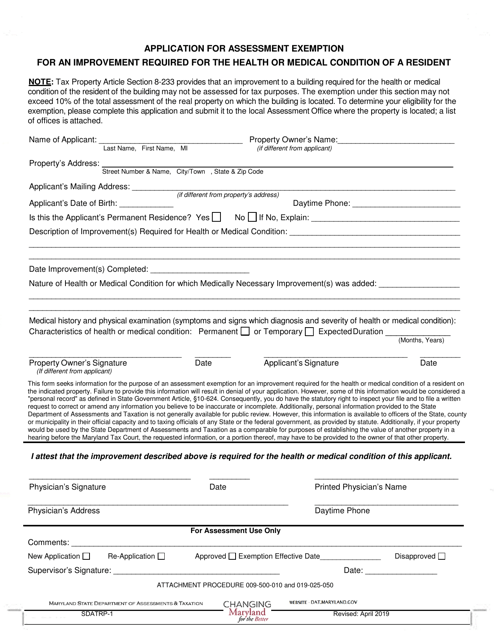

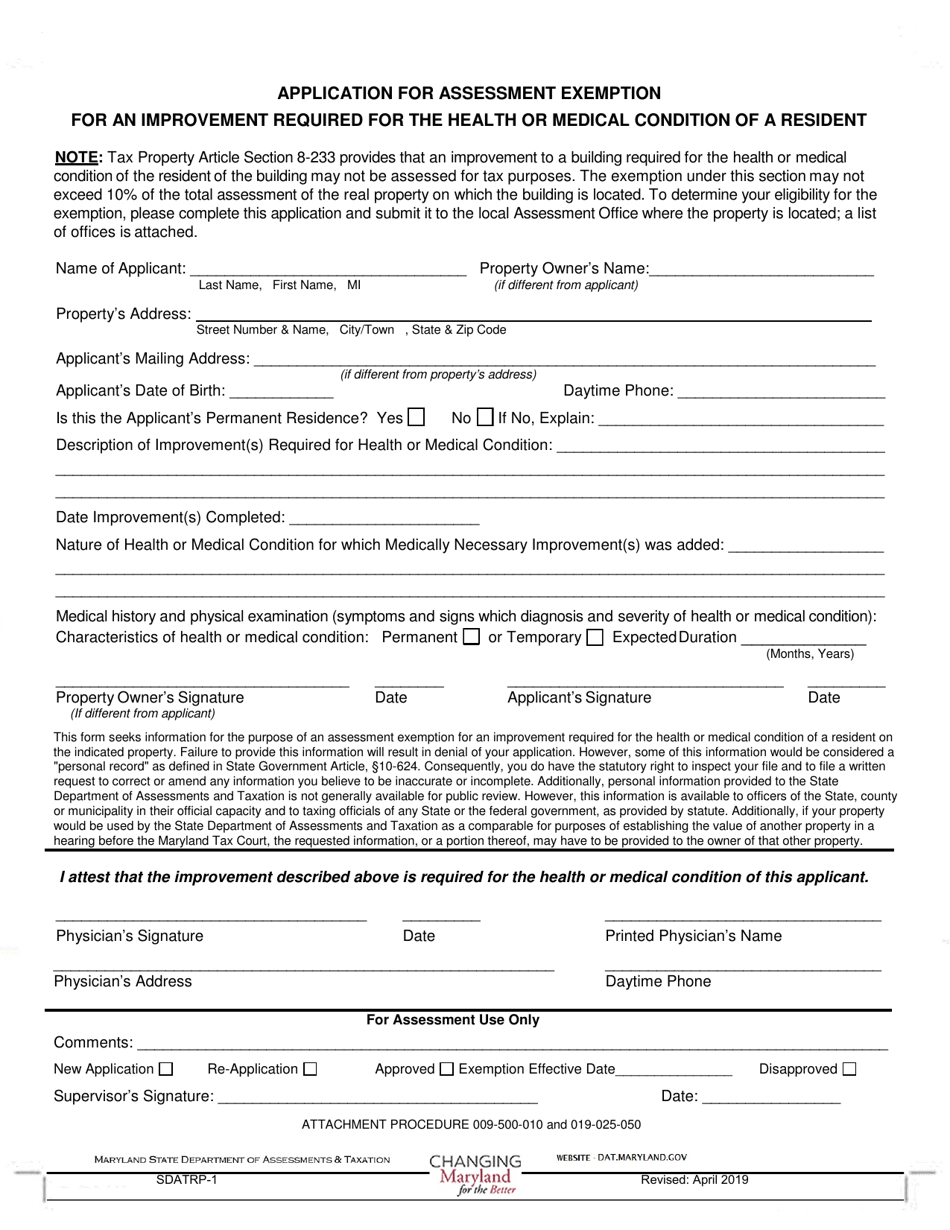

Form SDATRP_1 Assessment Exemption for an Improvement Required for the Health or Medical Condition of a Resident - Maryland

What Is Form SDATRP_1?

