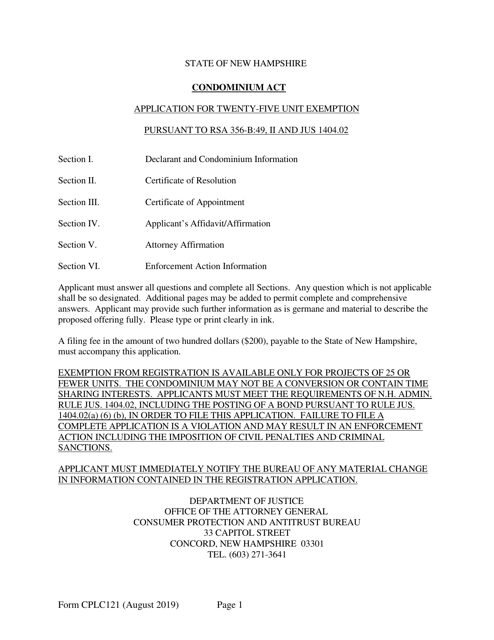

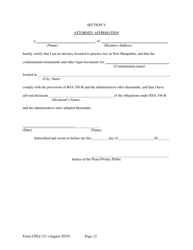

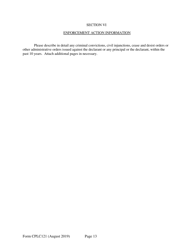

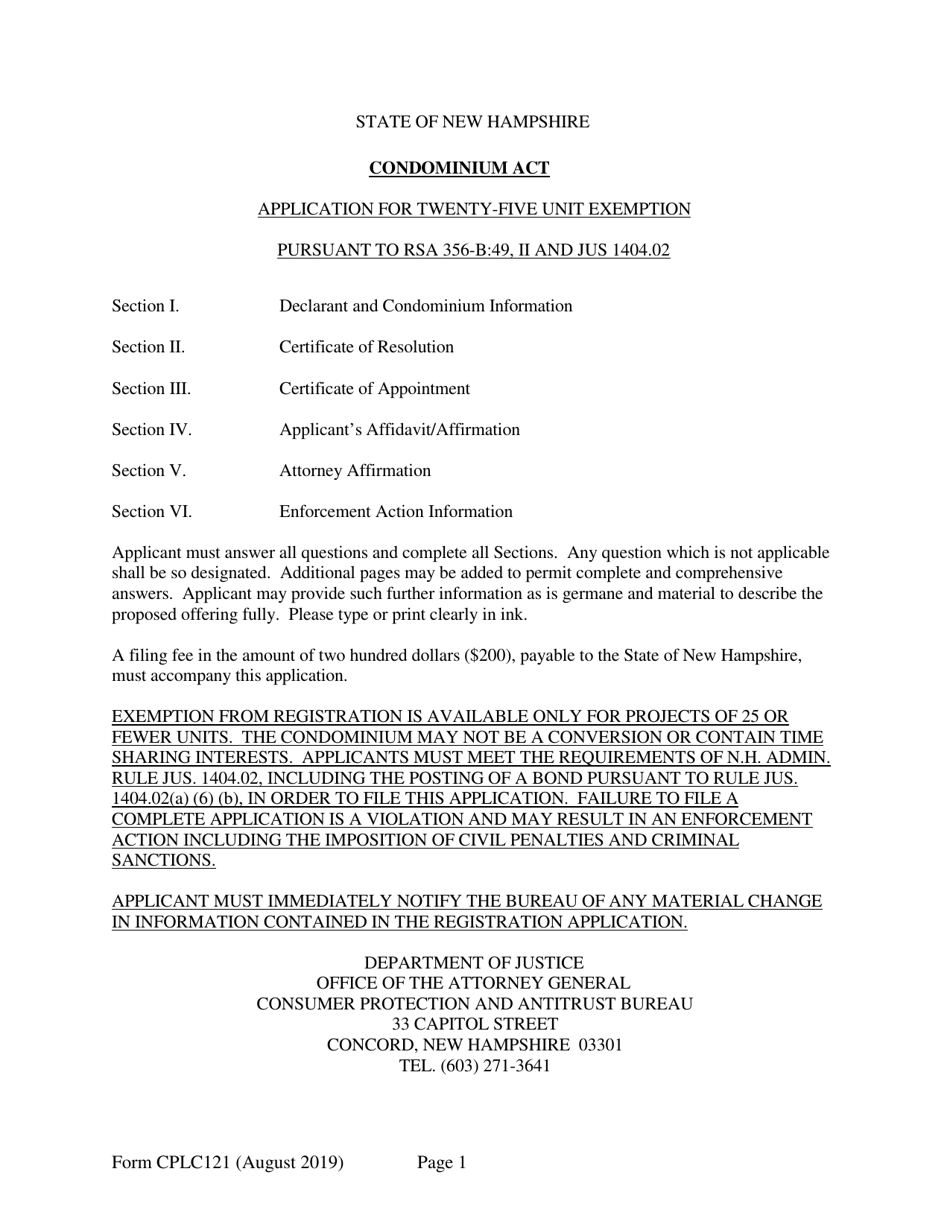

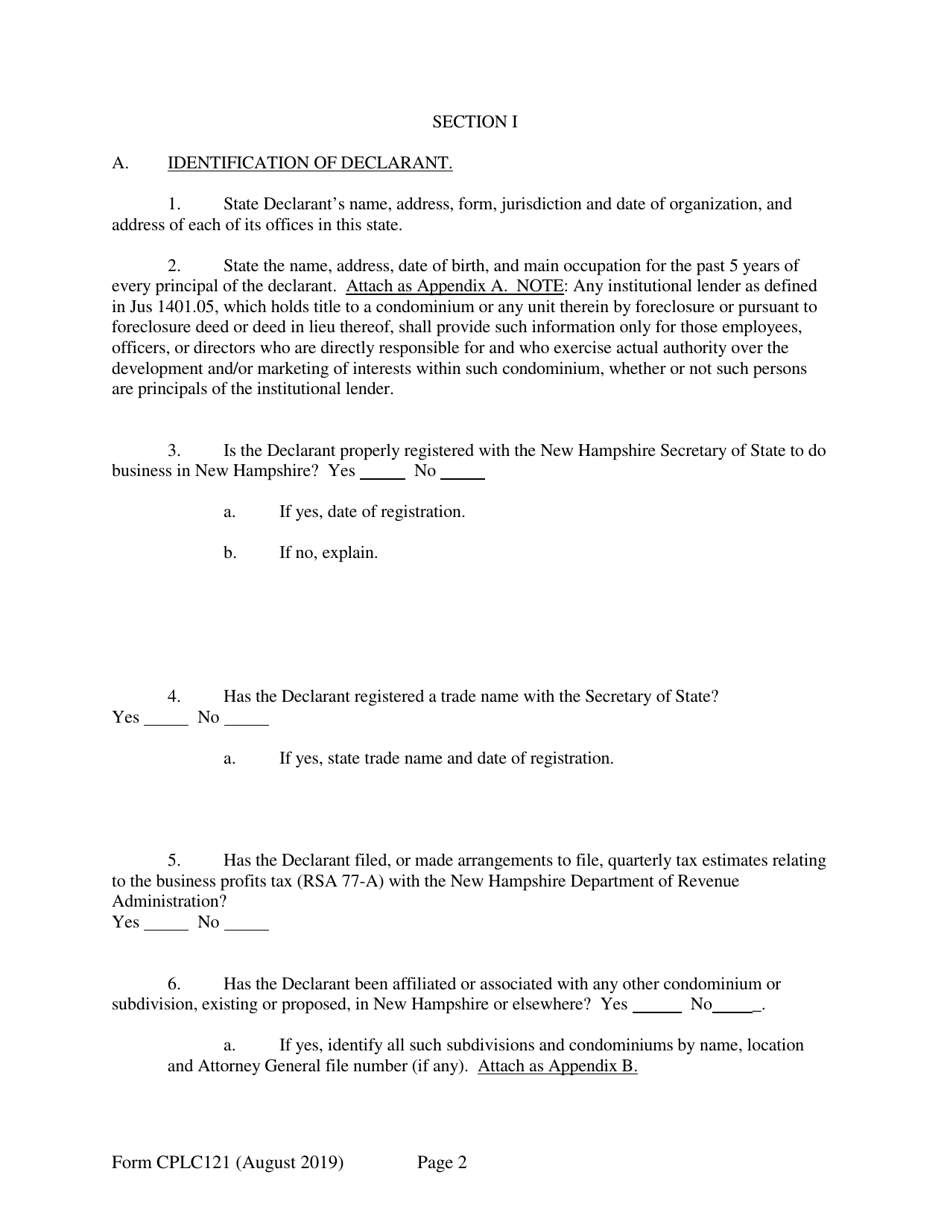

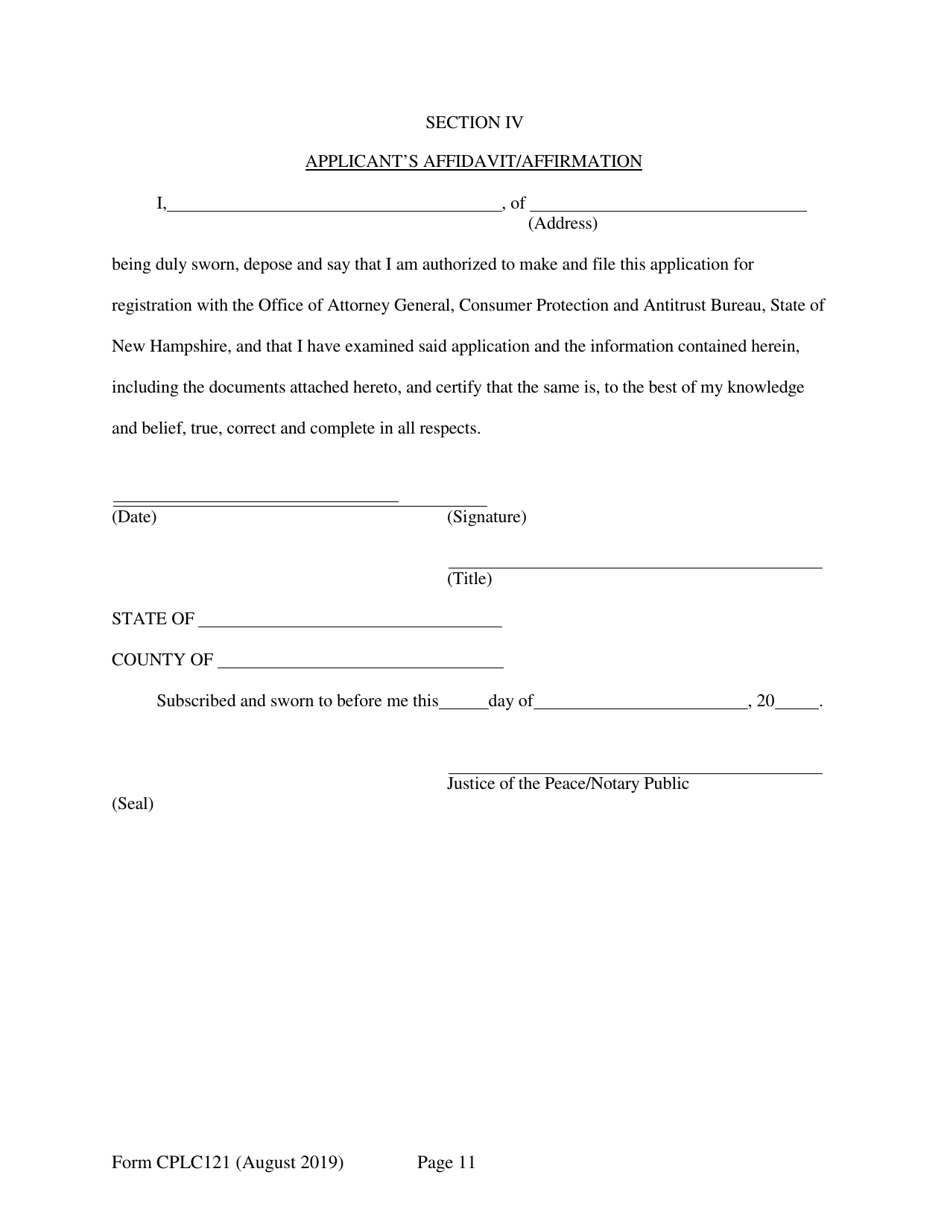

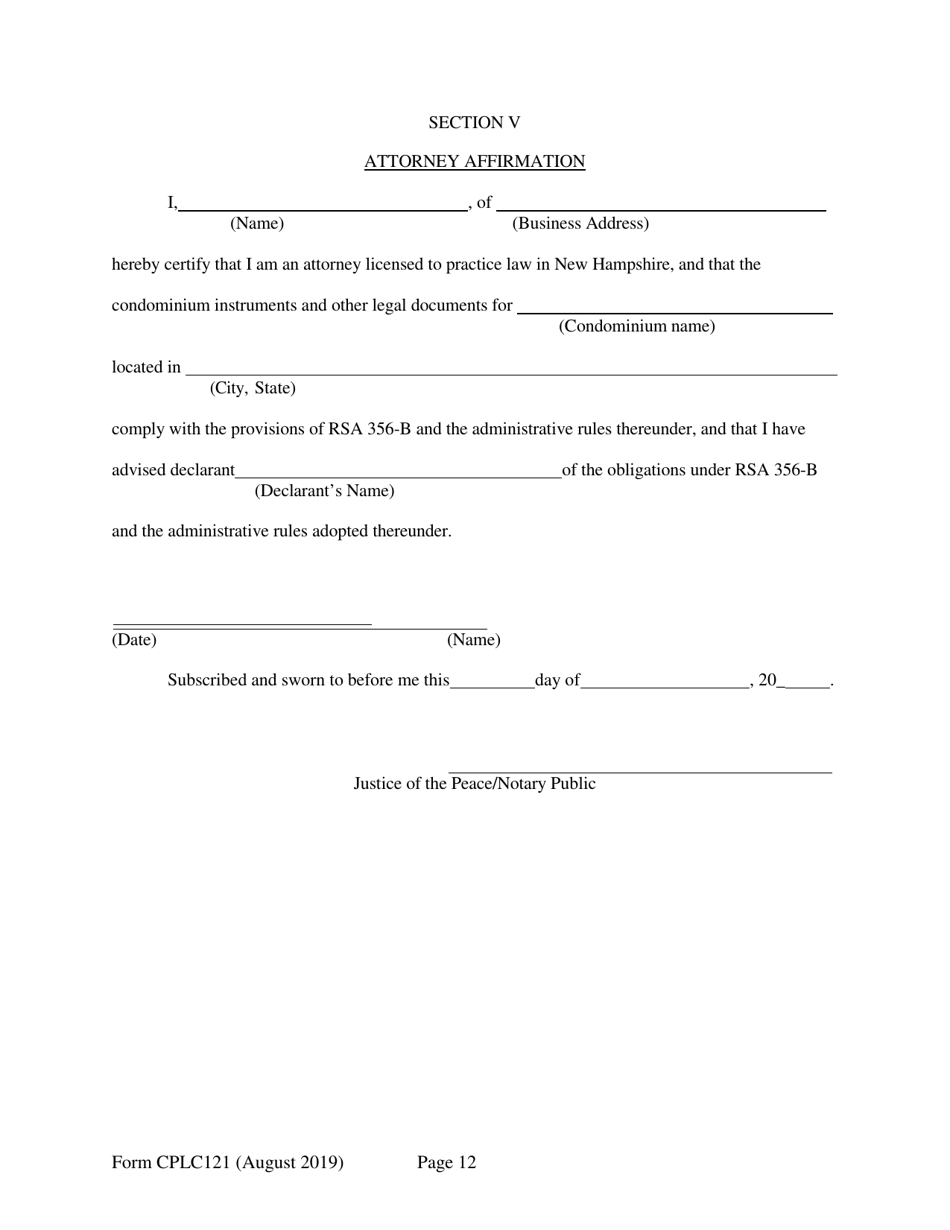

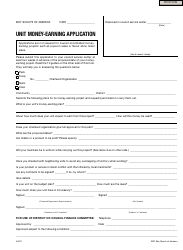

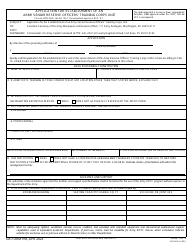

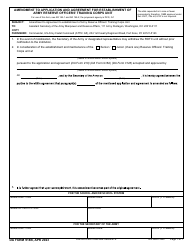

Form CPLC121 Application for Twenty-Five Unit Exemption - New Hampshire

