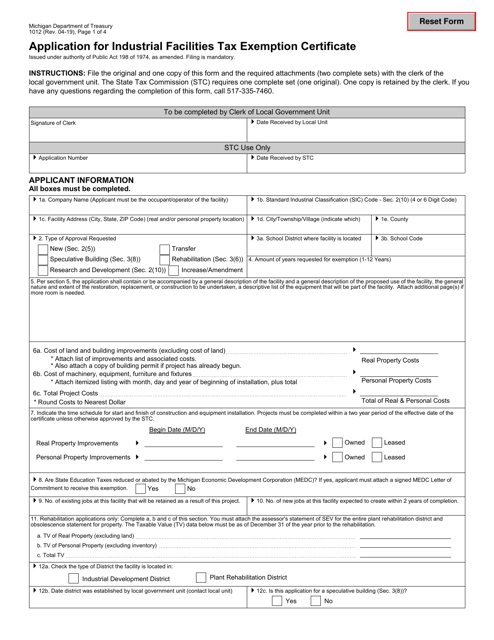

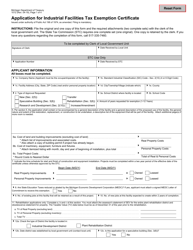

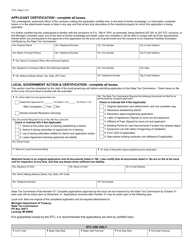

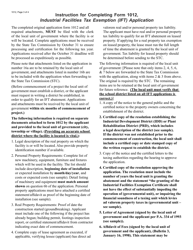

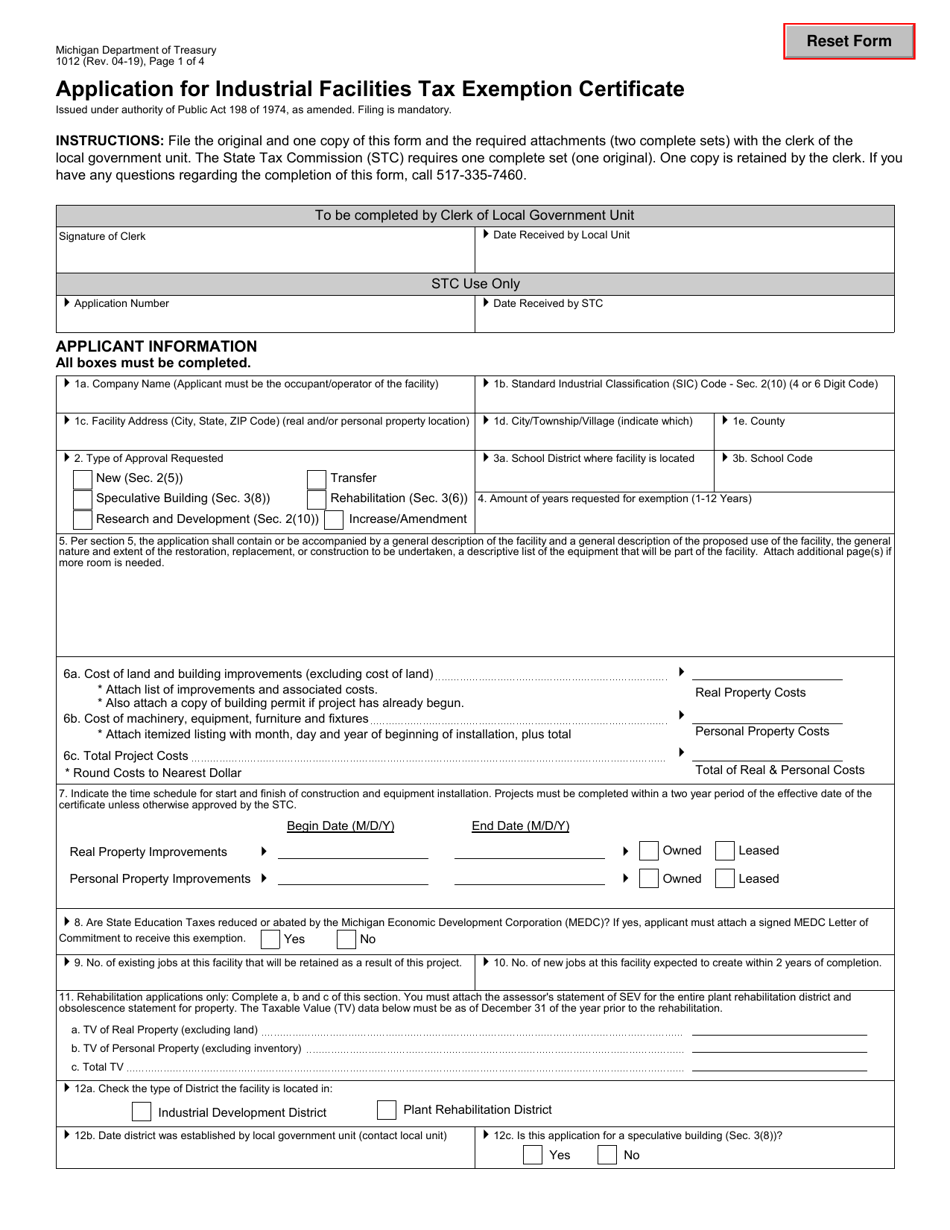

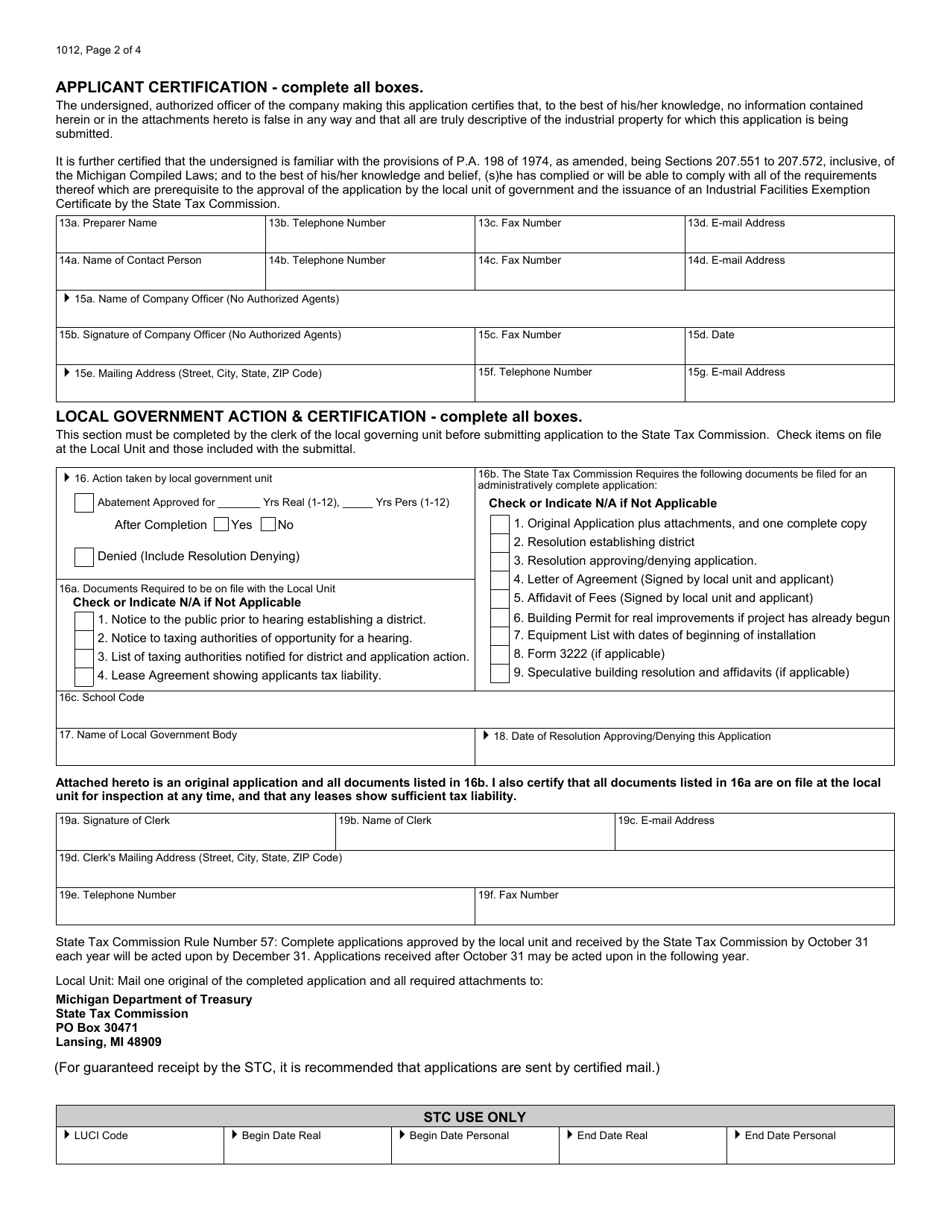

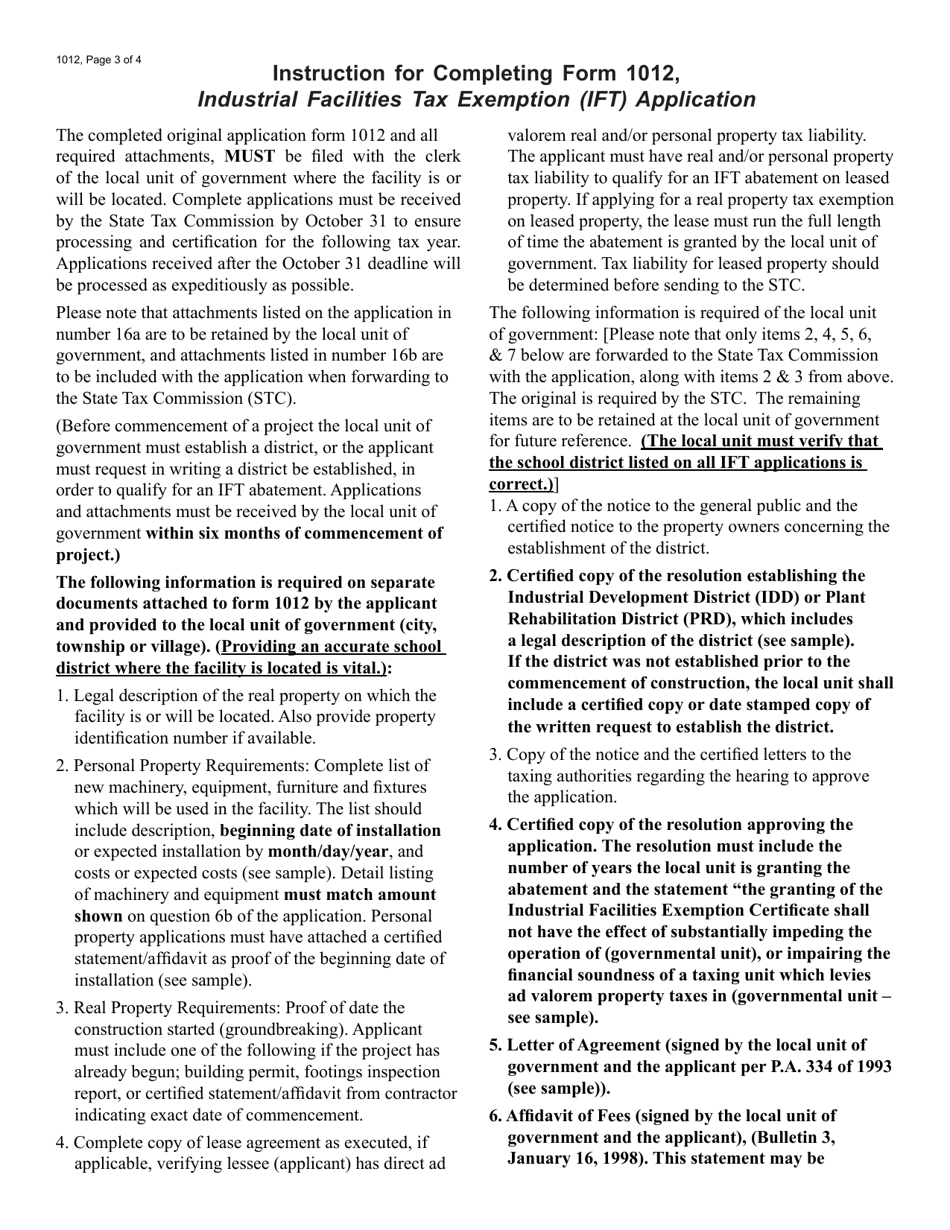

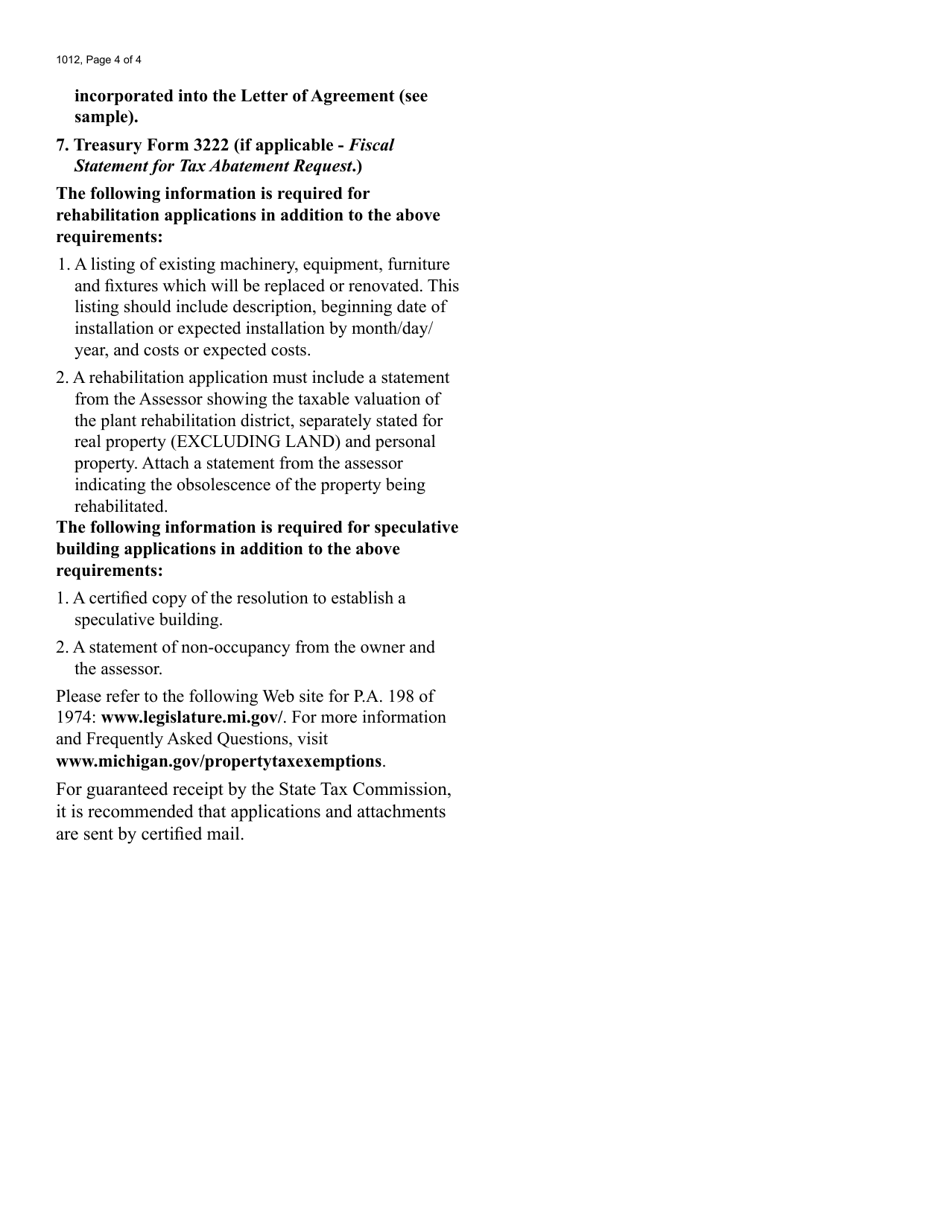

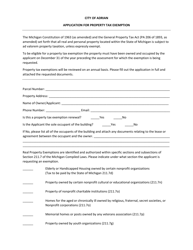

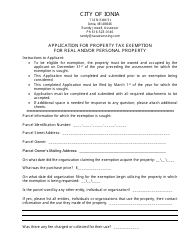

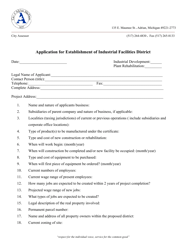

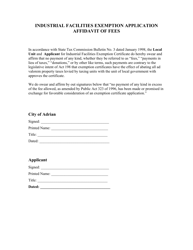

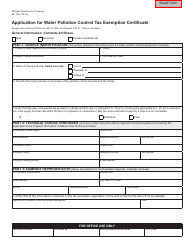

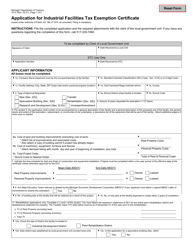

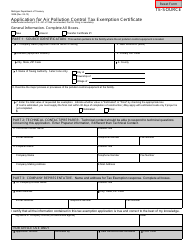

