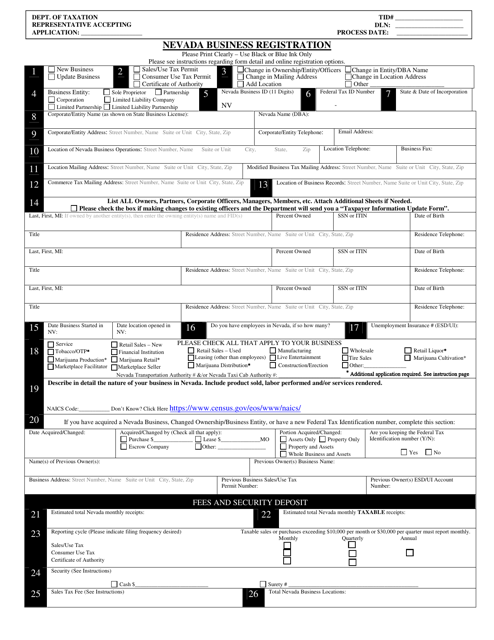

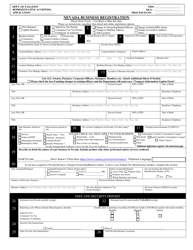

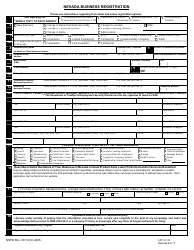

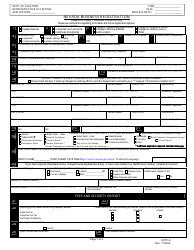

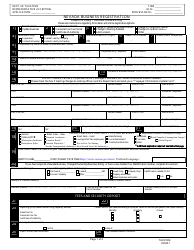

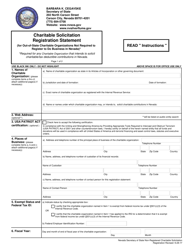

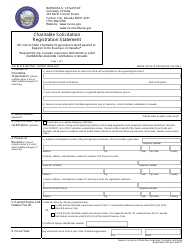

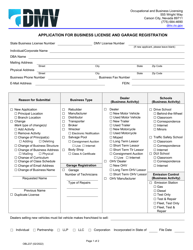

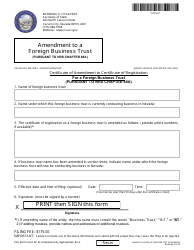

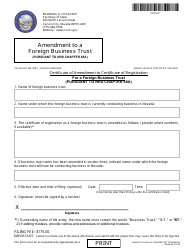

Nevada Business Registration Form - Nevada

Nevada Business Registration Form is a legal document that was released by the Nevada Department of Taxation - a government authority operating within Nevada.

