This version of the form is not currently in use and is provided for reference only. Download this version of

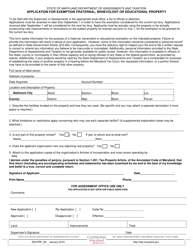

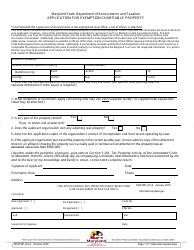

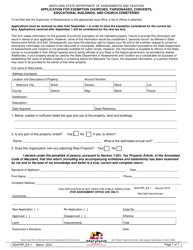

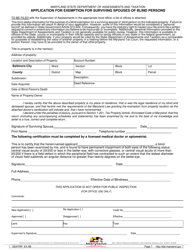

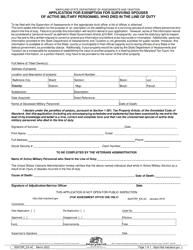

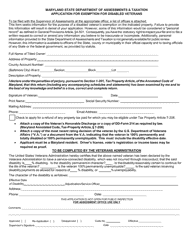

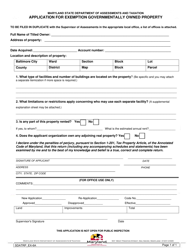

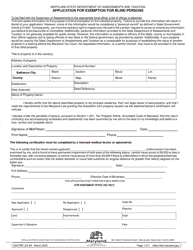

Form SDATRP_EX4B

for the current year.

