This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1079

for the current year.

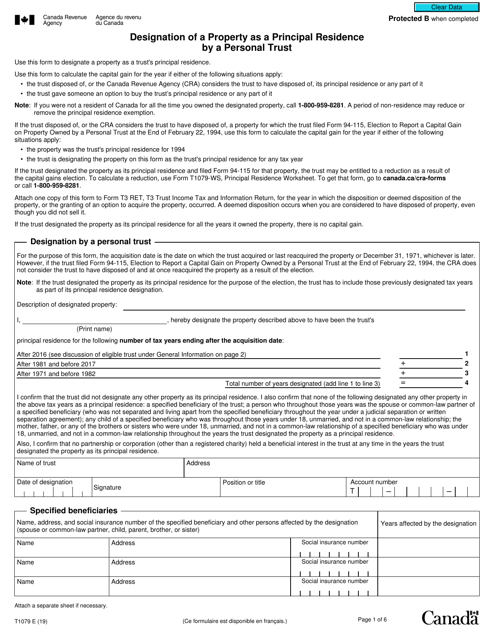

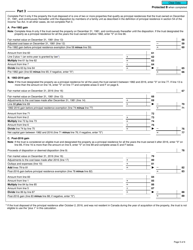

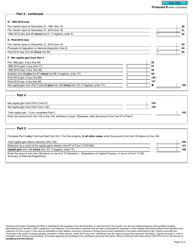

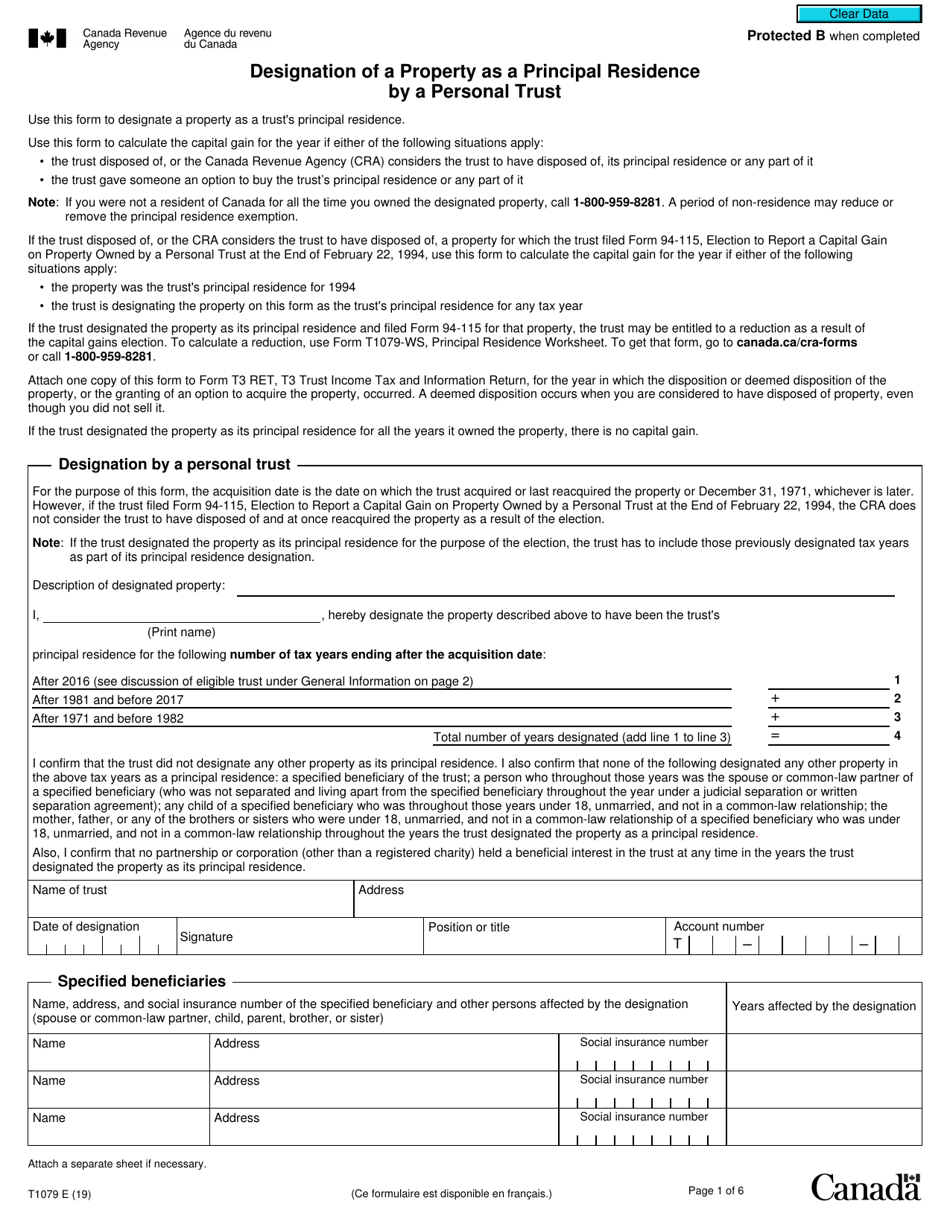

