This version of the form is not currently in use and is provided for reference only. Download this version of

Form L403

for the current year.

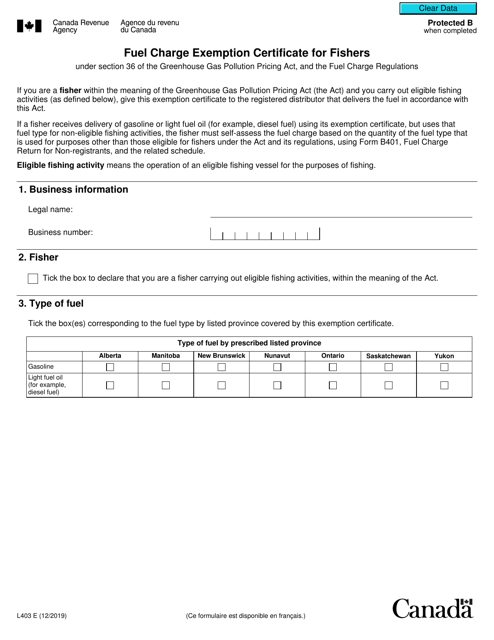

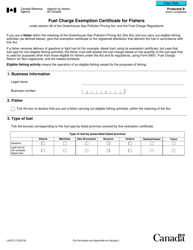

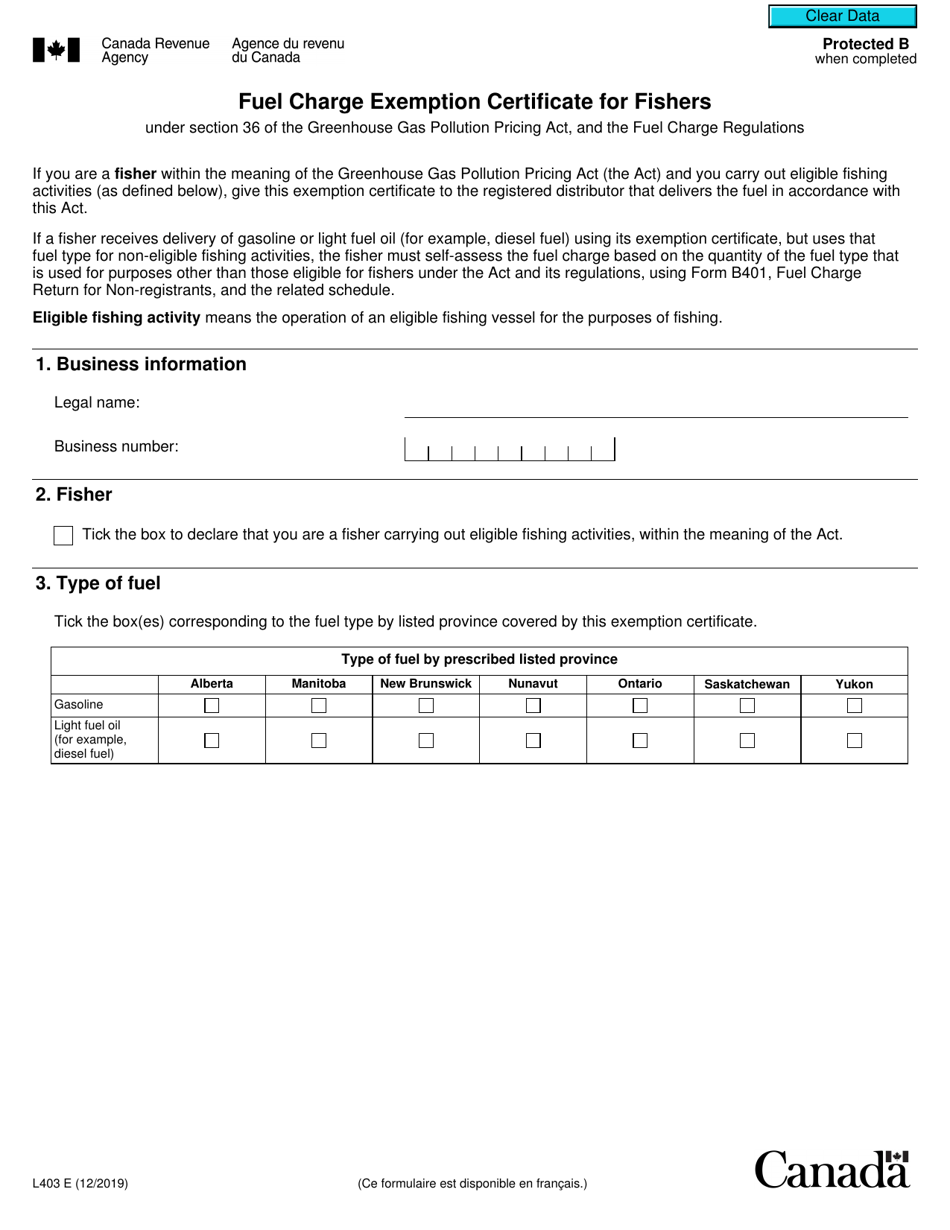

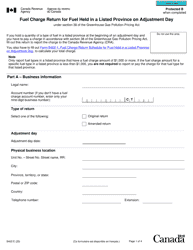

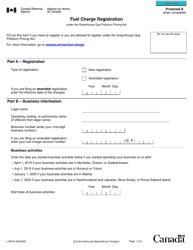

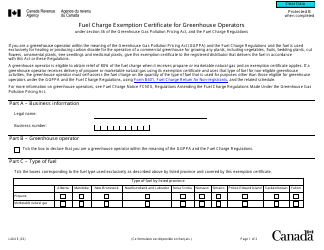

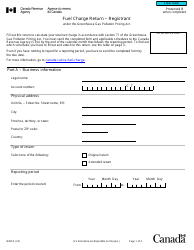

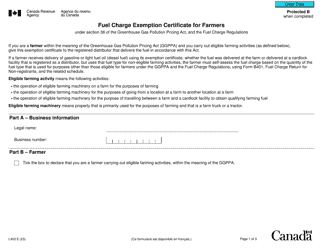

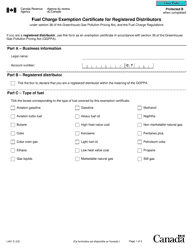

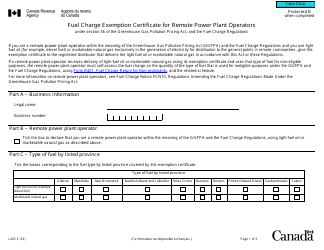

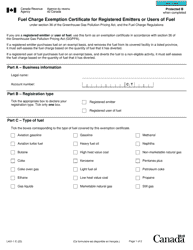

Form L403 Fuel Charge Exemption Certificate for Fishers Under Section 36 of the Greenhouse Gas Pollution Pricing Act, and the Fuel Charge Regulations - Canada

Form L403 Fuel Charge Exemption Certificate for Fishers under Section 36 of the Greenhouse Gas Pollution Pricing Act and the Fuel Charge Regulations in Canada is a document that allows fishers to claim an exemption from the fuel charge imposed on certain types of fuel. This exemption is specifically provided to support the fishing industry and mitigate the impact of greenhouse gas emissions pricing.

The fisher themselves would file the Form L403 Fuel Charge Exemption Certificate.

FAQ

Q: What is Form L403?

A: Form L403 is the Fuel Charge Exemption Certificate for Fishers.

Q: Who is eligible to use Form L403?

A: Fishers who qualify under Section 36 of the Greenhouse Gas Pollution Pricing Act and the Fuel Charge Regulations in Canada are eligible to use Form L403.

Q: What is the purpose of Form L403?

A: The purpose of Form L403 is to claim exemptions from the fuel charge for fishers.

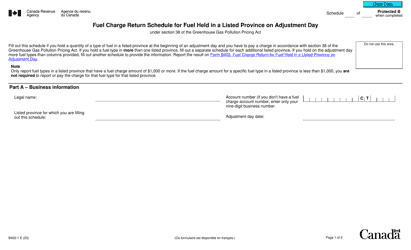

Q: What is the Greenhouse Gas Pollution Pricing Act?

A: The Greenhouse Gas Pollution Pricing Act is a federal law in Canada that aims to reduce greenhouse gas emissions and combat climate change.

