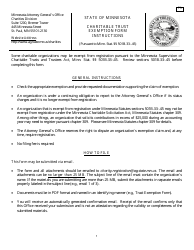

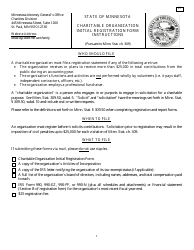

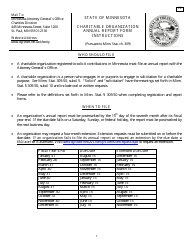

Charitable Organization - Exemption Form - Minnesota

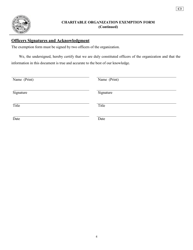

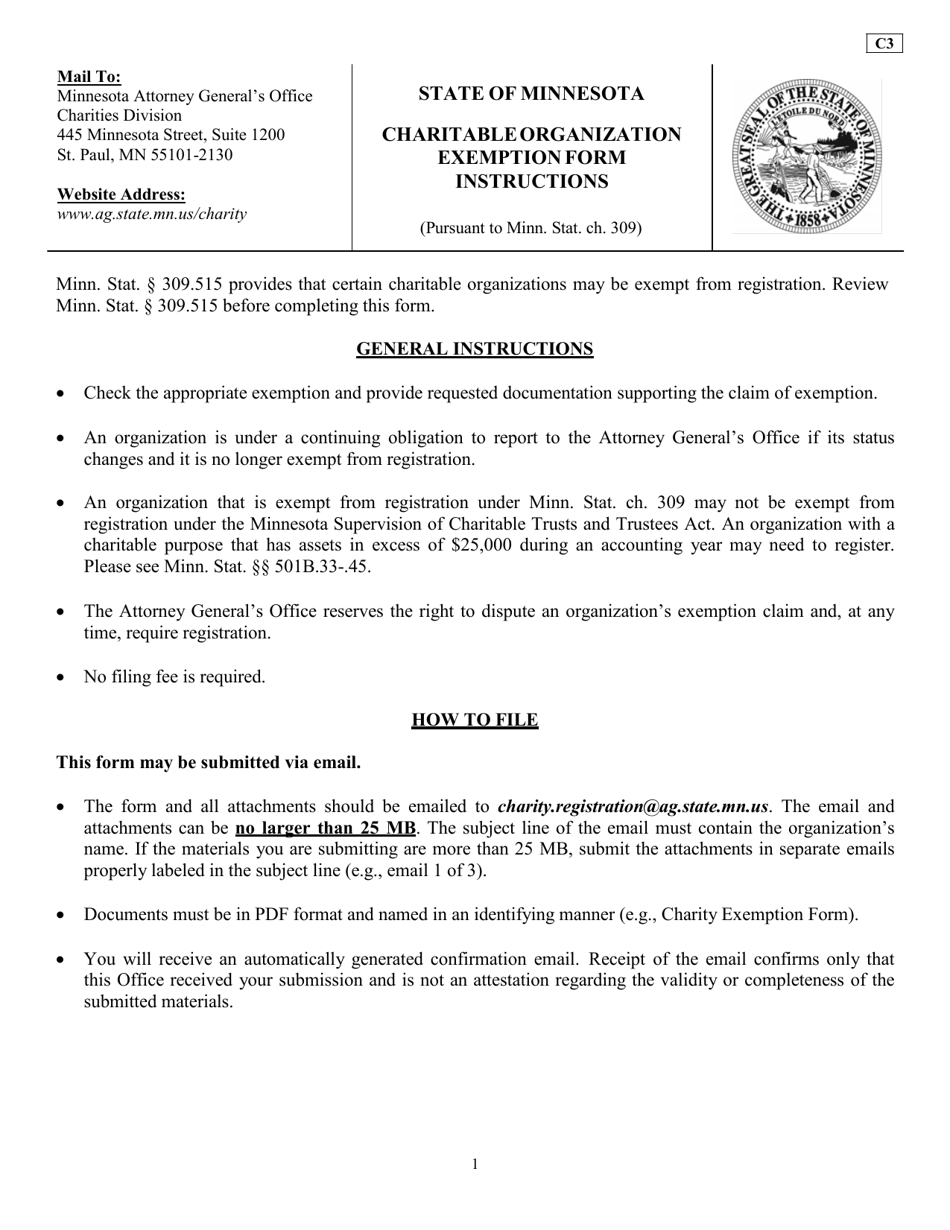

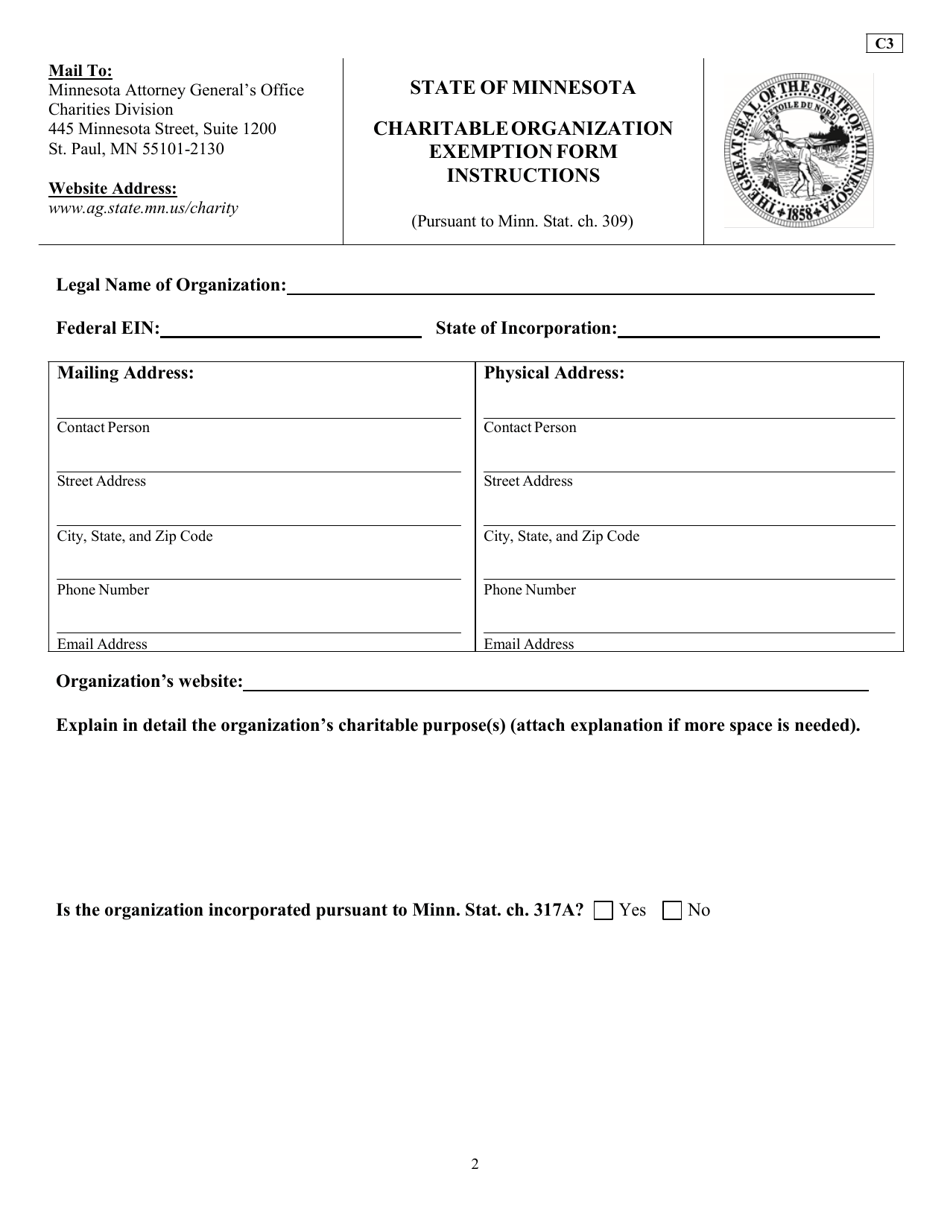

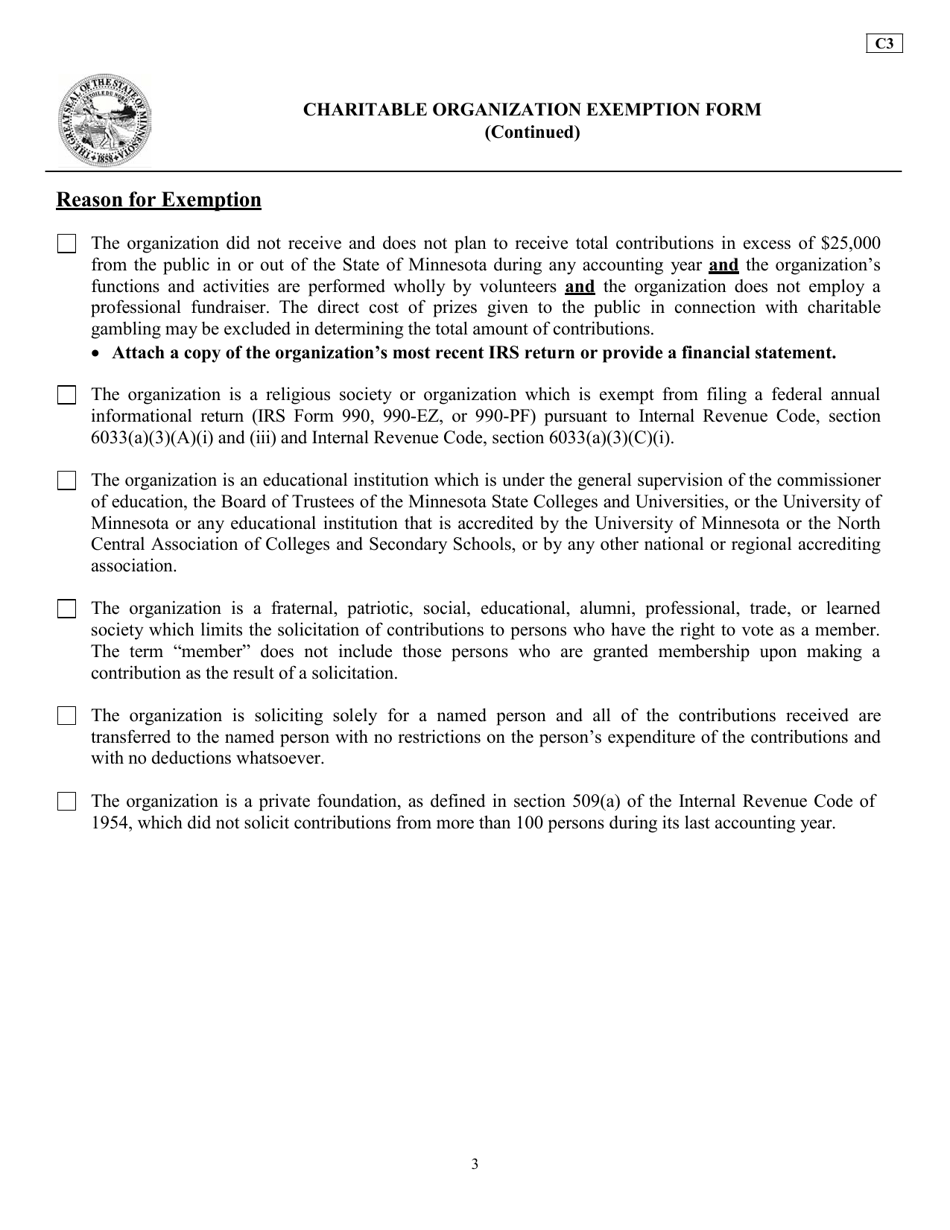

Charitable Organization - Exemption Form is a legal document that was released by the Office of the Minnesota Attorney General - a government authority operating within Minnesota.

FAQ

Q: What is a charitable organization?

A: A charitable organization is a non-profit organization that aims to help others and serve a charitable purpose.

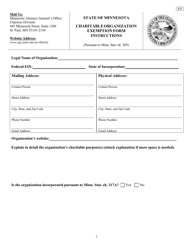

Q: What is an exemption form for charitable organizations in Minnesota?

A: An exemption form for charitable organizations in Minnesota is a form that allows qualifying organizations to apply for tax-exempt status.

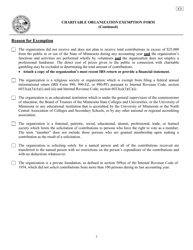

Q: Who is eligible to apply for an exemption form?

A: Non-profit organizations that meet certain criteria and purposes are eligible to apply for an exemption form.

Q: What are the benefits of having tax-exempt status?

A: Having tax-exempt status means that the organization is not required to pay certain taxes, such as income tax.

Q: Are there any requirements or obligations for tax-exempt organizations?

A: Yes, tax-exempt organizations are generally required to file annual reports and adhere to certain regulations to maintain their tax-exempt status.

Form Details:

- The latest edition currently provided by the Office of the Minnesota Attorney General;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Office of the Minnesota Attorney General.