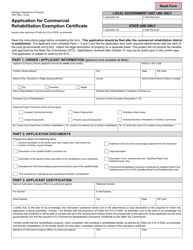

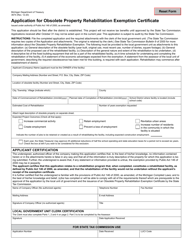

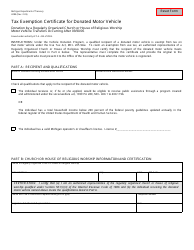

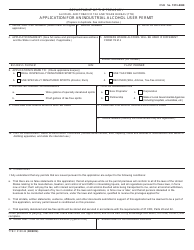

Form 1012 (L-4380) Application for Industrial Facilities Tax Exemption Certificate - Michigan

What Is Form 1012 (L-4380)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1012 (L-4380)?

A: Form 1012 (L-4380) is the Application for Industrial Facilities Tax Exemption Certificate in Michigan.

Q: What is the purpose of Form 1012 (L-4380)?

A: The purpose of Form 1012 (L-4380) is to apply for an Industrial Facilities Tax Exemption Certificate in Michigan.

Q: Who can use Form 1012 (L-4380)?

A: Form 1012 (L-4380) can be used by businesses and industries applying for a tax exemption for industrial facilities in Michigan.

Q: Are there any fees associated with filing Form 1012 (L-4380)?

A: Yes, there is an application fee associated with filing Form 1012 (L-4380), which is based on the value of the new investment in the industrial facility.

Q: What are the eligibility requirements for the Industrial Facilities Tax Exemption Certificate?

A: The eligibility requirements for the Industrial Facilities Tax Exemption Certificate include making a certain level of new investment in an industrial facility and meeting other specific criteria set by the state of Michigan.

Q: What are the benefits of the Industrial Facilities Tax Exemption Certificate?

A: The Industrial Facilities Tax Exemption Certificate provides tax exemptions on certain qualified real and personal property investments made in an industrial facility in Michigan.

Q: How long is the tax exemption period with the Industrial Facilities Tax Exemption Certificate?

A: The tax exemption period with the Industrial Facilities Tax Exemption Certificate is typically 12 years, but certain projects may qualify for a longer exemption period.

Q: Can the Industrial Facilities Tax Exemption Certificate be transferred to a new owner?

A: Yes, the Industrial Facilities Tax Exemption Certificate can be transferred to a new owner if the facility is sold or ownership is transferred.

Q: What is the deadline for filing Form 1012 (L-4380)?

A: The deadline for filing Form 1012 (L-4380) is typically within six months after the start of construction or installation of qualified personal property.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1012 (L-4380) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.