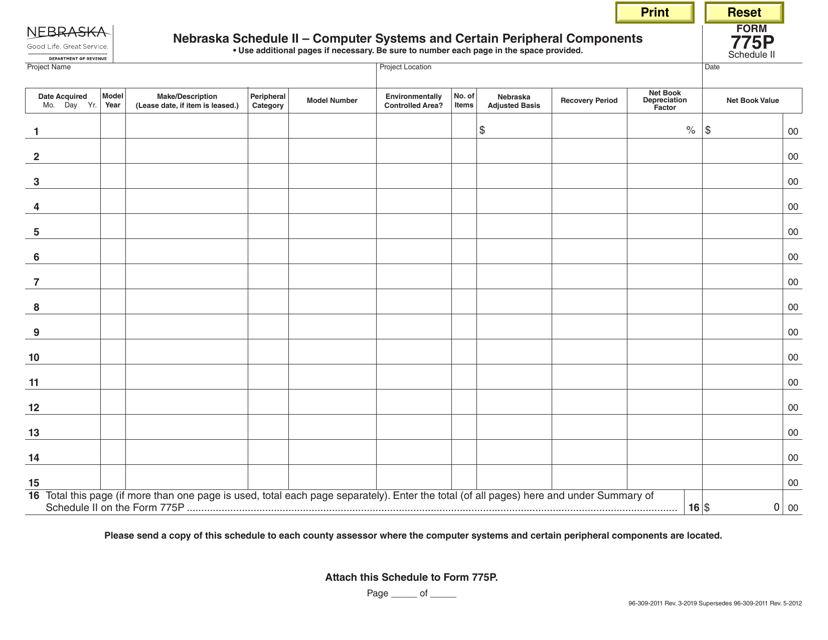

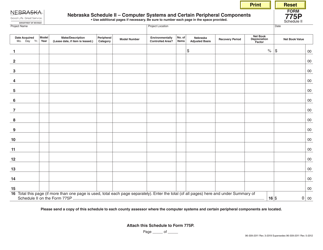

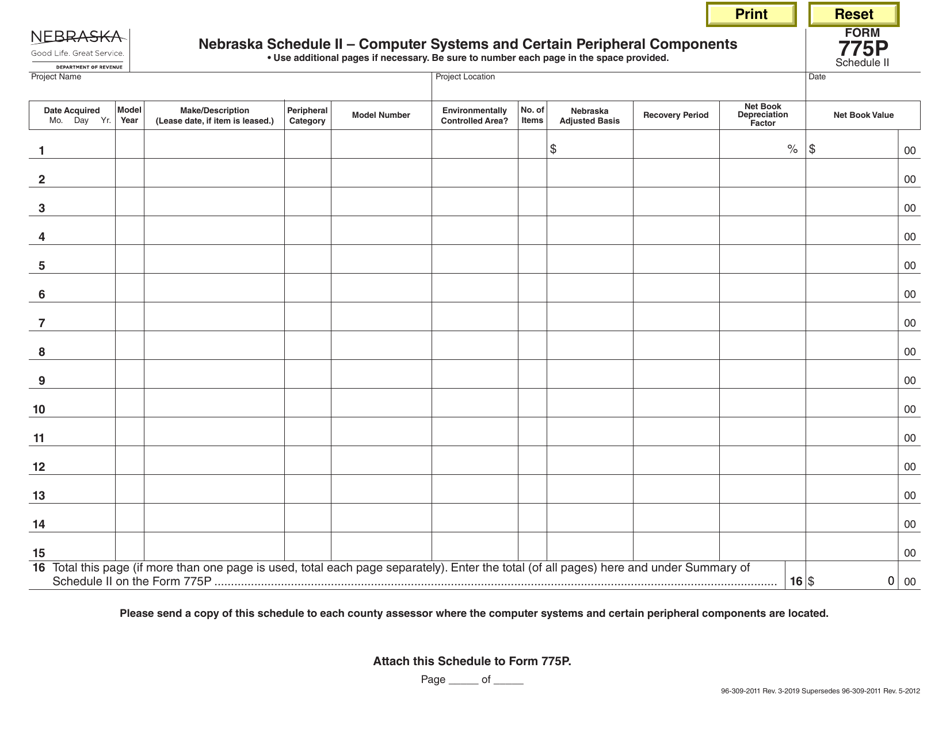

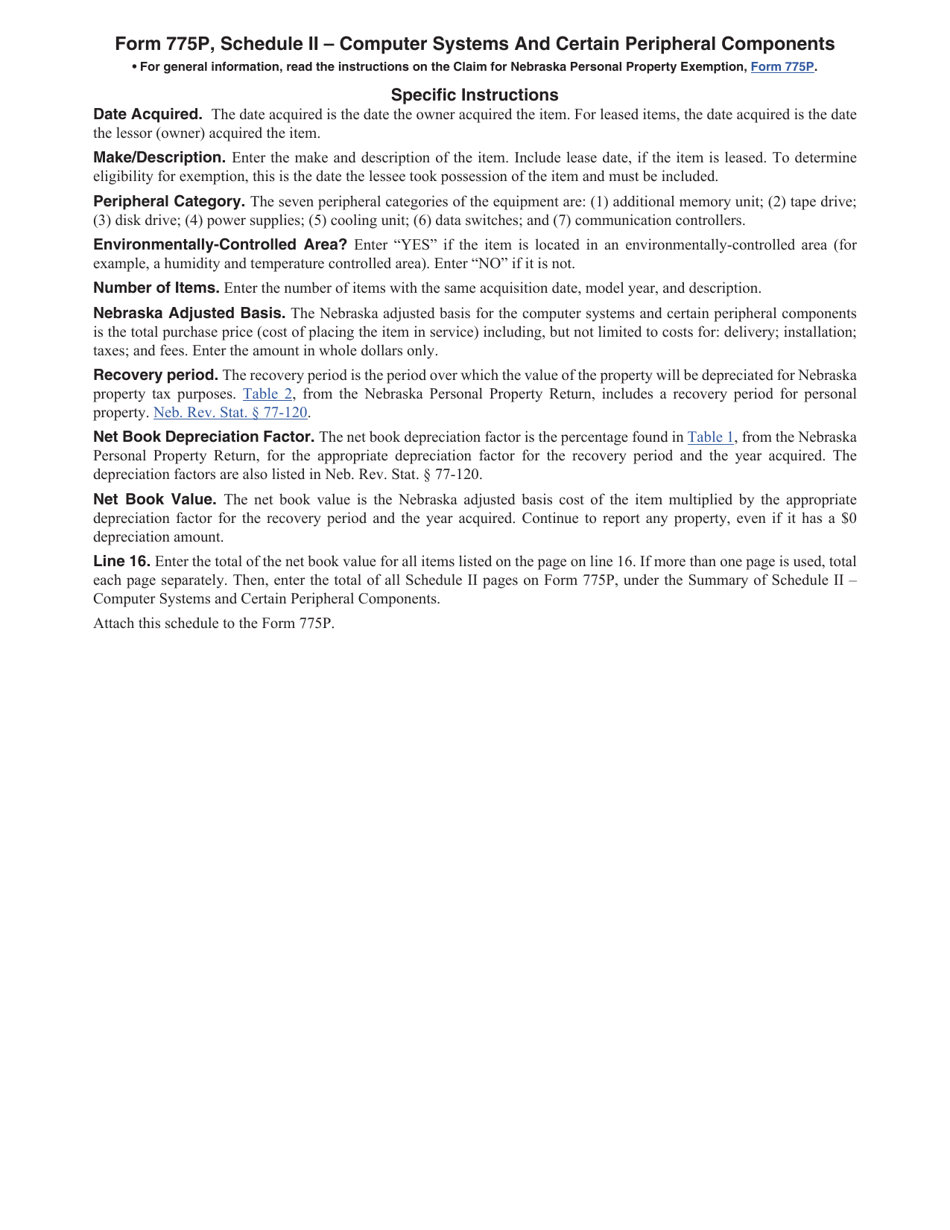

Form 775P Schedule II Computer Systems and Certain Peripheral Components - Nebraska

What Is Form 775P Schedule II?

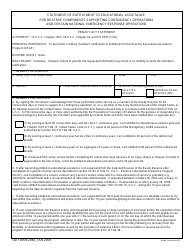

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.The document is a supplement to Form 775P, Claim for Nebraska Personal Property Exemption. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 775P Schedule II?

A: Form 775P Schedule II is a tax form specific to Nebraska that is used to report computer systems and certain peripheral components.

Q: Who needs to file Form 775P Schedule II?

A: Any taxpayer in Nebraska who has acquired or is using computer systems and certain peripheral components as defined by the Nebraska Department of Revenue.

Q: What are computer systems and certain peripheral components?

A: Computer systems include equipment such as desktops, laptops, and servers, while peripheral components include items like monitors, printers, and scanners.

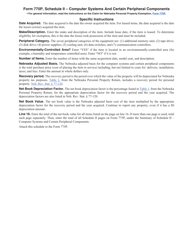

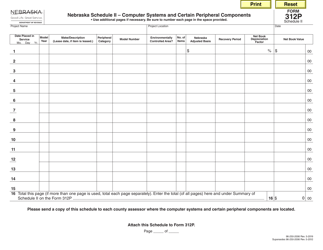

Q: What information is needed to complete Form 775P Schedule II?

A: You will need to provide details about the computer systems and peripheral components, including their cost, acquisition date, and description.

Q: What is the deadline for filing Form 775P Schedule II?

A: The form must be filed by April 1st of each year, or within 30 days of acquiring the computer systems and peripheral components, whichever is later.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 775P Schedule II by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.