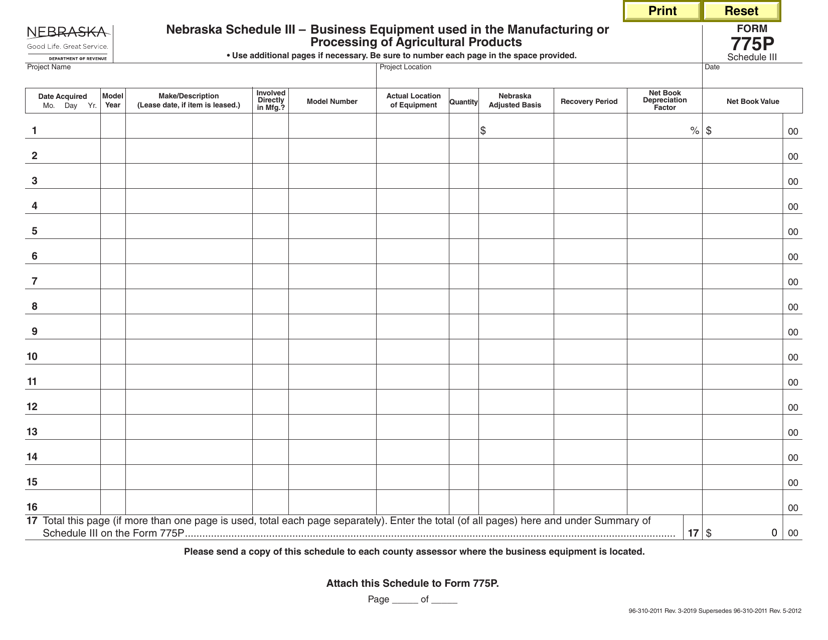

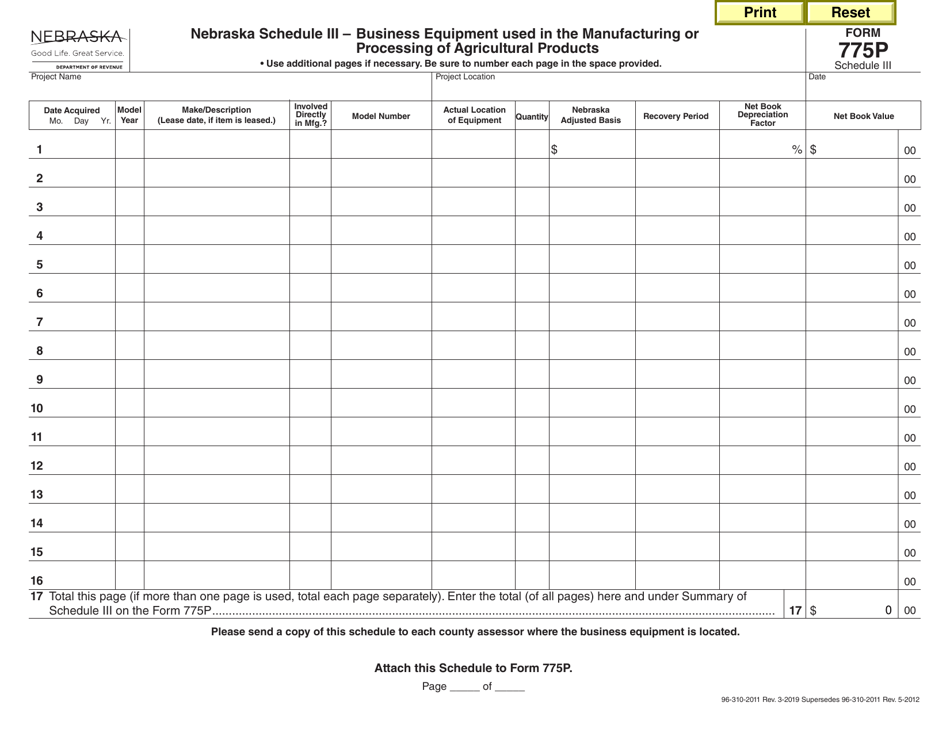

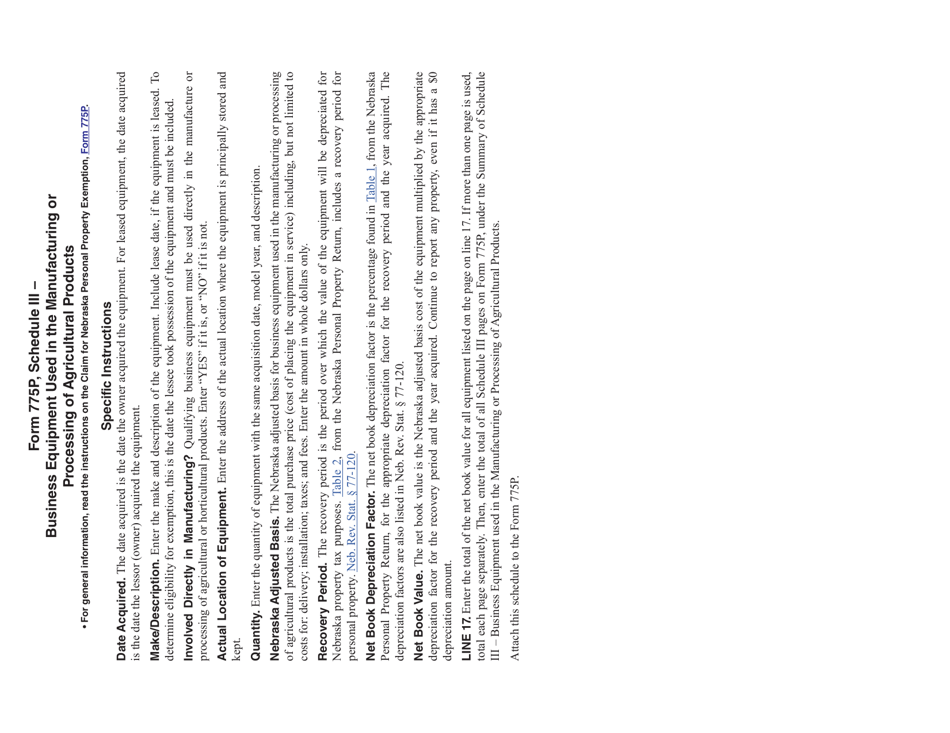

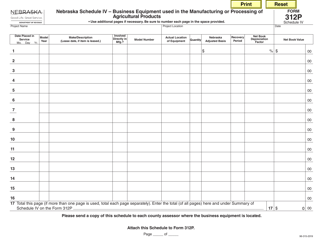

Form 775P Schedule III Business Equipment Used in the Manufacturing or Processing of Agricultural Products - Nebraska

What Is Form 775P Schedule III?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.The document is a supplement to Form 775P, Claim for Nebraska Personal Property Exemption. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 775P Schedule III?

A: Form 775P Schedule III is a tax form used in Nebraska.

Q: What does Schedule III relate to?

A: Schedule III relates to business equipment used in the manufacturing or processing of agricultural products.

Q: Who needs to fill out Schedule III?

A: Individuals and businesses that use business equipment for agricultural processing or manufacturing in Nebraska need to fill out Schedule III.

Q: What is the purpose of Schedule III?

A: The purpose of Schedule III is to report the value of business equipment used for agricultural processing or manufacturing purposes in Nebraska.

Q: What information is required on Schedule III?

A: Schedule III requires the listing of specific types of business equipment and their corresponding values.

Q: Is Schedule III specific to Nebraska?

A: Yes, Schedule III is specific to Nebraska only.

Q: Are there any deadlines for filing Schedule III?

A: Yes, Schedule III must be filed with the Nebraska Department of Revenue by the designated deadline, typically April 15th.

Q: Are there any penalties for not filing Schedule III?

A: Yes, failure to file Schedule III or filing it late may result in penalties and interest charges.

Q: Can I get assistance in filling out Schedule III?

A: Yes, you can seek assistance from tax professionals or contact the Nebraska Department of Revenue for guidance in filling out Schedule III.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 775P Schedule III by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.