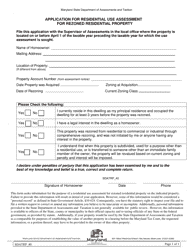

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the SDATRP_1 Assessment Exemption for an Improvement Required for the Health or Medical Condition of a Resident?

A: The SDATRP_1 Assessment Exemption is a program in Maryland that allows for an exemption from property tax assessment for improvements required for the health or medical condition of a resident.

Q: Who is eligible for the SDATRP_1 Assessment Exemption?

A: Property owners in Maryland who have made improvements to their property that are necessary for the health or medical condition of a resident.

Q: What types of improvements qualify for the exemption?

A: Improvements that are necessary for the health or medical condition of a resident, such as installing wheelchair ramps or modifying bathrooms for accessibility.

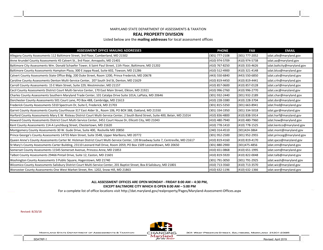

Q: How do I apply for the SDATRP_1 Assessment Exemption?

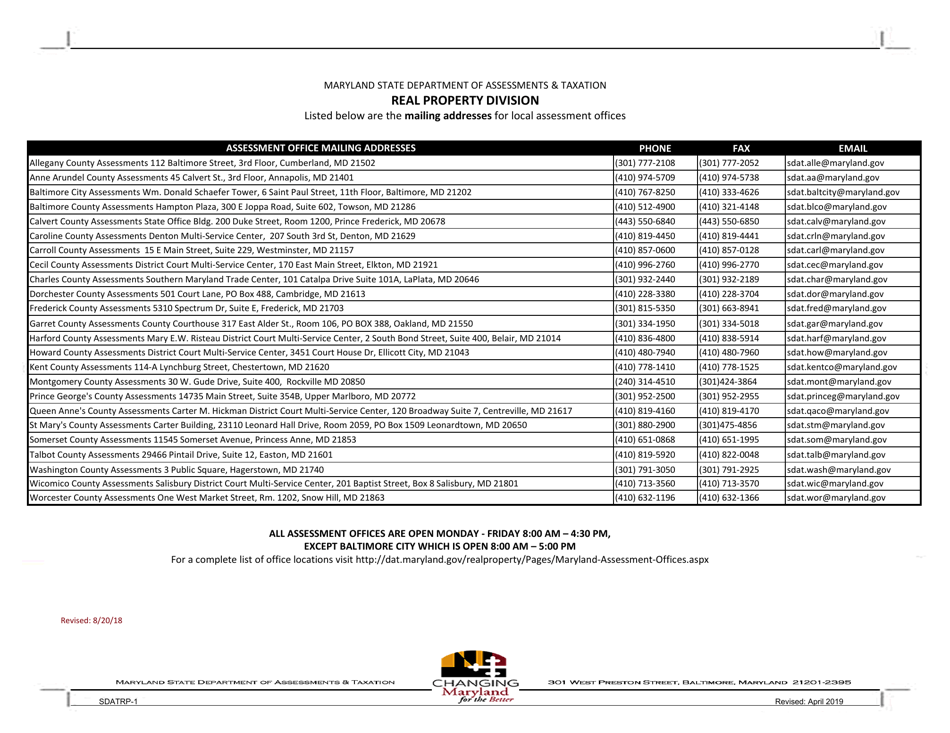

A: To apply, you need to complete the SDATRP_1 application form and submit it to the Maryland Department of Assessments and Taxation.

Q: What documents do I need to provide with my application?

A: You will need to provide documentation from a medical professional stating that the improvements are necessary for the health or medical condition of the resident.

Q: Is there a deadline for applying for the exemption?

A: Yes, applications must be submitted by December 31st of the year in which the improvements were made.

Q: How long does the exemption last?

A: The exemption lasts for as long as the improvements are necessary for the health or medical condition of the resident.

Q: Will the exemption reduce my property taxes?

A: Yes, if your application is approved, your property tax assessment will be lowered to reflect the value of the property without the improvements.

Q: Can I apply for the exemption if the improvements were made by a previous owner?

A: Yes, as long as the improvements are still necessary for the health or medical condition of the current resident.

Q: Can I appeal if my application for the exemption is denied?

A: Yes, you can file an appeal with the Maryland Tax Court if your application is denied.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SDATRP_1 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.