This version of the form is not currently in use and is provided for reference only. Download this version of

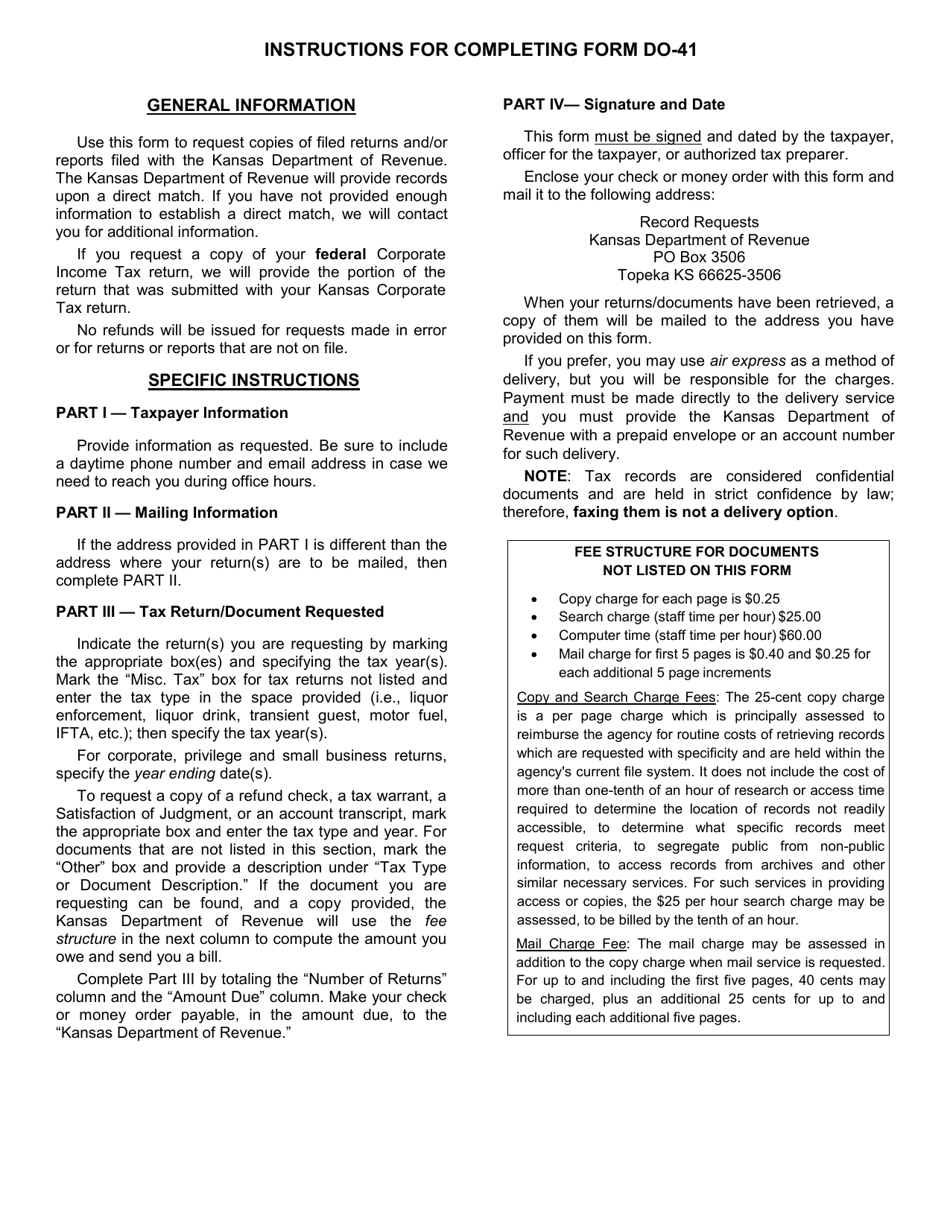

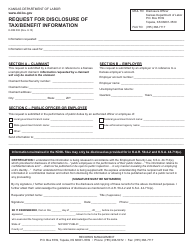

Form DO-41

for the current year.

