This version of the form is not currently in use and is provided for reference only. Download this version of

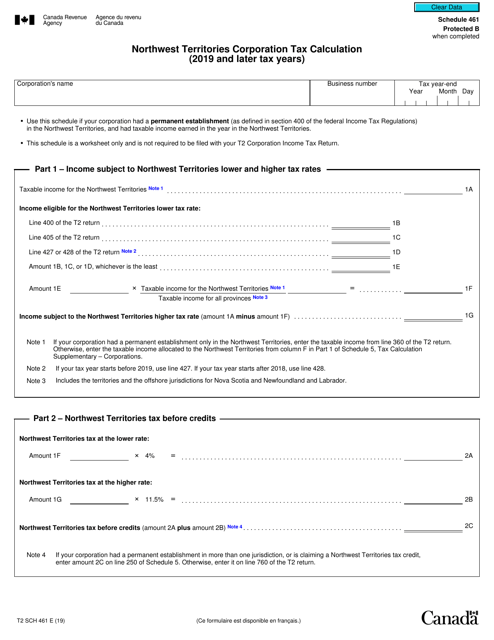

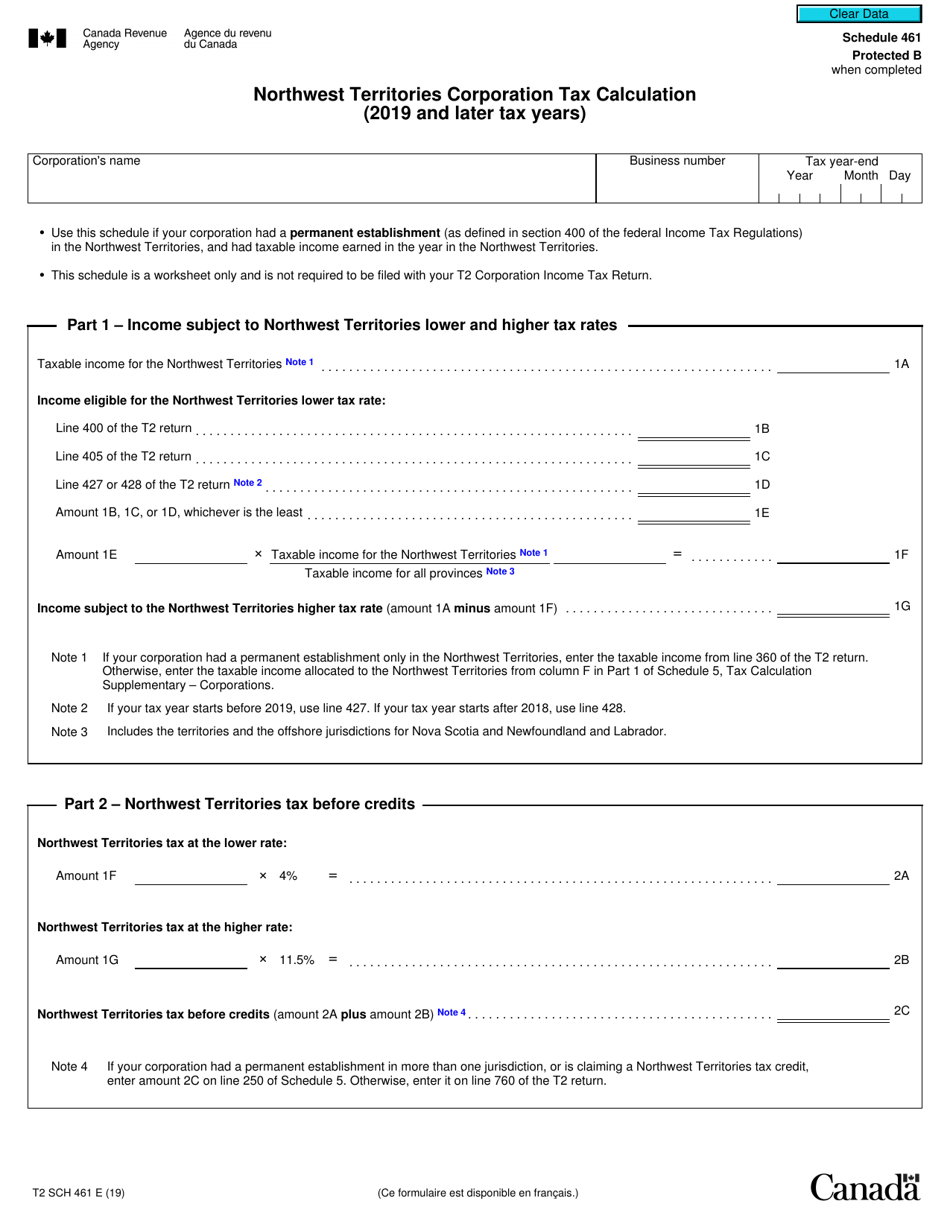

Form T2 Schedule 461

for the current year.

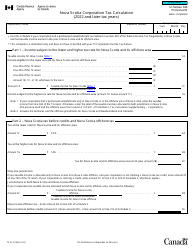

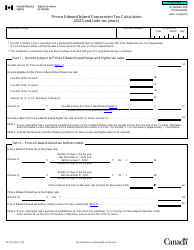

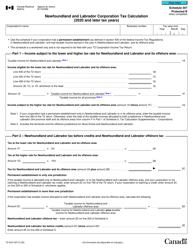

Form T2 Schedule 461 Northwest Territories Corporation Tax Calculation (2019 and Later Tax Years) - Canada

Form T2 Schedule 461 is used for calculating the Northwest Territories Corporation Tax for the tax years 2019 and onwards in Canada. It is specifically designed for corporations operating in the Northwest Territories to determine their tax liability.

The corporation in the Northwest Territories, Canada, should file the Form T2 Schedule 461 for tax calculation in the specified tax years.

FAQ

Q: What is Form T2 Schedule 461?

A: Form T2 Schedule 461 is the Northwest Territories Corporation Tax Calculation form for the 2019 and later tax years in Canada.

Q: Who needs to fill out Form T2 Schedule 461?

A: Northwest Territories corporations that are required to file a tax return in Canada need to fill out Form T2 Schedule 461.

Q: What is the purpose of Form T2 Schedule 461?

A: The purpose of Form T2 Schedule 461 is to calculate the corporation tax owed by Northwest Territories corporations in Canada.

Q: What tax years is Form T2 Schedule 461 applicable for?

A: Form T2 Schedule 461 is applicable for the 2019 and later tax years in Canada.