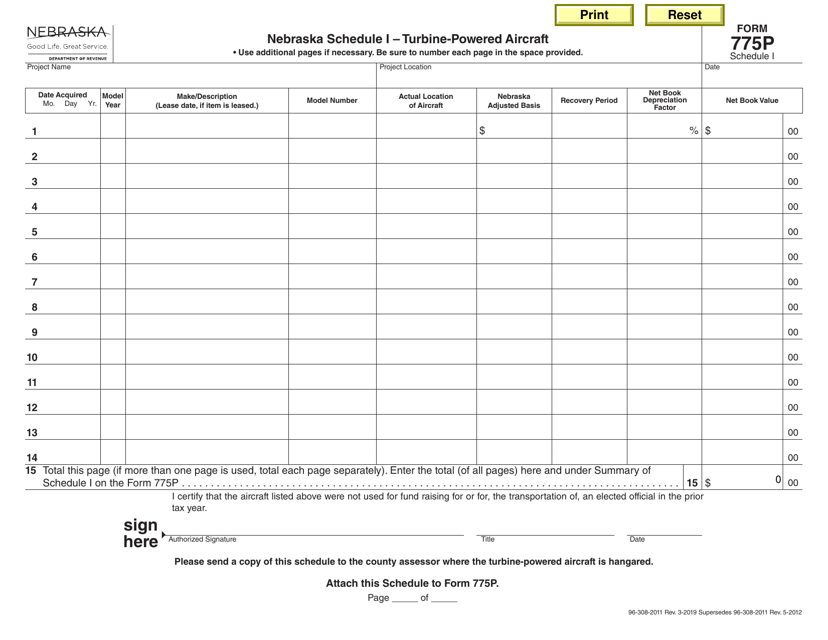

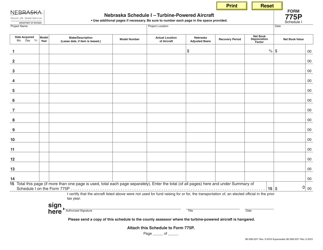

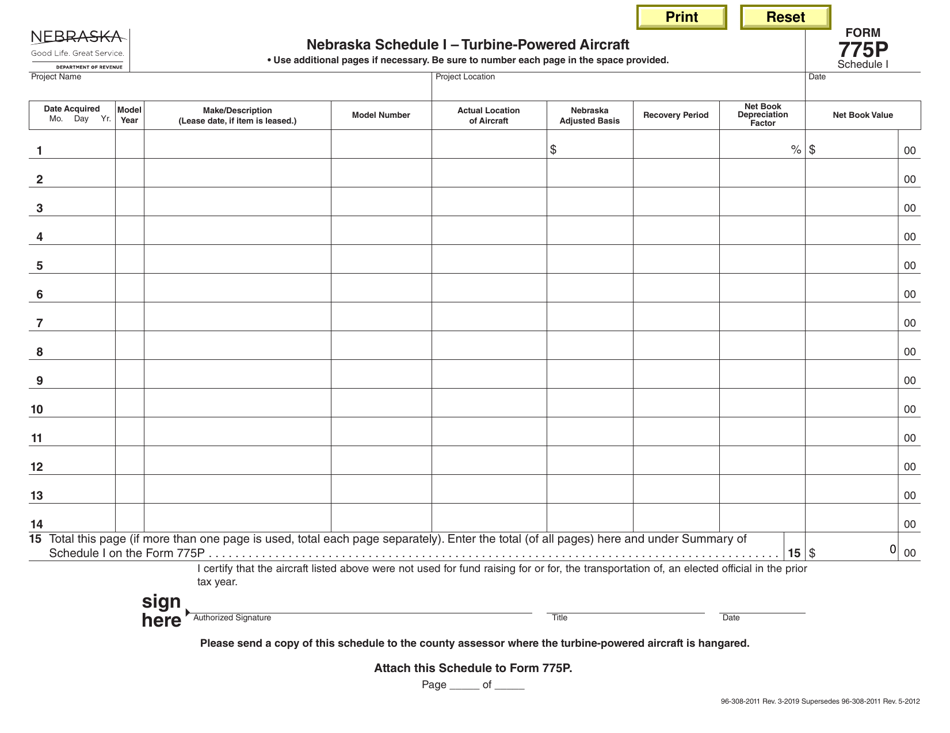

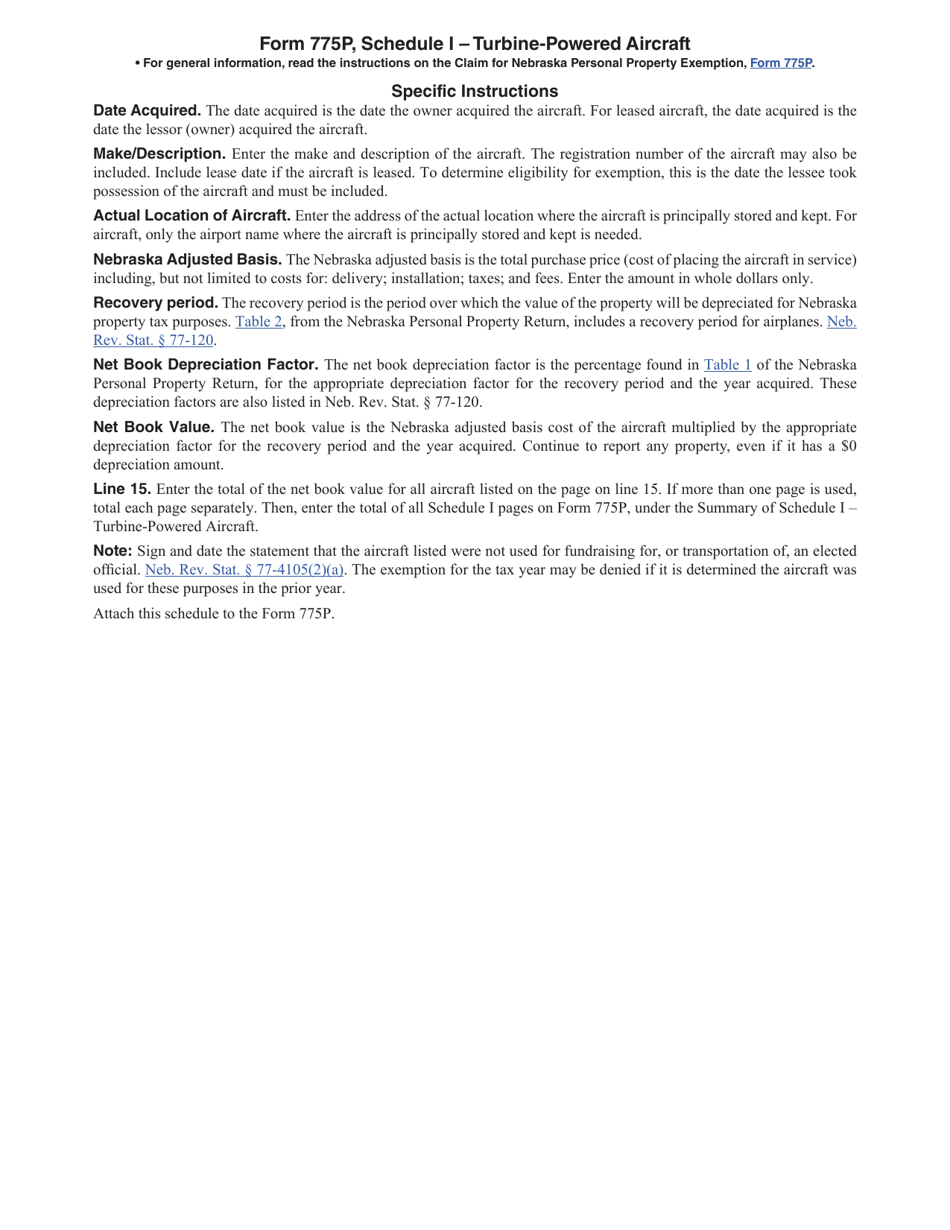

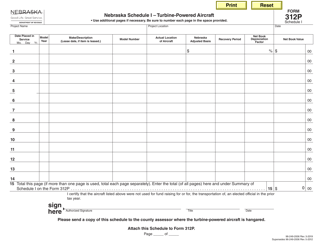

Form 775P Schedule I Turbine-Powered Aircraft - Nebraska

What Is Form 775P Schedule I?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.The document is a supplement to Form 775P, Claim for Nebraska Personal Property Exemption. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 775P Schedule I?

A: Form 775P Schedule I is a document related to turbine-powered aircraft in Nebraska.

Q: What is the purpose of Form 775P Schedule I?

A: The purpose of Form 775P Schedule I is to report and pay a property tax on turbine-powered aircraft.

Q: Who needs to file Form 775P Schedule I?

A: Any individual or company who owns or operates a turbine-powered aircraft in Nebraska needs to file Form 775P Schedule I.

Q: When is Form 775P Schedule I due?

A: Form 775P Schedule I is due on or before December 31st of each year.

Q: Is there a fee for filing Form 775P Schedule I?

A: Yes, there is an annual filing fee for Form 775P Schedule I. The fee amount depends on the value of the turbine-powered aircraft.

Q: What happens if I don't file Form 775P Schedule I?

A: Failure to file Form 775P Schedule I or pay the required tax can result in penalties and interest.

Q: Are there any exemptions for filing Form 775P Schedule I?

A: There are certain exemptions available for filing Form 775P Schedule I. Contact the Nebraska Department of Revenue for more information.

Q: Can I amend my Form 775P Schedule I if needed?

A: Yes, you can file an amended Form 775P Schedule I if you need to make changes or correct any errors in your original filing.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 775P Schedule I by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.