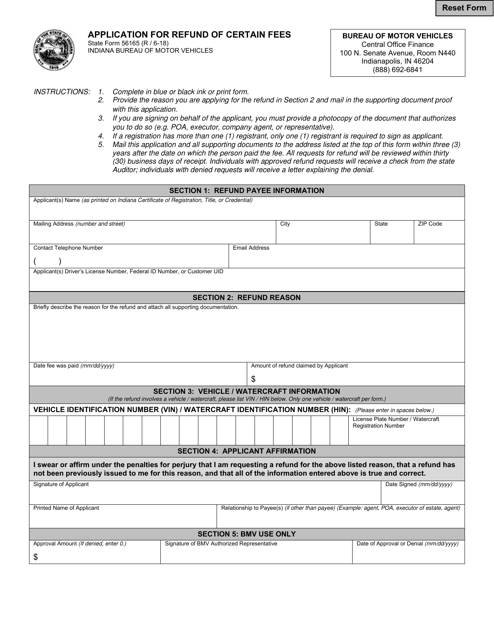

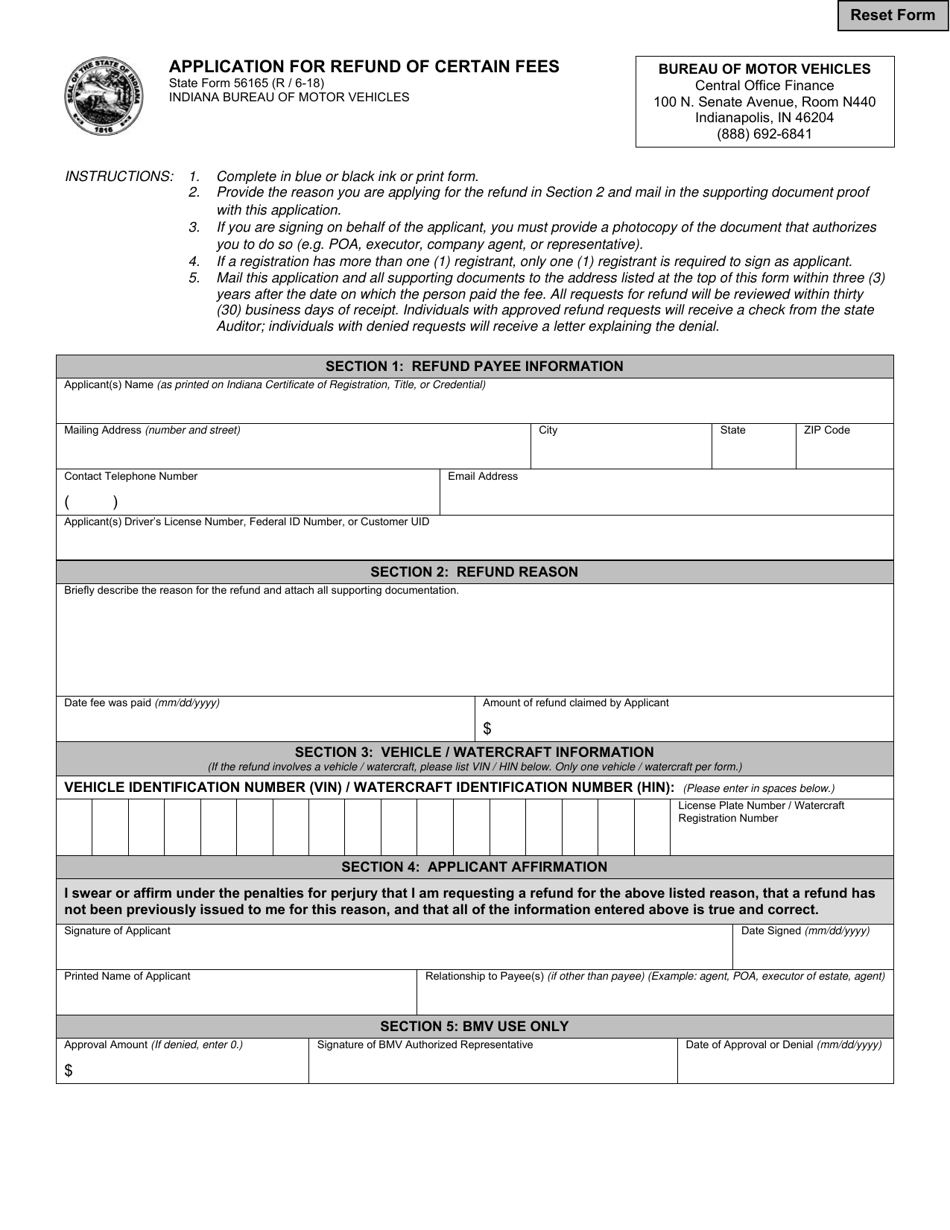

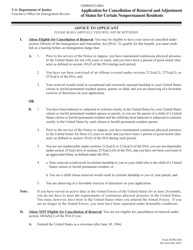

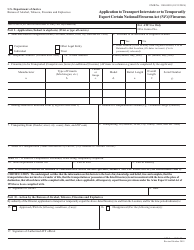

State Form 56165 Application for Refund of Certain Fees - Indiana

What Is State Form 56165?

This is a legal form that was released by the Indiana Bureau of Motor Vehicles - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 56165?

A: Form 56165 is the Application for Refund of Certain Fees in Indiana.

Q: What is the purpose of Form 56165?

A: The purpose of Form 56165 is to request a refund for certain fees paid in Indiana.

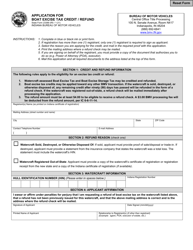

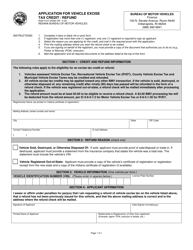

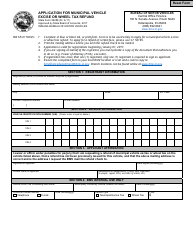

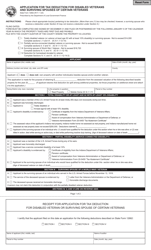

Q: What fees can be refunded using Form 56165?

A: Form 56165 can be used to request a refund for various fees, such as license fees, permit fees, and registration fees.

Q: Who is eligible to apply for a refund using Form 56165?

A: Anyone who has paid eligible fees in Indiana can apply for a refund using Form 56165.

Q: Are there any deadlines for submitting Form 56165?

A: Yes, there are specific deadlines for submitting Form 56165. It is recommended to check the instructions on the form or consult with the Indiana Department of Revenue for the current deadlines.

Q: Is there a fee for submitting Form 56165?

A: No, there is no fee for submitting Form 56165.

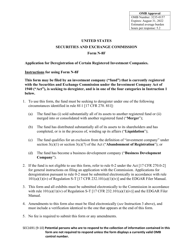

Q: How long does it take to process a refund request using Form 56165?

A: The processing time for a refund request using Form 56165 can vary. It is recommended to contact the Indiana Department of Revenue for more information.

Q: Can I track the status of my refund request?

A: Yes, you can track the status of your refund request by contacting the Indiana Department of Revenue.

Q: What should I do if my refund request is denied?

A: If your refund request is denied, you may have the option to appeal the decision or seek further assistance from the Indiana Department of Revenue.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Indiana Bureau of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 56165 by clicking the link below or browse more documents and templates provided by the Indiana Bureau of Motor Vehicles.