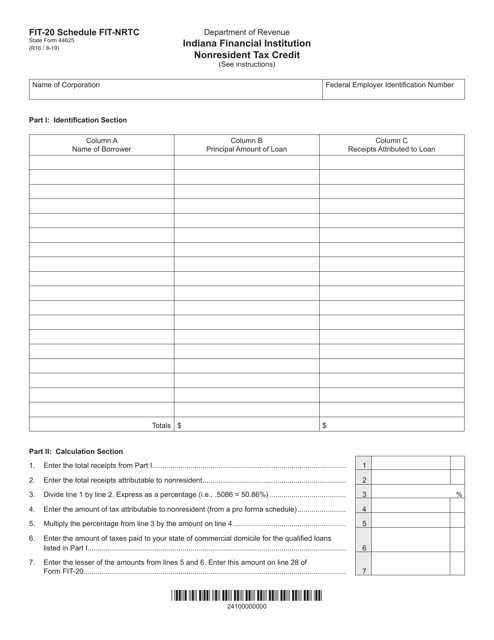

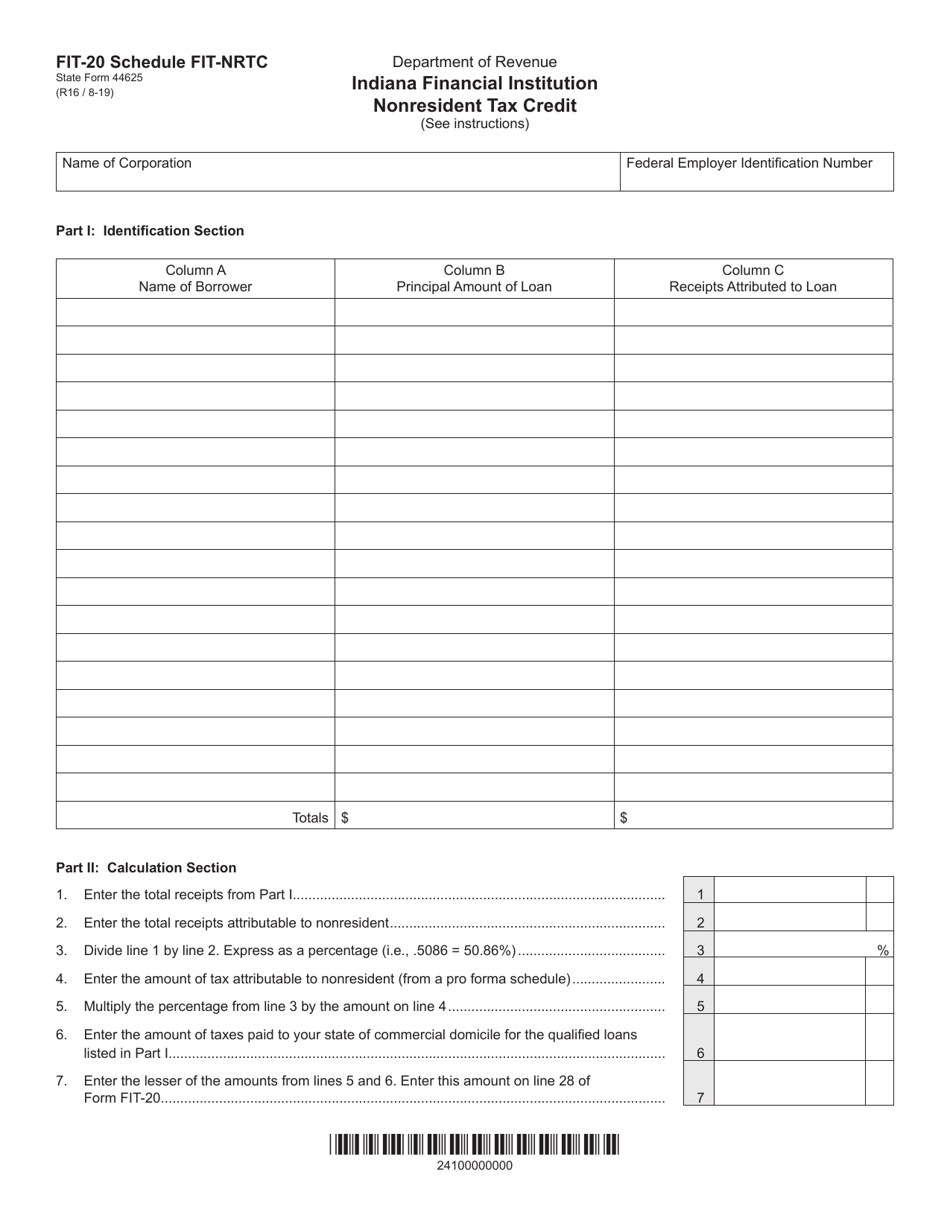

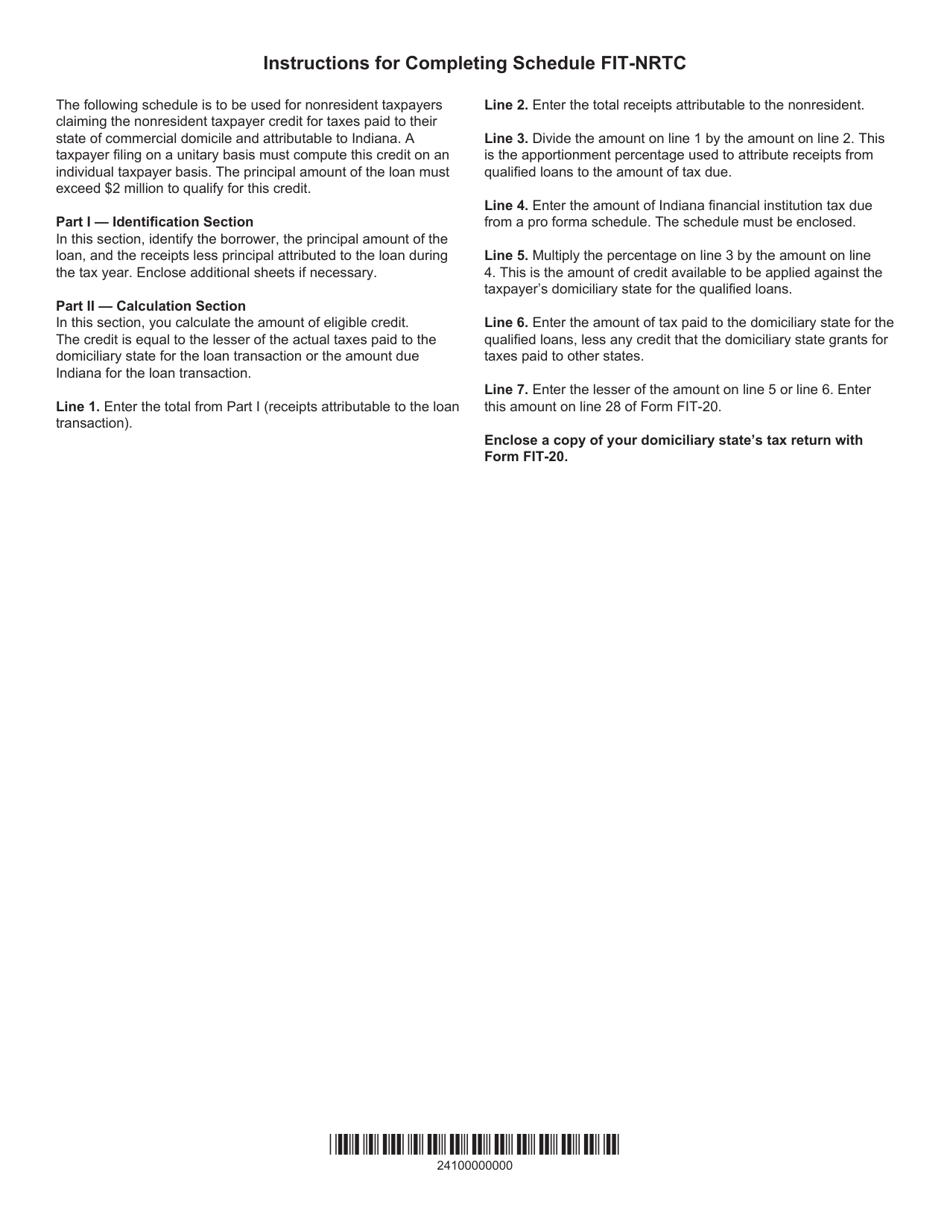

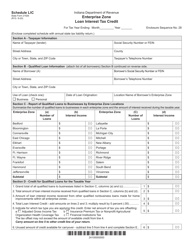

Form FIT-20 (State Form 44625) Schedule FIT-NRTC Indiana Financial Institution Nonresident Tax Credit - Indiana

What Is Form FIT-20 (State Form 44625) Schedule FIT-NRTC?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FIT-20?

A: Form FIT-20 is a state form used in Indiana.

Q: What is Schedule FIT-NRTC?

A: Schedule FIT-NRTC is a part of Form FIT-20.

Q: What is the purpose of Form FIT-NRTC?

A: The purpose of Form FIT-NRTC is to claim the Indiana Financial Institution Nonresident Tax Credit.

Q: Who should use Form FIT-20 and Schedule FIT-NRTC?

A: Financial institutions in Indiana should use Form FIT-20 and Schedule FIT-NRTC.

Q: What is the Indiana Financial Institution Nonresident Tax Credit?

A: The Indiana Financial Institution Nonresident Tax Credit is a tax credit available to financial institutions for income tax paid to other states by their nonresident shareholders.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIT-20 (State Form 44625) Schedule FIT-NRTC by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.