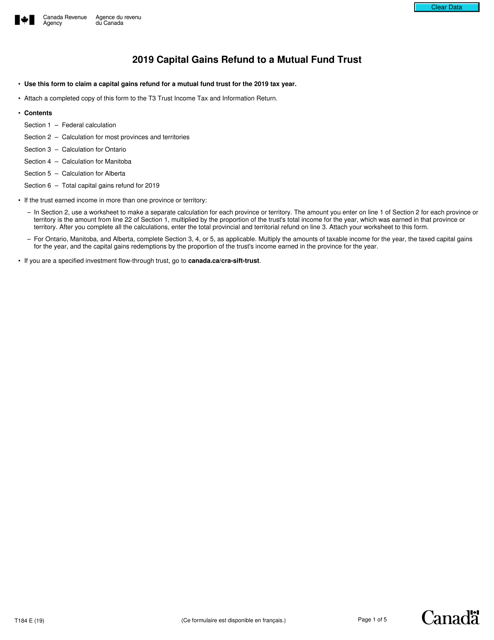

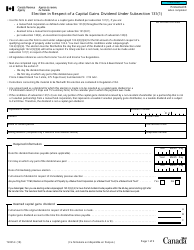

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T184

for the current year.

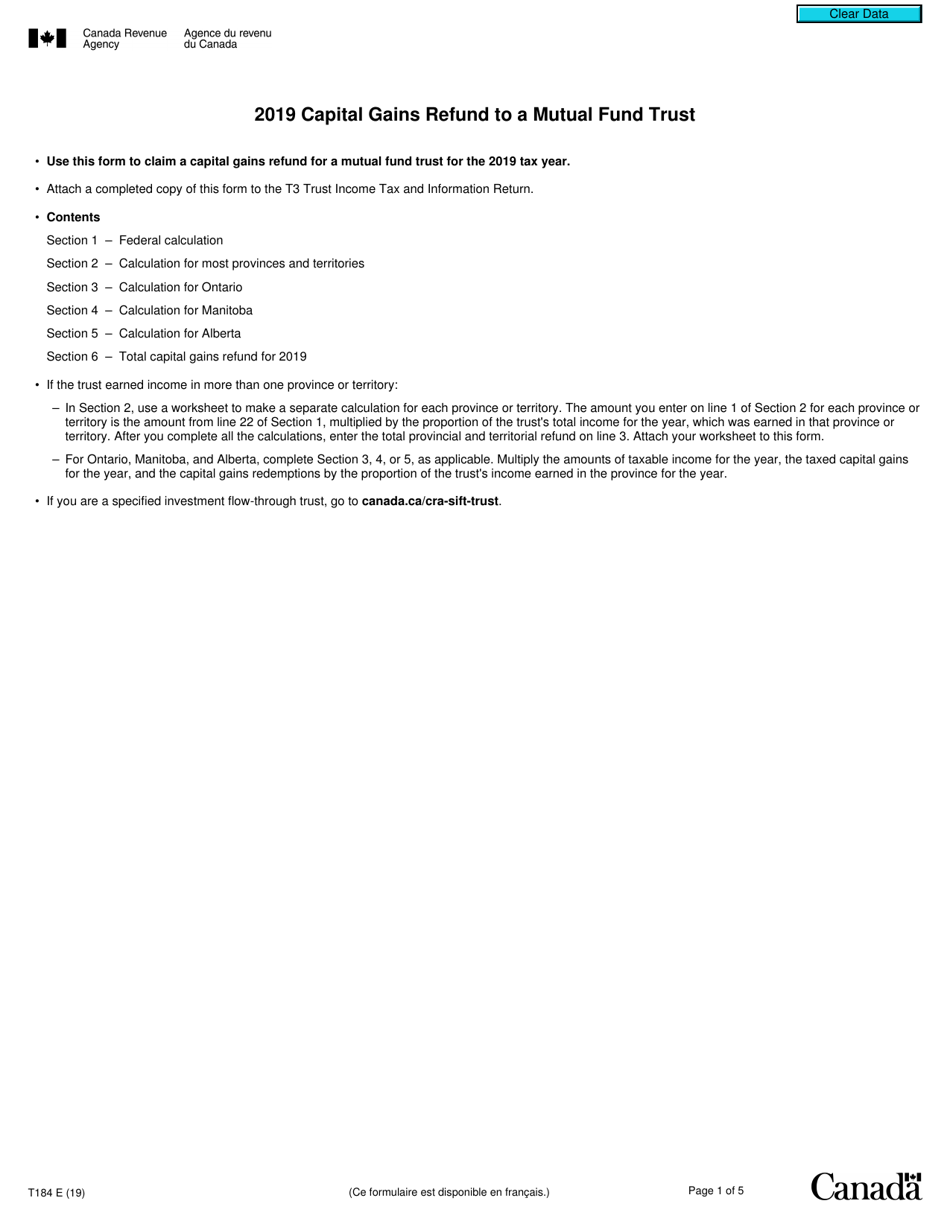

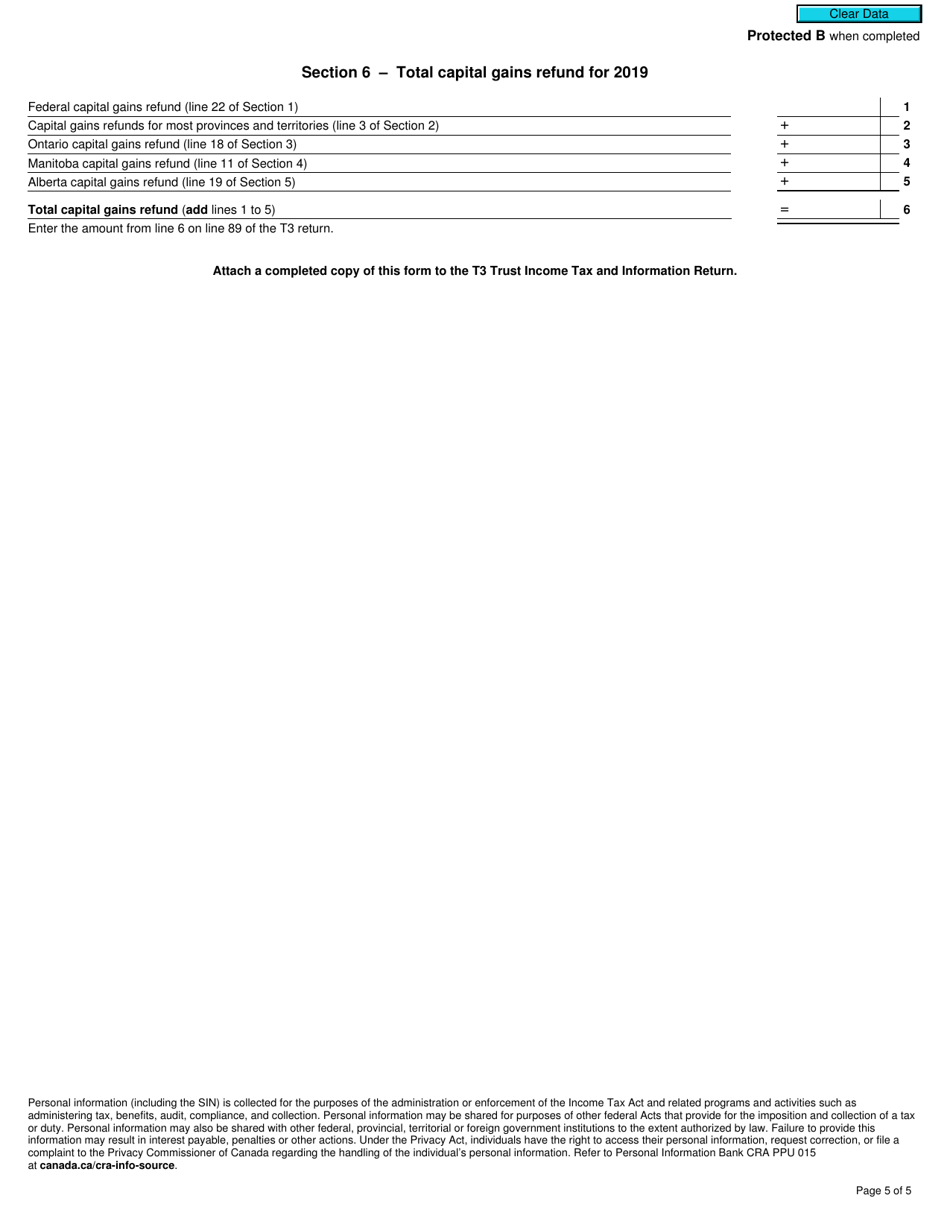

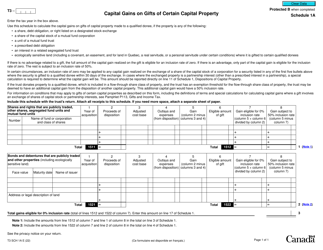

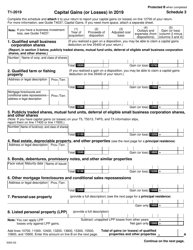

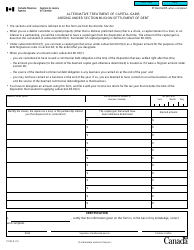

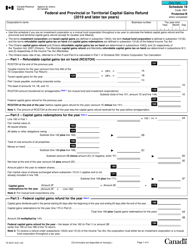

Form T184 Capital Gains Refund to a Mutual Fund Trust - Canada

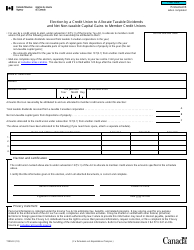

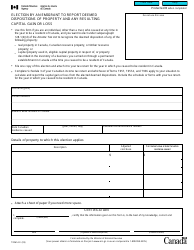

