This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

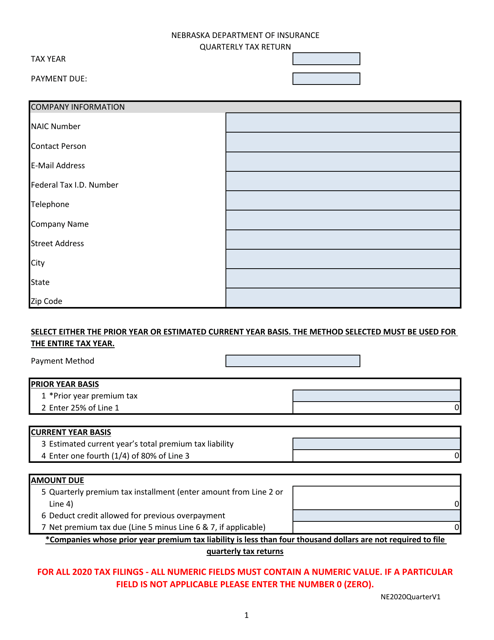

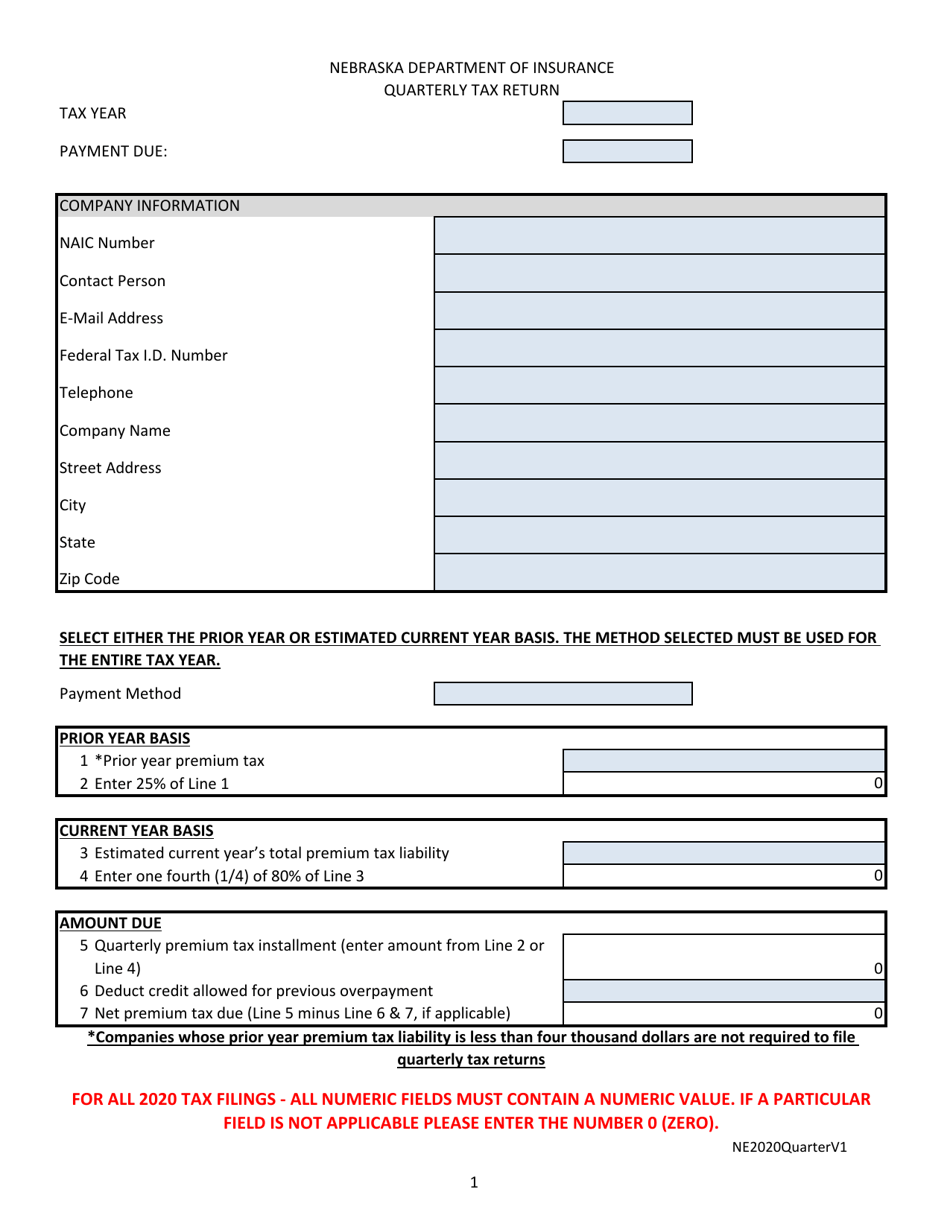

Quarterly Tax Return - Nebraska

Quarterly Tax Return is a legal document that was released by the Nebraska Department of Insurance - a government authority operating within Nebraska.

FAQ

Q: What is a quarterly tax return?

A: A quarterly tax return is a report you must file with the state of Nebraska every three months to report and pay your estimated income tax liability for that quarter.

Q: Who needs to file a quarterly tax return in Nebraska?

A: Individuals who are self-employed or have income from sources that are not subject to withholding, such as rental income or business profits, may need to file a quarterly tax return in Nebraska.

Q: What information is required for a Nebraska quarterly tax return?

A: You will need to provide information about your estimated income, deductions, and credits for the quarter, as well as any tax payments you have already made.

Q: When are Nebraska quarterly tax returns due?

A: Nebraska quarterly tax returns are generally due by the last day of the month following the end of the quarter. For example, the first quarter return is due by April 30th.

Form Details:

- The latest edition currently provided by the Nebraska Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Insurance.