What Is Form CPLC121?

This is a legal form that was released by the New Hampshire Department of Justice - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

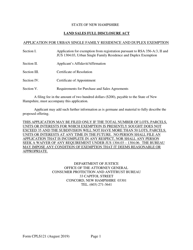

Q: What is CPLC121?

A: CPLC121 is an application for a twenty-five unit exemption in New Hampshire.

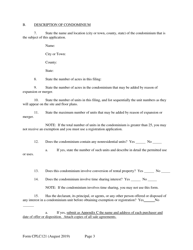

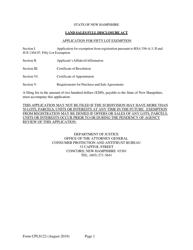

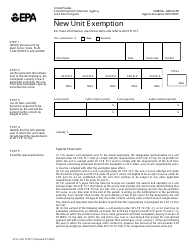

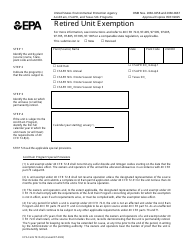

Q: What is a twenty-five unit exemption?

A: A twenty-five unit exemption allows for the exclusion of 25 units from the calculation of the property's assessed value for property tax purposes.

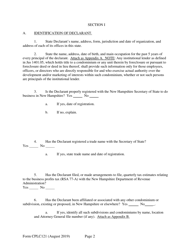

Q: Who can apply for CPLC121?

A: Anyone who owns a property in New Hampshire with 25 or more residential units can apply for CPLC121.

Q: What is the purpose of CPLC121?

A: The purpose of CPLC121 is to provide a tax exemption for properties with 25 or more residential units.

Q: How do I apply for CPLC121?

A: To apply for CPLC121, you need to fill out the CPLC121 application form and submit it to the appropriate local assessing officials in New Hampshire.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the New Hampshire Department of Justice;

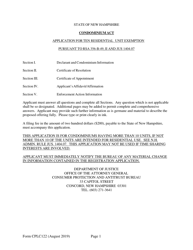

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CPLC121 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Justice.