This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC4522

for the current year.

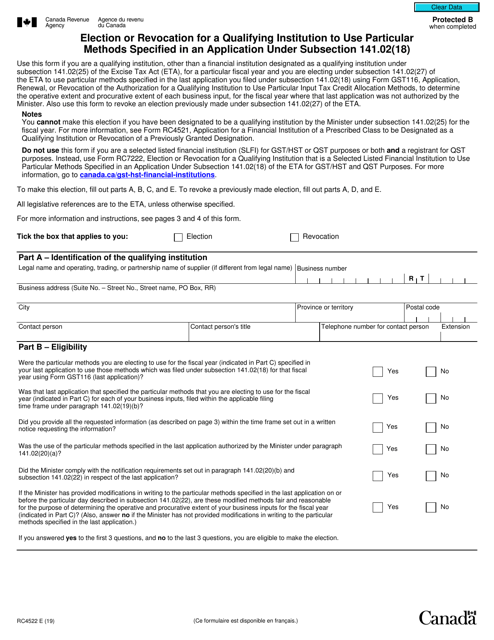

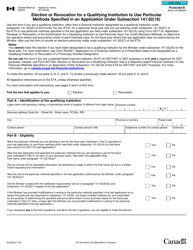

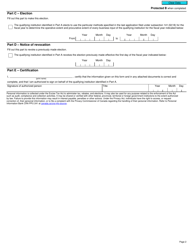

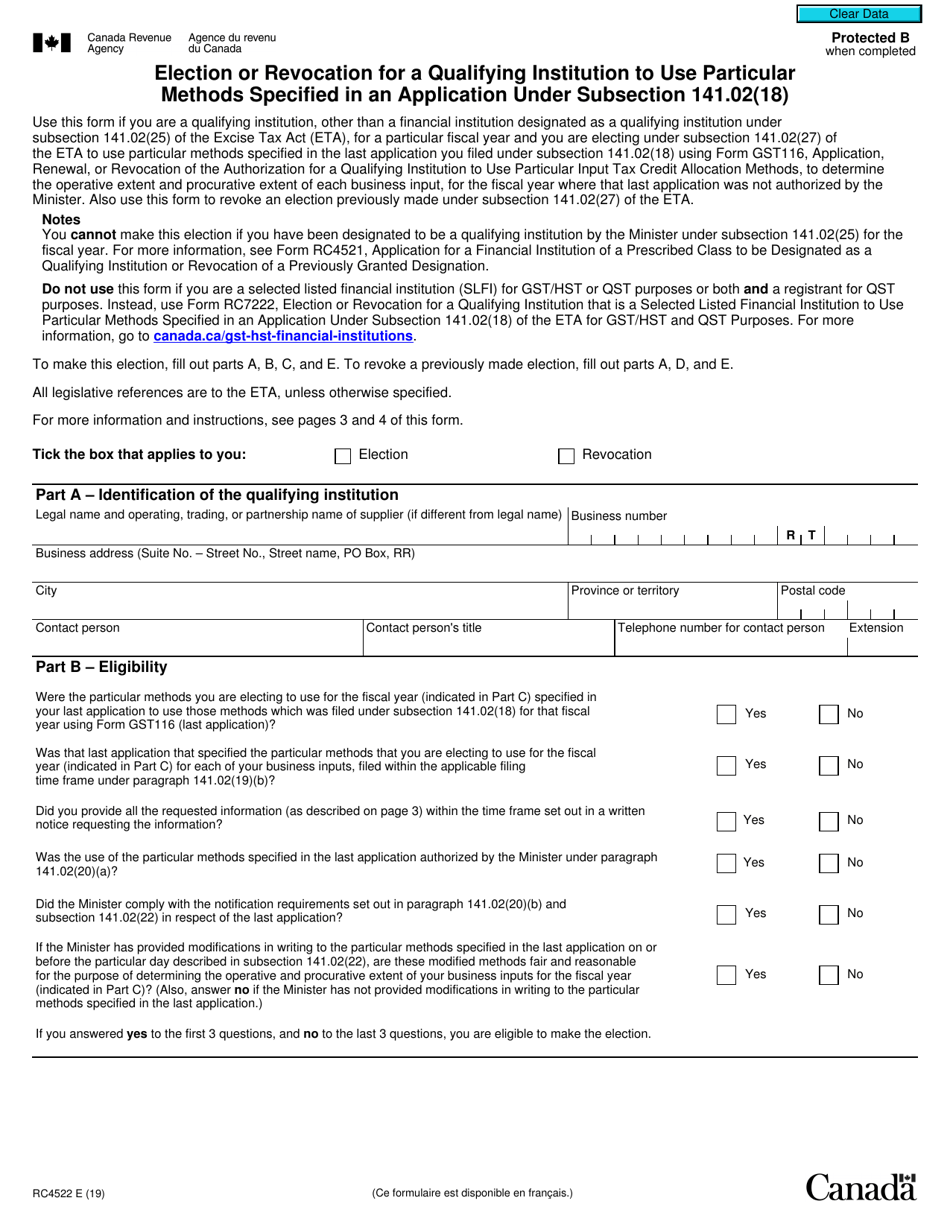

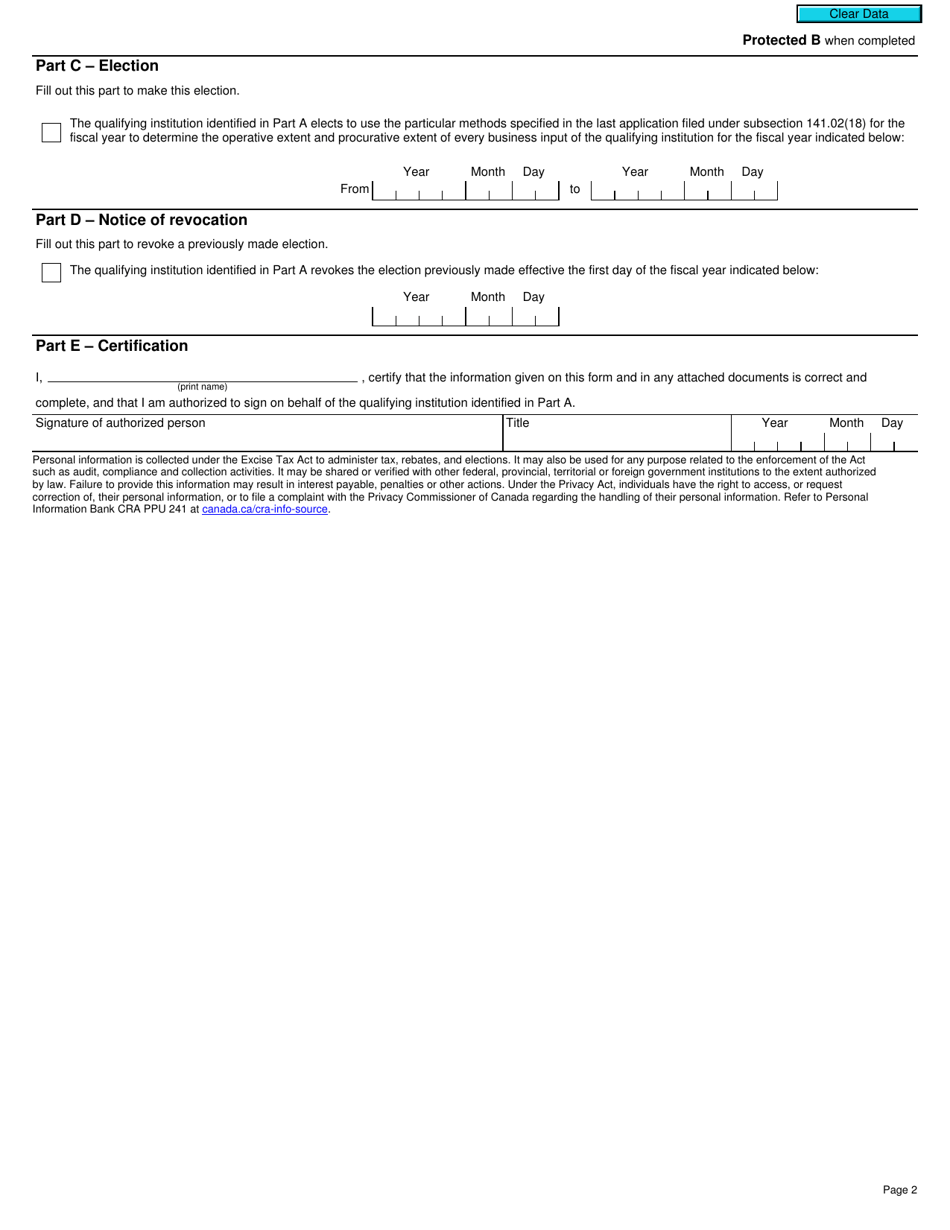

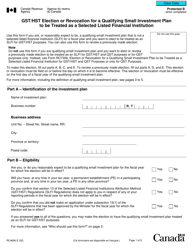

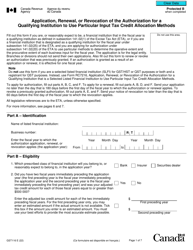

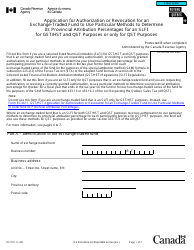

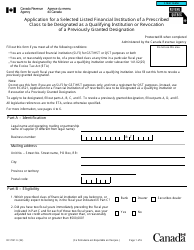

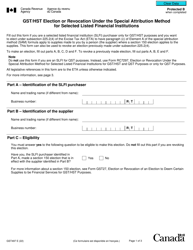

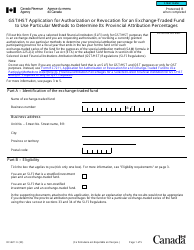

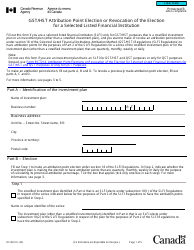

Form RC4522 Election or Revocation for a Qualifying Institution to Use Particular Methods Specified in an Application Under Subsection 141.02(18) - Canada

