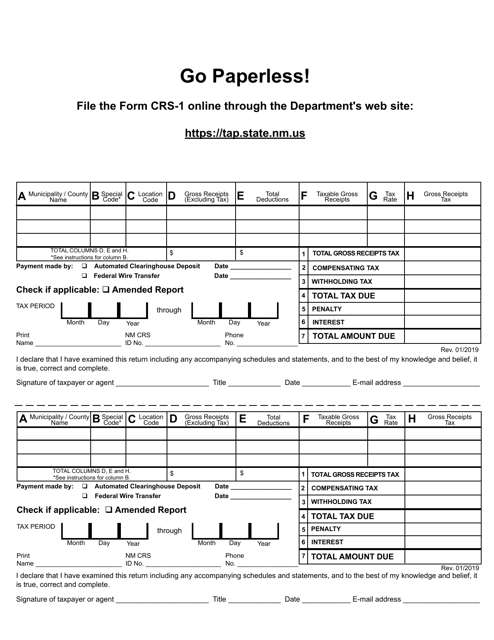

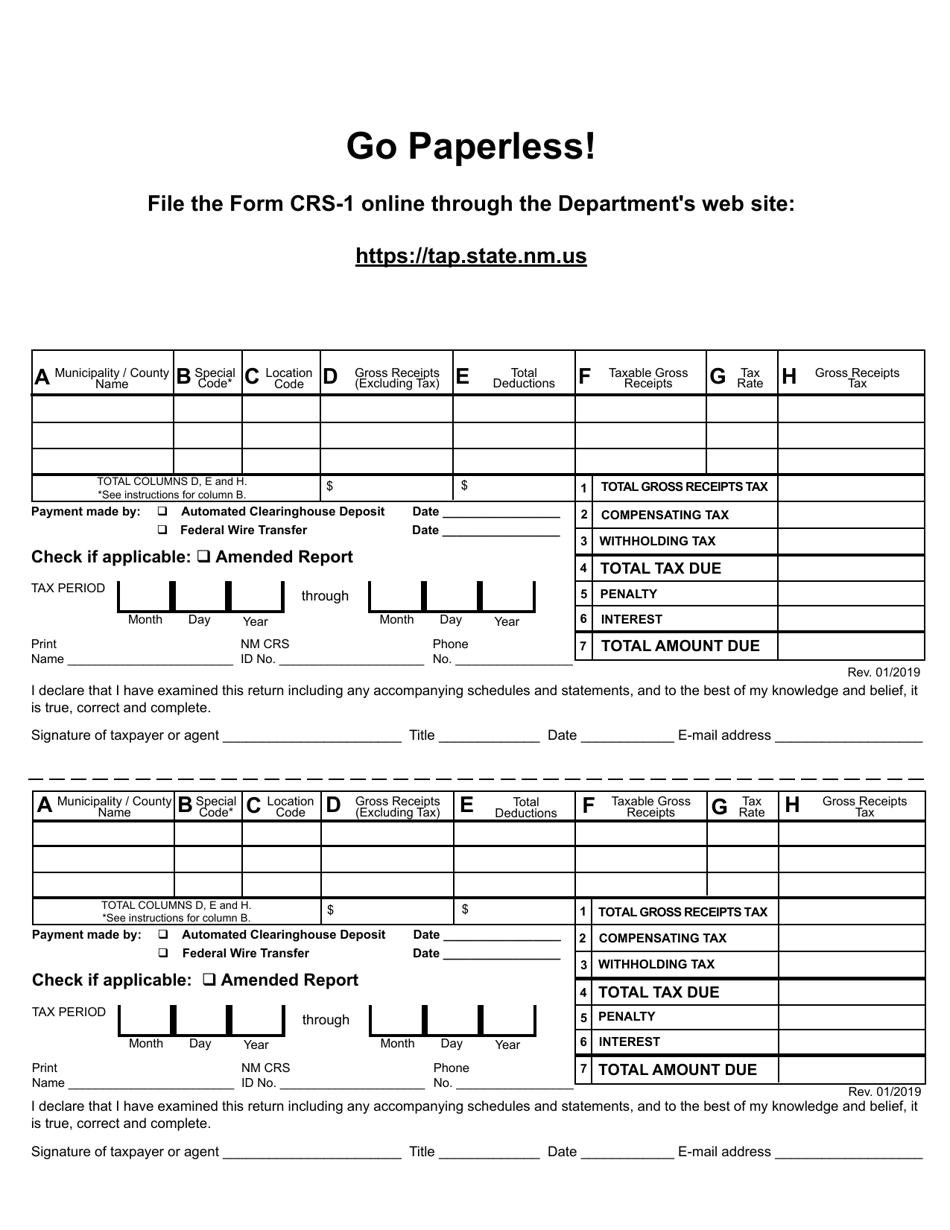

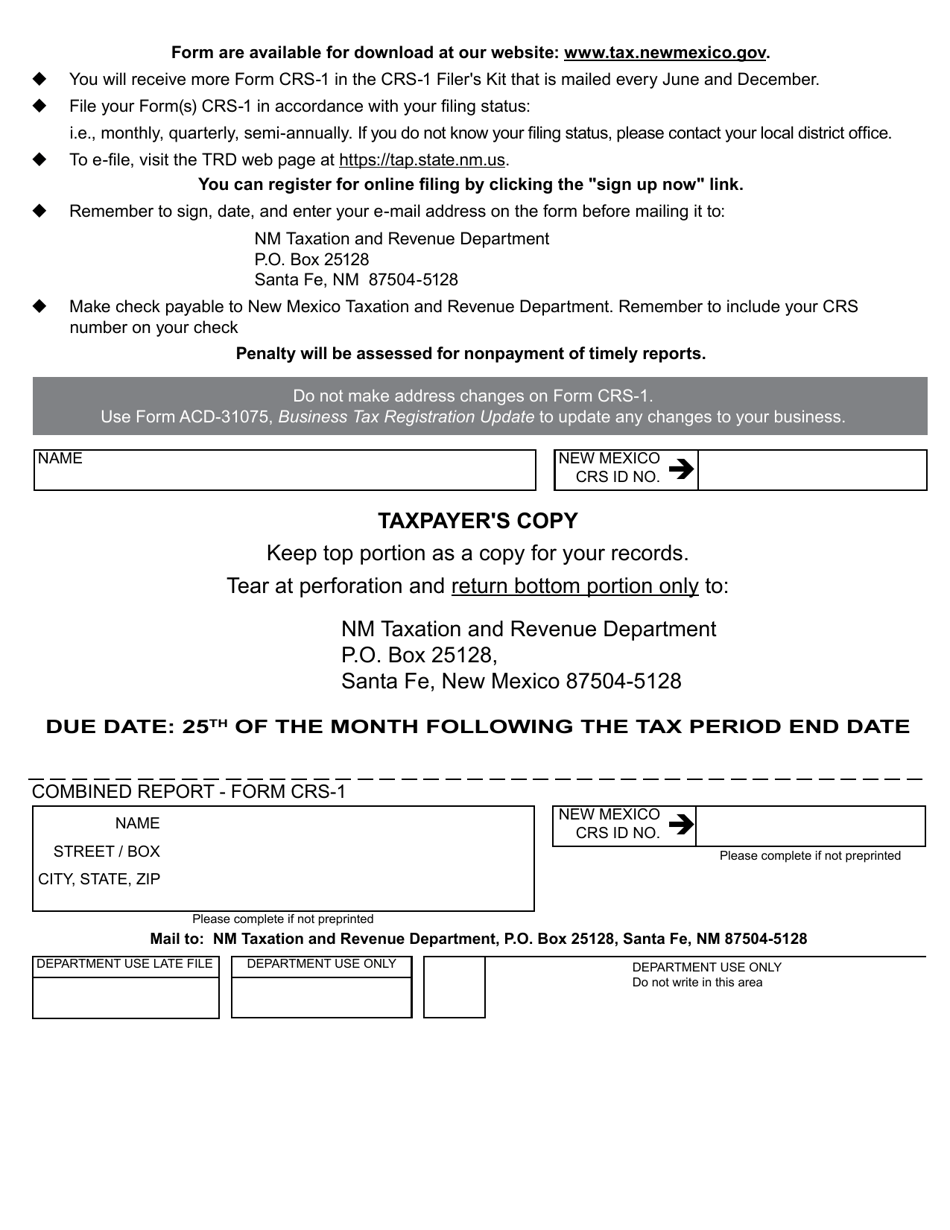

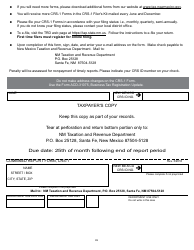

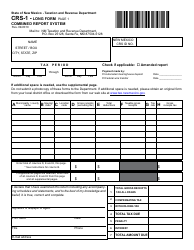

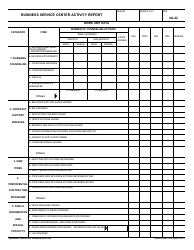

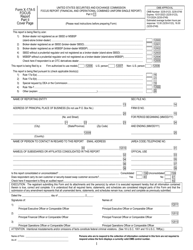

Form CRS-1 Combined Report (Short Form) for 3 or Fewer Business - New Mexico

What Is Form CRS-1?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CRS-1?

A: Form CRS-1 is a combined report (short form) for 3 or fewer businesses in New Mexico.

Q: Who is required to file Form CRS-1?

A: Businesses with 3 or fewer businesses in New Mexico are required to file Form CRS-1.

Q: What is the purpose of Form CRS-1?

A: The purpose of Form CRS-1 is to provide a combined report for businesses in New Mexico.

Q: Is Form CRS-1 specific to New Mexico?

A: Yes, Form CRS-1 is specific to businesses in New Mexico.

Q: Is Form CRS-1 for businesses only?

A: Yes, Form CRS-1 is for businesses with 3 or fewer businesses.

Q: Are there any exceptions to filing Form CRS-1?

A: No, all businesses with 3 or fewer businesses in New Mexico are required to file Form CRS-1.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CRS-1 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.