This version of the form is not currently in use and is provided for reference only. Download this version of

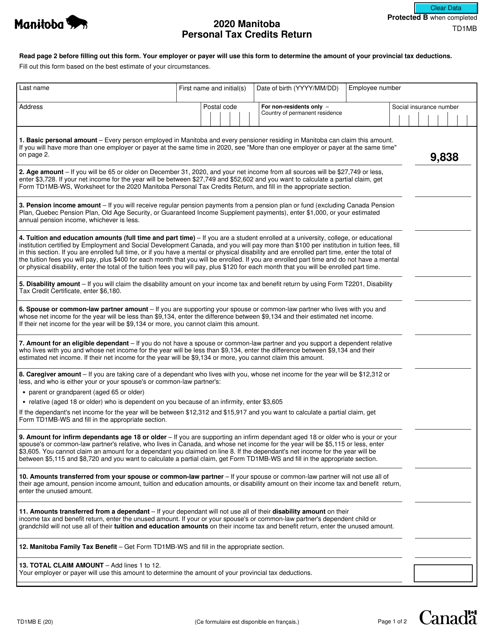

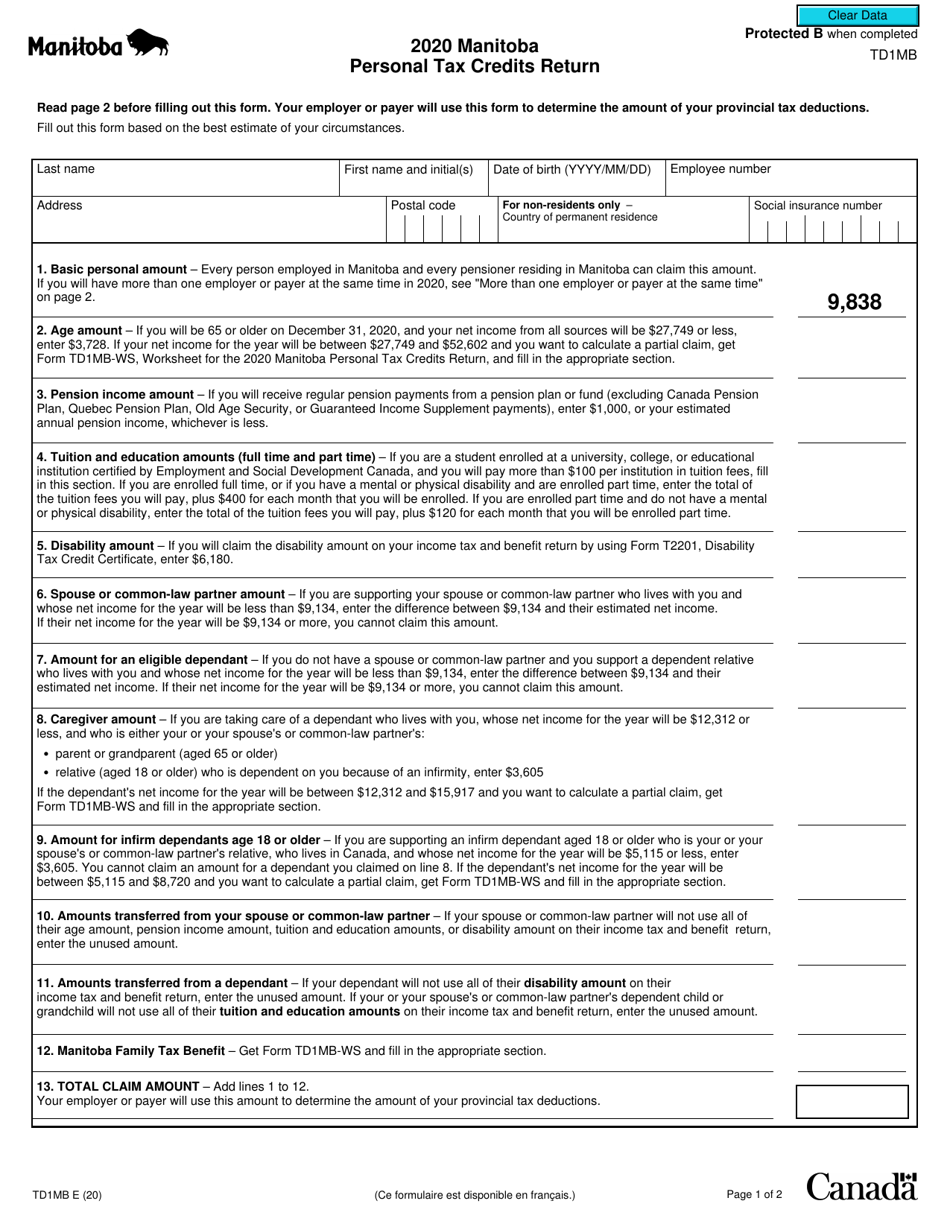

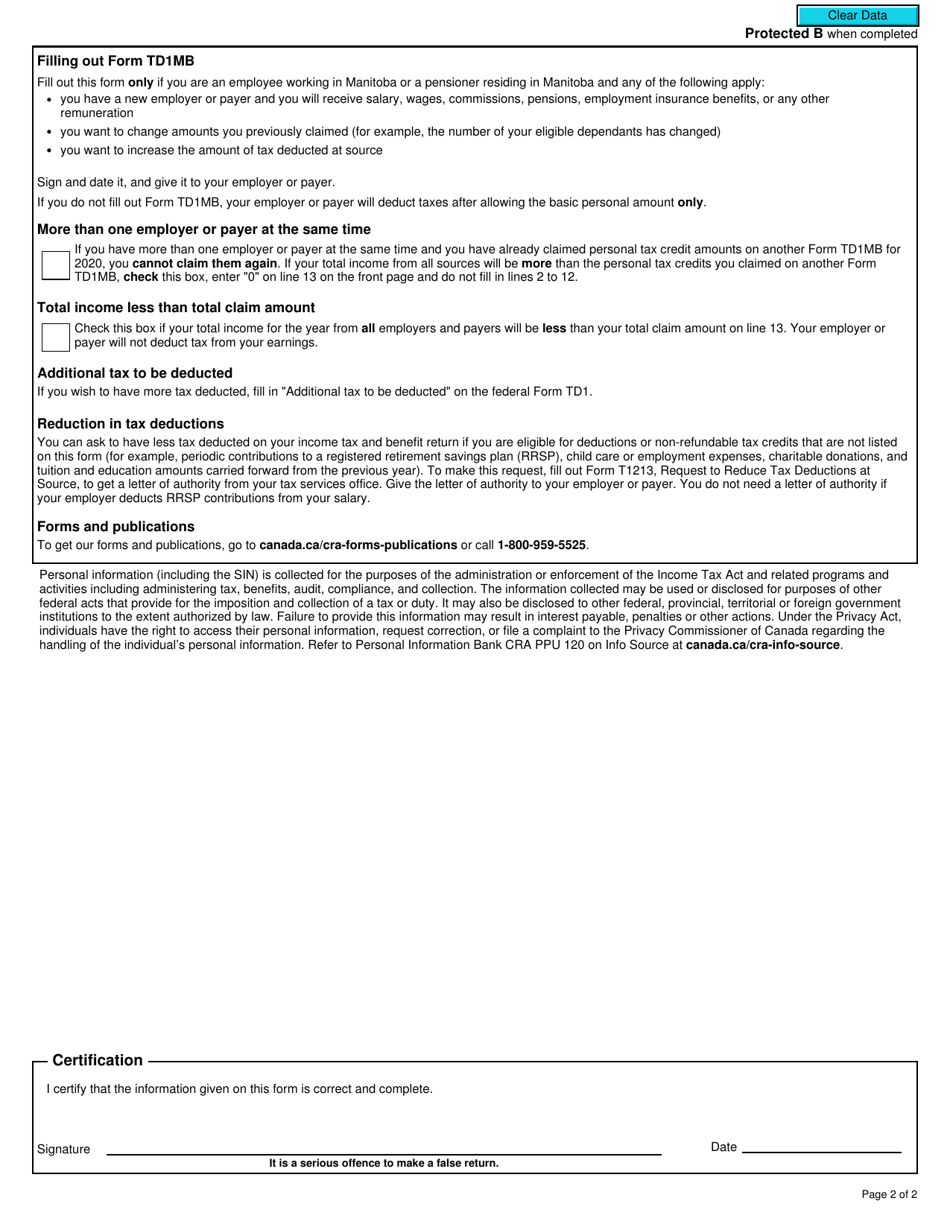

Form TD1MB

for the current year.

Form TD1MB Manitoba Personal Tax Credits Return - Canada

Form TD1MB Manitoba Personal Tax Credits Return is used by individuals residing in the province of Manitoba, Canada, to calculate the amount of provincial tax credits they are eligible for. This form helps taxpayers determine the amount of tax they need to have withheld from their income by their employers.

The Form TD1MB Manitoba Personal Tax Credits Return is typically filed by residents of Manitoba, Canada, to declare their personal tax credits for provincial tax purposes.

FAQ

Q: What is Form TD1MB?

A: Form TD1MB is the Manitoba Personal Tax Credits Return for residents of Manitoba.

Q: Who should use Form TD1MB?

A: Residents of Manitoba who want to claim additional tax credits should use Form TD1MB.

Q: What is the purpose of Form TD1MB?

A: The purpose of Form TD1MB is to determine the amount of personal tax credits that can be claimed by Manitoba residents.

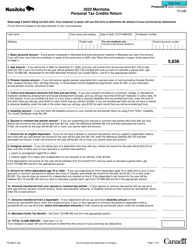

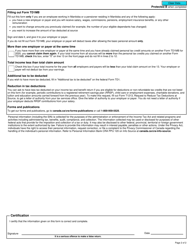

Q: How do I complete Form TD1MB?

A: To complete Form TD1MB, you will need to provide your personal information and indicate which tax credits you are eligible for.

Q: Is Form TD1MB mandatory?

A: Filling out Form TD1MB is not mandatory, but completing it accurately can help ensure the correct amount of taxes are deducted from your income.