Form T184 is used in Canada for individuals who have received a capital gains refund from a mutual fund trust. This form is used to claim the refund and provide the necessary information to the Canada Revenue Agency (CRA).

The investor who is selling units of a mutual fund trust files the Form T184 Capital Gains Refund.

FAQ

Q: What is Form T184?

A: Form T184 is a form used in Canada to apply for a capital gains refund to a mutual fund trust.

Q: Who can use Form T184?

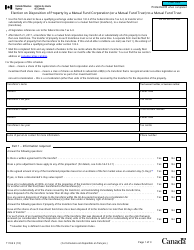

A: Form T184 can be used by individuals or corporations who are eligible for a capital gains refund from a mutual fund trust.

Q: What is a mutual fund trust?

A: A mutual fund trust is a type of investment vehicle that pools money from multiple investors to invest in a diversified portfolio of securities.

Q: Why would someone need to apply for a capital gains refund?

A: Someone may need to apply for a capital gains refund if they have realized a capital gain on the sale of mutual fund trust units and meet certain criteria for the refund.

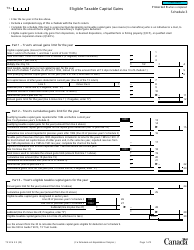

Q: What are the criteria for a capital gains refund?

A: The criteria for a capital gains refund vary depending on the specific situation, but generally involve holding units in a mutual fund trust for a certain period of time and meeting certain ownership and residency requirements.

