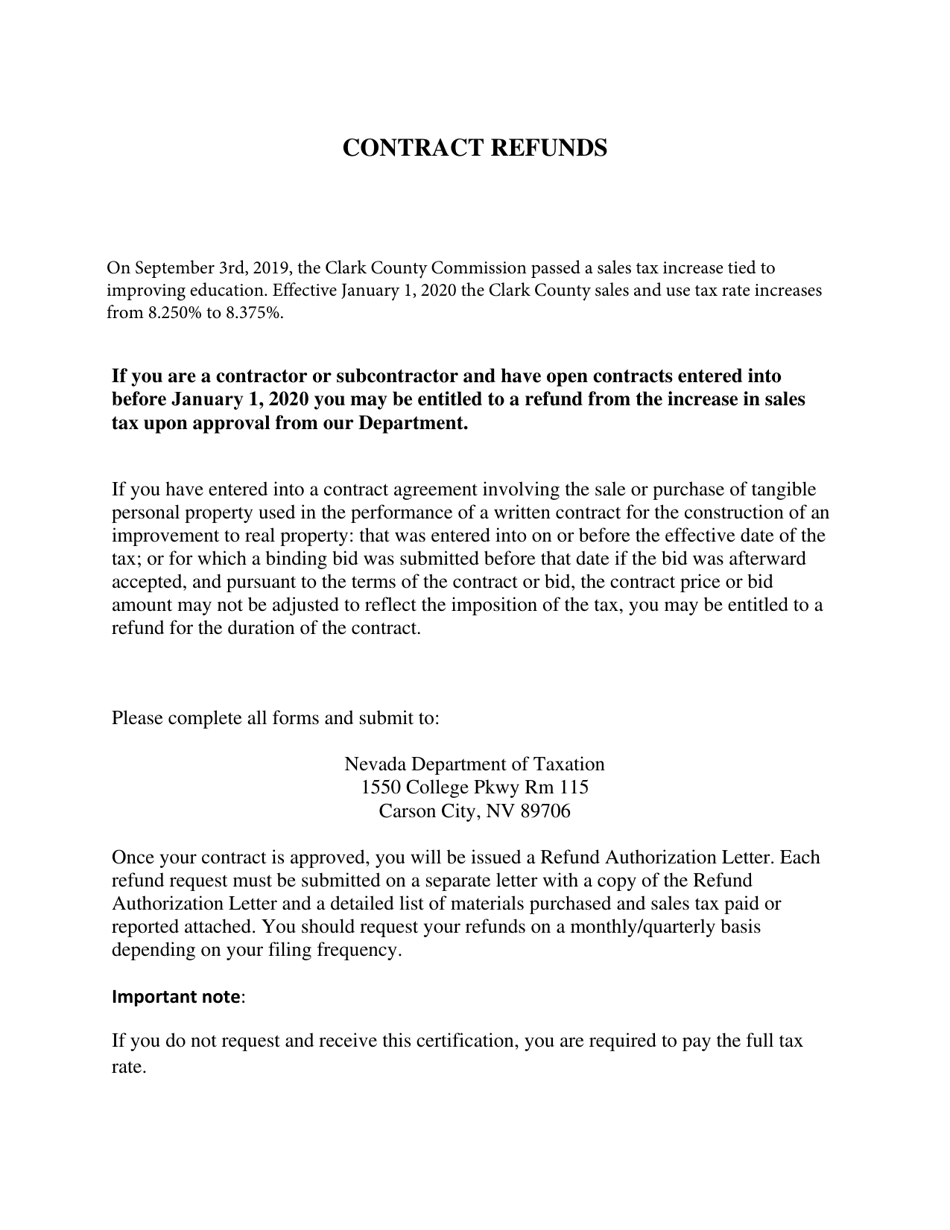

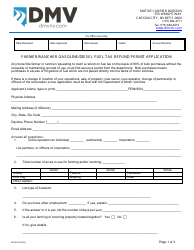

Application for Contractor Refund - Nevada

Application for Contractor Refund is a legal document that was released by the Nevada Department of Taxation - a government authority operating within Nevada.

