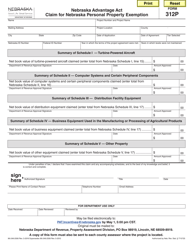

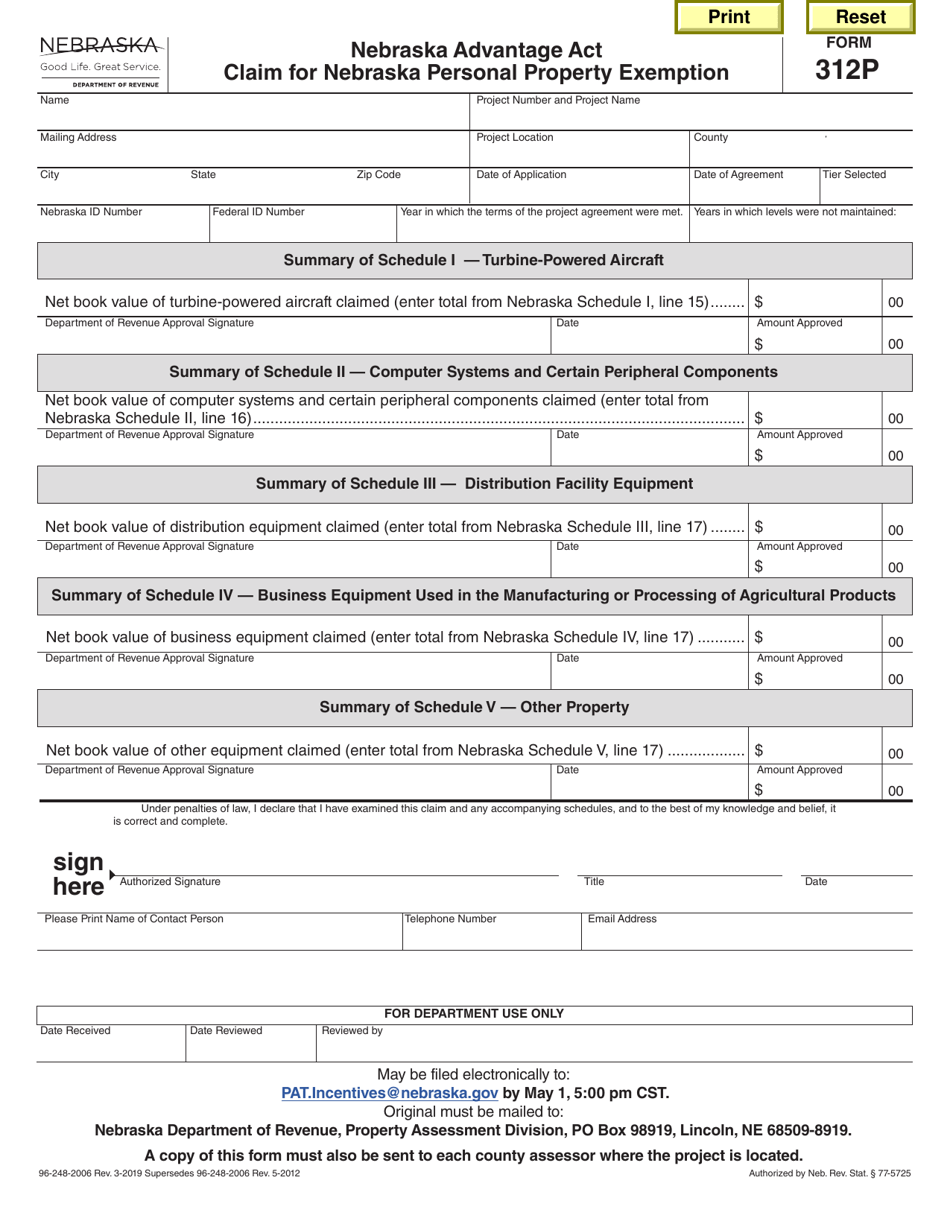

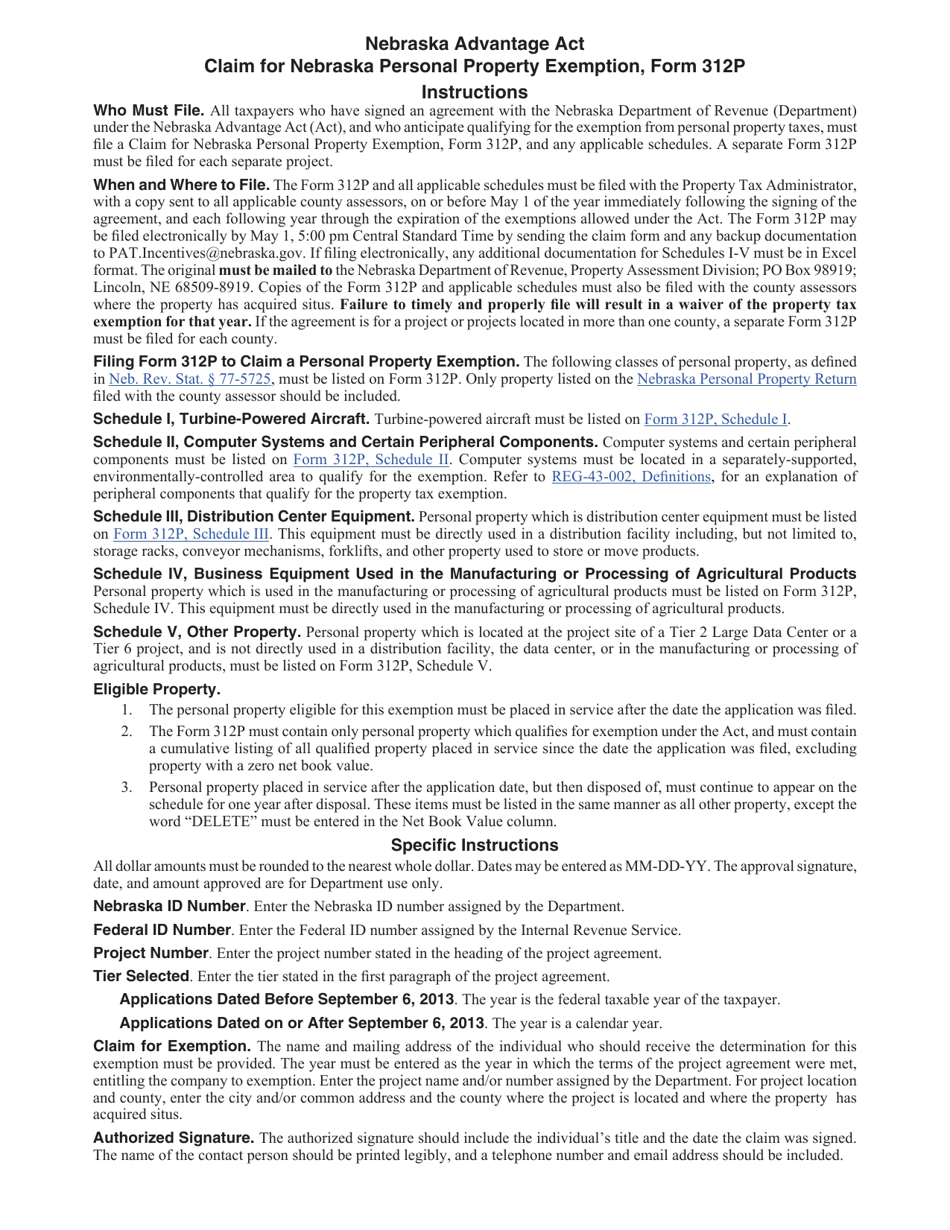

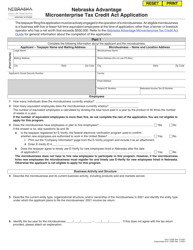

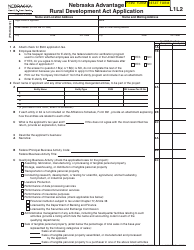

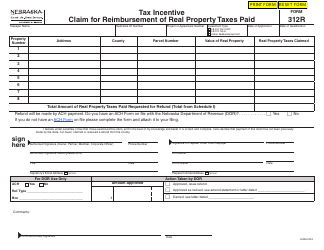

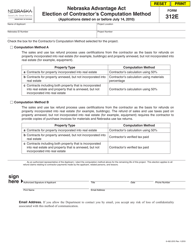

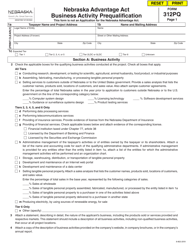

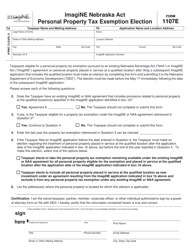

Form 312P Nebraska Advantage Act Claim for Nebraska Personal Property Exemption - Nebraska

What Is Form 312P?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 312P?

A: Form 312P is a claim form used to apply for the Nebraska Advantage Act personal property exemption.

Q: What is the Nebraska Advantage Act?

A: The Nebraska Advantage Act is a program that provides incentives to businesses for job creation and investment in the state.

Q: What is the purpose of Form 312P?

A: The purpose of Form 312P is to claim the personal property exemption provided under the Nebraska Advantage Act.

Q: Who can use Form 312P?

A: Businesses that are eligible for the Nebraska Advantage Act personal property exemption can use Form 312P.

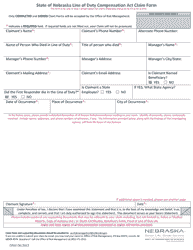

Q: What information is required on Form 312P?

A: Form 312P requires the business name, address, and other details, as well as information about the personal property being claimed for exemption.

Q: What is the deadline for filing Form 312P?

A: Form 312P must be filed by July 1st of the applicable tax year.

Q: What happens after I submit Form 312P?

A: The Nebraska Department of Revenue will review your claim and notify you of their decision.

Q: Can I appeal if my Form 312P claim is denied?

A: Yes, you have the right to appeal the decision if your Form 312P claim is denied.

Q: Are there any fees associated with filing Form 312P?

A: No, there are no fees associated with filing Form 312P.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 312P by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.