Q: What are the Fuel Charge Regulations?

A: The Fuel Charge Regulations are the regulations that outline the rules and requirements related to the fuel charge under the Greenhouse Gas Pollution Pricing Act.

Q: How can fishers claim exemptions using Form L403?

A: Fishers can claim fuel charge exemptions by completing and submitting Form L403 to the Canada Revenue Agency (CRA).

Q: Is there a deadline for submitting Form L403?

A: Yes, there may be specific deadlines for submitting Form L403. It is advisable to check with the Canada Revenue Agency (CRA) for the most up-to-date information.

Q: Are fishers the only group eligible for fuel charge exemptions?

A: No, there may be other groups and individuals who qualify for fuel charge exemptions. It is recommended to consult the Greenhouse Gas Pollution Pricing Act and the Fuel Charge Regulations or contact the Canada Revenue Agency (CRA) for more information.

Q: What happens if fishers do not submit Form L403?

A: If fishers do not submit Form L403, they may not be able to claim exemptions from the fuel charge and may be required to pay the applicable charges.

Q: Can Form L403 be used for multiple fishing vessels?

A: Yes, Form L403 can be used for multiple fishing vessels.

Q: What supporting documents are required with Form L403?

A: Depending on the circumstances, fishers may be required to provide supporting documents such as vessel registration, fishing licenses, or other relevant records.

Q: Who should be contacted for assistance with Form L403?

A: For assistance with Form L403, fishers can contact the Canada Revenue Agency (CRA) or consult with a tax professional.

Q: Is Form L403 only applicable in Canada?

A: Yes, Form L403 is specifically designed for use in Canada, as it relates to the Greenhouse Gas Pollution Pricing Act and the Fuel Charge Regulations in Canada.