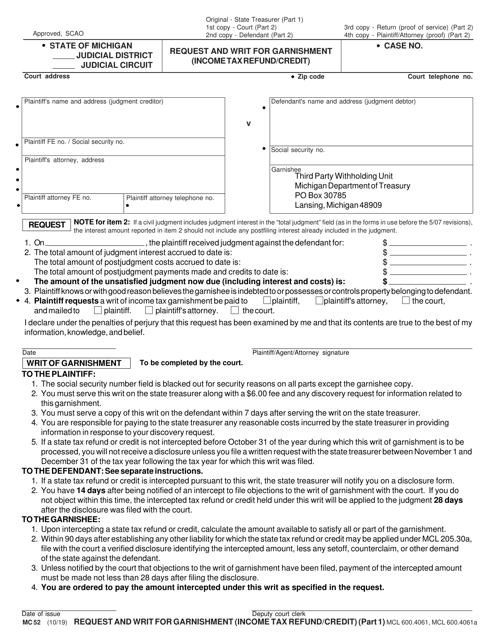

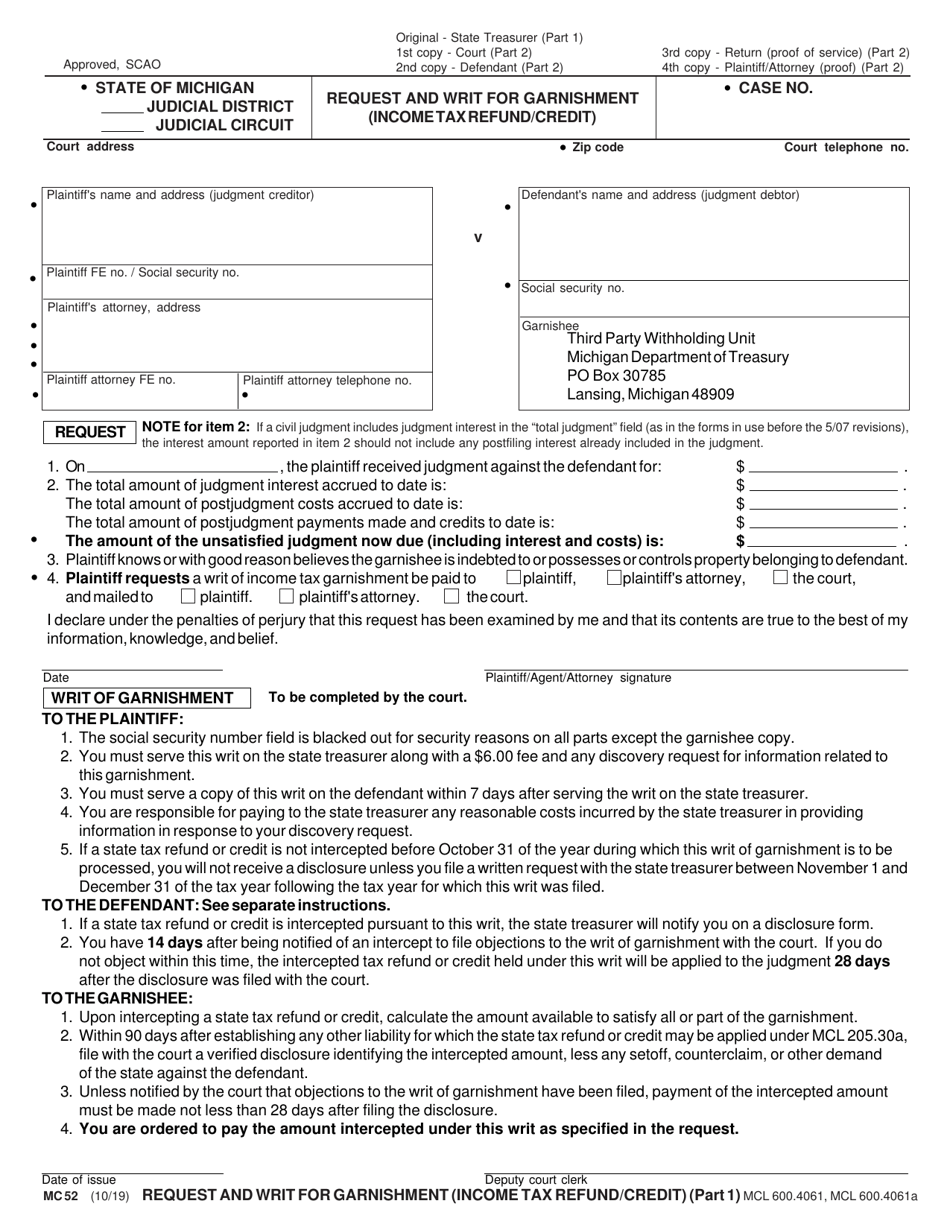

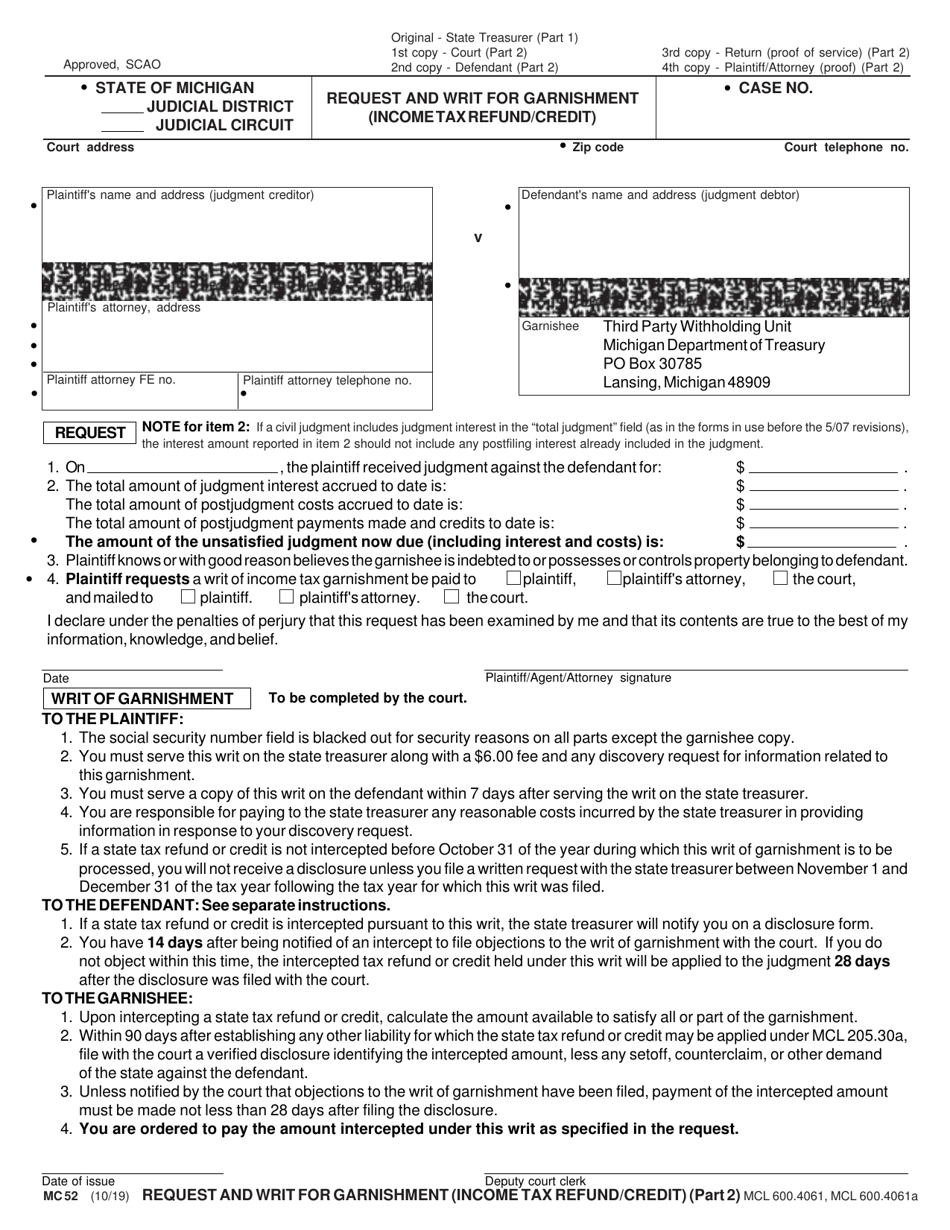

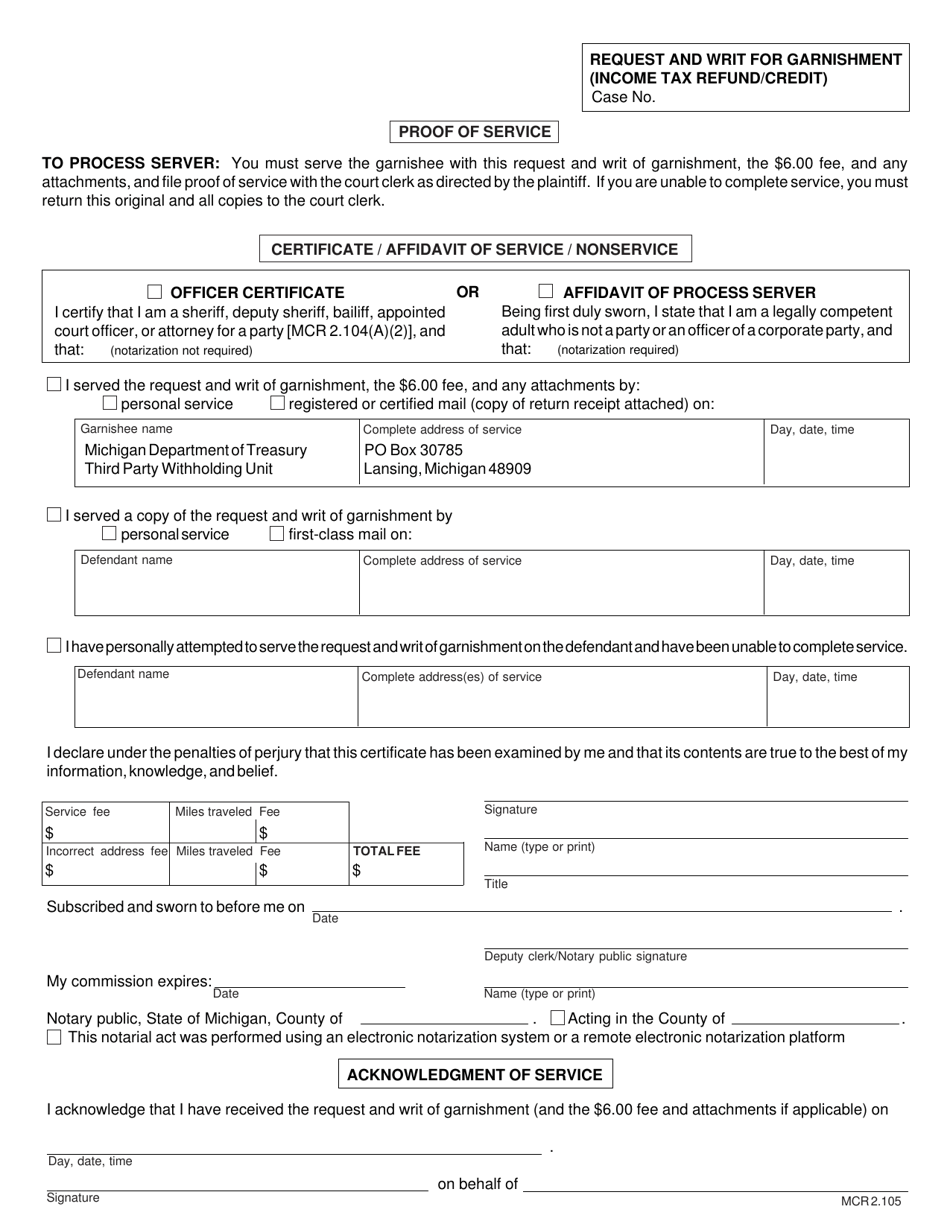

Form MC52 Request and Writ for Garnishment (Income Tax Refund / Credit) - Michigan

What Is Form MC52?

This is a legal form that was released by the Michigan Circuit Court - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a MC52 form?

A: A MC52 form is a Request and Writ for Garnishment (Income Tax Refund/Credit) form.

Q: What is the purpose of a MC52 form?

A: The purpose of a MC52 form is to request and obtain a writ for garnishment of a taxpayer's income tax refund or credit in Michigan.

Q: What information is required on a MC52 form?

A: The MC52 form requires information such as the debtor's name, address, social security number, and the amount of the debt.

