This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3 PRP

for the current year.

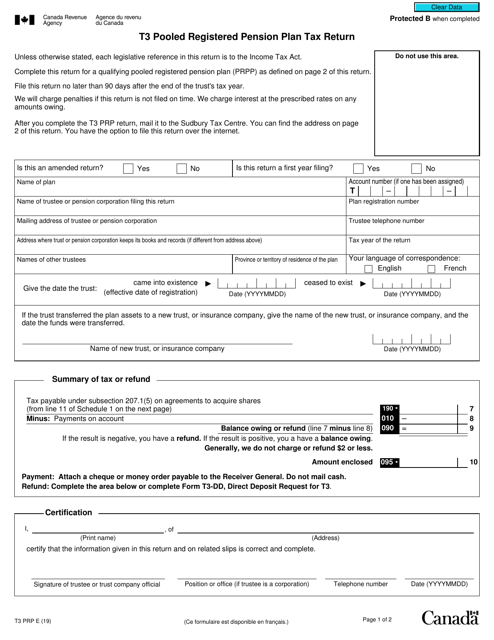

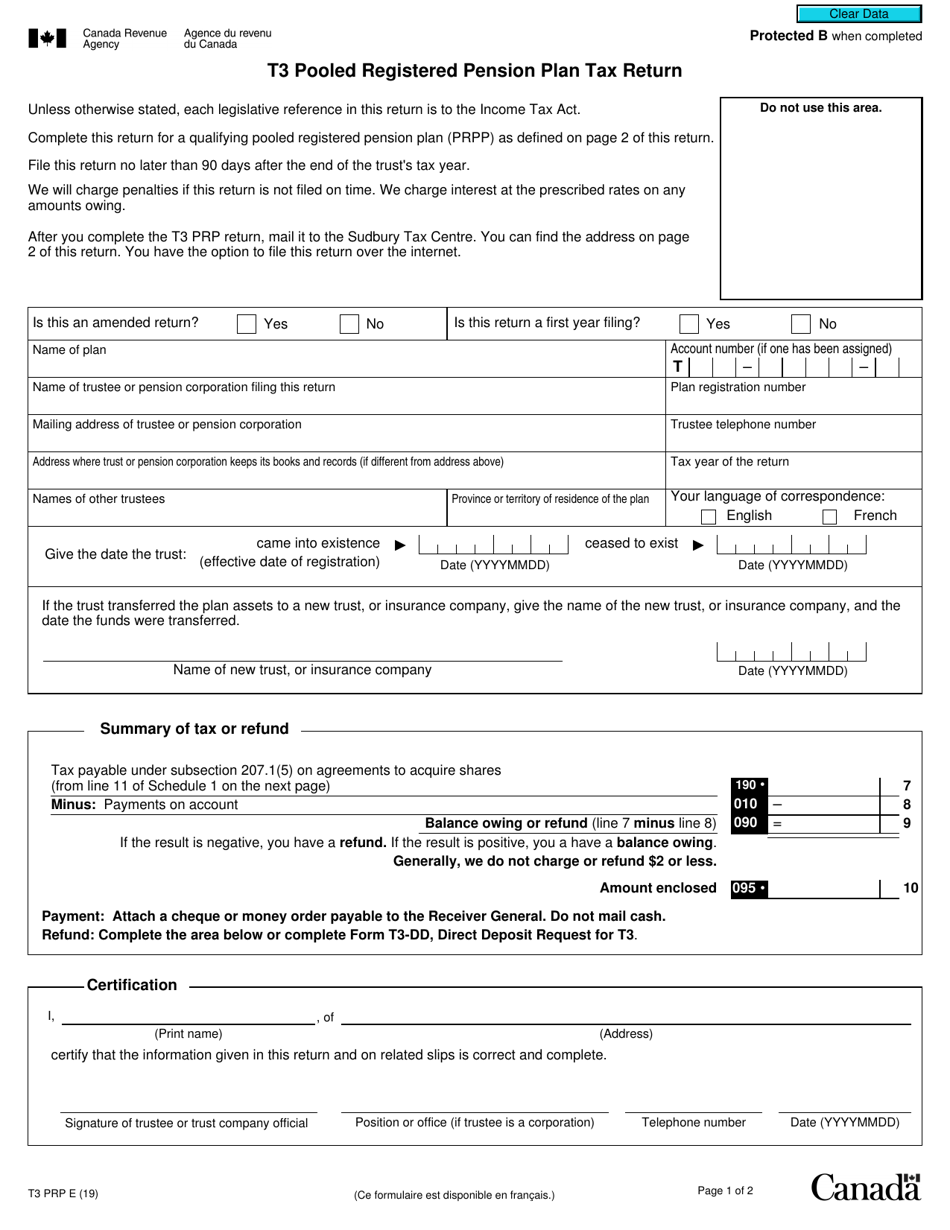

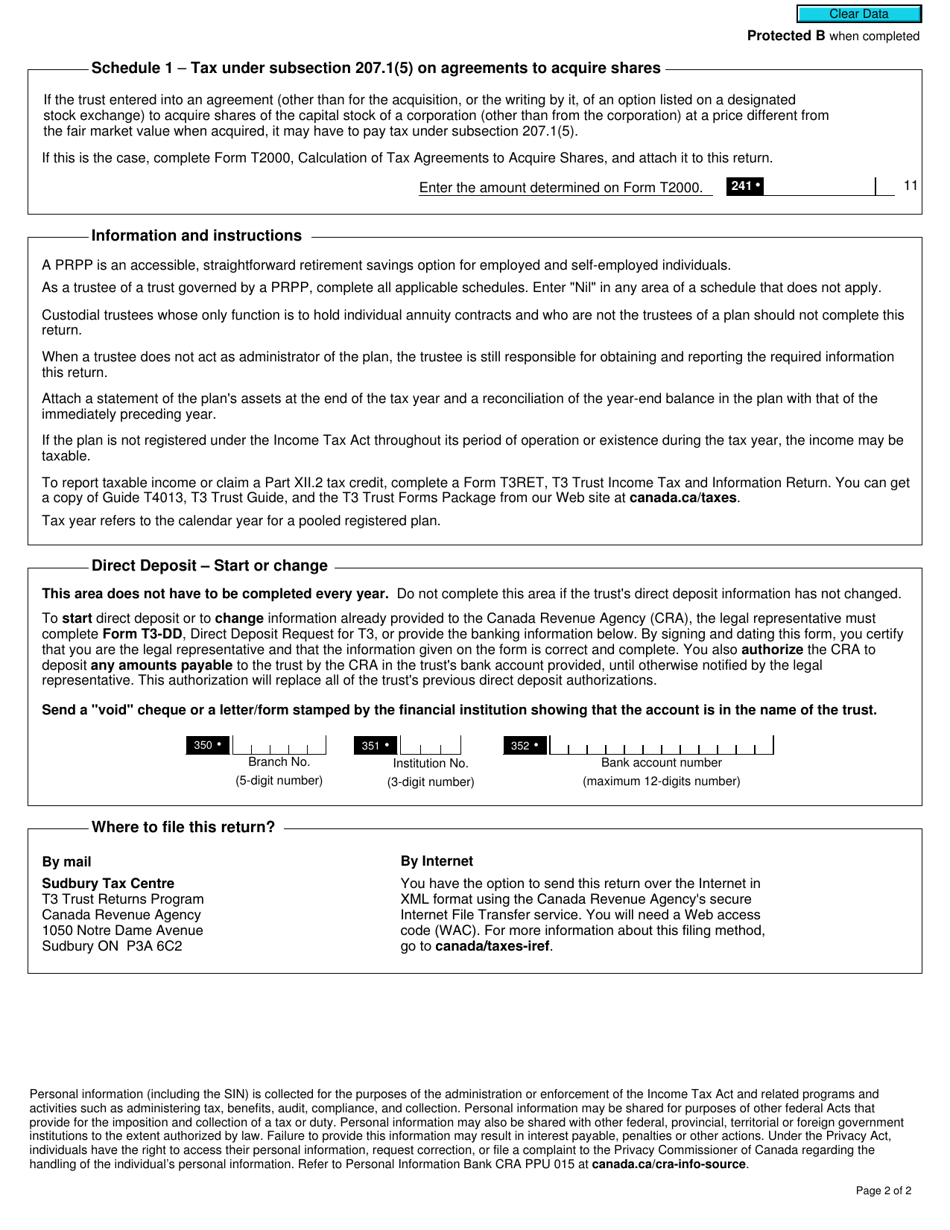

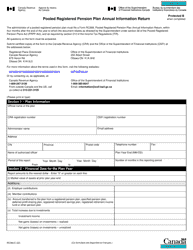

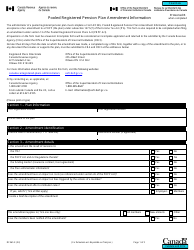

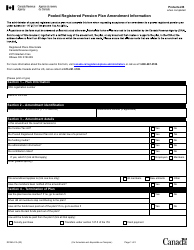

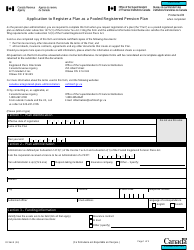

Form T3 PRP T3 Pooled Registered Pension Plan Tax Return - Canada

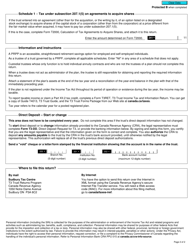

Form T3 PRP is the tax return for Pooled Registered Pension Plans (PRPPs) in Canada. It is used to report income, deductions, and contributions related to PRPPs.

The administrator of the Pooled Registered Pension Plan (PRPP) files the Form T3 PRP T3 Pooled Registered Pension Plan Tax Return in Canada.

FAQ

Q: What is Form T3 PRP?

A: Form T3 PRP is the tax return for Pooled Registered Pension Plans (PRP) in Canada.

Q: Who needs to file Form T3 PRP?

A: Any entity that is a PRP in Canada needs to file Form T3 PRP.

Q: What is a Pooled Registered Pension Plan?

A: A Pooled Registered Pension Plan is a type of pension plan that is offered by financial institutions and managed by an administrator.

Q: What information is required on Form T3 PRP?

A: Form T3 PRP requires information about the PRP's income, expenses, contributions, and distributions.

Q: When is the deadline to file Form T3 PRP?

A: The deadline to file Form T3 PRP is 90 days after the end of the PRP's taxation year.

Q: Are there any penalties for late filing of Form T3 PRP?

A: Yes, there are penalties for late filing of Form T3 PRP. The penalty amount depends on the number of days late and the amount of taxes owed.

Q: Are there any exemptions from filing Form T3 PRP?

A: There are some exemptions from filing Form T3 PRP, such as if the PRP is a small PRP with no more than 10 members.

Q: Do I need to include supporting documents with Form T3 PRP?

A: Yes, you may need to include supporting documents with Form T3 PRP to substantiate the information reported.