FAQ

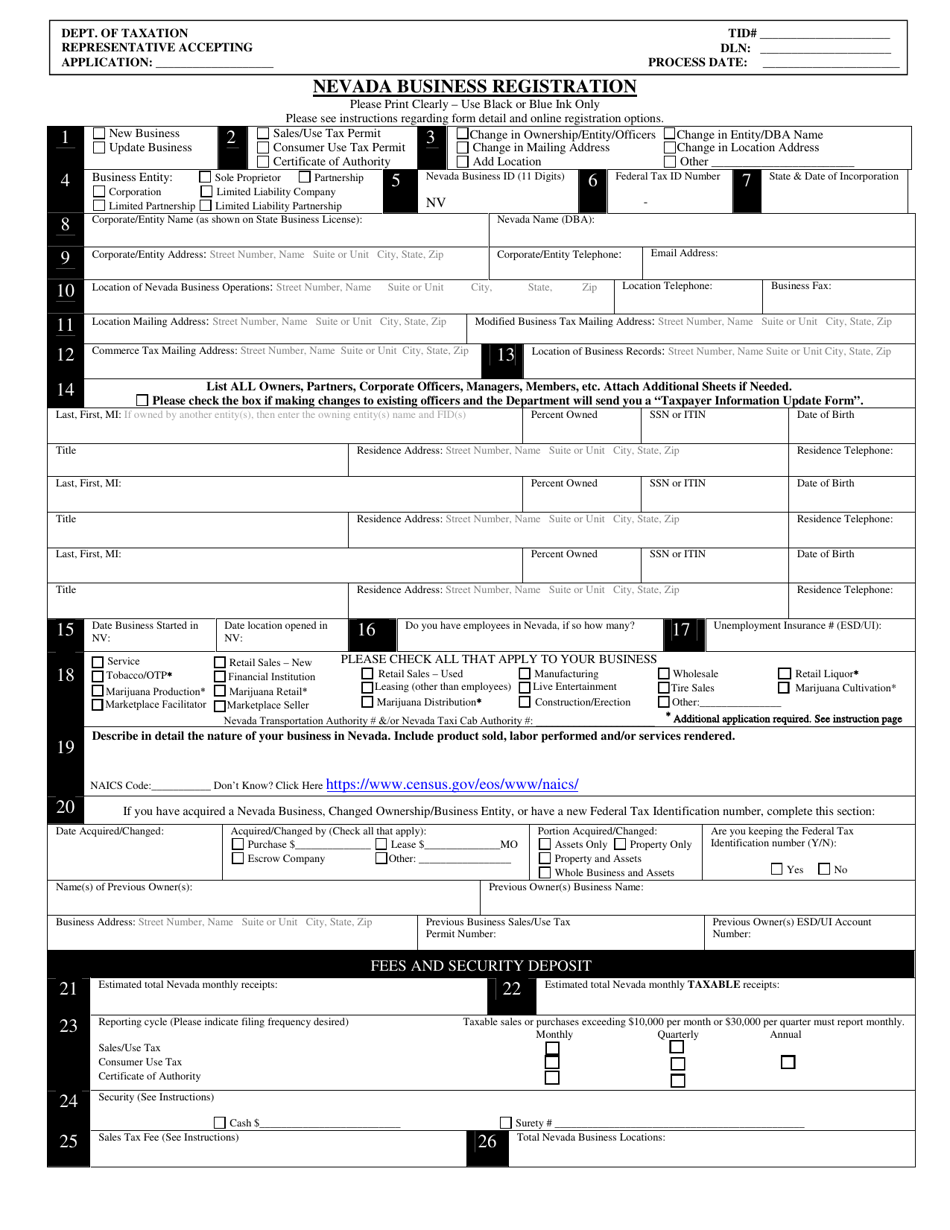

Q: What is the Nevada Business Registration Form?

A: The Nevada Business Registration Form is a document that businesses in Nevada need to file in order to register with the state.

Q: Who needs to file the Nevada Business Registration Form?

A: Any business planning to operate in Nevada needs to file the Nevada Business Registration Form.