FAQ

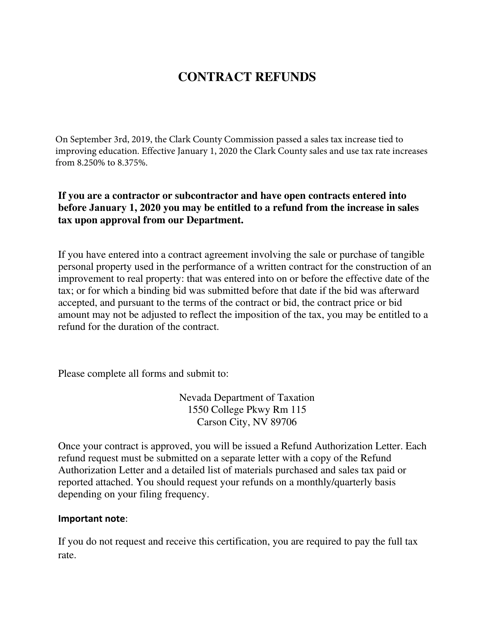

Q: What is the application for a contractor refund in Nevada?

A: The application for a contractor refund is a form that contractors in Nevada can use to request a refund of certain fees or excess payments made to the Nevada State Contractors Board.

Q: Who can apply for a contractor refund in Nevada?

A: Contractors in Nevada can apply for a contractor refund.

Q: What can contractors request a refund for?

A: Contractors can request a refund for certain fees or excess payments made to the Nevada State Contractors Board.