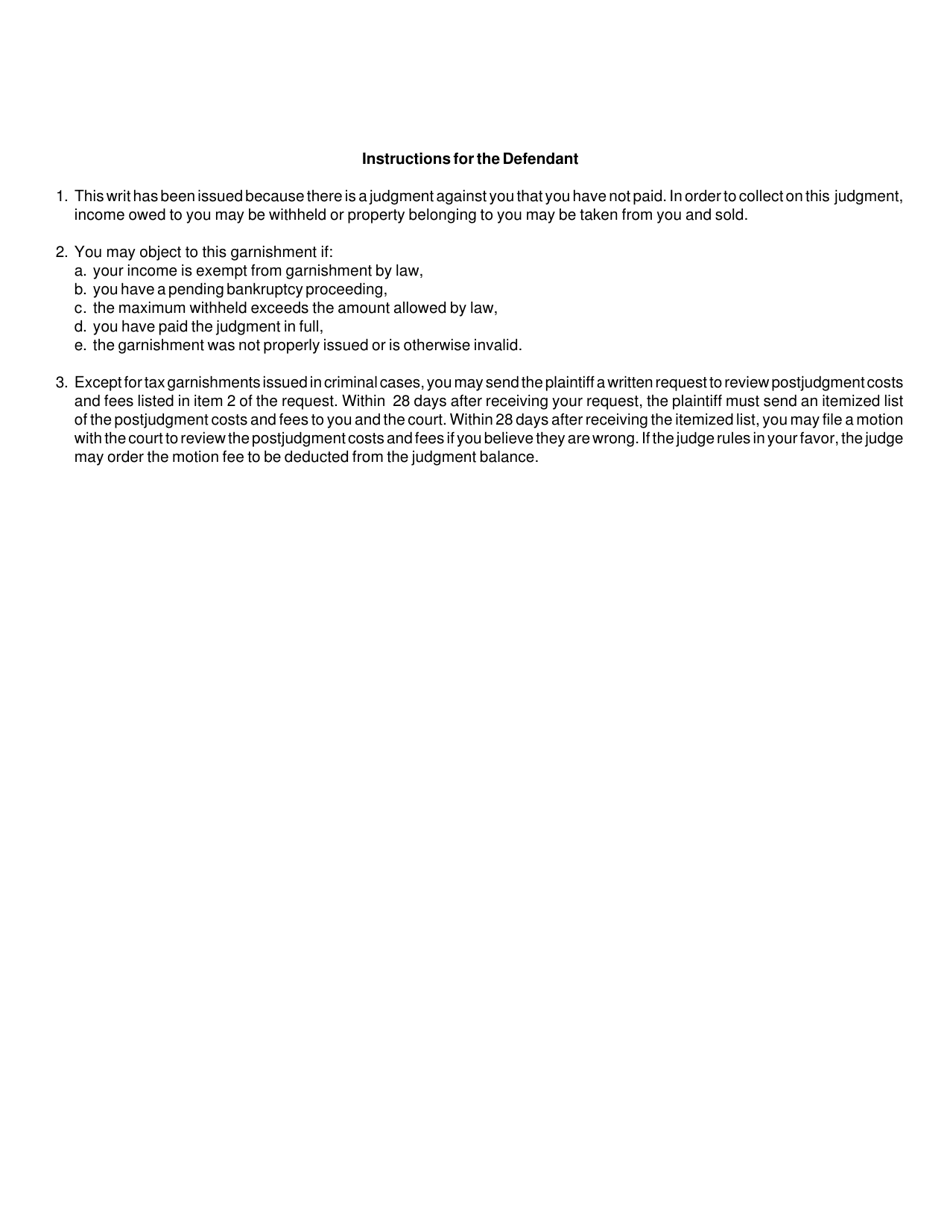

Q: Can I use a MC52 form for any type of debt?

A: No, the MC52 form specifically applies to garnishment of income tax refunds or credits.

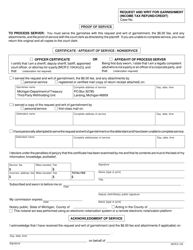

Q: What should I do after completing the MC52 form?

A: After completing the MC52 form, you should file it with the appropriate court and serve it on the debtor and the Michigan Department of Treasury.

Q: Is there a fee for filing a MC52 form?

A: Yes, there is a fee for filing a MC52 form. The fee amount may vary depending on the court jurisdiction.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Michigan Circuit Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MC52 by clicking the link below or browse more documents and templates provided by the Michigan Circuit Court.