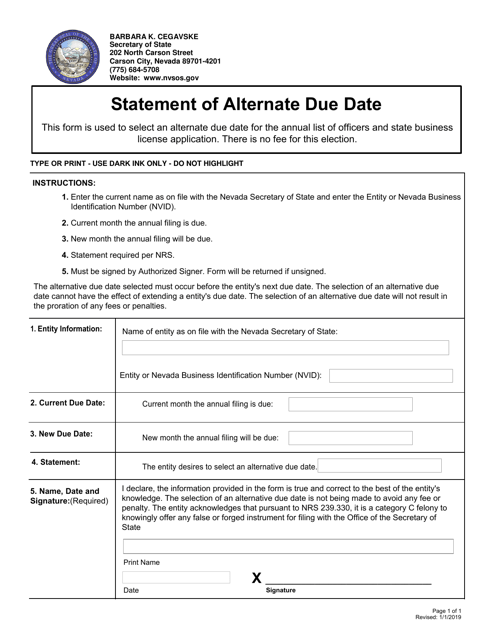

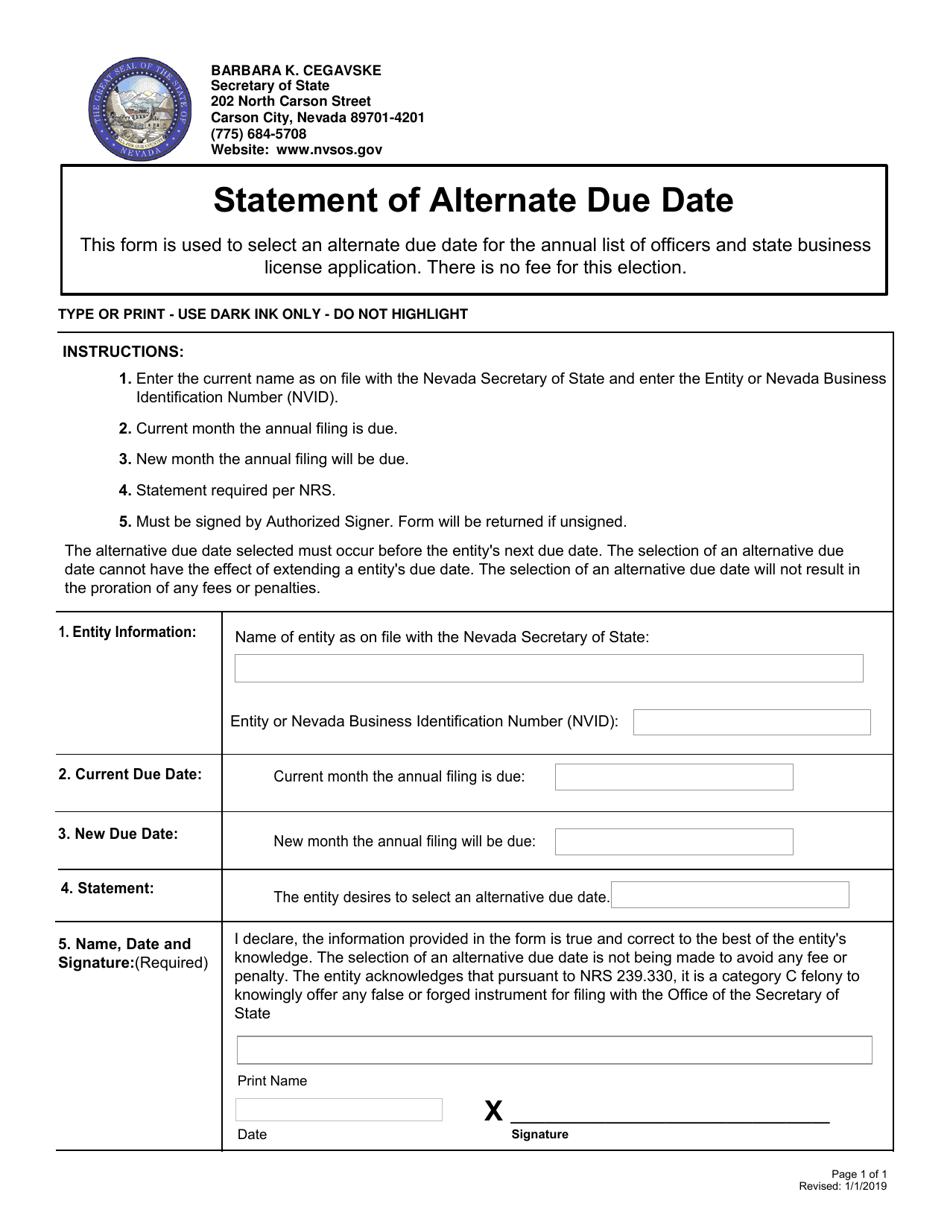

Statement of Alternate Due Date - Nevada

Statement of Alternate Due Date is a legal document that was released by the Nevada Secretary of State - a government authority operating within Nevada.

FAQ

Q: What is a Statement of Alternate Due Date?

A: A Statement of Alternate Due Date is a document that allows Nevada businesses to request to file their sales and use tax returns on a different day of the month.

Q: Why would a business request an alternate due date?

A: A business may request an alternate due date if their regular due date falls on a weekend or a holiday.

Q: How can a business request an alternate due date?

A: Businesses can request an alternate due date by completing and submitting Form STAD-01 to the Nevada Department of Taxation.

Q: Is there a fee to request an alternate due date?

A: No, there is no fee to request an alternate due date.

Q: How long does it take for the Nevada Department of Taxation to process a request for an alternate due date?

A: The Nevada Department of Taxation typically processes requests for alternate due dates within 30 days.

Q: What happens after the request for an alternate due date is approved?

A: If the request is approved, the business will receive a new due date for their sales and use tax returns.

Q: Are businesses required to file their tax returns on the alternate due date?

A: Yes, once the request for an alternate due date is approved, the business is required to file their tax returns on the new due date.

Q: Can a business change their alternate due date?

A: Yes, a business can request to change their alternate due date by submitting a new Form STAD-01 to the Nevada Department of Taxation.

Form Details:

- Released on January 1, 2019;

- The latest edition currently provided by the Nevada Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Secretary of State.