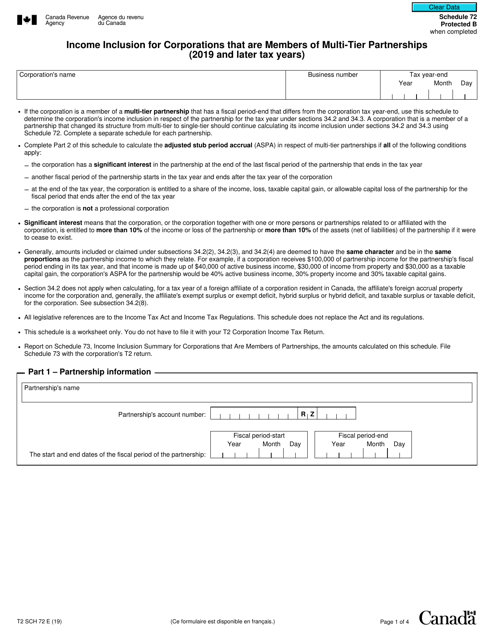

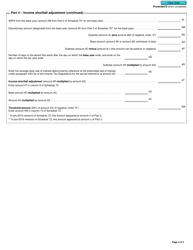

Form T2 Schedule 72 Income Inclusion for Corporations That Are Members of Multi-Tier Partnerships (2019 and Later Tax Years) - Canada

