This version of the form is not currently in use and is provided for reference only. Download this version of

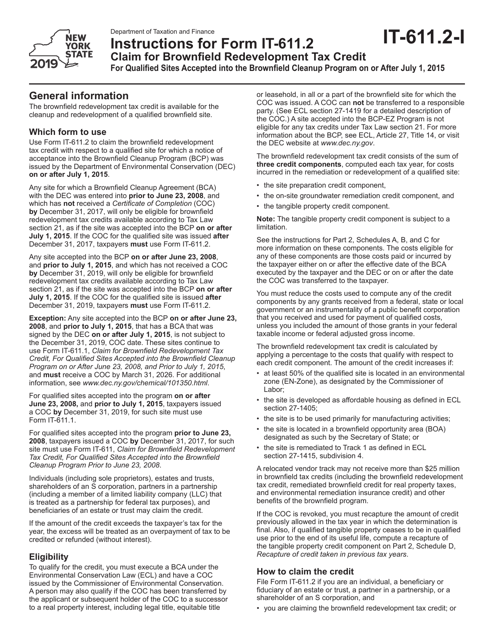

Instructions for Form IT-611.2

for the current year.

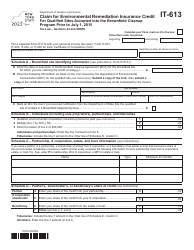

Instructions for Form IT-611.2 Claim for Brownfield Redevelopment Tax Credit for Qualified Sites Accepted Into the Brownfield Cleanup Program on or After July 1, 2015 - New York

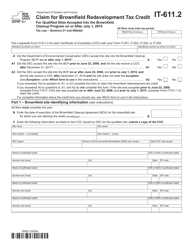

This document contains official instructions for Form IT-611.2 , Claim for Brownfield Cleanup Program on or After July 1, 2015 - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-611.2 is available for download through this link.

FAQ

Q: What is Form IT-611.2?

A: Form IT-611.2 is used to claim the Brownfield Redevelopment Tax Credit for qualified sites accepted into the Brownfield Cleanup Program on or after July 1, 2015 in New York.

Q: Who can use Form IT-611.2?

A: Property owners or developers who have a site accepted into the Brownfield Cleanup Program on or after July 1, 2015 in New York can use Form IT-611.2.

Q: What is the purpose of the Brownfield Redevelopment Tax Credit?

A: The Brownfield Redevelopment Tax Credit is a tax incentive to encourage the cleanup and redevelopment of contaminated sites in New York.

Q: How do I qualify for the Brownfield Redevelopment Tax Credit?

A: To qualify for the Brownfield Redevelopment Tax Credit, your site must be accepted into the Brownfield Cleanup Program on or after July 1, 2015 in New York.

Q: What expenses can be claimed for the Brownfield Redevelopment Tax Credit?

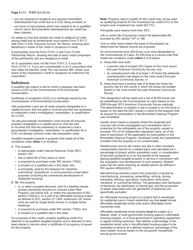

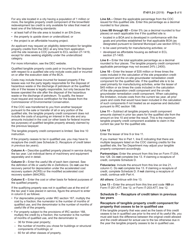

A: Eligible expenses for the Brownfield Redevelopment Tax Credit include site preparation costs, remediation costs, and development costs directly related to the cleanup and redevelopment of the qualified site.

Q: How much tax credit can I claim?

A: The amount of tax credit you can claim depends on the eligible expenses incurred for the cleanup and redevelopment of the qualified site. The credit is generally equal to 10% of the eligible expenses.

Q: How do I submit Form IT-611.2?

A: You must complete and mail Form IT-611.2 to the New York State Department of Taxation and Finance. The address to send the form is provided on the instructions of the form.

Q: Are there any deadlines for submitting Form IT-611.2?

A: Yes, there are deadlines for submitting Form IT-611.2. The form must be filed no later than three years from the due date of the return for the taxable year in which the credit is claimed.

Q: Can I amend my claim after submitting Form IT-611.2?

A: No, once you have submitted Form IT-611.2, you cannot amend your claim. It is important to ensure the accuracy of your claim before submitting the form.

Instruction Details:

- This 6-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.