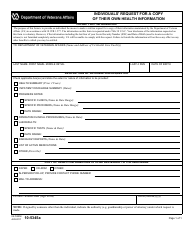

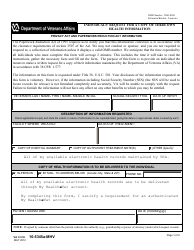

Form DO-41 Request for Copy of Kansas Tax Documents - Kansas

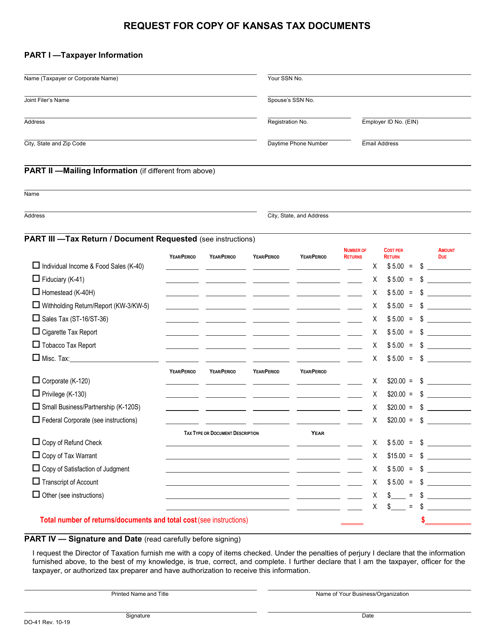

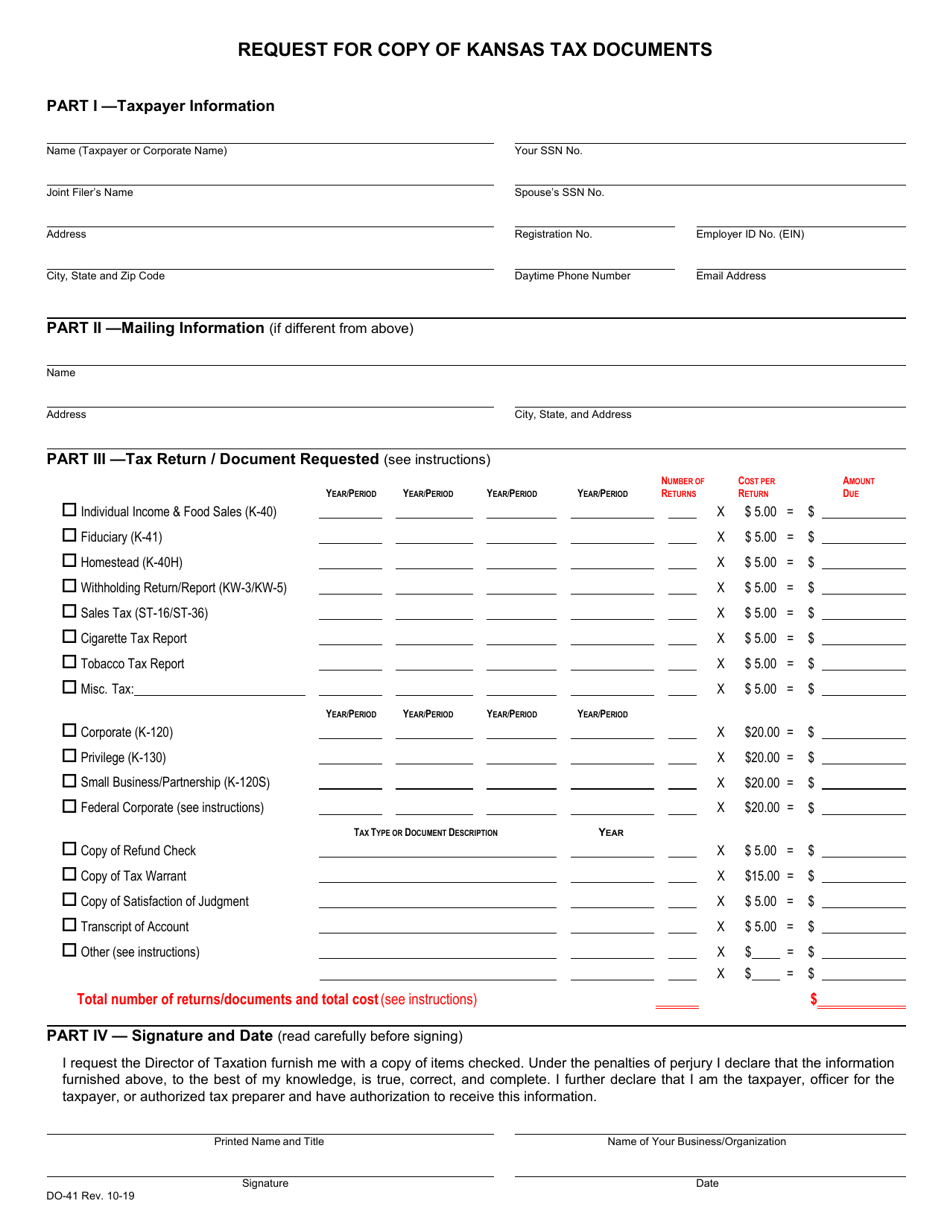

What Is Form DO-41?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

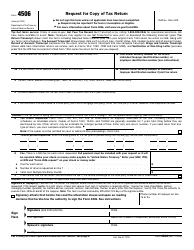

Q: What is Form DO-41?

A: Form DO-41 is a request form used to obtain copies of Kansas tax documents.

Q: Who can use Form DO-41?

A: Any individual or business entity can use Form DO-41 to request copies of their Kansas tax documents.

Q: What type of tax documents can I request with Form DO-41?

A: You can request copies of various Kansas tax documents, including income tax returns, sales tax records, payroll tax filings, and more.

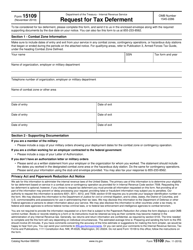

Q: How do I fill out Form DO-41?

A: You need to provide your personal or business information, specify the type of tax documents you are requesting, and include the tax years or periods for which you need copies.

Q: Is there a fee for requesting copies of tax documents?

A: Yes, there may be a fee for each tax document copy requested. The specific fee amount and payment instructions can be found on the Form DO-41 instructions.

Q: How long does it take to receive the requested tax documents?

A: The processing time for requests can vary, but you should expect to receive the requested tax documents within a few weeks of submitting Form DO-41.

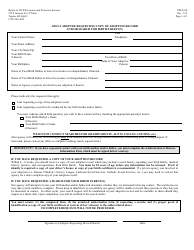

Q: Can I request tax documents for multiple tax years or periods?

A: Yes, you can specify multiple tax years or periods on Form DO-41 to request copies of tax documents for those specific time frames.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DO-41 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.