This version of the form is not currently in use and is provided for reference only. Download this version of

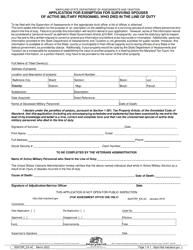

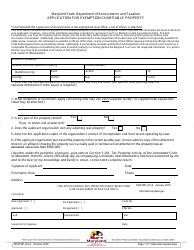

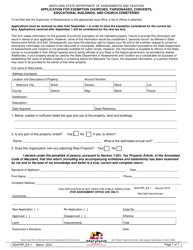

Form SDATRP_EX-5B

for the current year.

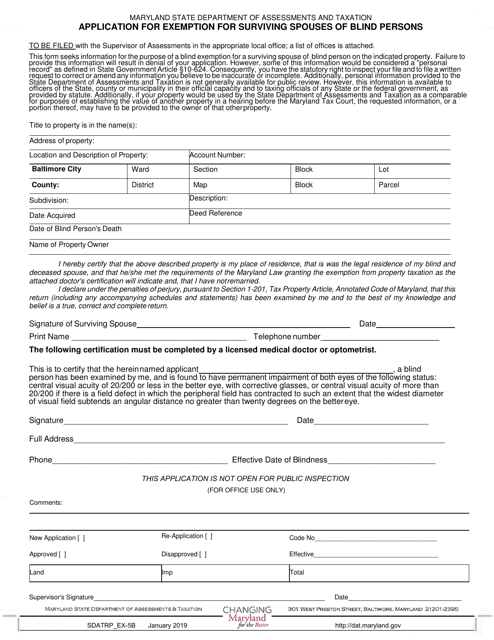

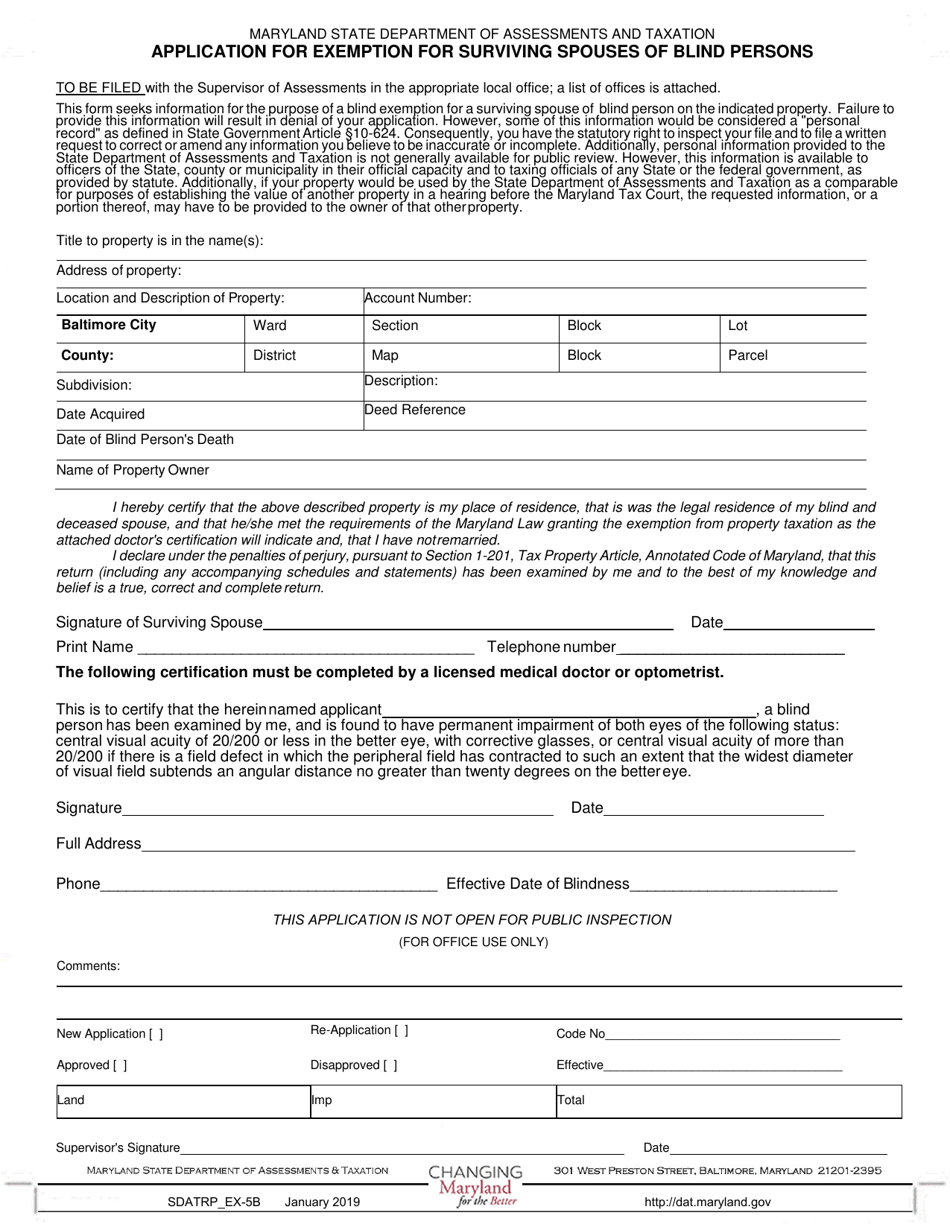

Form SDATRP_EX-5B Application for Exemption for Surviving Spouses of Blind Persons - Maryland

What Is Form SDATRP_EX-5B?

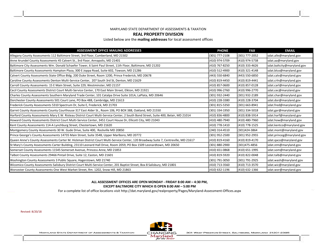

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SDATRP_EX-5B?

A: SDATRP_EX-5B is an application form for exemption for surviving spouses of blind persons in Maryland.

Q: Who can apply for exemption for surviving spouses of blind persons?

A: Surviving spouses of blind persons in Maryland can apply for this exemption.

Q: What is the purpose of this exemption?

A: The exemption is designed to provide financial relief to surviving spouses of blind persons in Maryland by reducing their property tax burden.

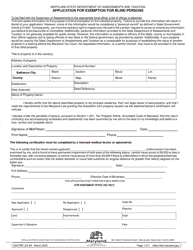

Q: Are there any eligibility requirements for this exemption?

A: Yes, to be eligible, the surviving spouse must have been married to the blind person at the time of their death and must meet certain income and asset criteria.

Q: What documents are required to accompany the application?

A: The application must be accompanied by a copy of the death certificate of the blind person, proof of marriage to the blind person, and documentation of the surviving spouse's income and assets.

Q: Is there a deadline for submitting the application?

A: Yes, the application must be submitted on or before September 1st of the year for which the exemption is being sought.

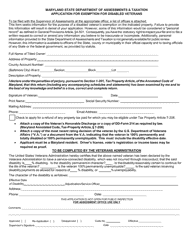

Q: What happens after I submit the application?

A: Once the application is received, SDAT will review the documents and determine if the surviving spouse qualifies for the exemption. If approved, the property will be granted the exemption and the tax burden will be reduced.

Q: Is this exemption renewable?

A: Yes, the exemption must be renewed annually by submitting a new application and supporting documentation before September 1st.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

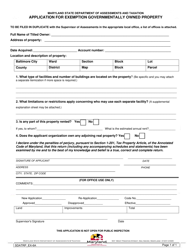

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SDATRP_EX-5B by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.