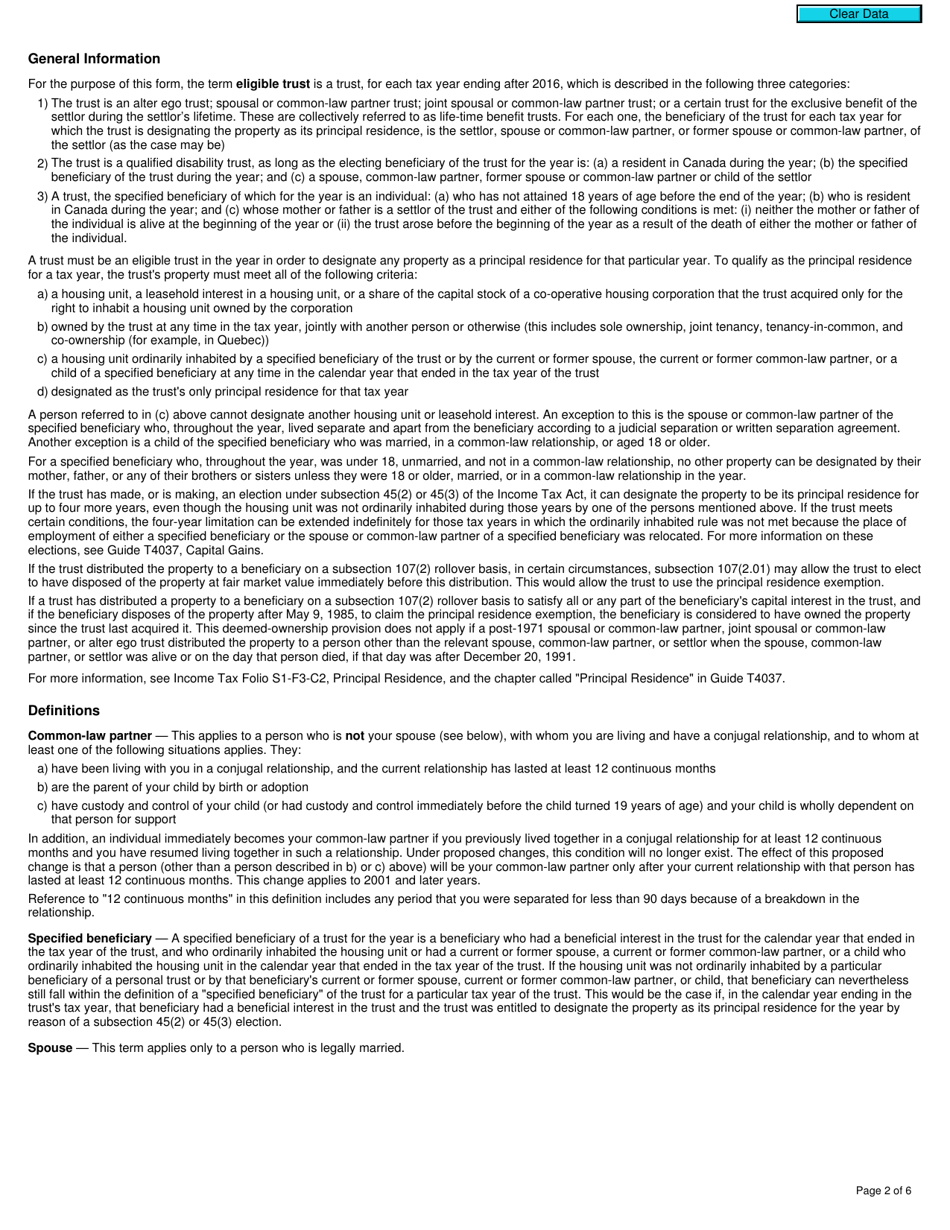

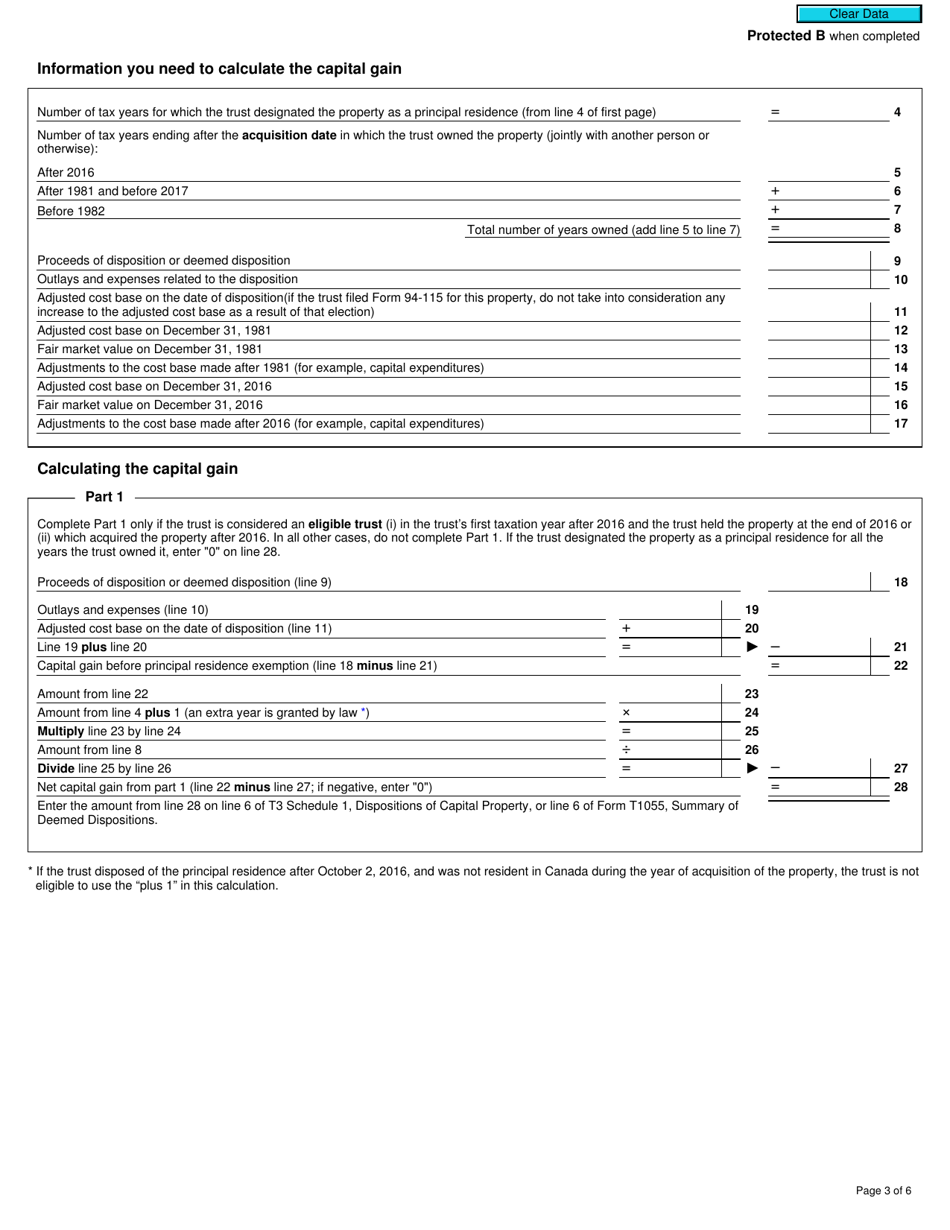

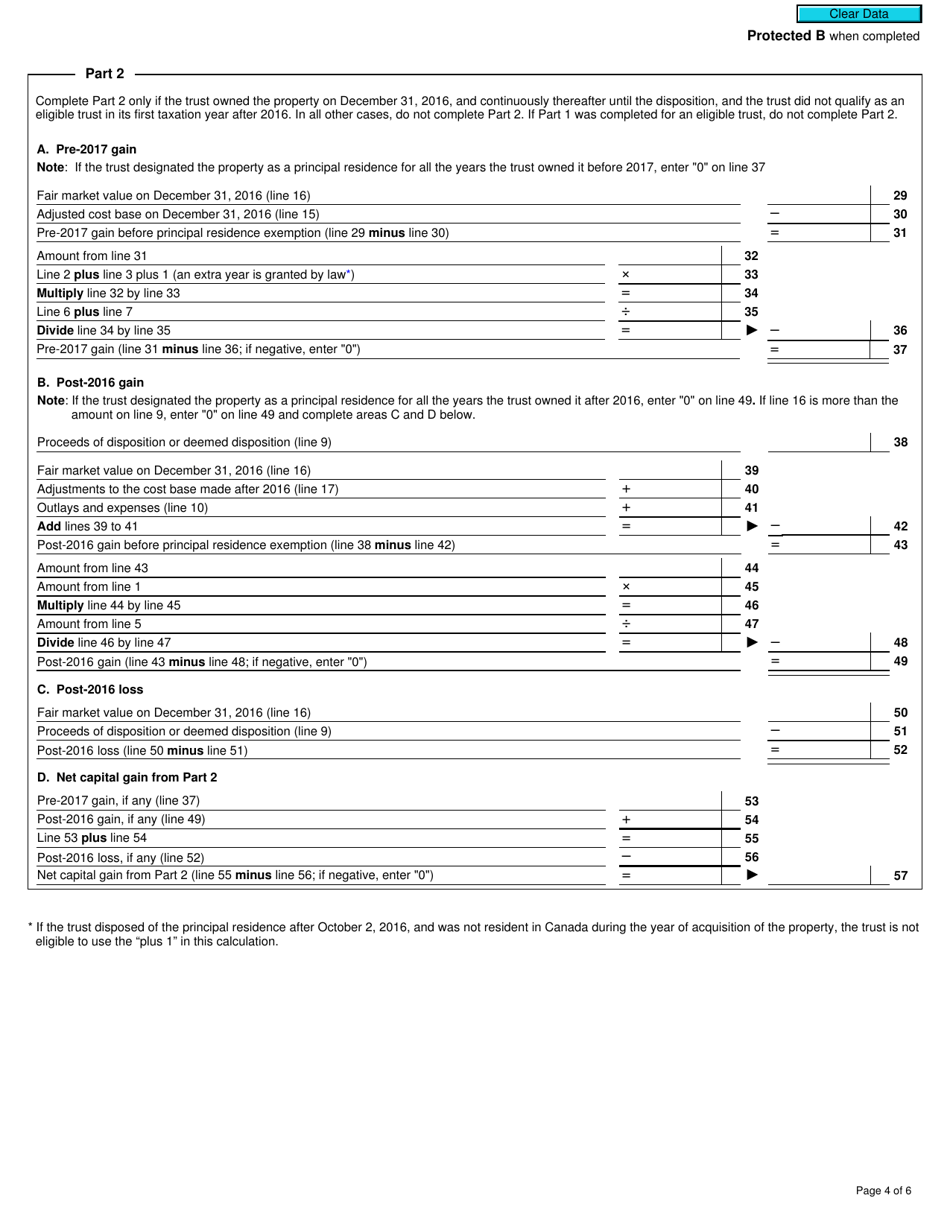

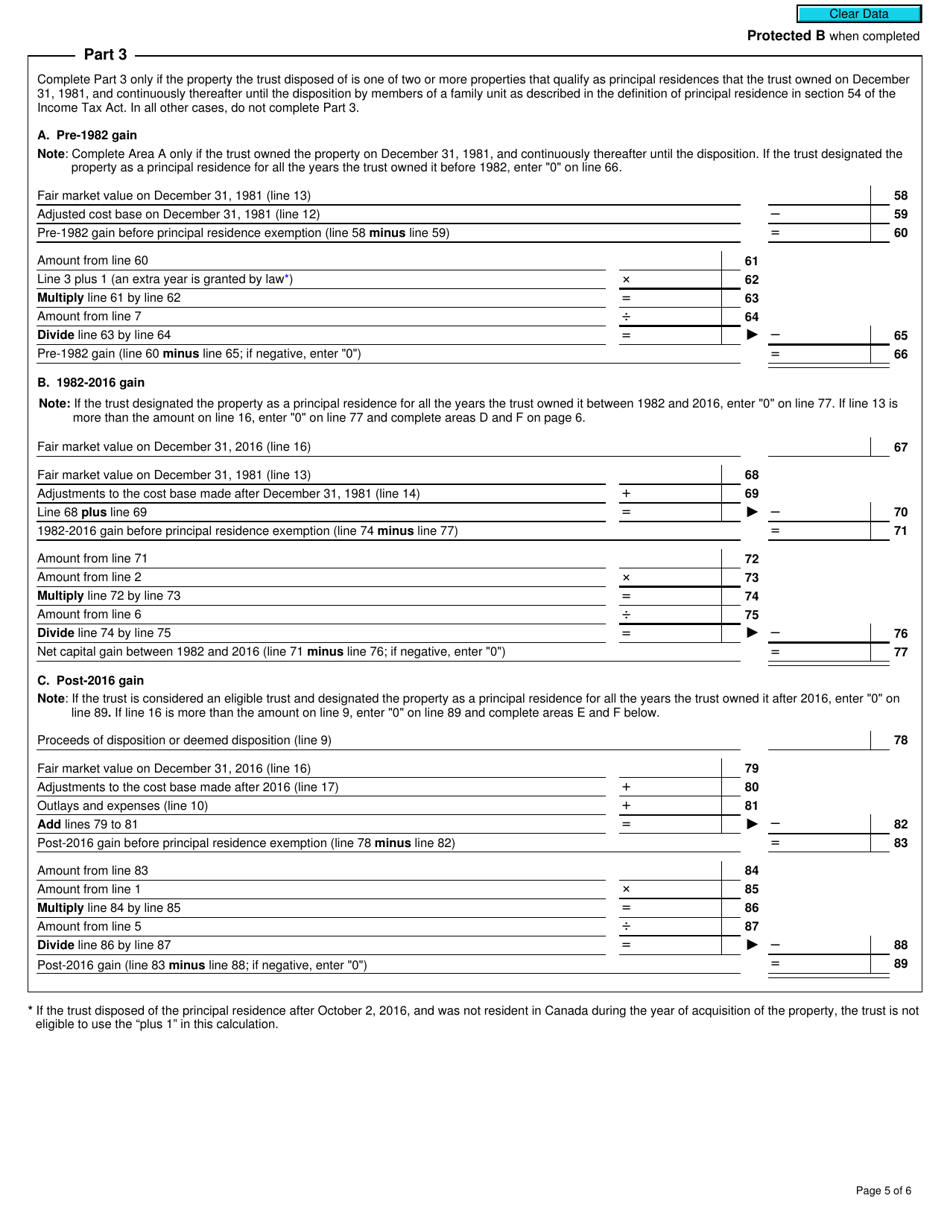

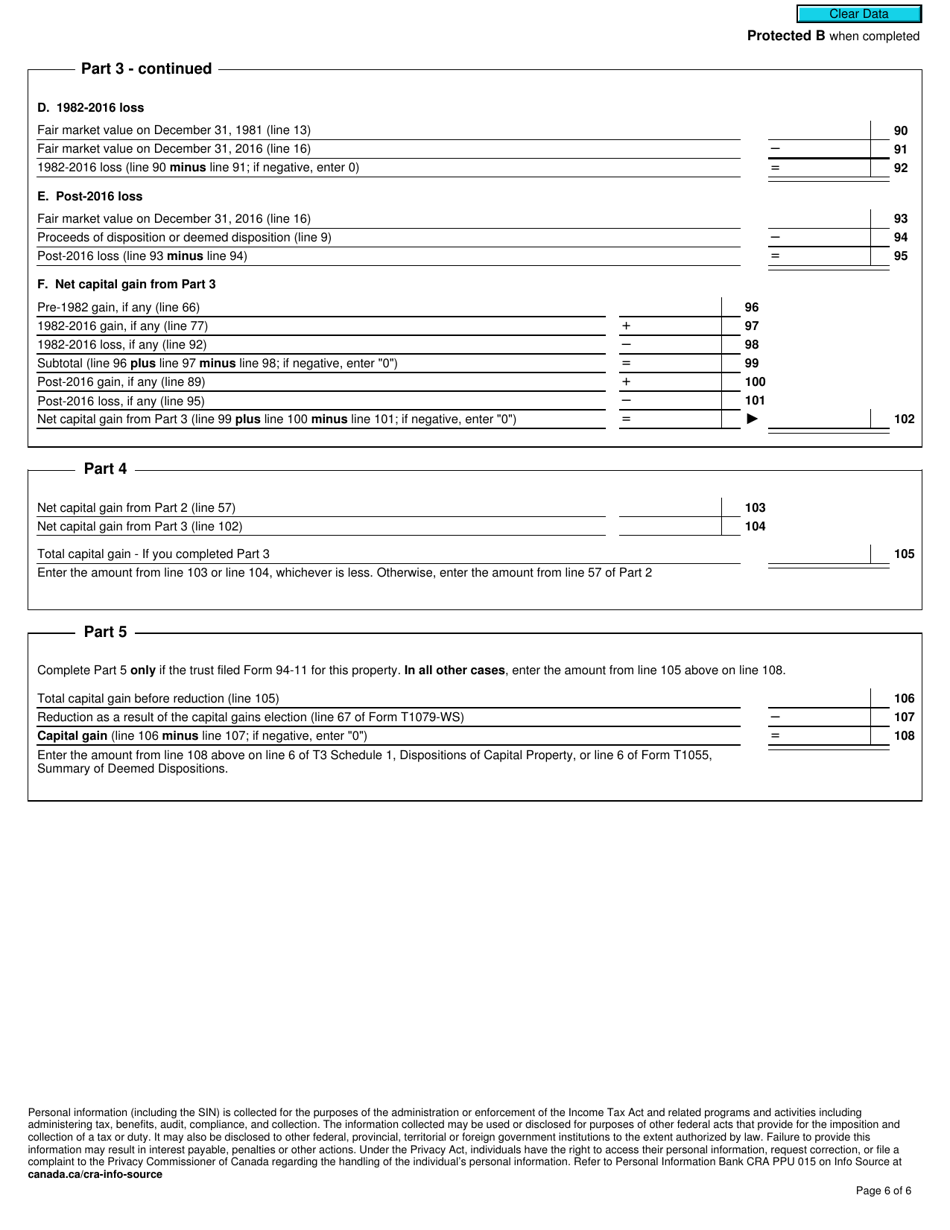

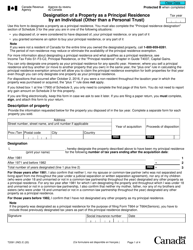

Form T1079 Designation of a Property as a Principal Residence by a Personal Trust - Canada

Form T1079 - Designation of a Property as a Principal Residence by a Personal Trust in Canada is used to designate a property as a principal residence by a personal trust for tax purposes.

In Canada, the Form T1079 Designation of a Property as a Principal Residence by a Personal Trust must be filed by the personal trust that owns the property.

FAQ

Q: What is Form T1079?

A: Form T1079 is a form used in Canada to designate a property as a principal residence by a personal trust.

Q: What is the purpose of Form T1079?

A: The purpose of Form T1079 is to declare and designate a property as a principal residence for tax purposes.

Q: Who can use Form T1079?

A: Form T1079 can be used by personal trusts in Canada to designate a property as a principal residence.

Q: Why would someone use Form T1079?

A: Someone would use Form T1079 to ensure that a property owned by a personal trust is eligible for the principal residence exemption for tax purposes.