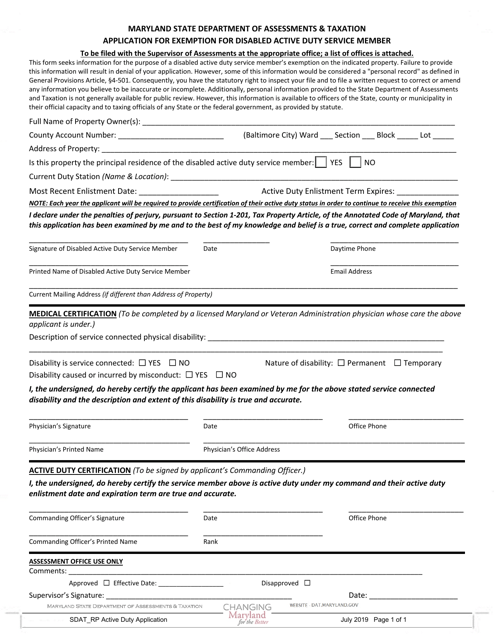

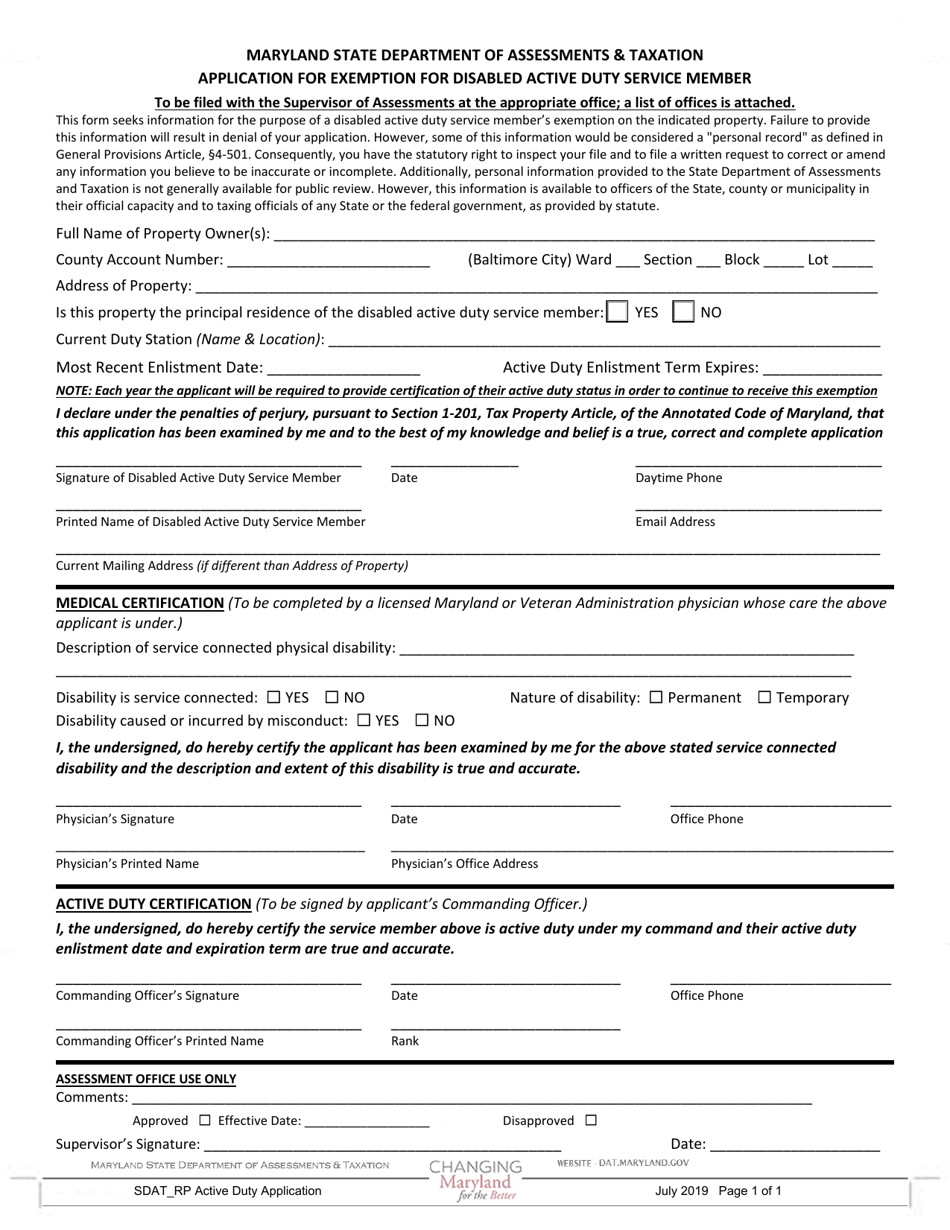

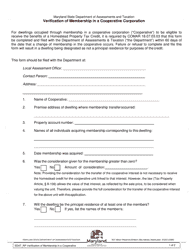

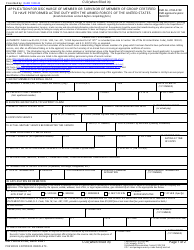

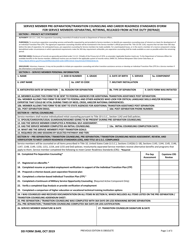

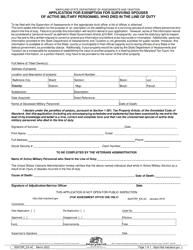

Form SDAT_RP Application for Exemption for Disabled Active Duty Service Member - Maryland

What Is Form SDAT_RP?

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the SDAT_RP Application for Exemption for Disabled Active Duty Service Member in Maryland?

A: The SDAT_RP Application for Exemption for Disabled Active Duty Service Member in Maryland is a form that allows disabled active dutyservice members to apply for a property tax exemption.

Q: Who is eligible to apply for this exemption?

A: Disabled active duty service members are eligible to apply for this exemption.

Q: What does this exemption provide?

A: This exemption provides a property tax exemption for disabled active duty service members.

Q: Is there a deadline to submit the application?

A: Yes, the application must be submitted by September 1st of the year for which the exemption is sought.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SDAT_RP by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.