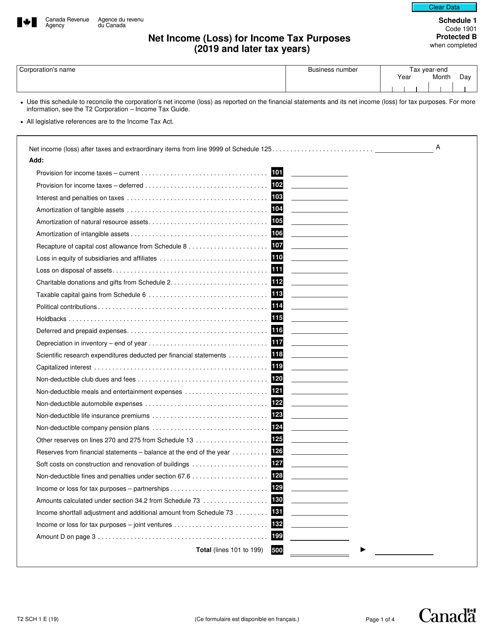

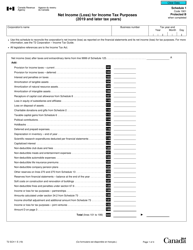

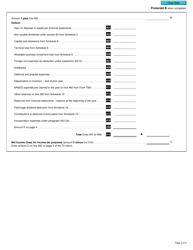

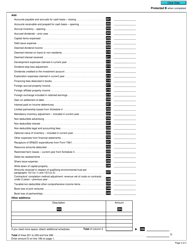

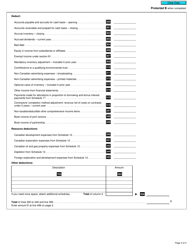

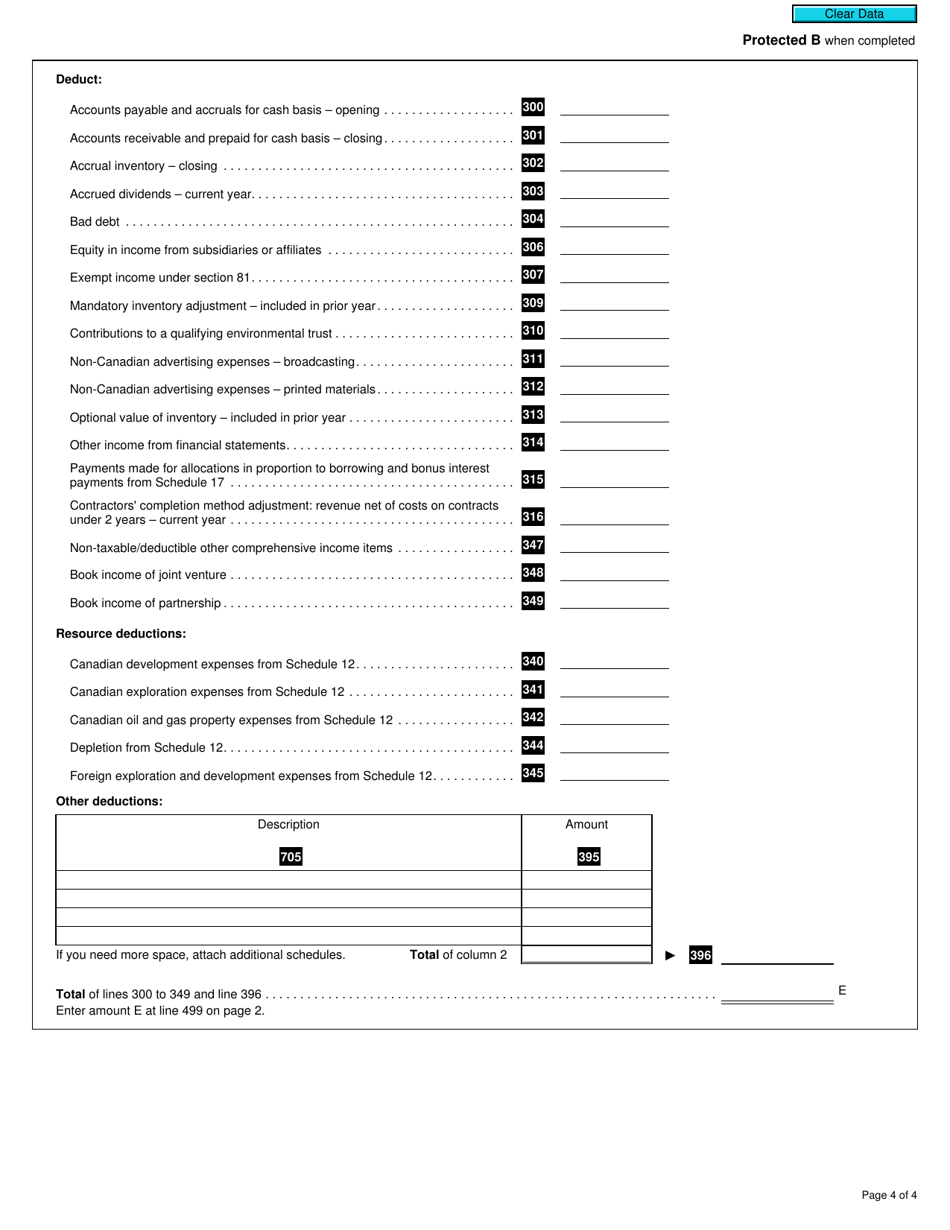

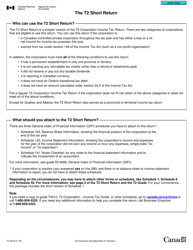

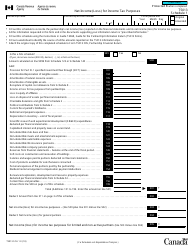

Form T2 Schedule 1 Net Income (Loss) for Income Tax Purposes (2019 and Later Tax Years) - Canada

