This version of the form is not currently in use and is provided for reference only. Download this version of

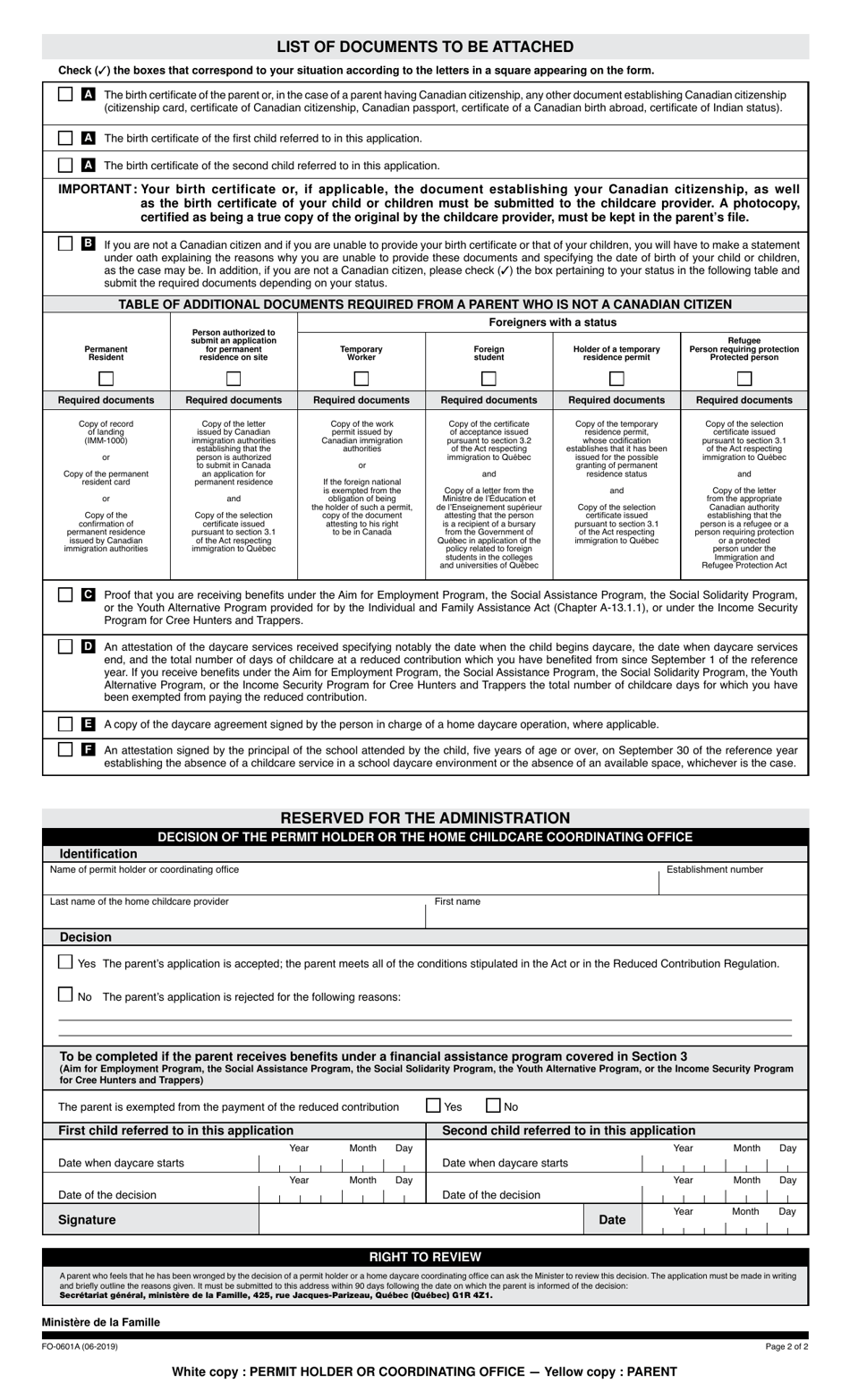

Form FO-0601A

for the current year.

