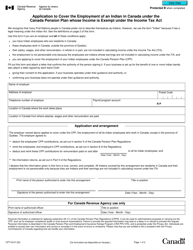

This version of the form is not currently in use and is provided for reference only. Download this version of

Form TD1-IN

for the current year.

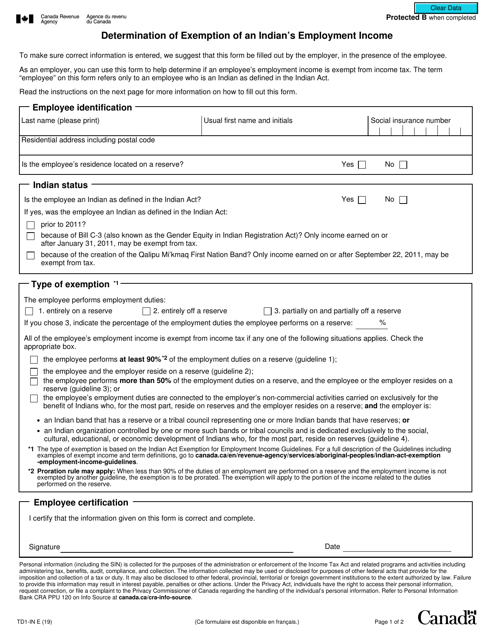

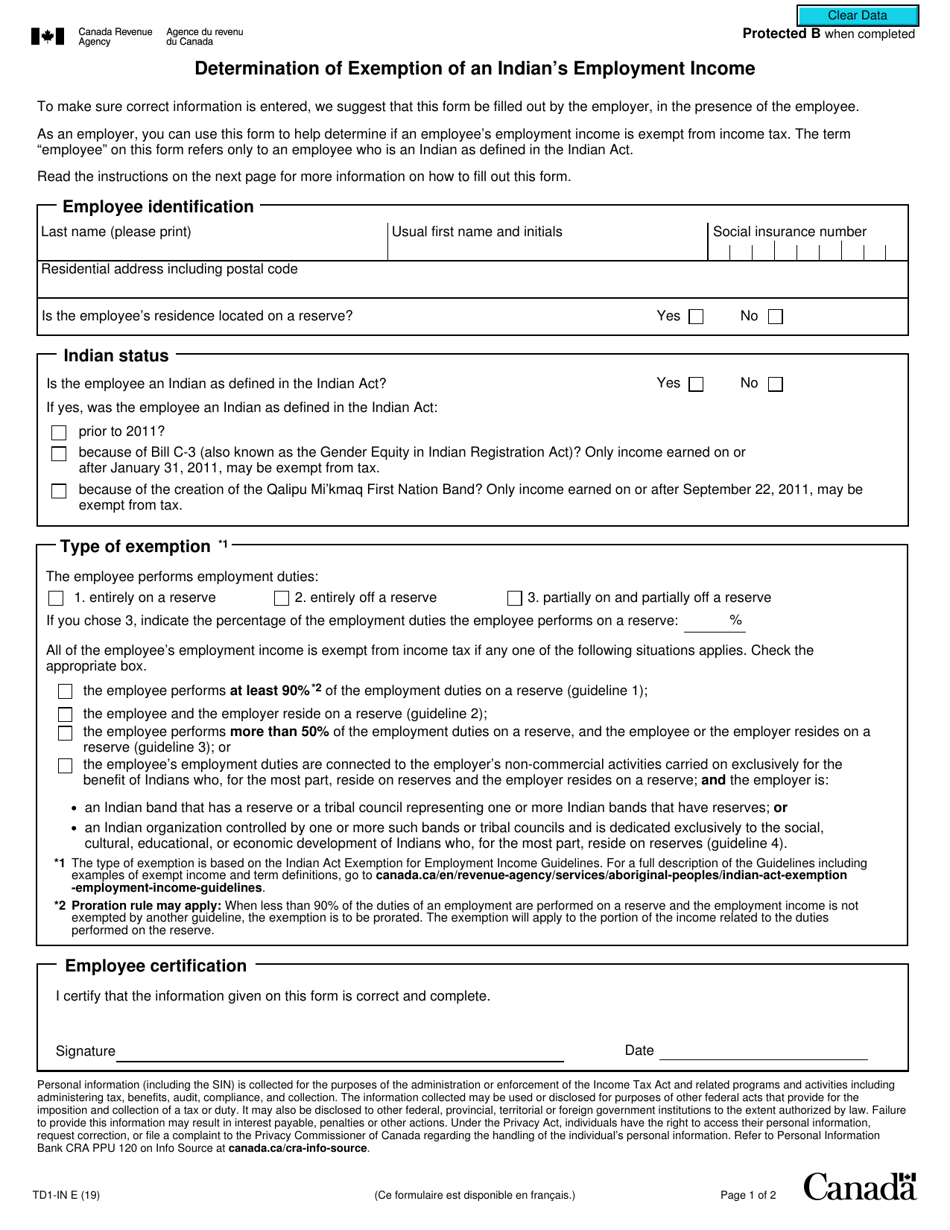

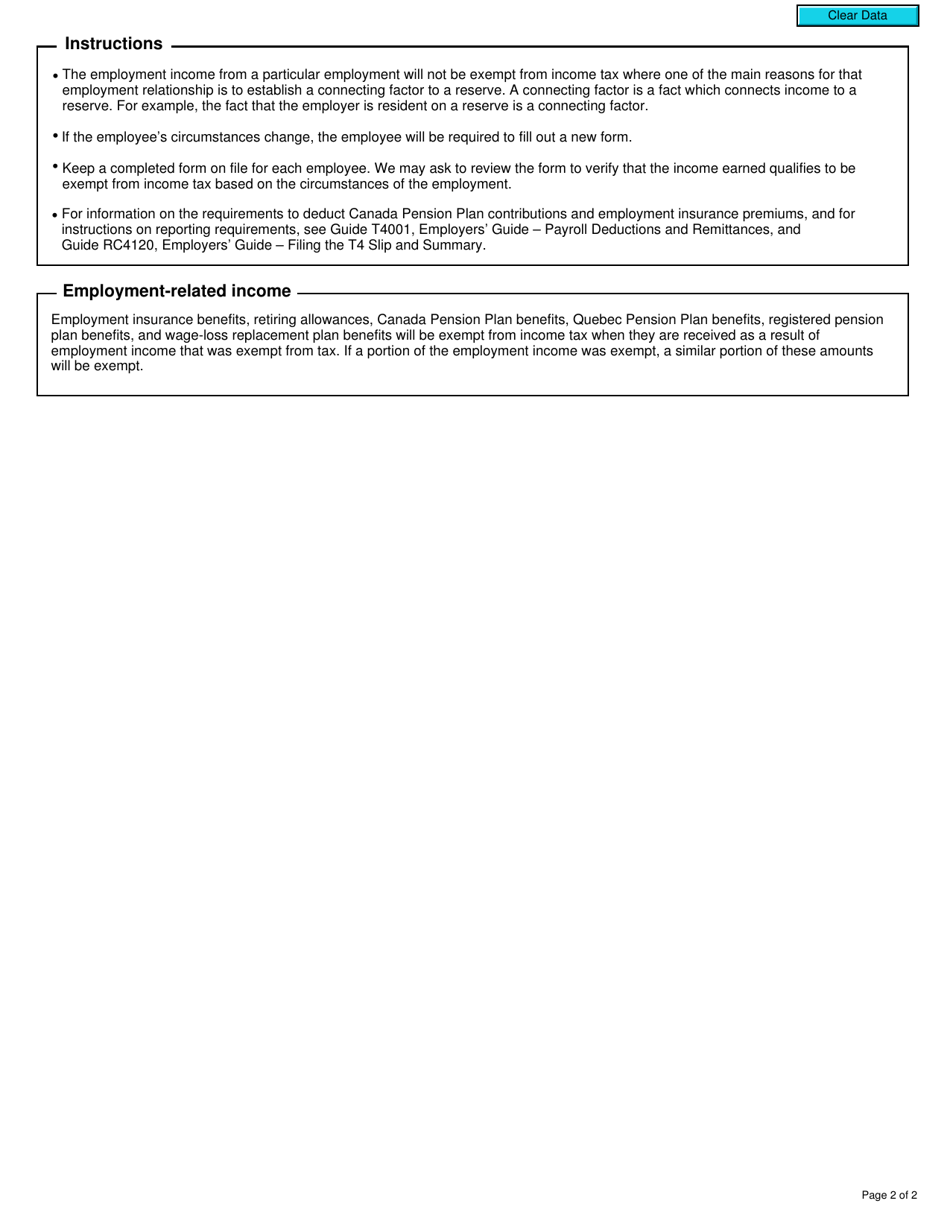

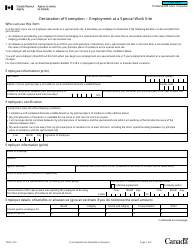

Form TD1-IN Determination of Exemption of an Indian's Employment Income - Canada

Form TD1-IN is used by individuals of Indian origin who are residents of Canada for determining the exemption status of their employment income earned in India. This form helps in calculating the amount of income that may be exempt from Canadian income tax.

The Form TD1-IN "Determination of Exemption of an Indian's Employment Income" in Canada is usually filed by individuals who are claiming a tax exemption on employment income earned by Indians working on reserves or settlements. The form is typically completed by the Indian employee and submitted to their employer.

FAQ

Q: What is Form TD1-IN?

A: Form TD1-IN is a document used in Canada to determine the exemption of an Indian's employment income.

Q: Who is eligible to use Form TD1-IN?

A: Form TD1-IN is specifically for Indians who are exempt from paying tax on certain employment income.

Q: Why is Form TD1-IN used?

A: Form TD1-IN is used to determine the amount of income tax to be deducted from an Indian's employment income.

Q: How is the exemption determined on Form TD1-IN?

A: The exemption is determined based on the individual's treaty rights under the Canada-India Tax Treaty.