This version of the form is not currently in use and is provided for reference only. Download this version of

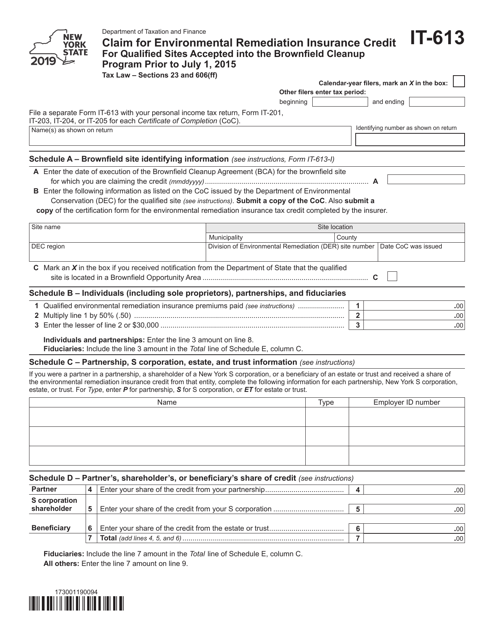

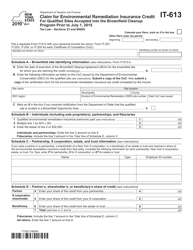

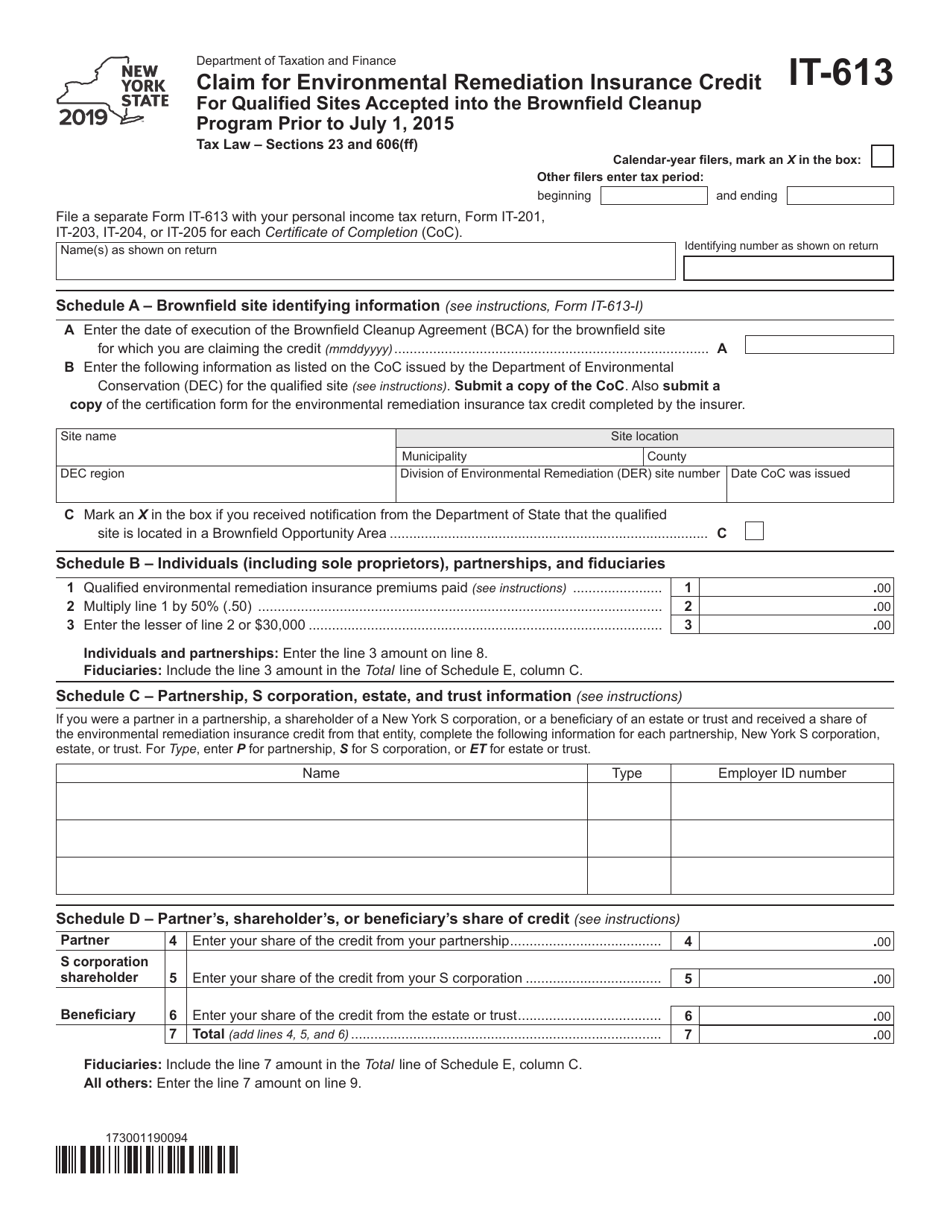

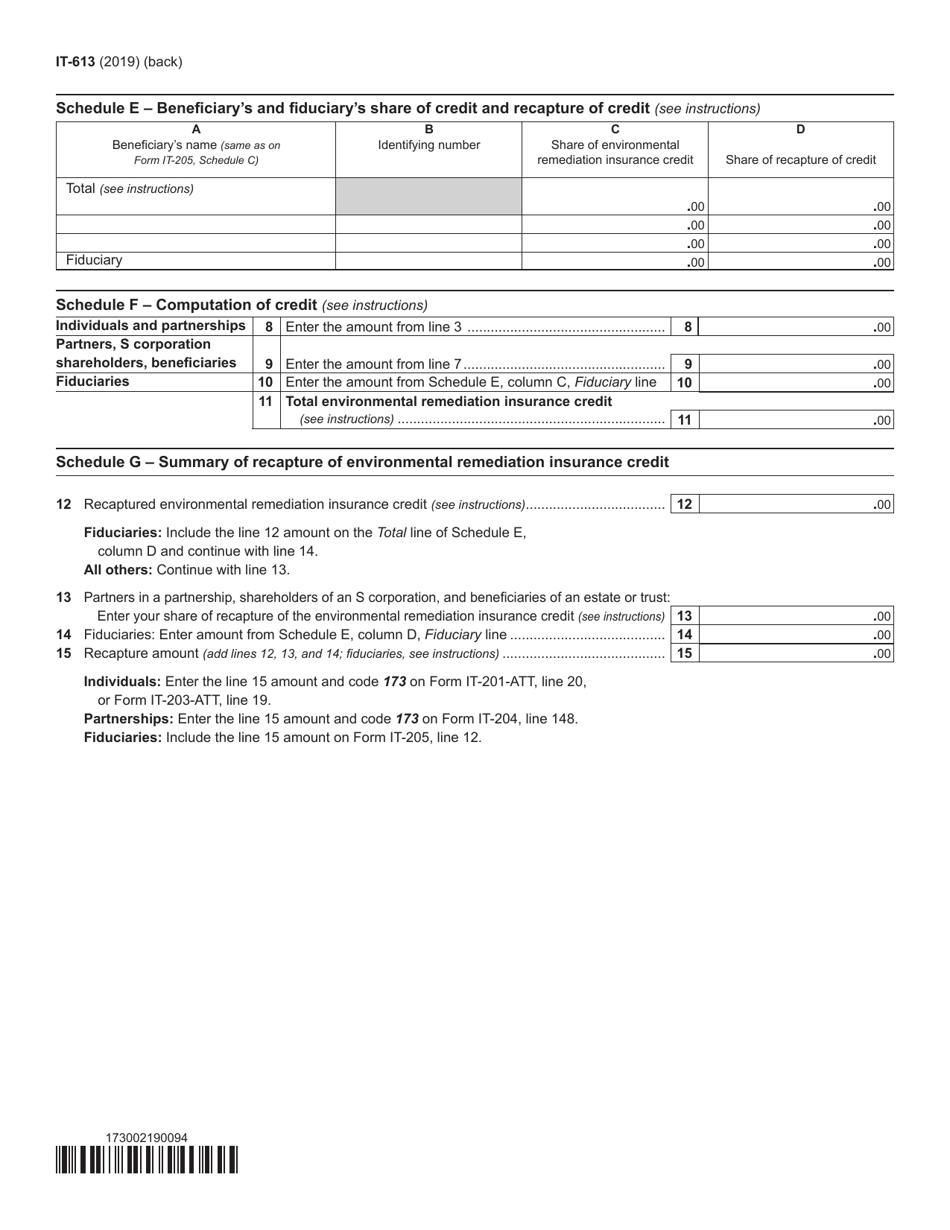

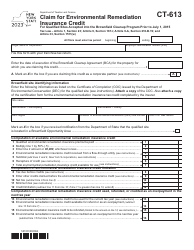

Form IT-613

for the current year.

Form IT-613 Claim for Environmental Remediation Insurance Credit for Qualified Sites Accepted Into the Brownfield Cleanup Program Prior to July 1, 2015 - New York

What Is Form IT-613?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-613?

A: Form IT-613 is a form used to claim the Environmental RemediationInsurance Credit for qualified sites accepted into the Brownfield Cleanup Program prior to July 1, 2015 in New York.

Q: What is the Environmental Remediation Insurance Credit?

A: The Environmental Remediation Insurance Credit is a tax credit provided by New York State for costs incurred in the cleanup and remediation of brownfield sites.

Q: Who is eligible to claim the Environmental Remediation Insurance Credit?

A: Those who have qualified sites accepted into the Brownfield Cleanup Program prior to July 1, 2015 in New York are eligible to claim the credit.

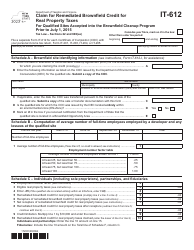

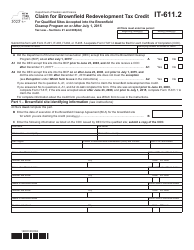

Q: What is the Brownfield Cleanup Program?

A: The Brownfield Cleanup Program is a program in New York that provides incentives and assistance for the cleanup and redevelopment of contaminated properties.

Q: How do I claim the Environmental Remediation Insurance Credit?

A: To claim the credit, you need to complete Form IT-613 and attach it to your New York State income tax return.

Q: Are there any deadlines for claiming the credit?

A: Yes, you must claim the credit within 3 years from the due date of the original tax return or within 3 years from the date the tax was paid, whichever is later.

Q: What expenses qualify for the Environmental Remediation Insurance Credit?

A: Expenses related to the cleanup and remediation of brownfield sites, as approved by the Brownfield Cleanup Program, may qualify for the credit.

Q: Is the Environmental Remediation Insurance Credit refundable?

A: No, the credit is not refundable. It can only be used to offset your New York State tax liability.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-613 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.