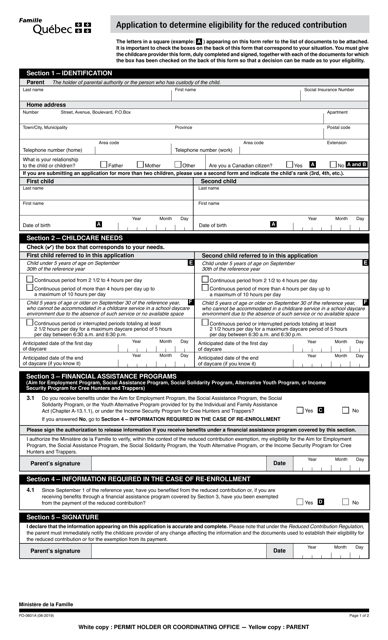

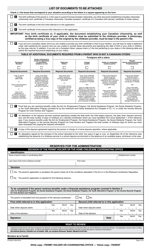

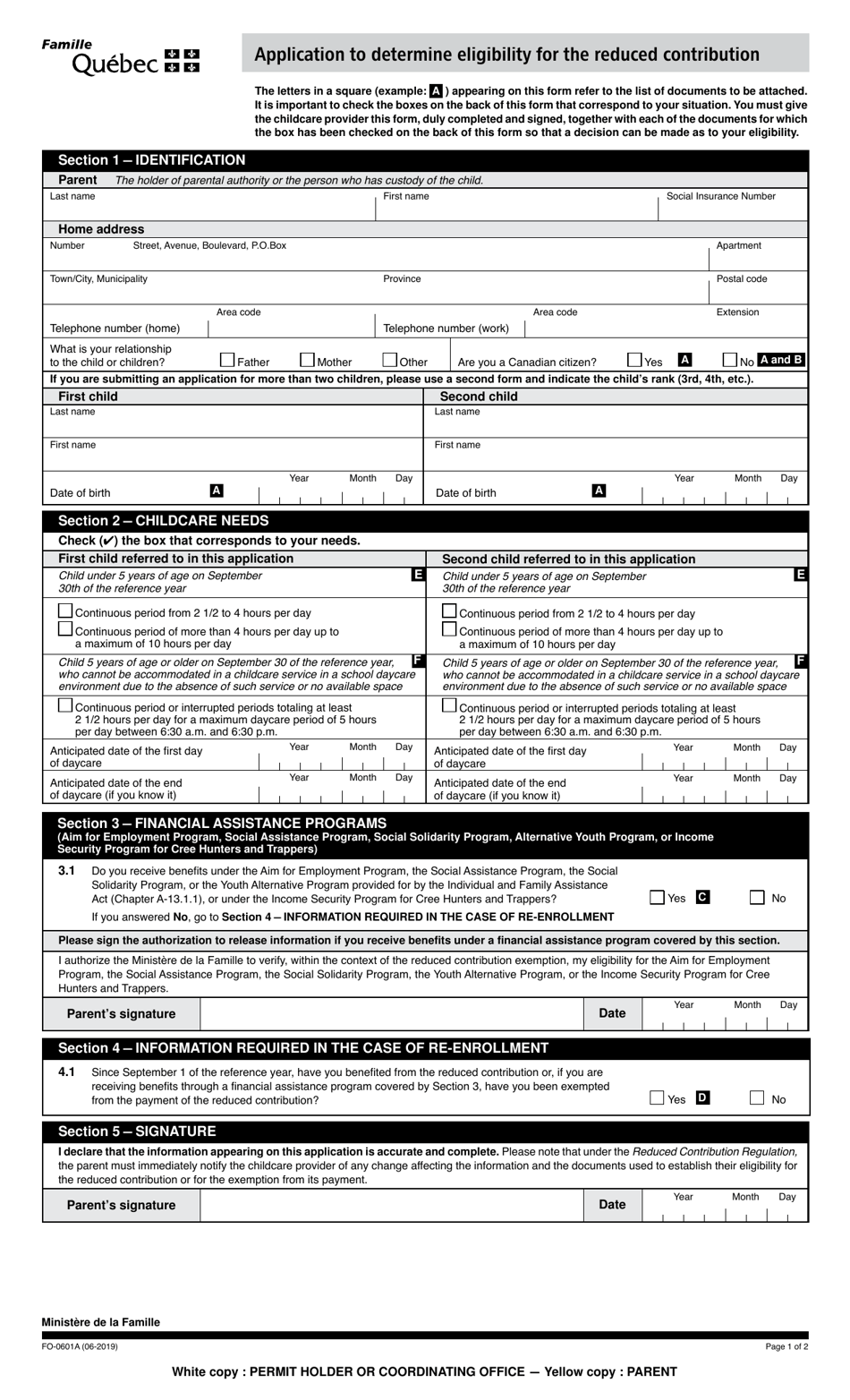

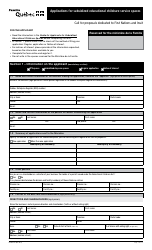

Form FO-0601A Application to Determine Eligibility for the Reduced Contribution - Quebec, Canada

Form FO-0601A Application to Determine Eligibility for the Reduced Contribution in Quebec, Canada is used to apply for a reduction in contribution rates for certain employers in the province of Quebec. This reduction is applicable to employers who meet specific criteria and is designed to help ease the financial burden of contributing to the Quebec Pension Plan (QPP).

The employer files the Form FO-0601A Application to Determine Eligibility for the Reduced Contribution - Quebec, Canada.

FAQ

Q: What is Form FO-0601A?

A: Form FO-0601A is an application to determine eligibility for the reduced contribution in Quebec, Canada.

Q: What is the reduced contribution?

A: The reduced contribution is a program in Quebec, Canada that allows eligible individuals to pay a lower contribution for certain benefits.

Q: Who is eligible for the reduced contribution?

A: Eligibility for the reduced contribution is determined based on factors such as income and family size. Specific eligibility criteria can be found on Form FO-0601A.

Q: How do I fill out Form FO-0601A?

A: You should carefully follow the instructions provided on the form and provide accurate and complete information about your income and family size.

Q: What benefits does the reduced contribution apply to?

A: The reduced contribution applies to specific benefits determined by the government in Quebec, Canada. Details of these benefits can be found on Form FO-0601A.

Q: Is the reduced contribution available in other provinces of Canada?

A: No, the reduced contribution program is specific to Quebec, Canada and may not be available in other provinces.

Q: Is there a deadline for submitting Form FO-0601A?

A: The exact deadline for submitting Form FO-0601A may vary, so it is important to check the instructions or contact the relevant government agency for the most accurate information.

Q: Are there any fees associated with applying for the reduced contribution?

A: There may be administrative fees or processing fees associated with applying for the reduced contribution. Details of any fees should be provided in the instructions of Form FO-0601A.

Q: Can I appeal if my application for the reduced contribution is denied?

A: Yes, if your application for the reduced contribution is denied, you may have the right to appeal the decision. Information on the appeals process should be provided by the relevant government agency.