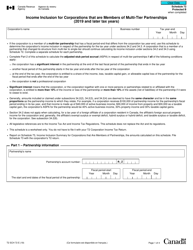

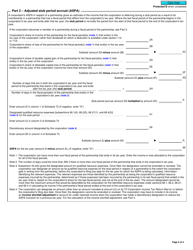

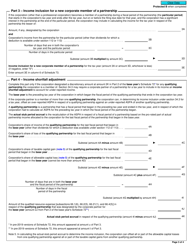

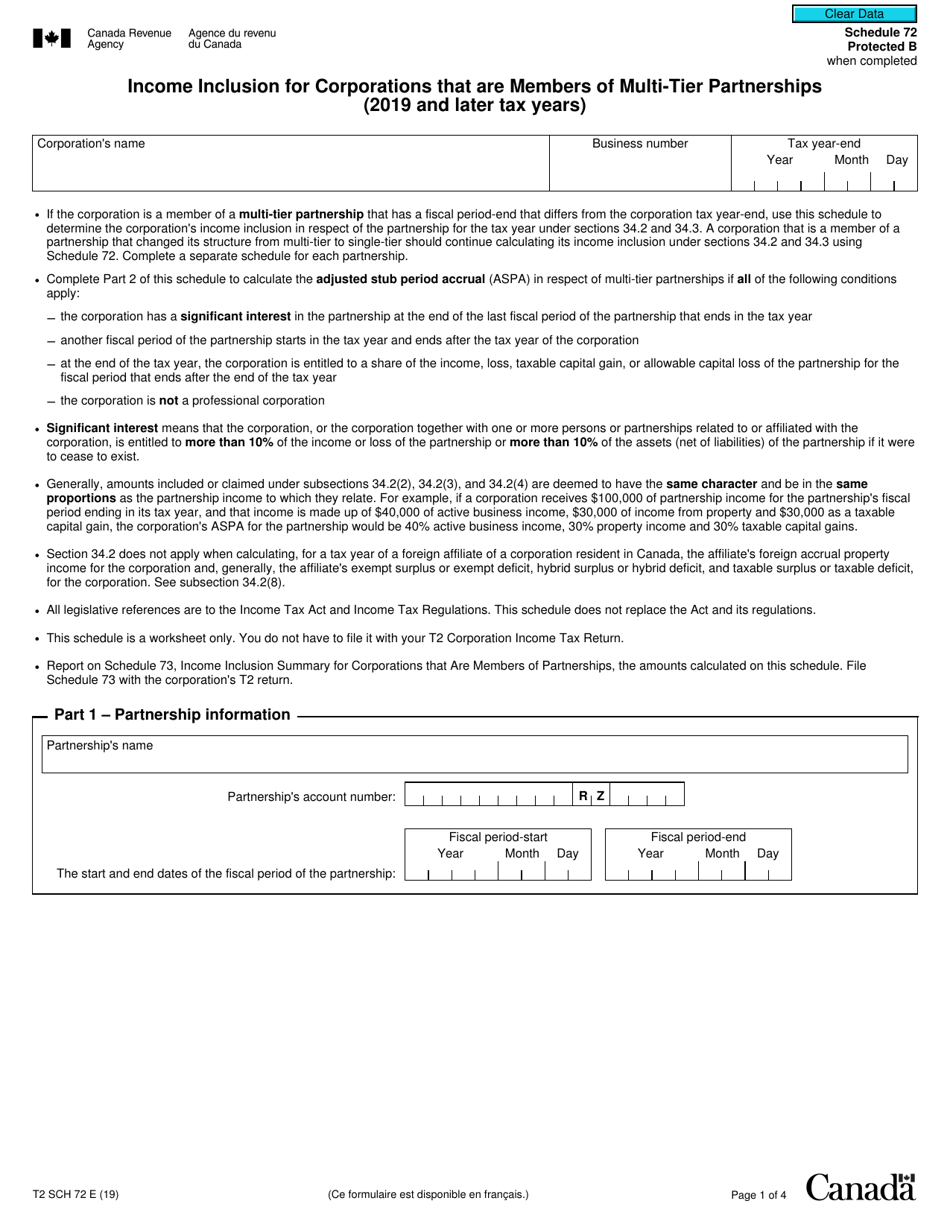

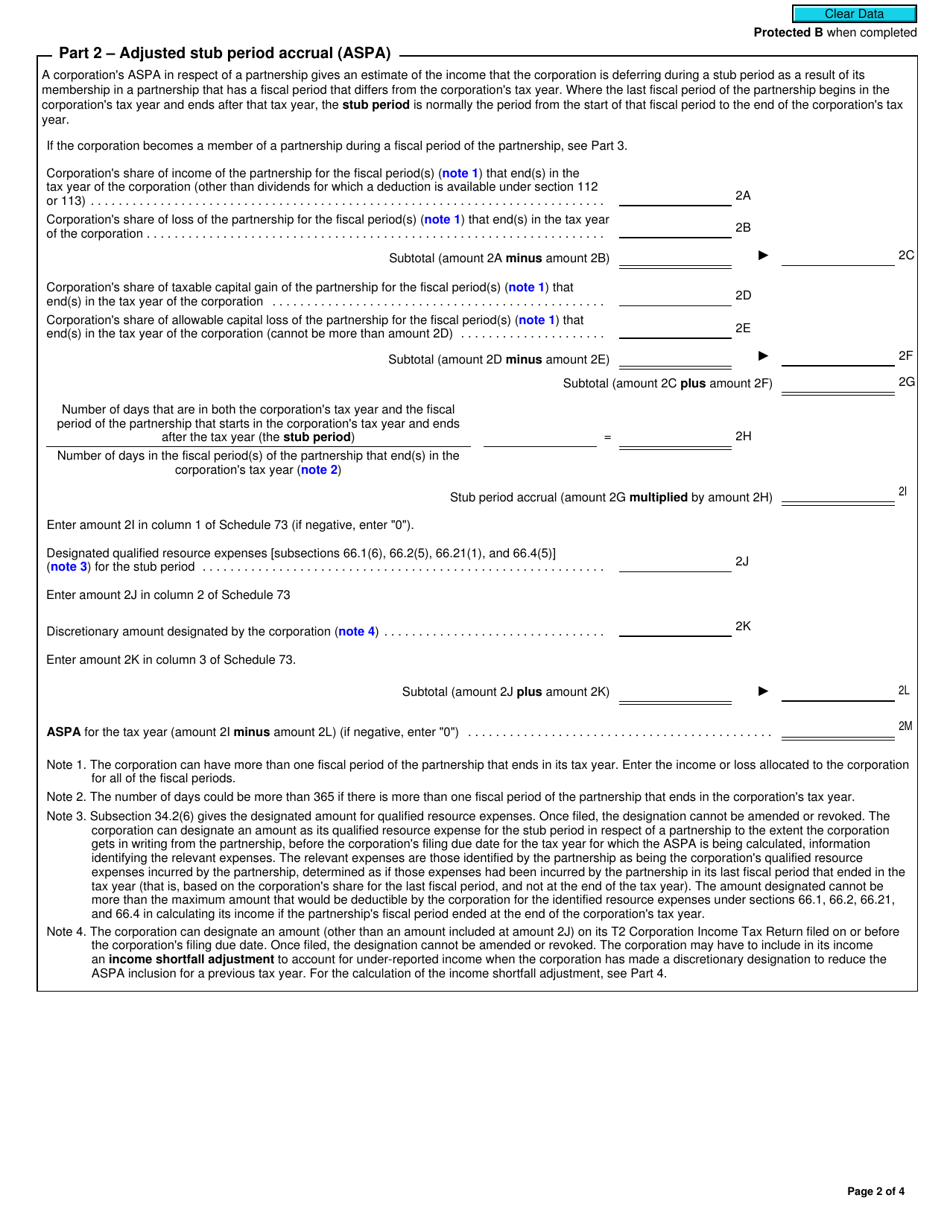

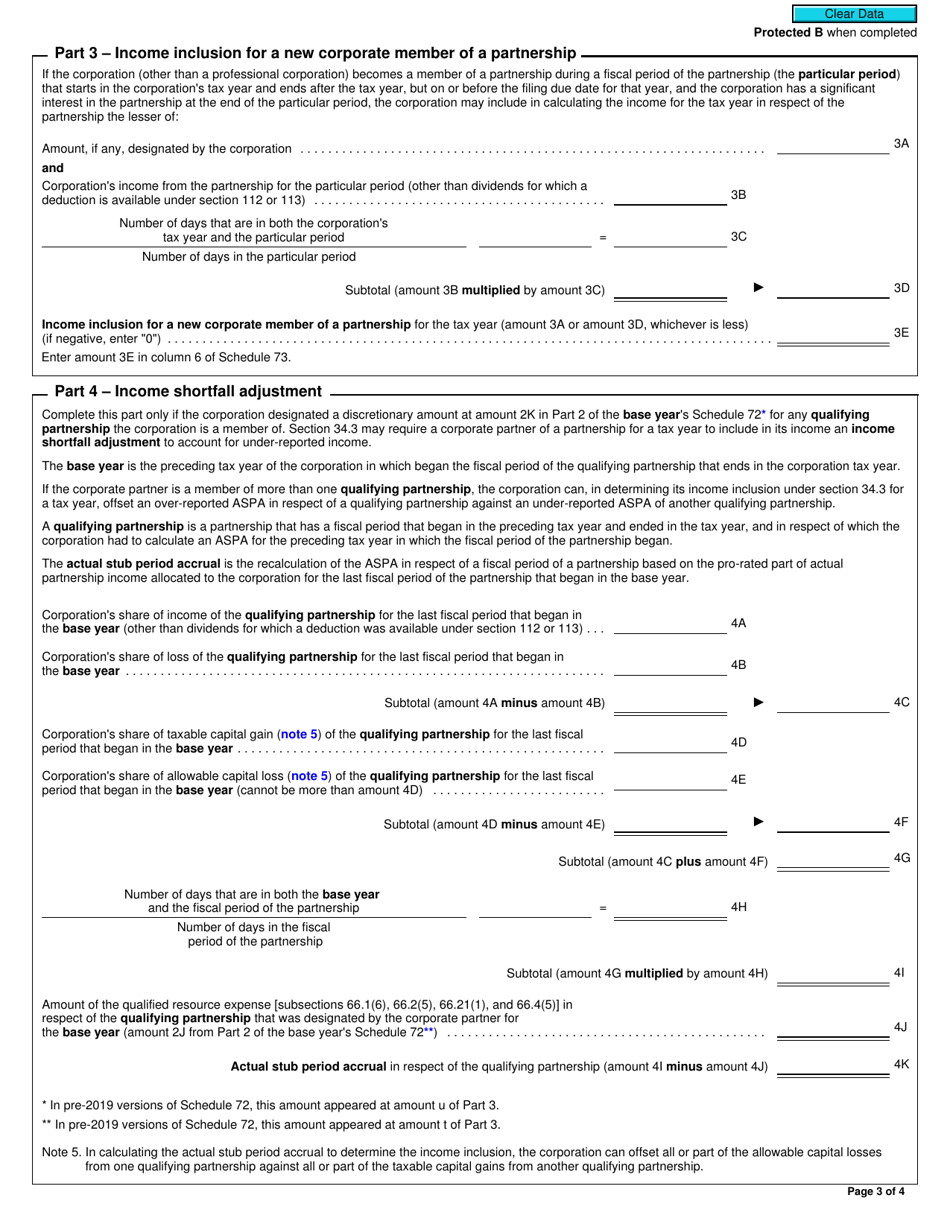

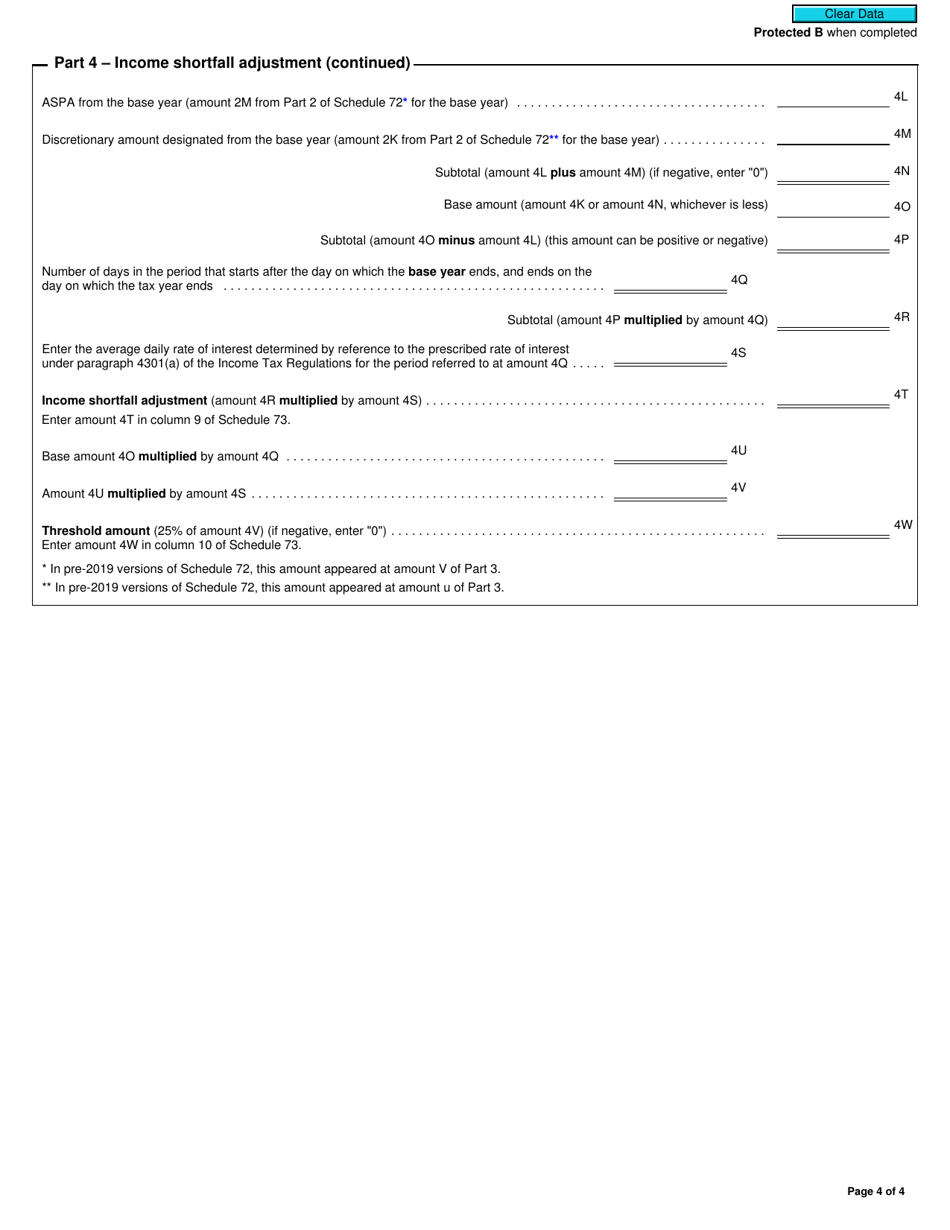

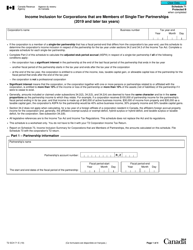

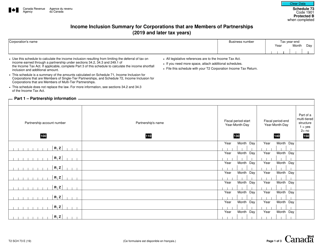

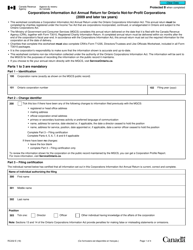

Form T2 Schedule 72 Income Inclusion for Corporations That Are Members of Multi-Tier Partnerships is used by corporations in Canada to report their income that is included from multi-tier partnerships for the 2019 and later tax years.

The Form T2 Schedule 72 Income Inclusion for Corporations That Are Members of Multi-Tier Partnerships (2019 and Later Tax Years) in Canada is filed by corporations that are members of multi-tier partnerships.

FAQ

Q: What is T2 Schedule 72?

A: T2 Schedule 72 is a form used by Canadian corporations that are members of multi-tier partnerships to include their income in their tax calculations.

Q: Who needs to fill out T2 Schedule 72?

A: Canadian corporations that are members of multi-tier partnerships need to fill out T2 Schedule 72.

Q: What does T2 Schedule 72 determine?

A: T2 Schedule 72 determines the income inclusion for corporations that are part of multi-tier partnerships.

Q: What tax years is T2 Schedule 72 applicable for?

A: T2 Schedule 72 is applicable for tax years starting in 2019 and later.

Q: Are there any special requirements for filing T2 Schedule 72?

A: Yes, there may be additional requirements depending on the nature of the multi-tier partnership. It is advisable to consult with a tax professional or refer to the official guidelines from the CRA.