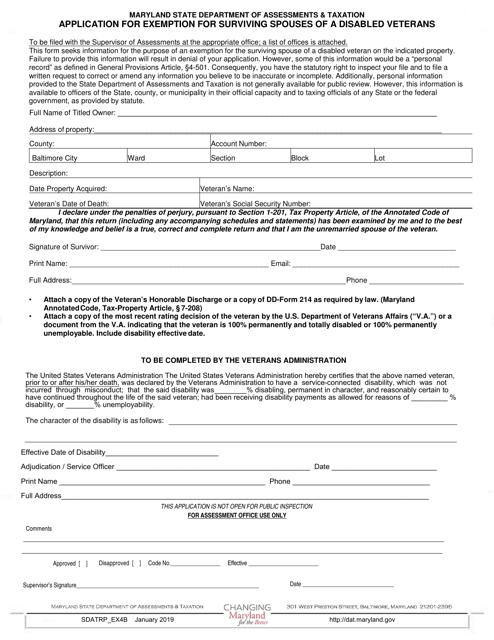

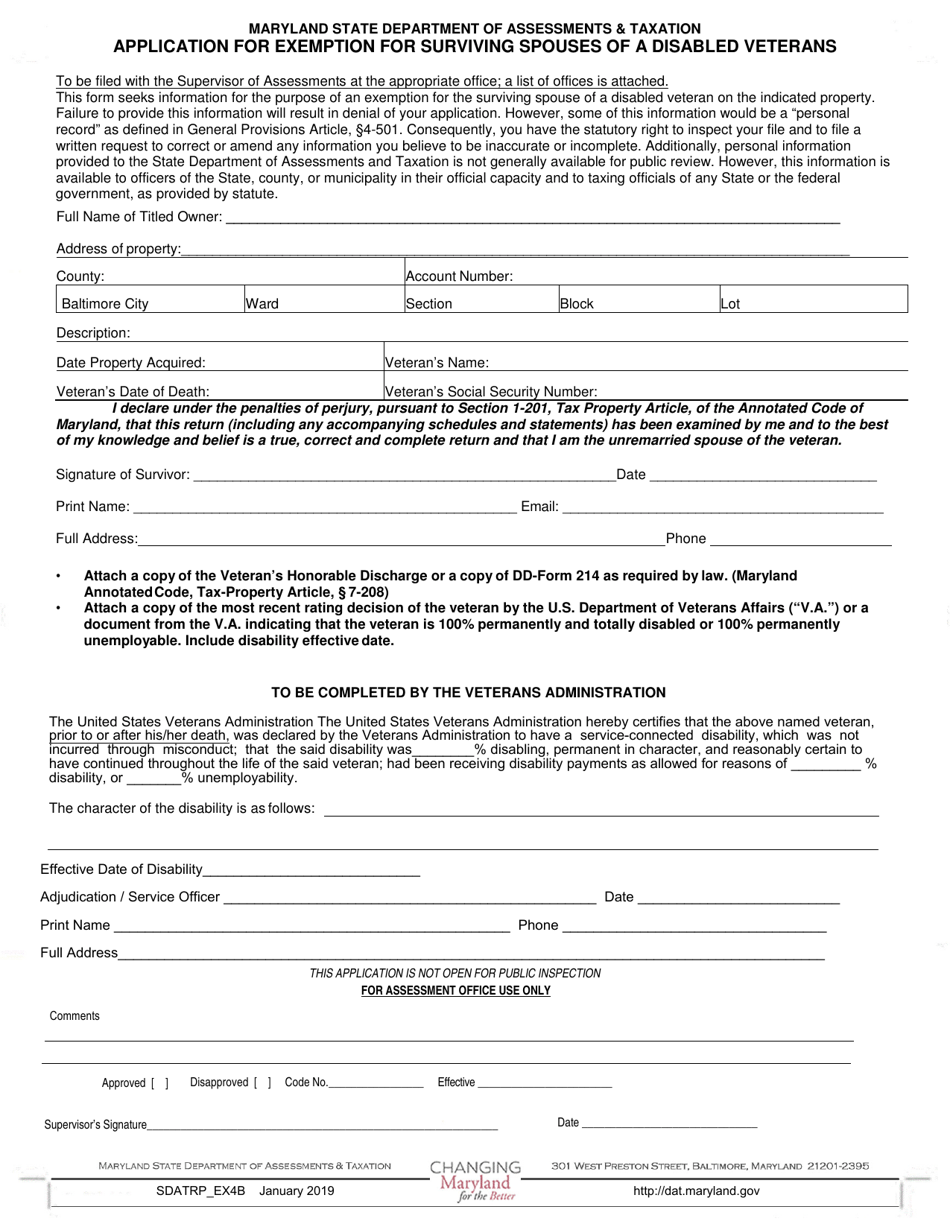

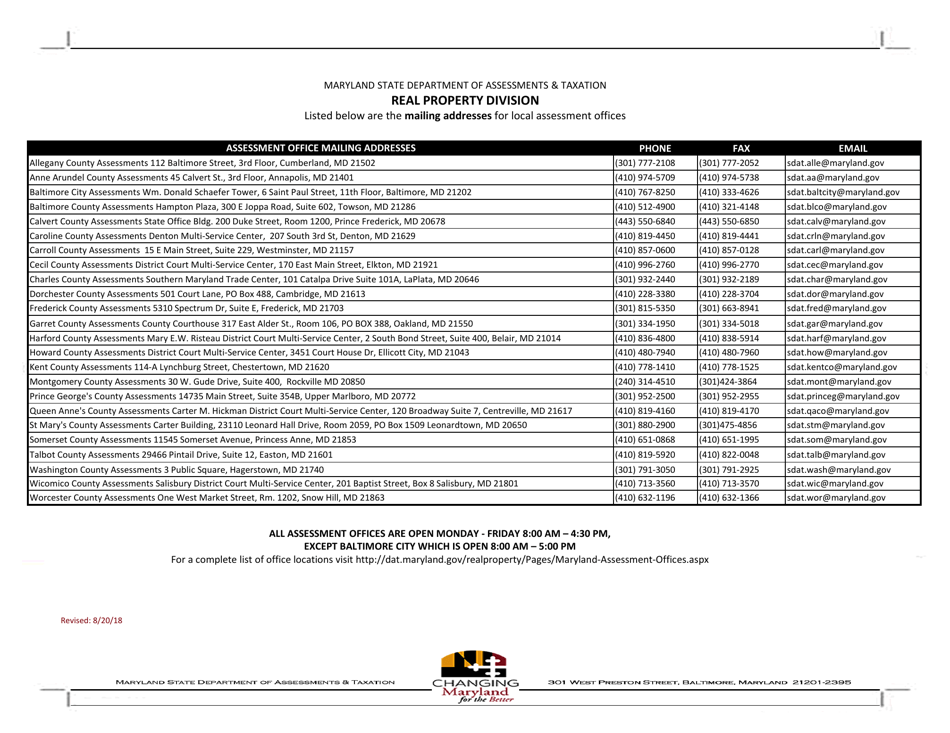

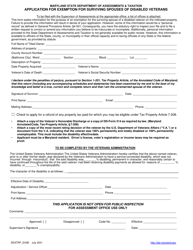

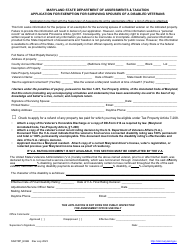

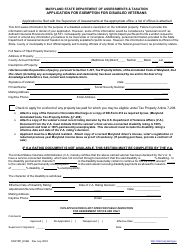

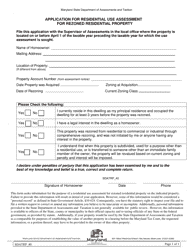

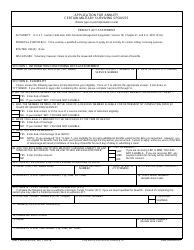

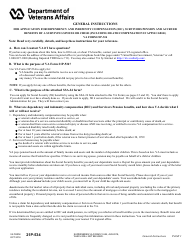

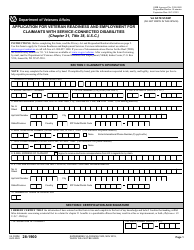

Form SDATRP_EX4B Application for Exemption for Surviving Spouses of a Disabled Veterans - Maryland

What Is Form SDATRP_EX4B?

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the SDATRP_EX4B Application?

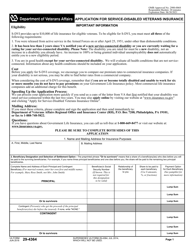

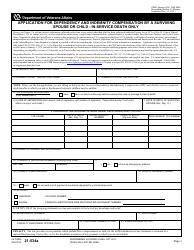

A: The SDATRP_EX4B Application is the application for exemption for surviving spouses of disabled veterans in Maryland.

Q: Who can apply for the exemption?

A: Surviving spouses of disabled veterans can apply for the exemption.

Q: What is the purpose of the exemption?

A: The exemption is designed to provide property tax relief for surviving spouses of disabled veterans.

Q: What are the eligibility criteria for the exemption?

A: To be eligible for the exemption, the surviving spouse must meet certain criteria, which include being the surviving spouse of a disabled veteran and meeting income and residency requirements.

Q: How can I apply for the exemption?

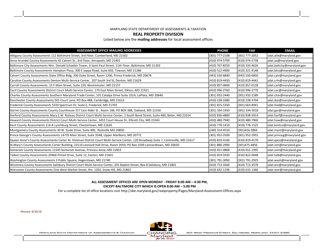

A: You can apply for the exemption by completing the SDATRP_EX4B Application form and submitting it to the appropriate authorities in Maryland.

Q: Is there a deadline for submitting the application?

A: Yes, there is a deadline for submitting the application. The specific deadline may vary, so it's important to check the instructions on the application form or contact the authorities for the most up-to-date information.

Q: What supporting documents do I need to include with the application?

A: You may be required to provide supporting documents such as proof of marriage to the disabled veteran, proof of the veteran's disability, and proof of income and residency.

Q: What happens after I submit the application?

A: Once you submit the application, it will be reviewed by the authorities. If you meet the eligibility criteria, you will be granted the exemption and receive property tax relief.

Q: Can I appeal if my application is denied?

A: Yes, you have the right to appeal if your application is denied. You can follow the appeals process outlined by the Maryland Department of Assessments and Taxation (SDAT).

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SDATRP_EX4B by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.