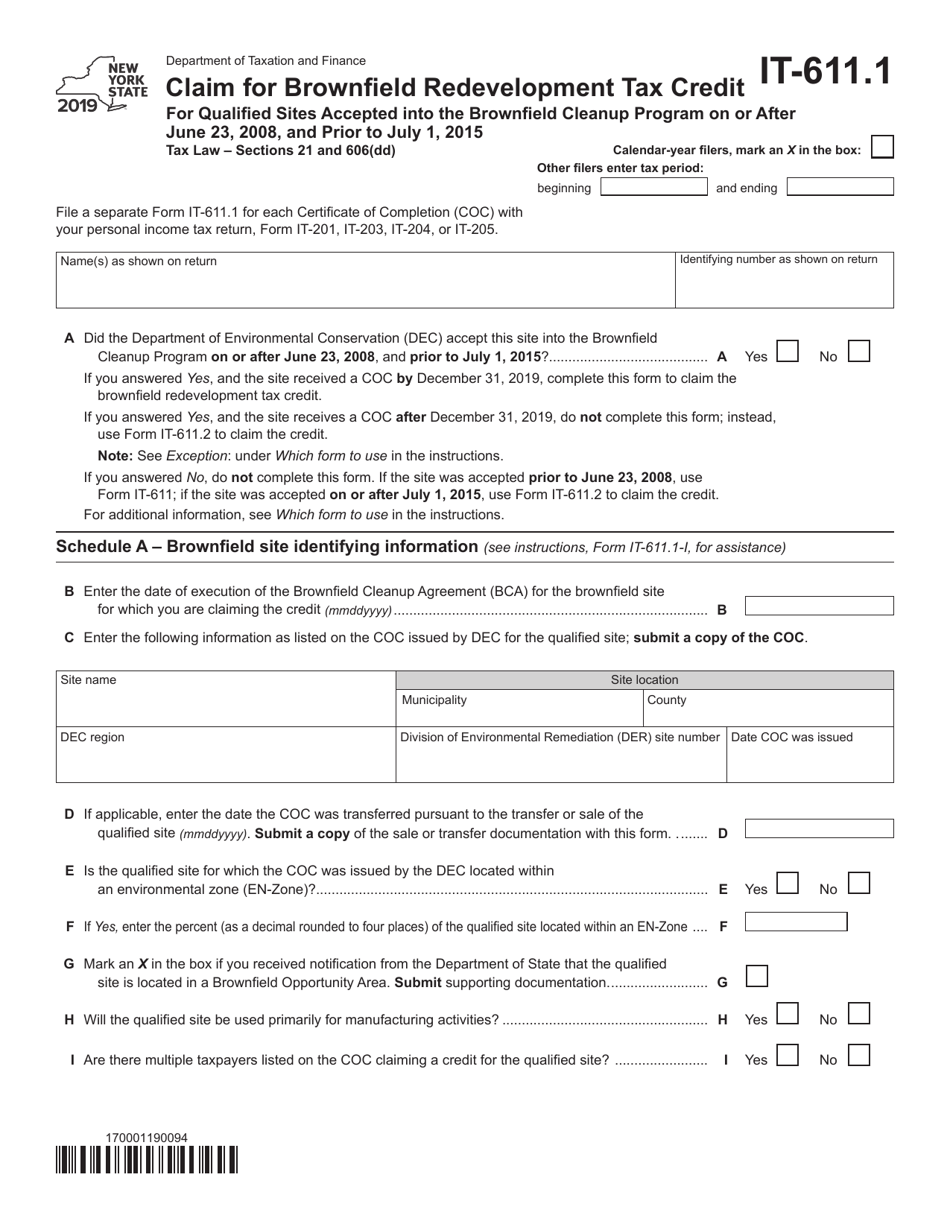

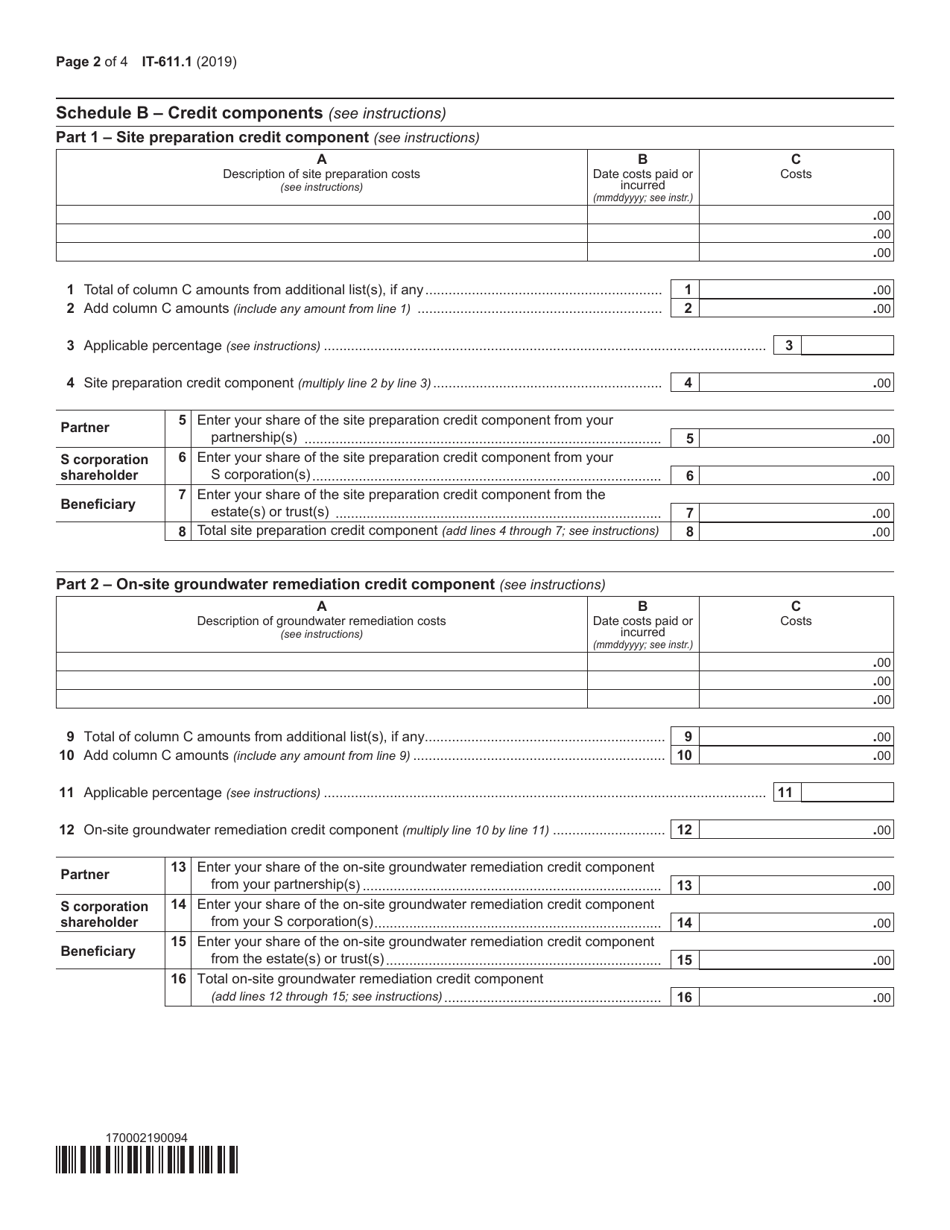

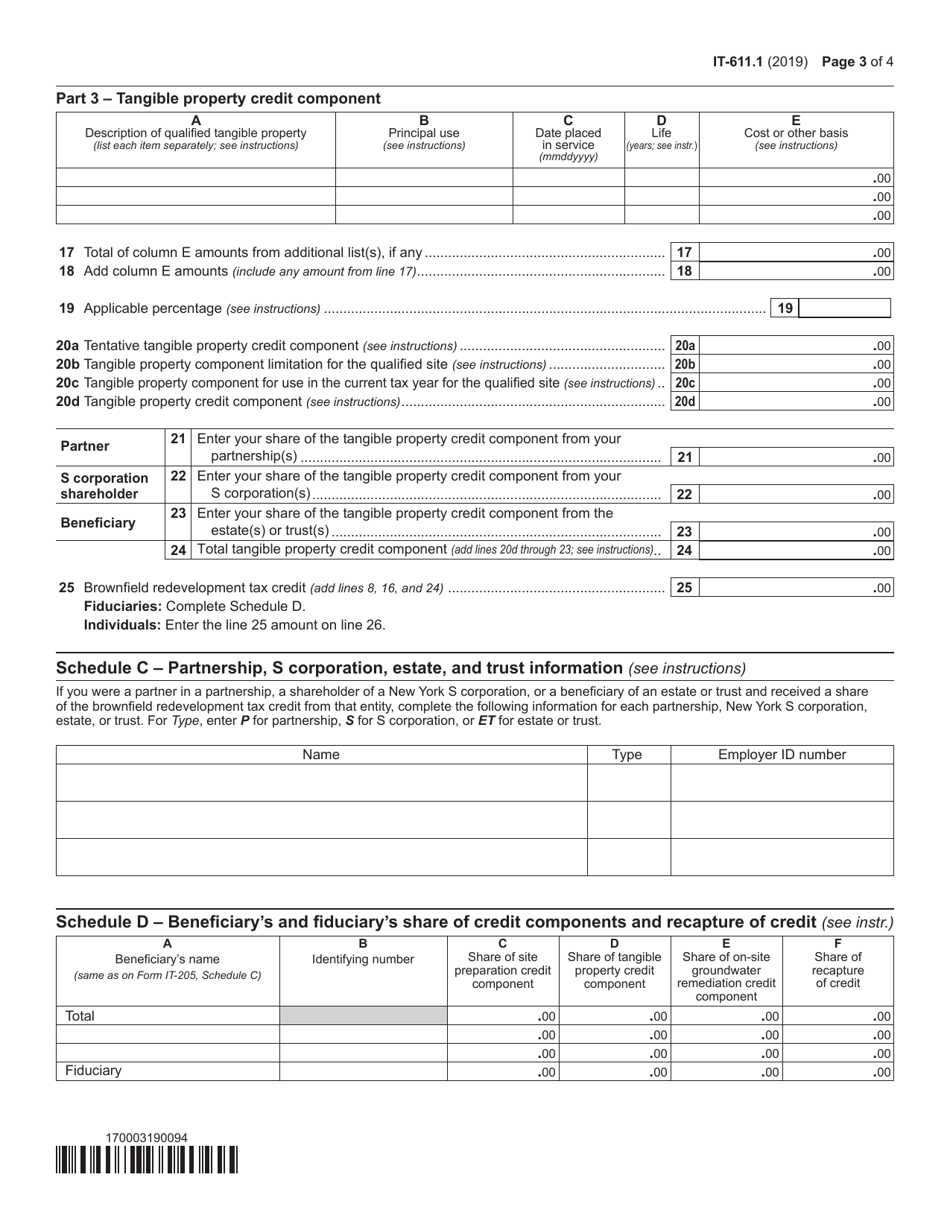

Q: What information do I need to complete Form IT-611.1?

A: To complete Form IT-611.1, you will need information about the qualified site accepted into the Brownfield Cleanup Program, including the site identification number and the amount of eligible QREs (Qualified Remediation Expenditures).

Q: When is the deadline for filing Form IT-611.1?

A: The deadline for filing Form IT-611.1 is generally the same as the filing due date for your New York state tax return, which is usually April 15th.

Q: Is there a limit to the amount of Brownfield Redevelopment Tax Credit I can claim?

A: Yes, there is a limit to the amount of Brownfield Redevelopment Tax Credit you can claim. The maximum credit allowed is typically $35 million, but it may vary based on the specific circumstances of your project.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-611.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.