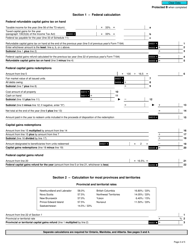

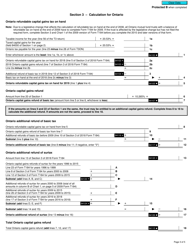

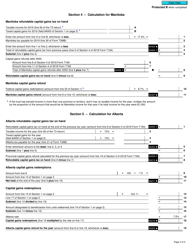

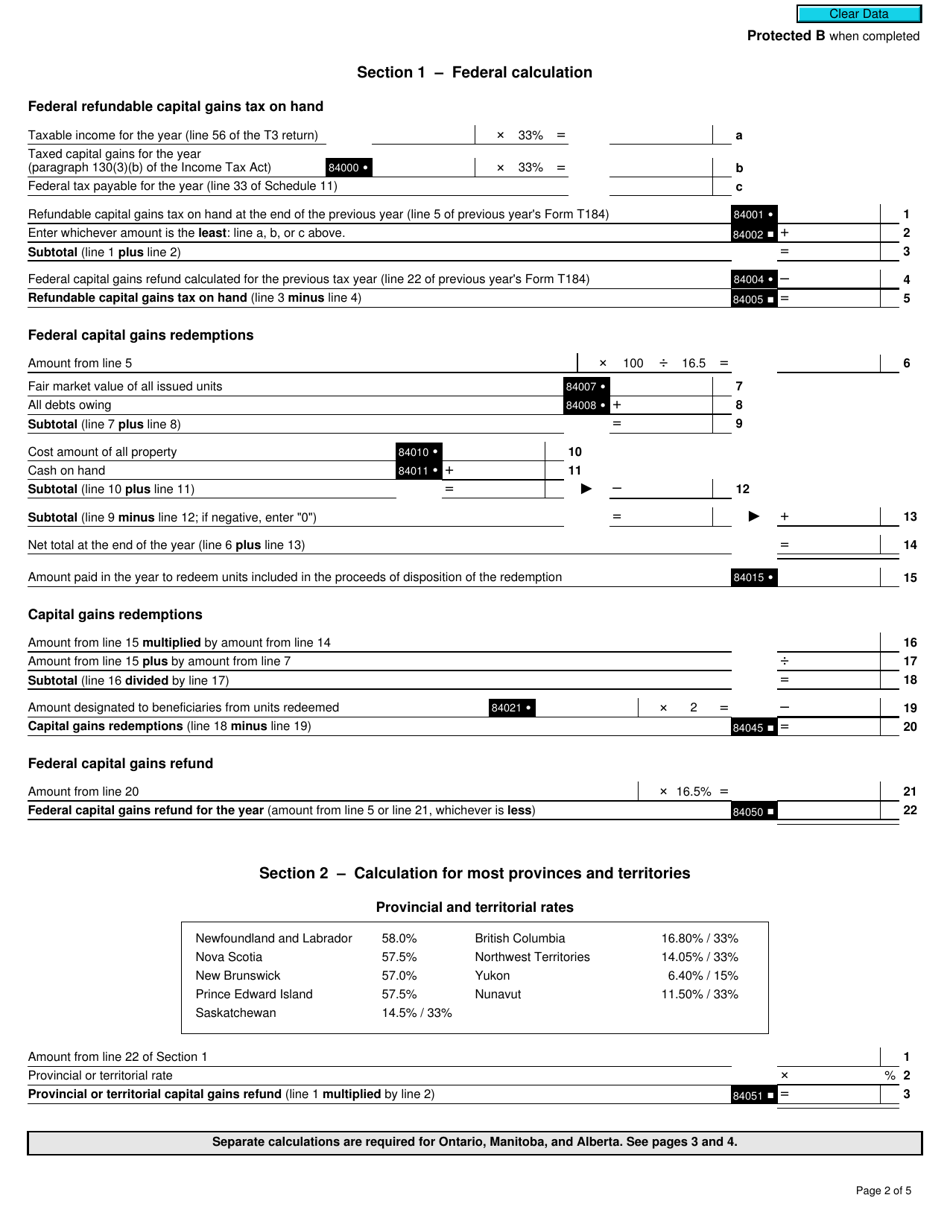

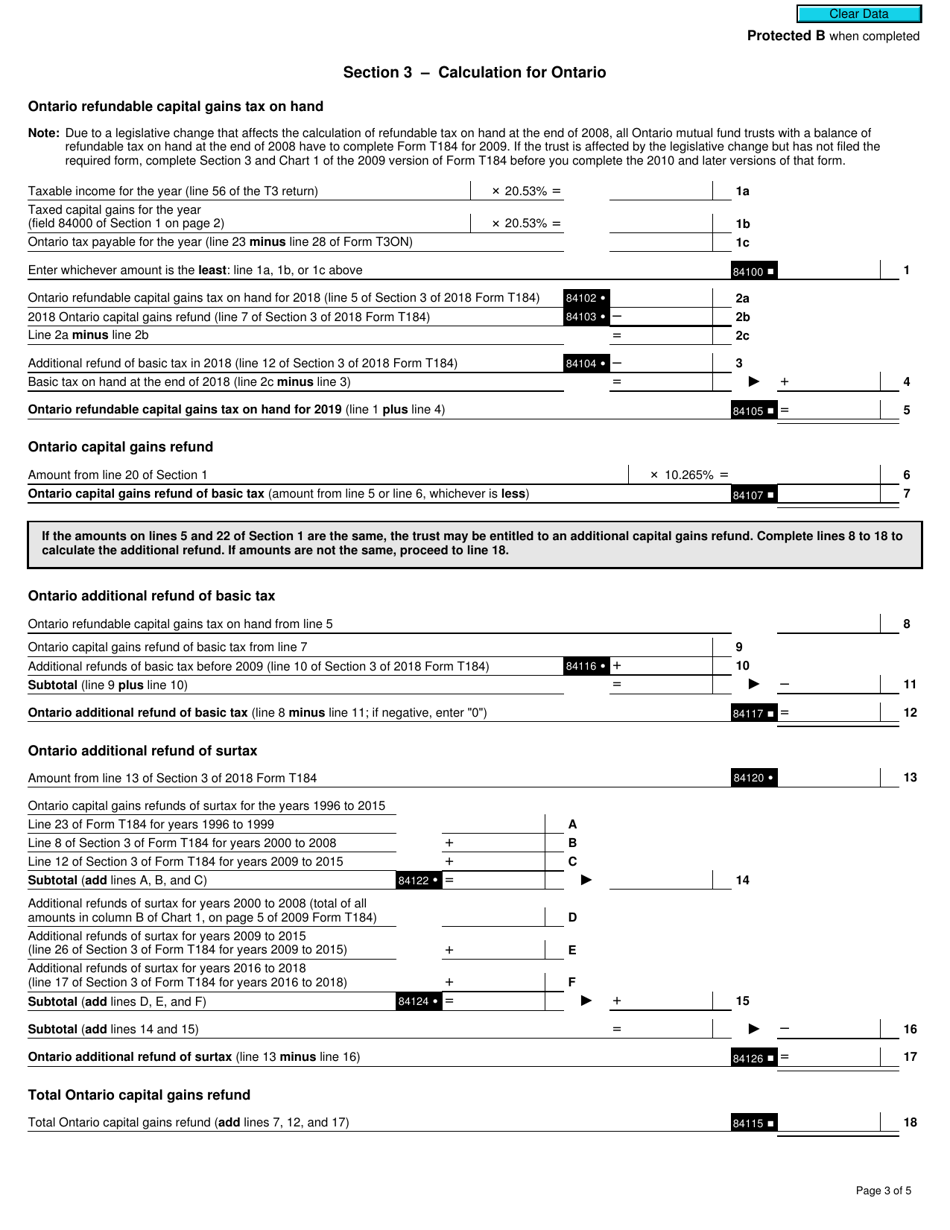

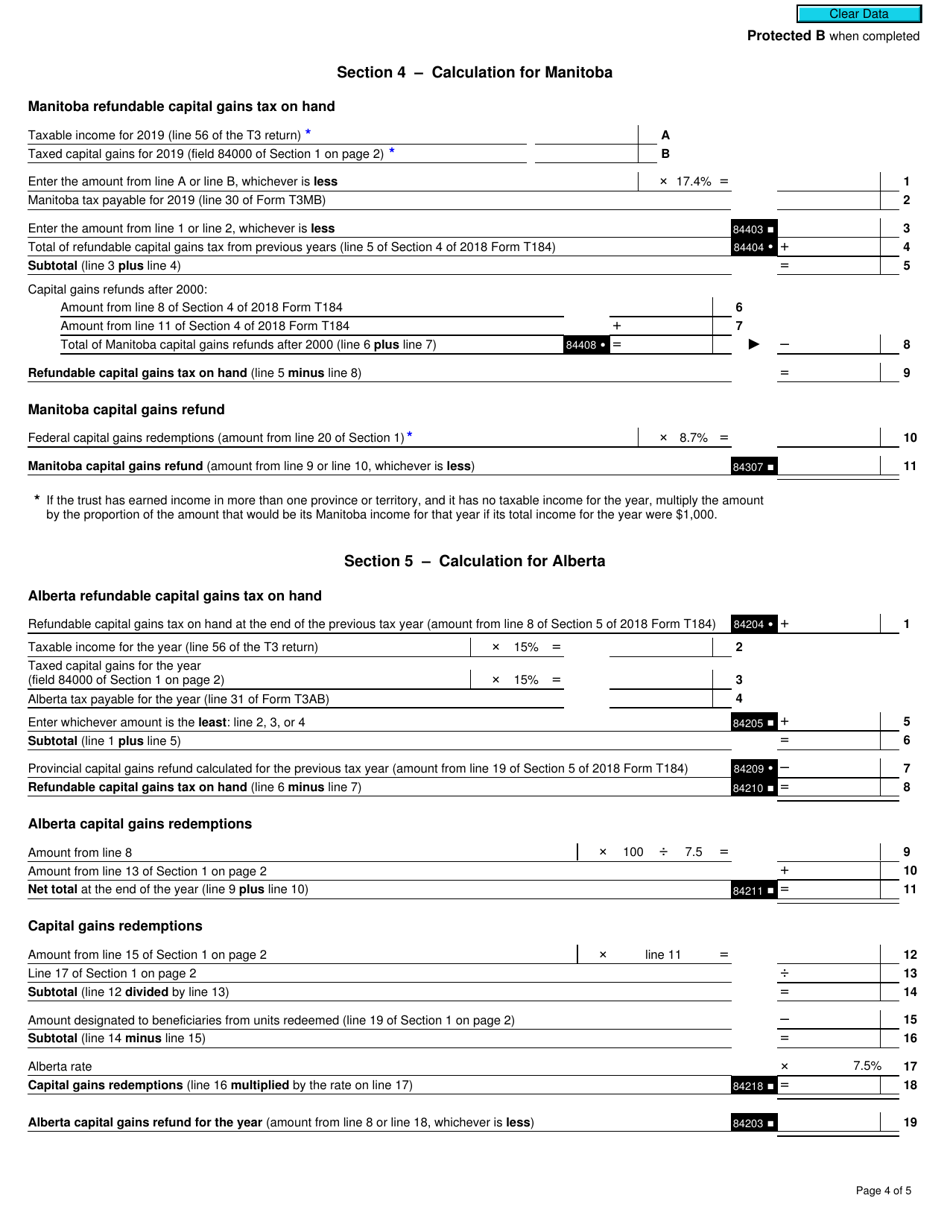

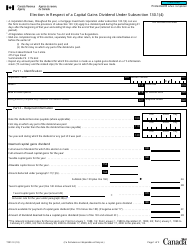

Q: How do I fill out Form T184?

A: Form T184 must be completed with the required information, including details about the mutual fund trust units, the capital gains realized, and the eligibility criteria for the refund.

Q: Are there any deadlines for submitting Form T184?

A: Yes, there are deadlines for submitting Form T184. The specific deadlines can vary depending on the situation, so it is important to review the instructions on the form or consult with the CRA.

Q: Can I e-file Form T184?

A: No, Form T184 cannot be e-filed. It must be completed on paper and sent to the CRA by mail or courier.