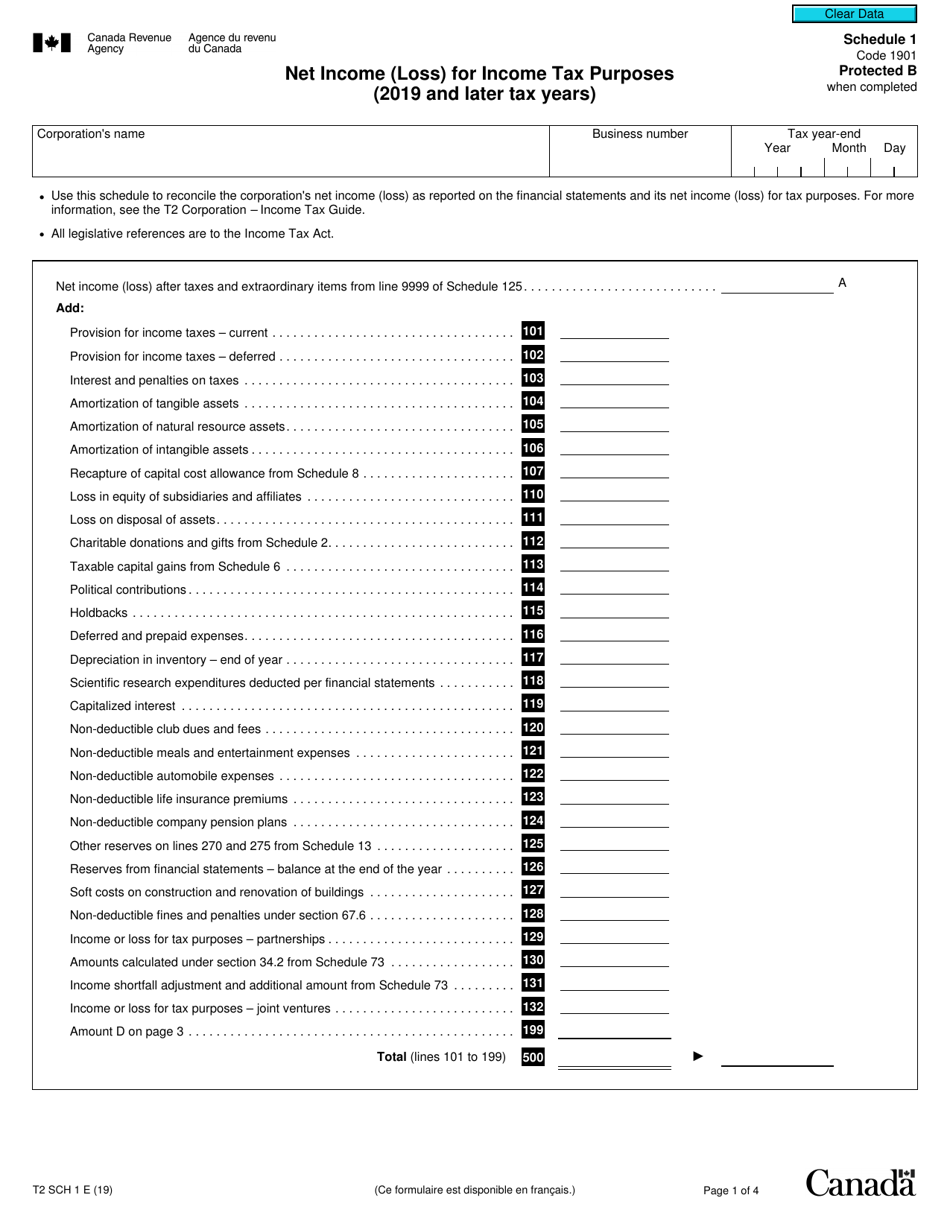

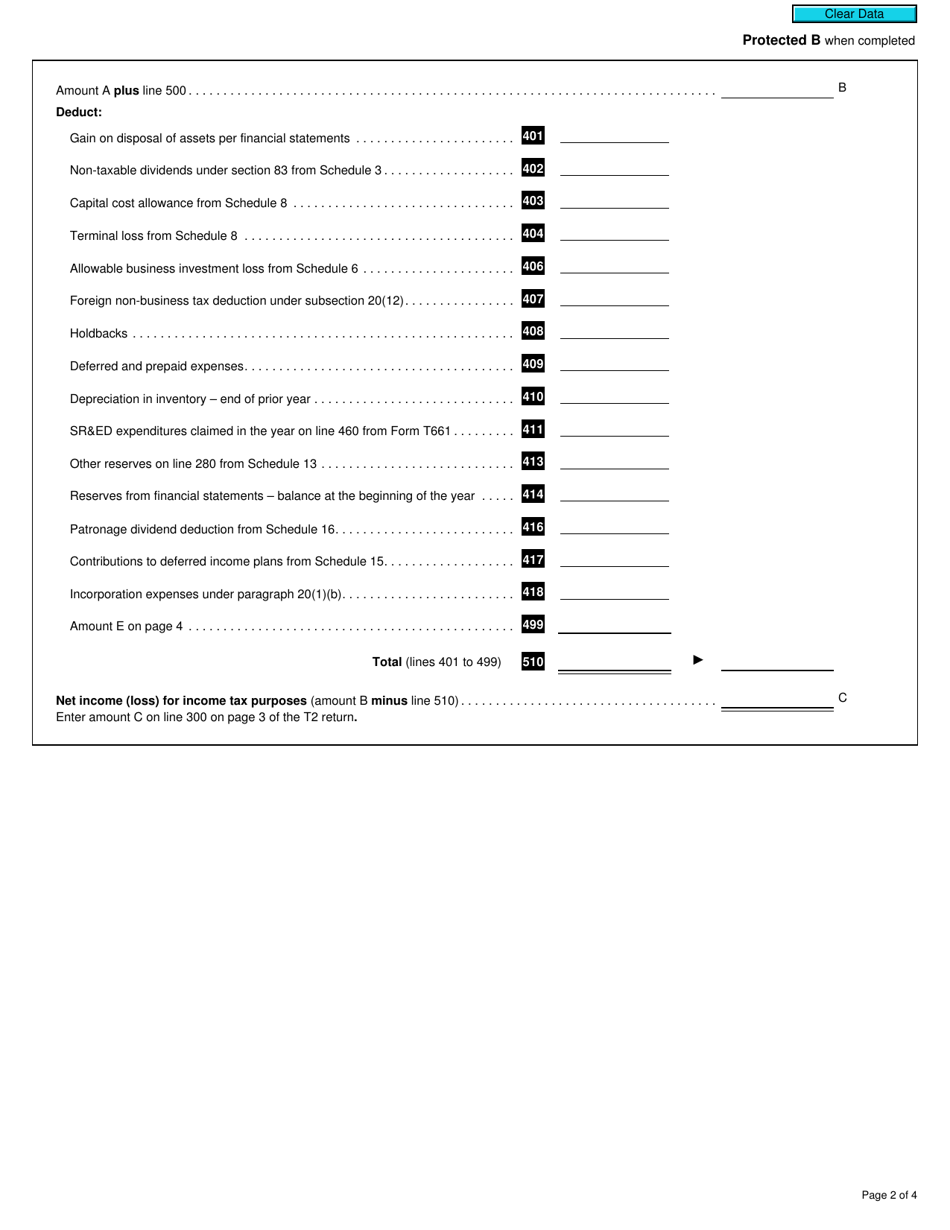

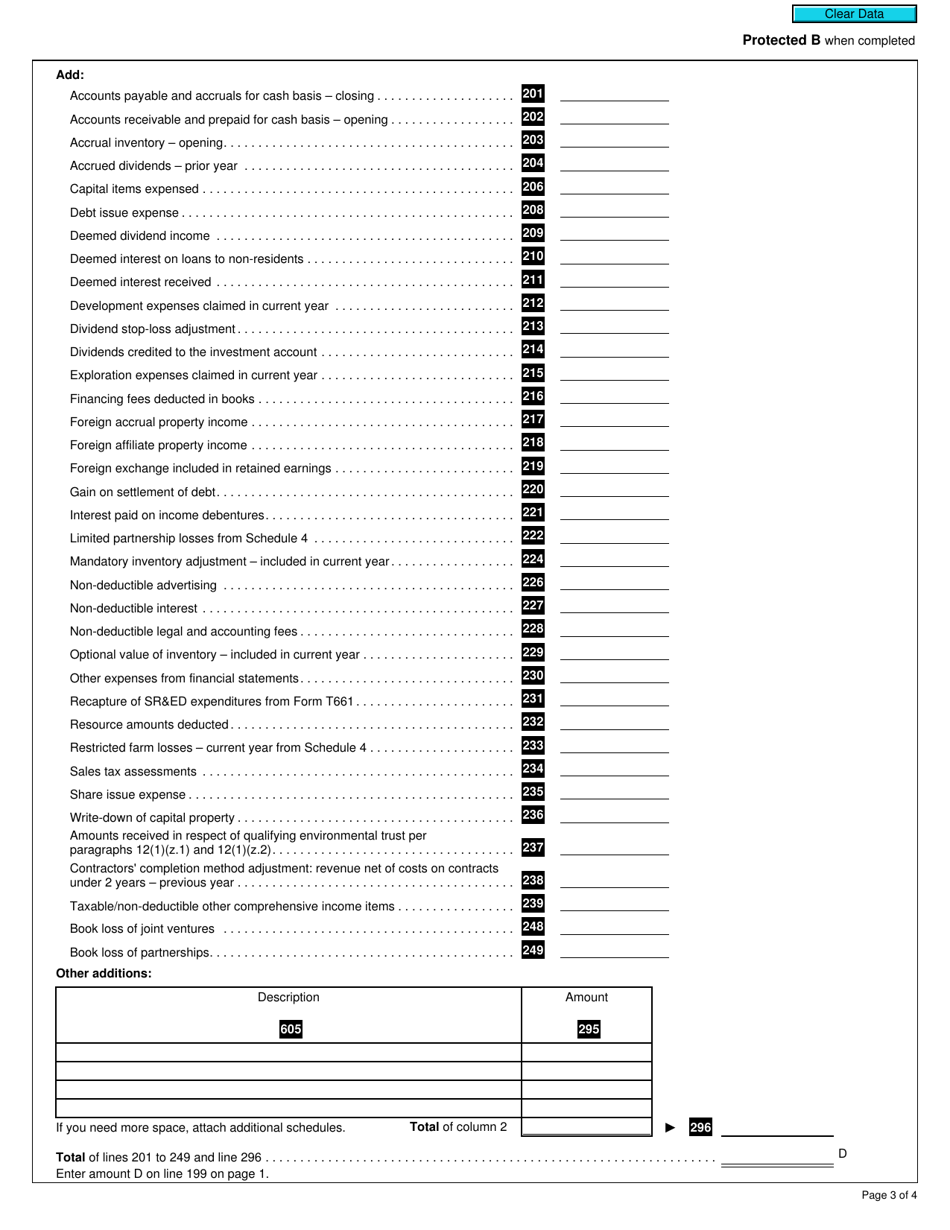

Form T2 Schedule 1 - Net Income (Loss) for Income Tax Purposes is used in Canada for reporting the net income or loss of a corporation for income tax purposes. It is used to calculate the taxable income of a corporation and determine the amount of income tax to be paid.

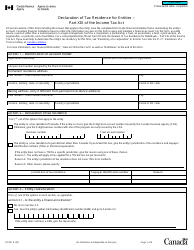

The Form T2 Schedule 1 for net income (loss) for income tax purposes in Canada is filed by corporations.

FAQ

Q: What is Form T2 Schedule 1?

A: Form T2 Schedule 1 is used to calculate the net income (loss) for income tax purposes in Canada.

Q: What tax years does Form T2 Schedule 1 apply to?

A: Form T2 Schedule 1 applies to the tax years 2019 and later.

Q: What is net income (loss) for income tax purposes?

A: Net income (loss) for income tax purposes is the amount of income or loss that is used to calculate the taxes owed by a corporation.

Q: Do I need to file Form T2 Schedule 1?

A: Whether or not you need to file Form T2 Schedule 1 depends on your corporation's financial situation. It is recommended to consult with a tax professional or the CRA for guidance.

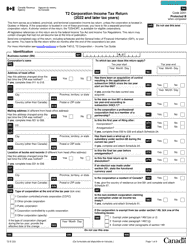

Q: What information is required to complete Form T2 Schedule 1?

A: To complete Form T2 Schedule 1, you will need to provide information about your corporation's income, expenses, deductions, and other relevant financial details.

Q: Are there any deadlines for filing Form T2 Schedule 1?

A: The deadline for filing Form T2 Schedule 1 is generally within six months of the end of your corporation's taxation year. It is important to check the specific deadline for your tax year.

Q: What happens if I don't file Form T2 Schedule 1 on time?

A: If you fail to file Form T2 Schedule 1 on time, you may be subject to penalties and interest charges imposed by the CRA.