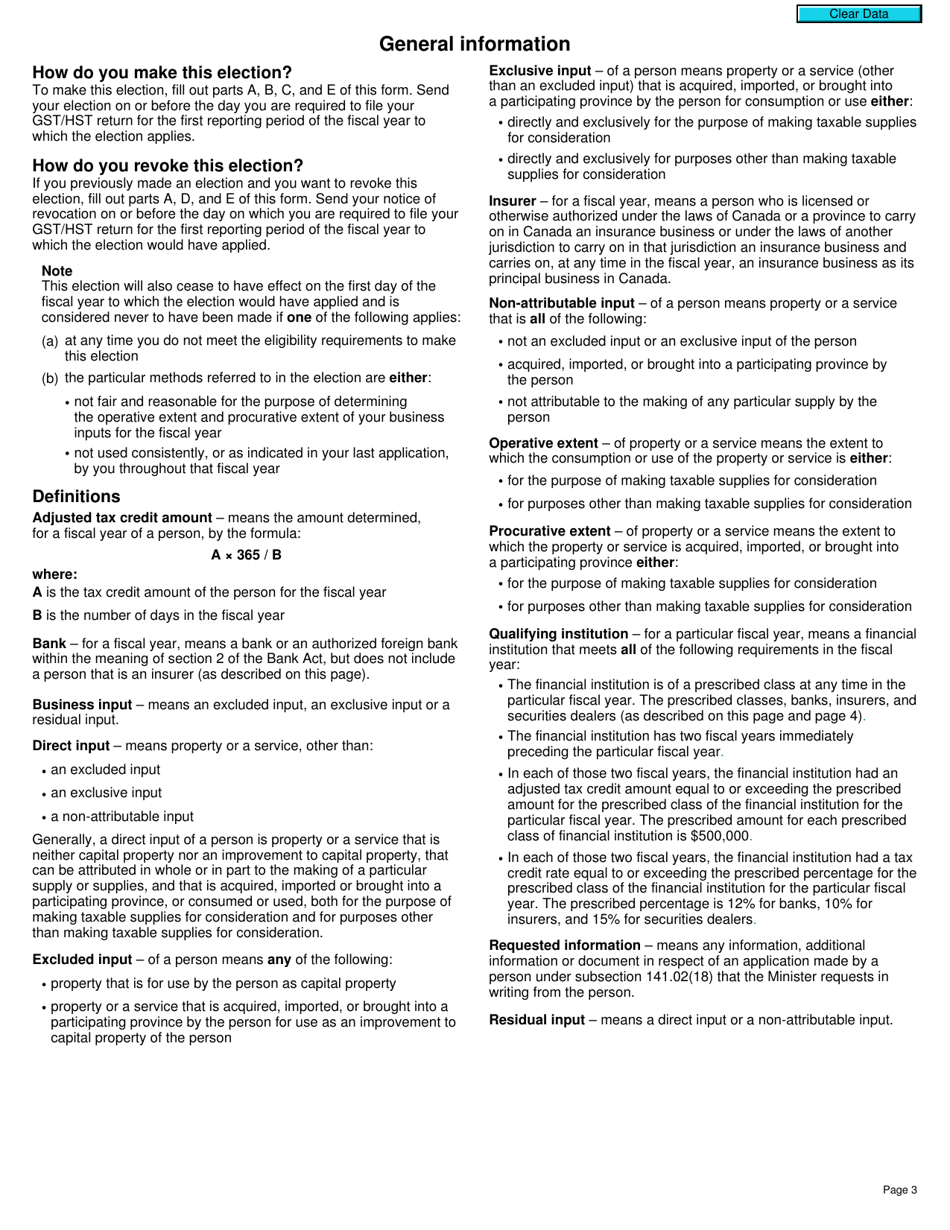

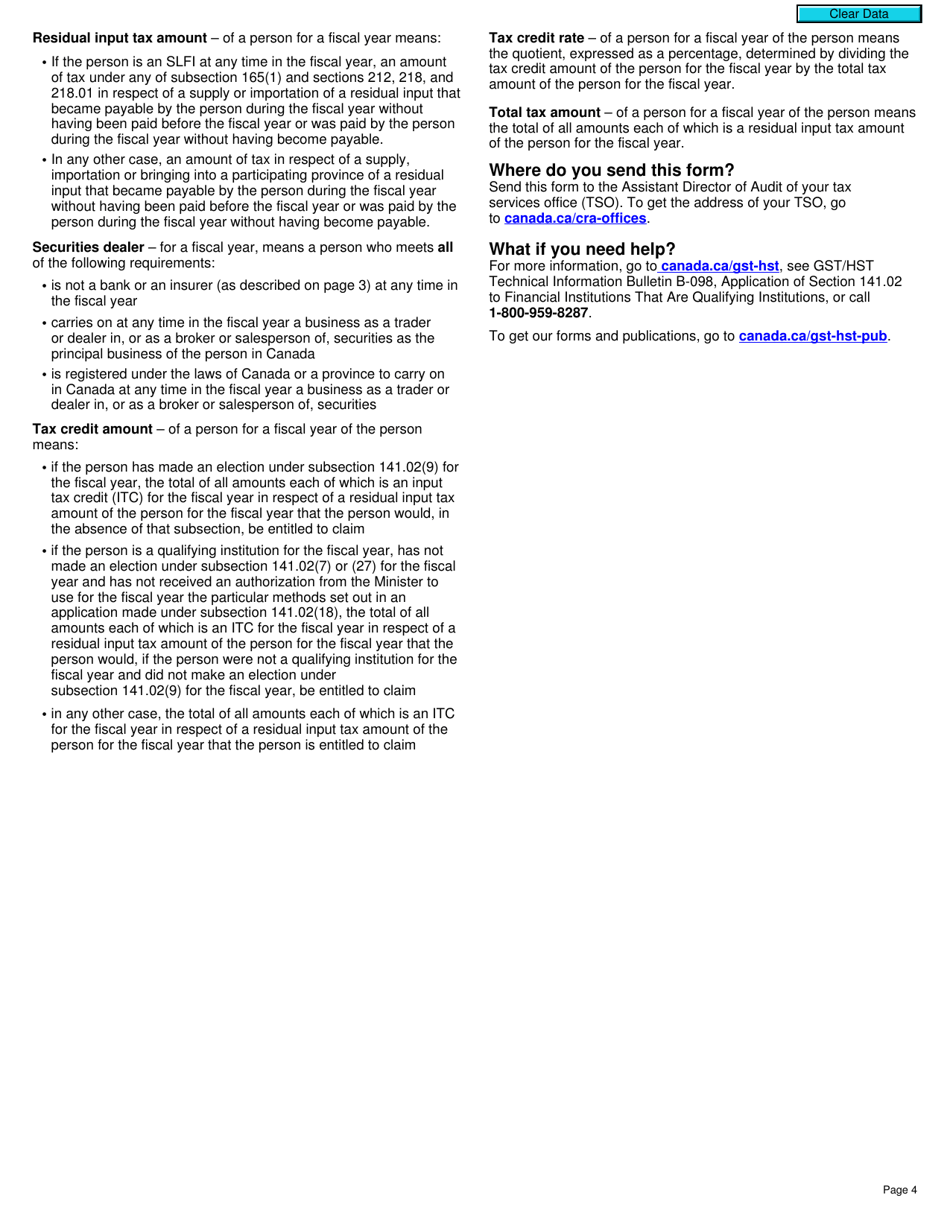

Form RC4522 Election or Revocation for a Qualifying Institution to Use Particular Methods Specified in an Application Under Subsection 141.02(18) is used in Canada for a qualifying institution to elect or revoke the use of specific methods outlined in their application under subsection 141.02(18). It allows the institution to choose or change the methods they use for tax purposes.

In Canada, the Form RC4522 Election or Revocation for a Qualifying Institution to Use Particular Methods Specified in an Application Under Subsection 141.02(18) is filed by the qualifying institution itself.

FAQ

Q: What is Form RC4522?

A: Form RC4522 is used for the election or revocation for a qualifying institution to use particular methods specified in an application under subsection 141.02(18) in Canada.

Q: What is the purpose of Form RC4522?

A: The purpose of Form RC4522 is to allow a qualifying institution in Canada to elect or revoke the use of specific methods specified in an application under subsection 141.02(18).

Q: Who can use Form RC4522?

A: Qualifying institutions in Canada can use Form RC4522.

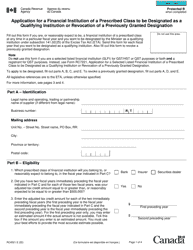

Q: What does 'qualifying institution' mean?

A: A qualifying institution refers to an institution that meets certain criteria set out in subsection 141.02(18) of the Canadian tax law.

Q: What methods are specified in the application under subsection 141.02(18)?

A: The specific methods that can be elected or revoked are outlined in the application under subsection 141.02(18) of the Canadian tax law.