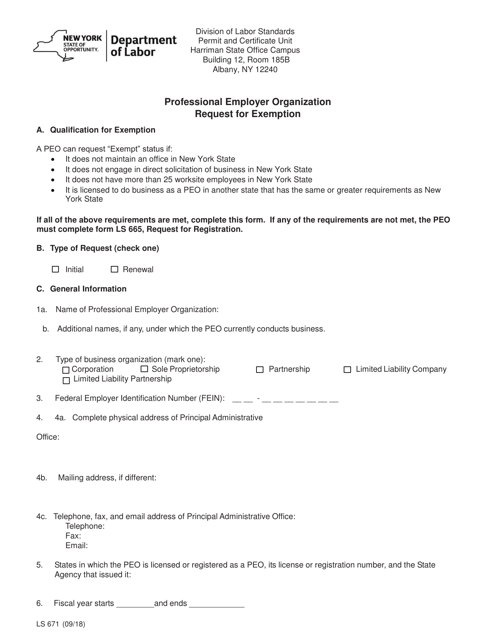

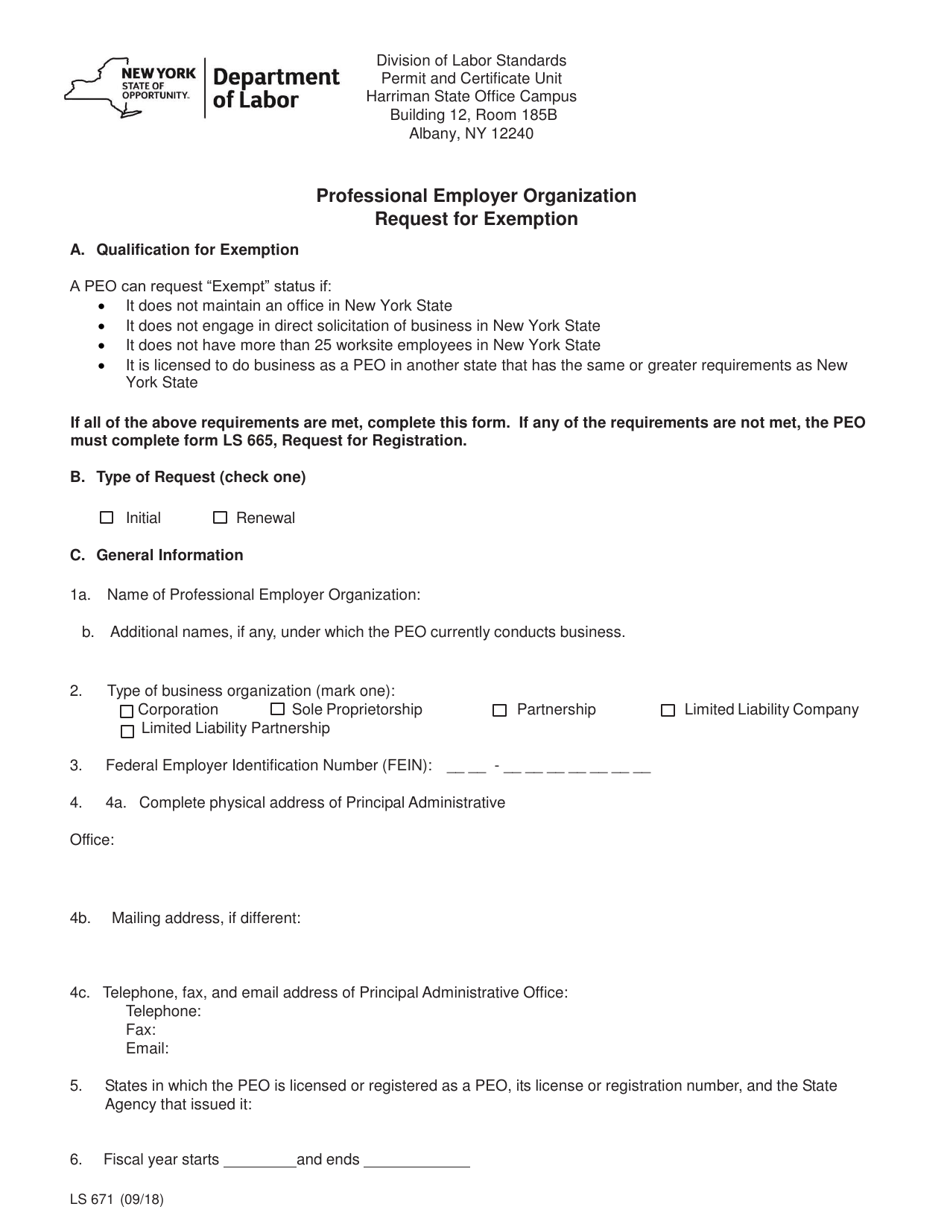

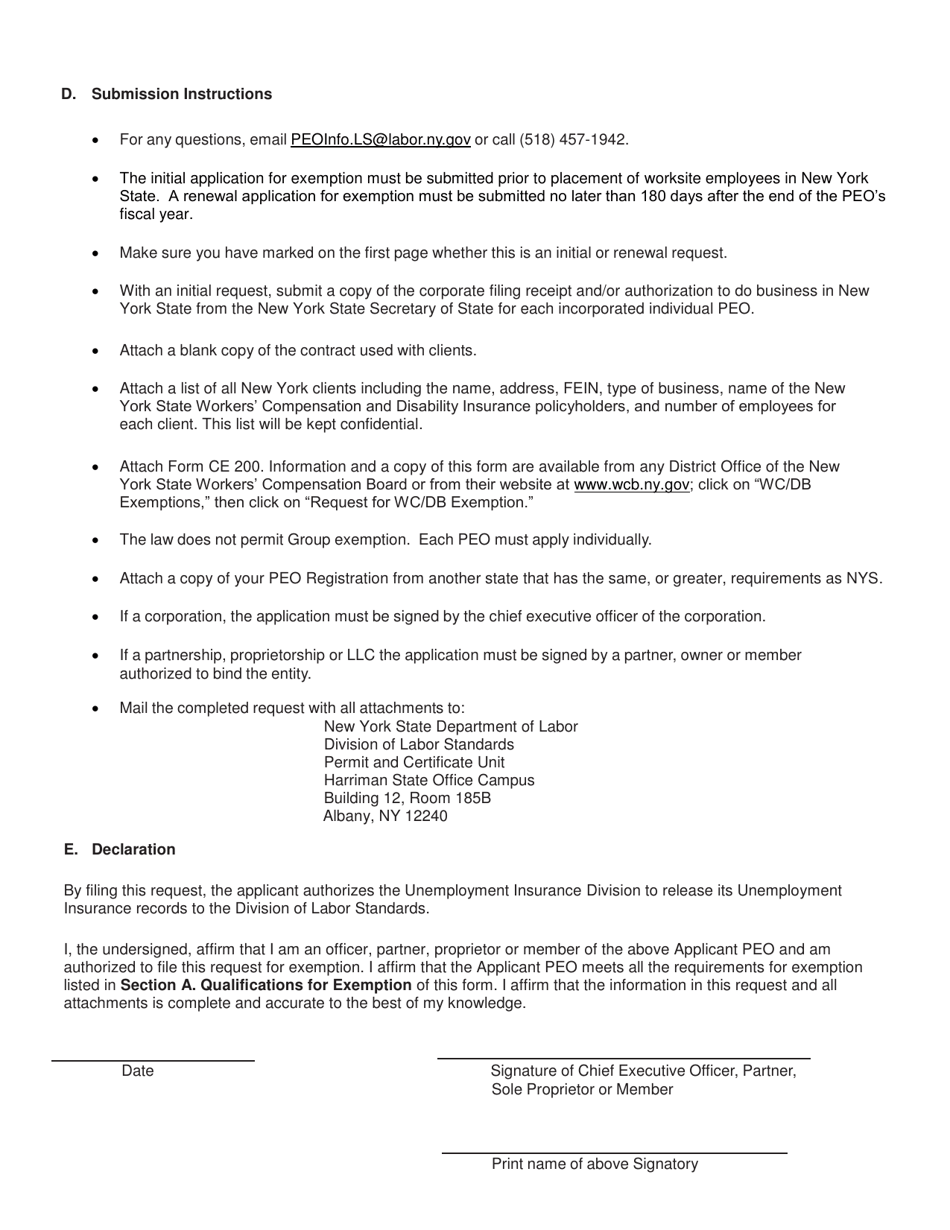

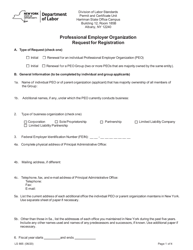

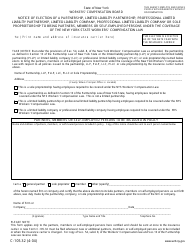

Form LS671 Professional Employer Organization Request for Exemption - New York

What Is Form LS671?

This is a legal form that was released by the New York State Department of Labor - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LS671?

A: Form LS671 is a professional employer organization request for exemption form.

Q: Who needs to file Form LS671?

A: Professional Employer Organizations (PEOs) in New York need to file Form LS671.

Q: What is the purpose of Form LS671?

A: The purpose of Form LS671 is to request exemption from certain licensing provisions for a PEO.

Q: Is there a fee to file Form LS671?

A: Yes, there is a fee associated with filing Form LS671.

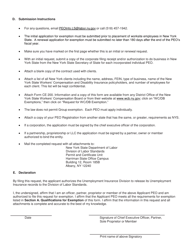

Q: What information is required on Form LS671?

A: Form LS671 requires information about the PEO's operations, financials, and compliance with specific regulations.

Q: Are there any deadlines for filing Form LS671?

A: Yes, Form LS671 must be filed annually by April 30th.

Q: What happens after I file Form LS671?

A: After filing Form LS671, the Department of Financial Services will review the request and notify the PEO of its decision.

Q: What should I do if my request for exemption is denied?

A: If your request for exemption is denied, you may need to obtain a license or take other appropriate actions as advised by the Department of Financial Services.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the New York State Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form LS671 by clicking the link below or browse more documents and templates provided by the New York State Department of Labor.