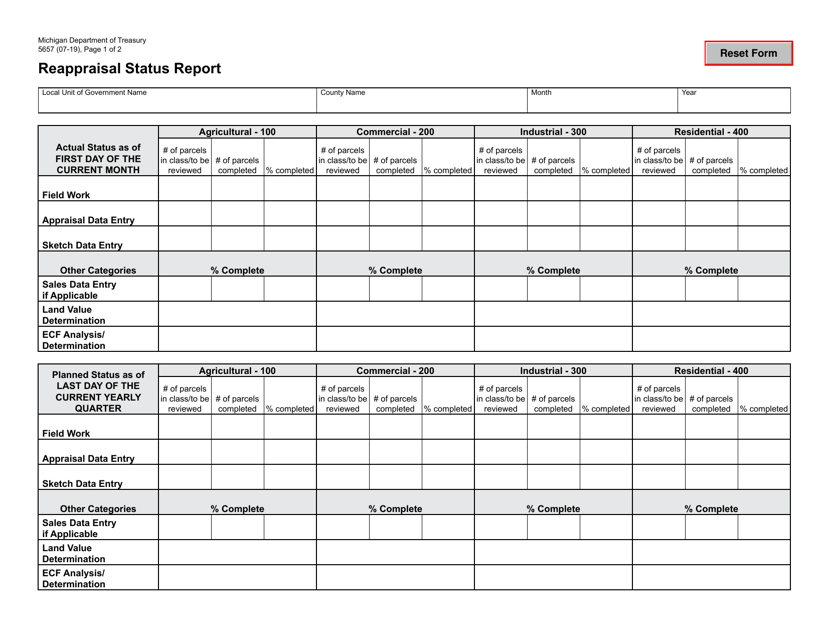

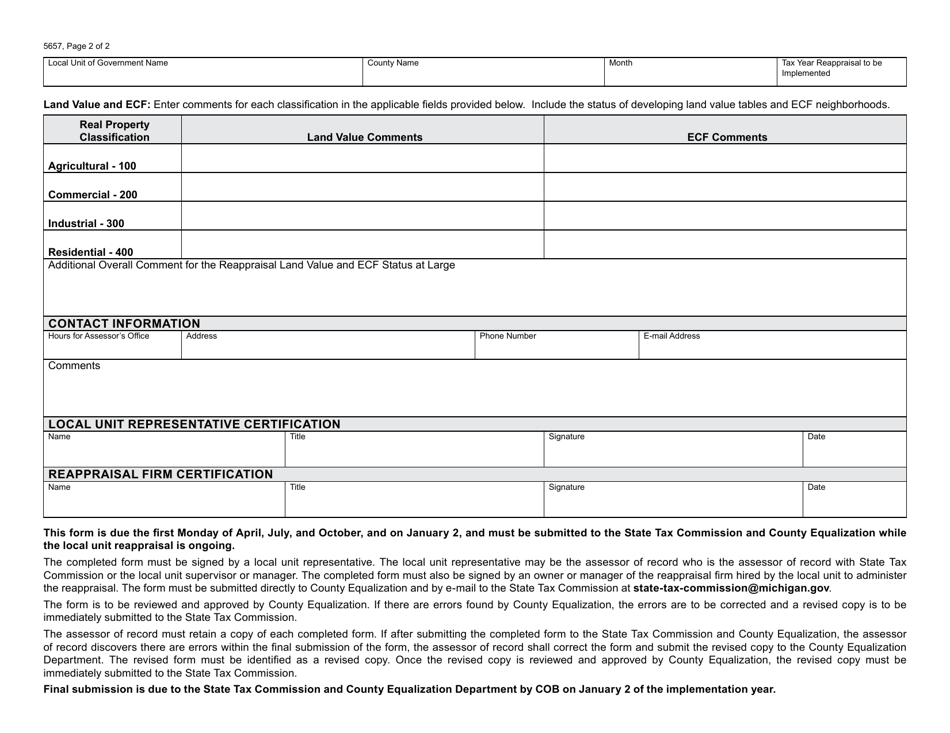

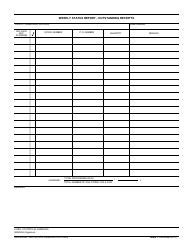

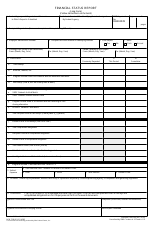

Form 5657 Reappraisal Status Report - Michigan

What Is Form 5657?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5657?

A: Form 5657 is the Reappraisal Status Report for properties in Michigan.

Q: Who needs to file Form 5657?

A: Form 5657 is filed by local tax assessors in Michigan.

Q: What is the purpose of Form 5657?

A: The purpose of Form 5657 is to report the status of property reappraisals in Michigan.

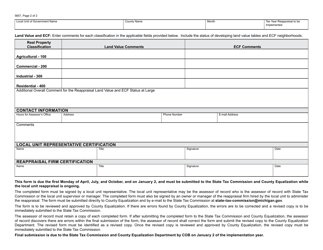

Q: What information is required on Form 5657?

A: Form 5657 requires information about the progress of property reappraisals, including the number of properties reappraised and the estimated completion date.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5657 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.