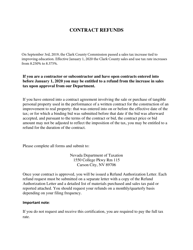

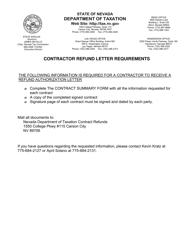

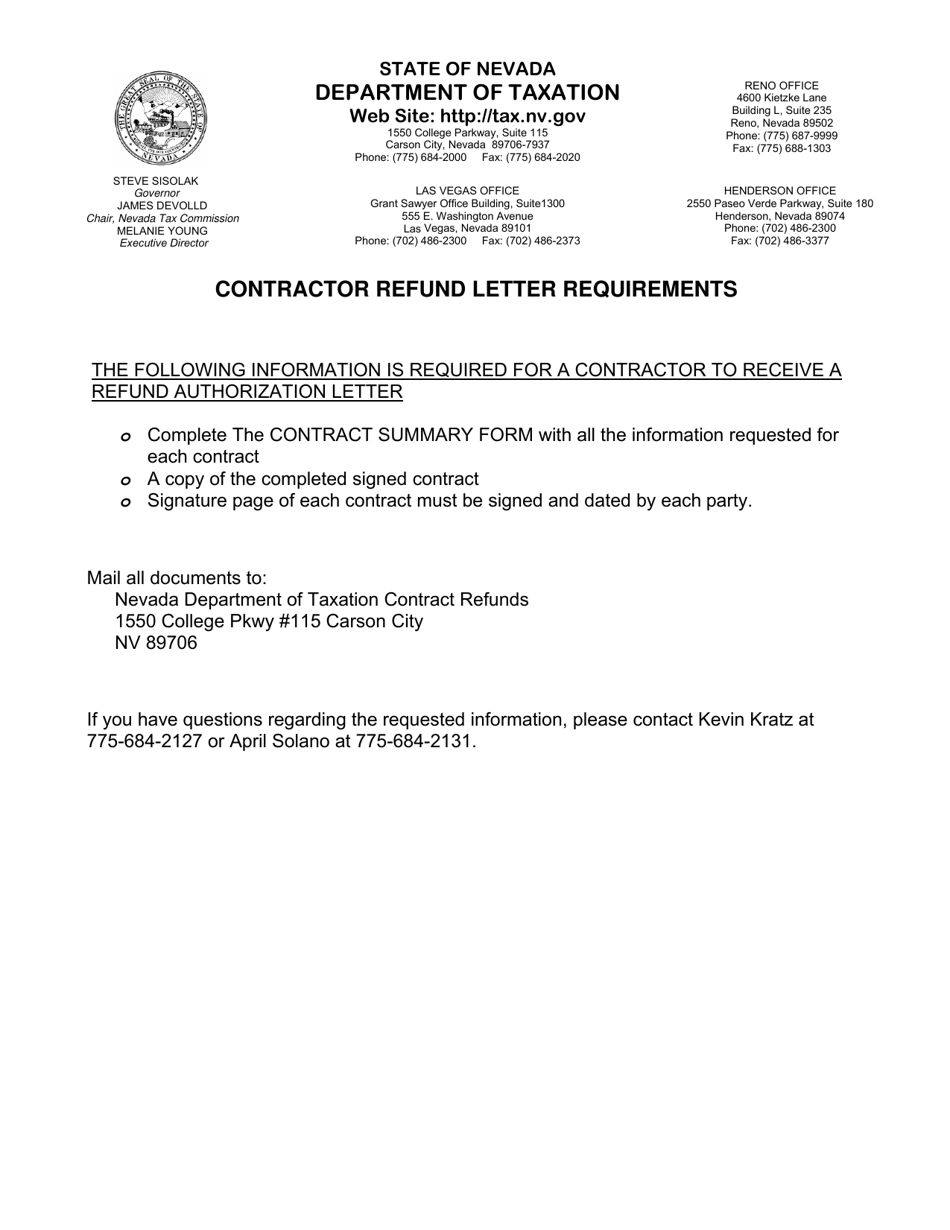

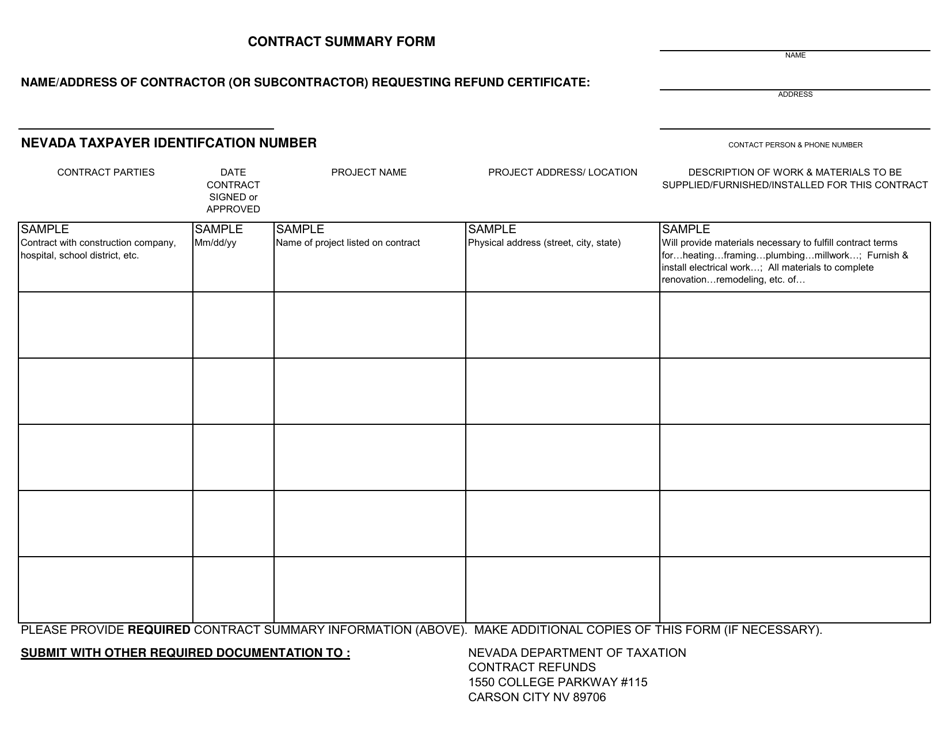

Q: How can contractors apply for a refund?

A: Contractors can apply for a refund by completing the application for a contractor refund form and submitting it to the Nevada State Contractors Board.

Q: Is there a fee for submitting the application?

A: No, there is no fee for submitting the application for a contractor refund.

Q: Is there a deadline for submitting the application?

A: Yes, the application for a contractor refund must be submitted within one year from the date of the fee payment or overpayment.

Q: How long does it take to process the refund?

A: The processing time for a contractor refund may vary, but the Nevada State Contractors Board aims to process refund requests within 30 days of receiving a complete application.

Q: What happens if the refund is approved?

A: If the refund is approved, the Nevada State Contractors Board will issue a refund check to the contractor.

Q: What happens if the refund is denied?

A: If the refund is denied, the contractor will be notified in writing and provided with an explanation for the denial.

Form Details:

- The latest edition currently provided by the Nevada Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.