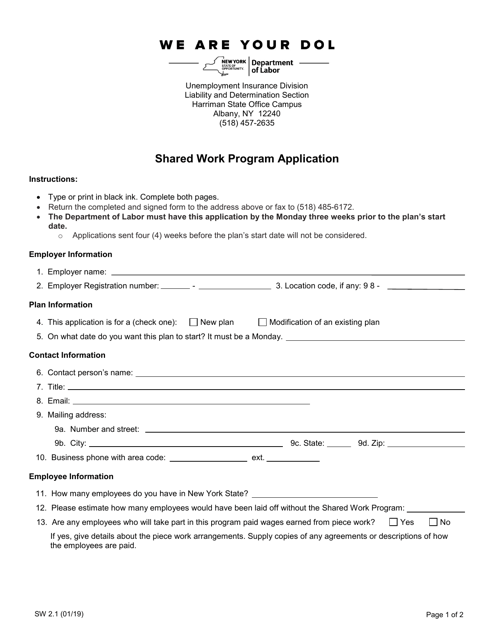

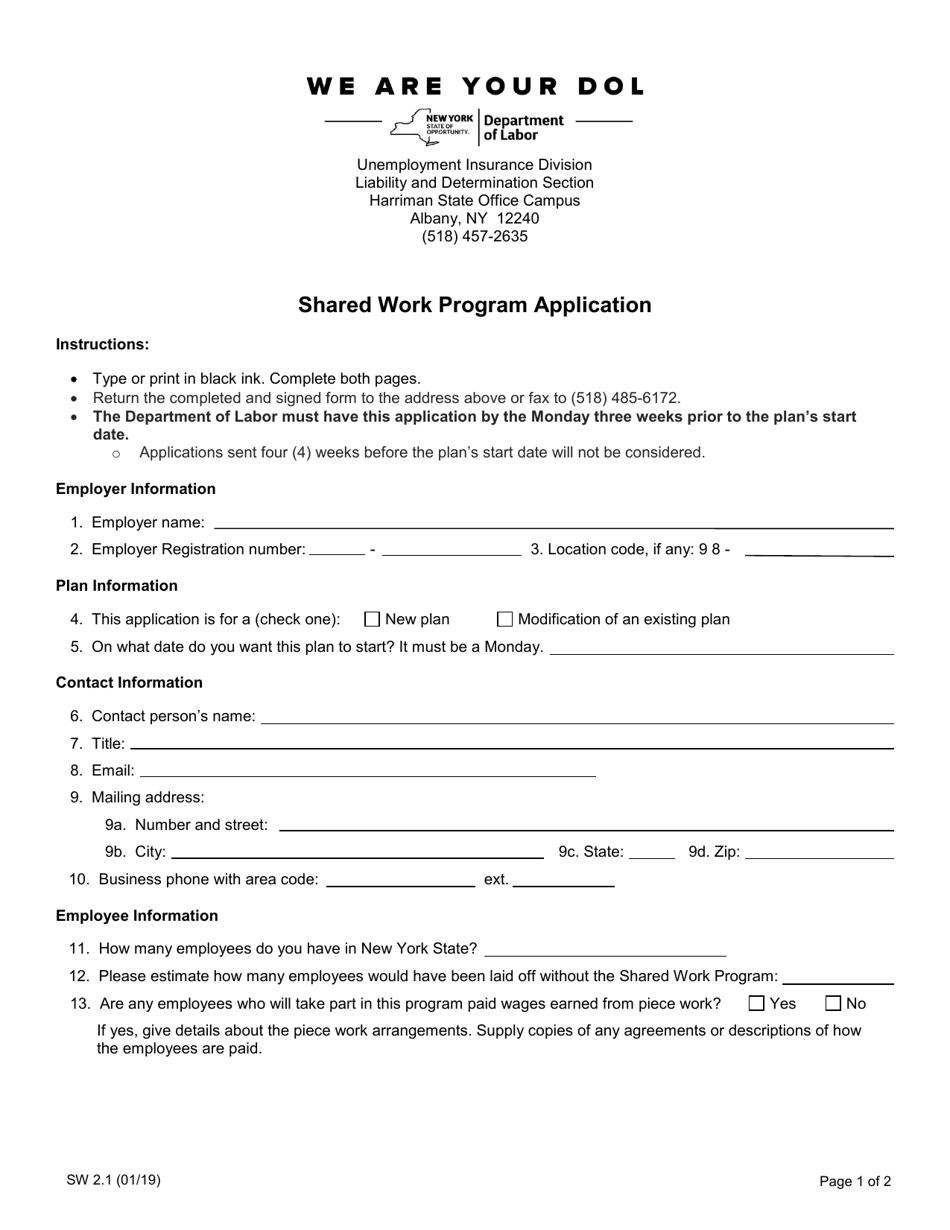

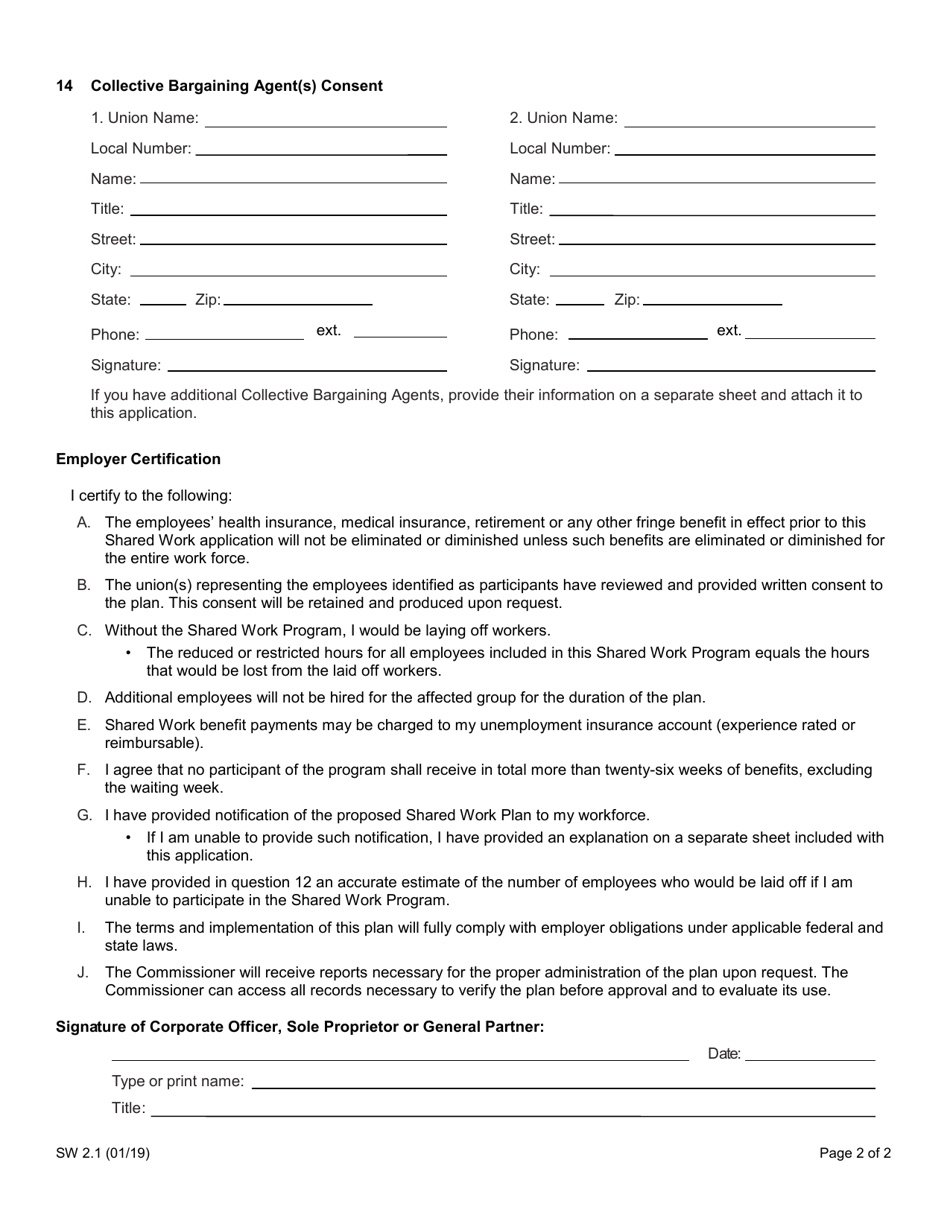

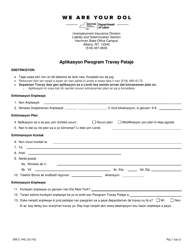

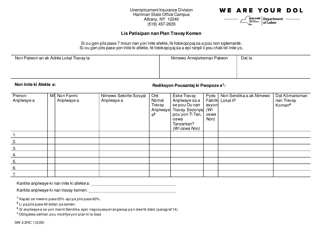

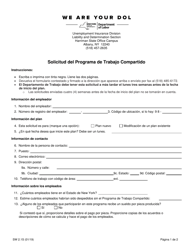

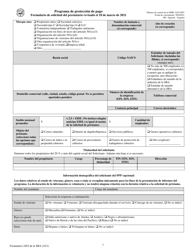

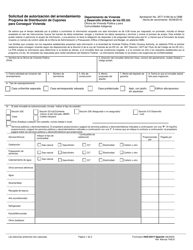

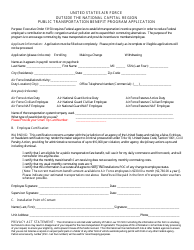

Form SW2.1 Shared Work Program Application - New York

What Is Form SW2.1?

This is a legal form that was released by the New York State Department of Labor - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SW2.1?

A: Form SW2.1 is the application for the Shared Work Program in New York.

Q: What is the Shared Work Program?

A: The Shared Work Program is a program in New York that allows employers to reduce the work hours of employees instead of laying them off, and the employees can receive partial unemployment benefits.

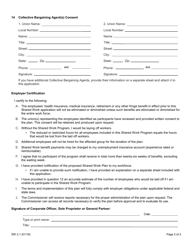

Q: How do I fill out Form SW2.1?

A: You need to fill out the form with your personal information, employer information, and work schedule information. Make sure to provide accurate and complete information.

Q: Who can apply for the Shared Work Program?

A: Employers in New York who meet the program requirements can apply for the Shared Work Program.

Q: What are the benefits of the Shared Work Program?

A: The benefits of the Shared Work Program include avoiding layoffs, retaining skilled employees, and reducing unemployment insurance costs.

Q: How long does it take to be approved for the Shared Work Program?

A: It usually takes about two weeks for the Shared Work Program application to be processed and approved.

Q: Can I apply for the Shared Work Program if I am self-employed?

A: No, the Shared Work Program is only available for employees of eligible employers.

Q: Can I receive full unemployment benefits while participating in the Shared Work Program?

A: No, participants in the Shared Work Program can only receive partial unemployment benefits based on their reduced work hours.

Q: How long can I participate in the Shared Work Program?

A: You can participate in the Shared Work Program for up to 26 weeks.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the New York State Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SW2.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Labor.