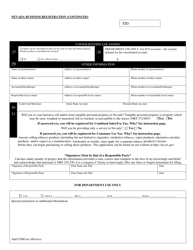

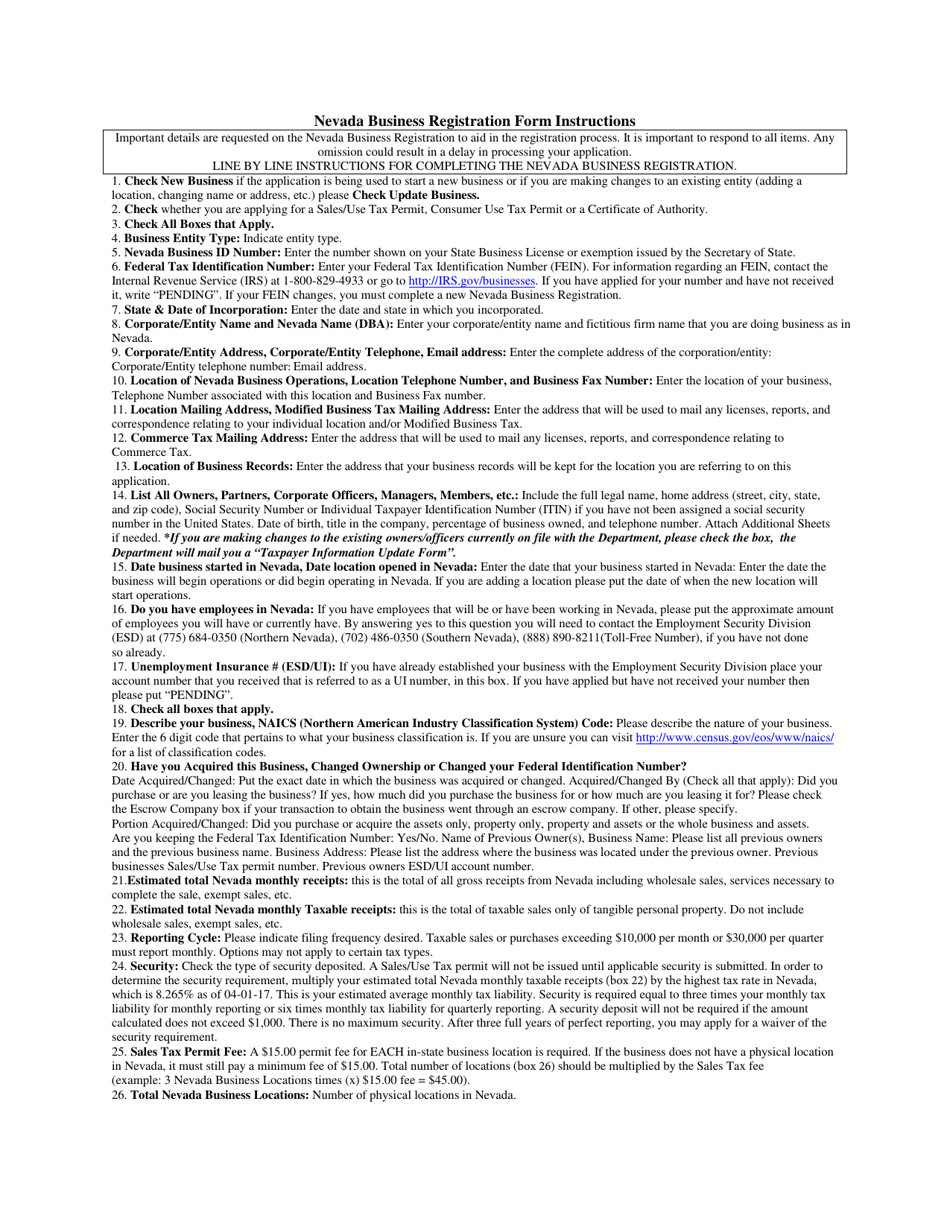

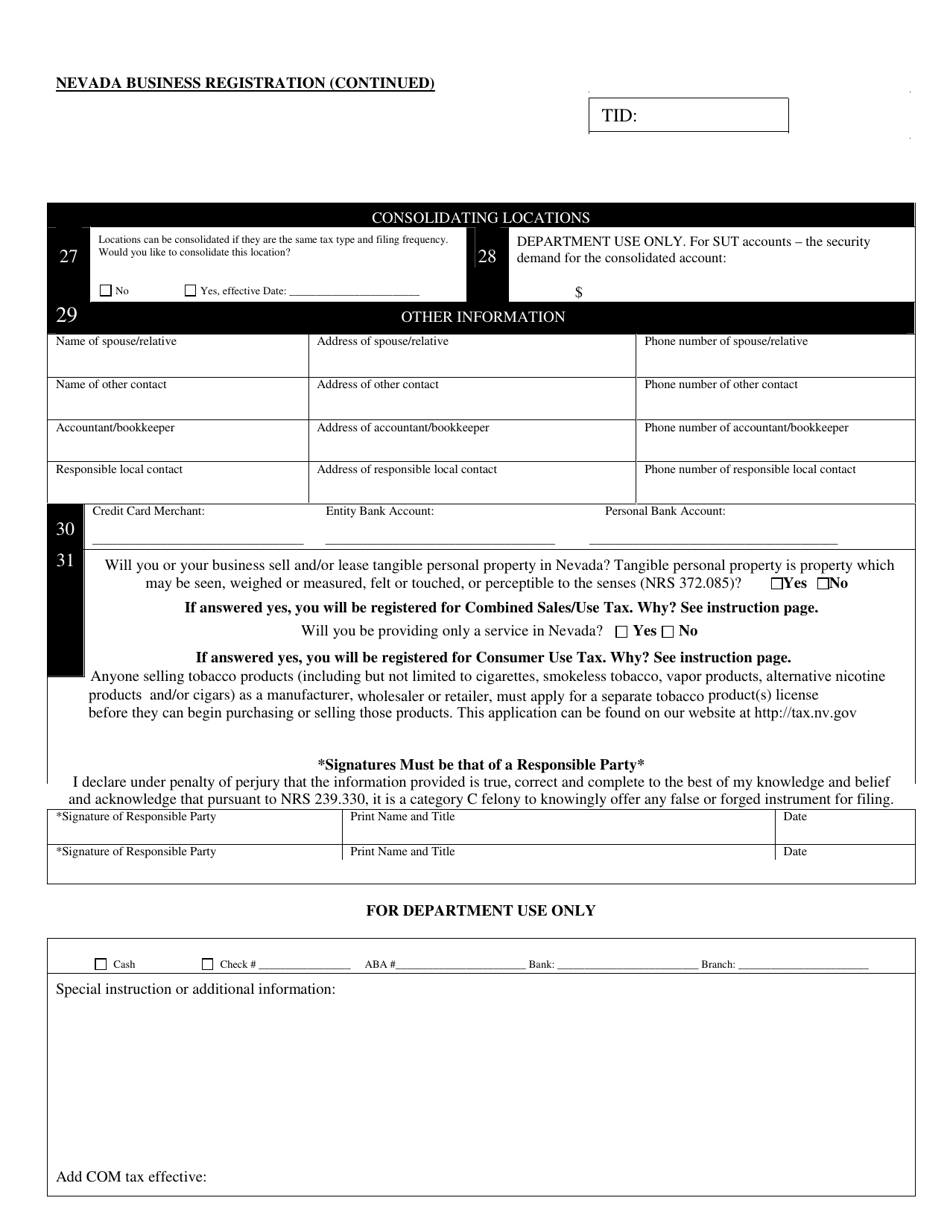

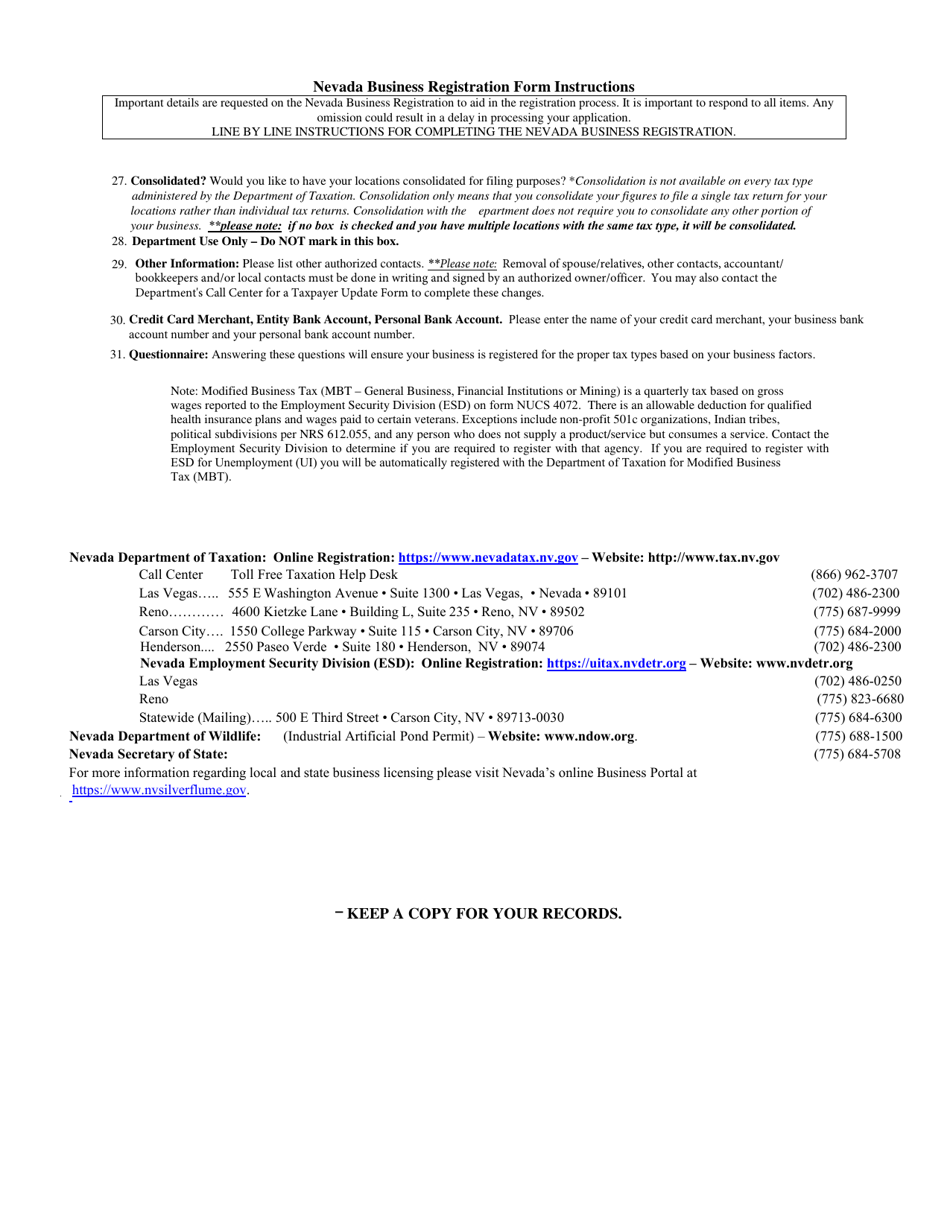

Q: What information is required to be provided in the Nevada Business Registration Form?

A: The form requires information such as the business name, address, type of entity, and details of the owners or officers.

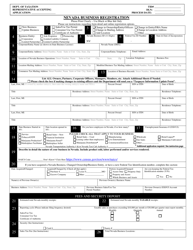

Q: Is there a fee to file the Nevada Business Registration Form?

A: Yes, there is a fee associated with filing the Nevada Business Registration Form. The fee amount varies depending on the type of business.

Q: What happens after I file the Nevada Business Registration Form?

A: Once the form is filed and the fee is paid, your business will be officially registered with the state of Nevada.

Q: Do I need to renew my Nevada business registration?

A: Yes, Nevada business registrations need to be renewed annually. Renewal fees and deadlines may vary.

Q: Can I operate my Nevada business without registering?

A: No, it is illegal to operate a business in Nevada without registering it with the state.

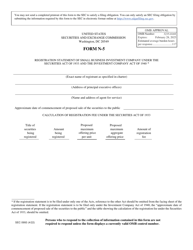

Q: Are there any additional requirements for specific types of businesses in Nevada?

A: Yes, some businesses may have additional requirements, such as obtaining specific licenses or permits.

Q: Can I register a business in Nevada if I am not a U.S. citizen?

A: Yes, non-U.S. citizens can register a business in Nevada as long as they meet the other requirements.

Form Details:

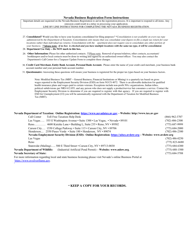

- The latest edition currently provided by the Nevada Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.