This version of the form is not currently in use and is provided for reference only. Download this version of

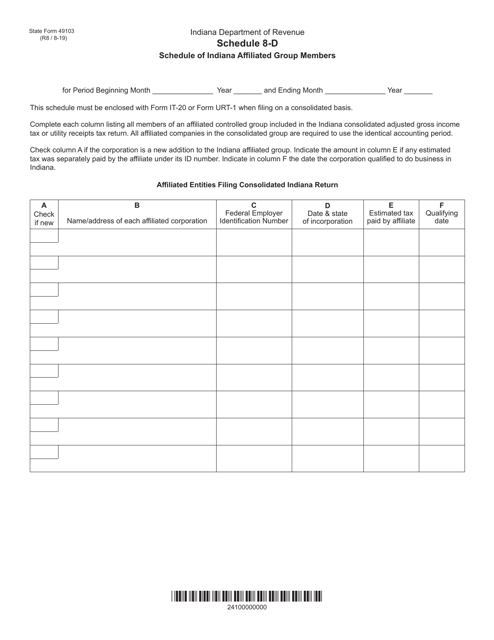

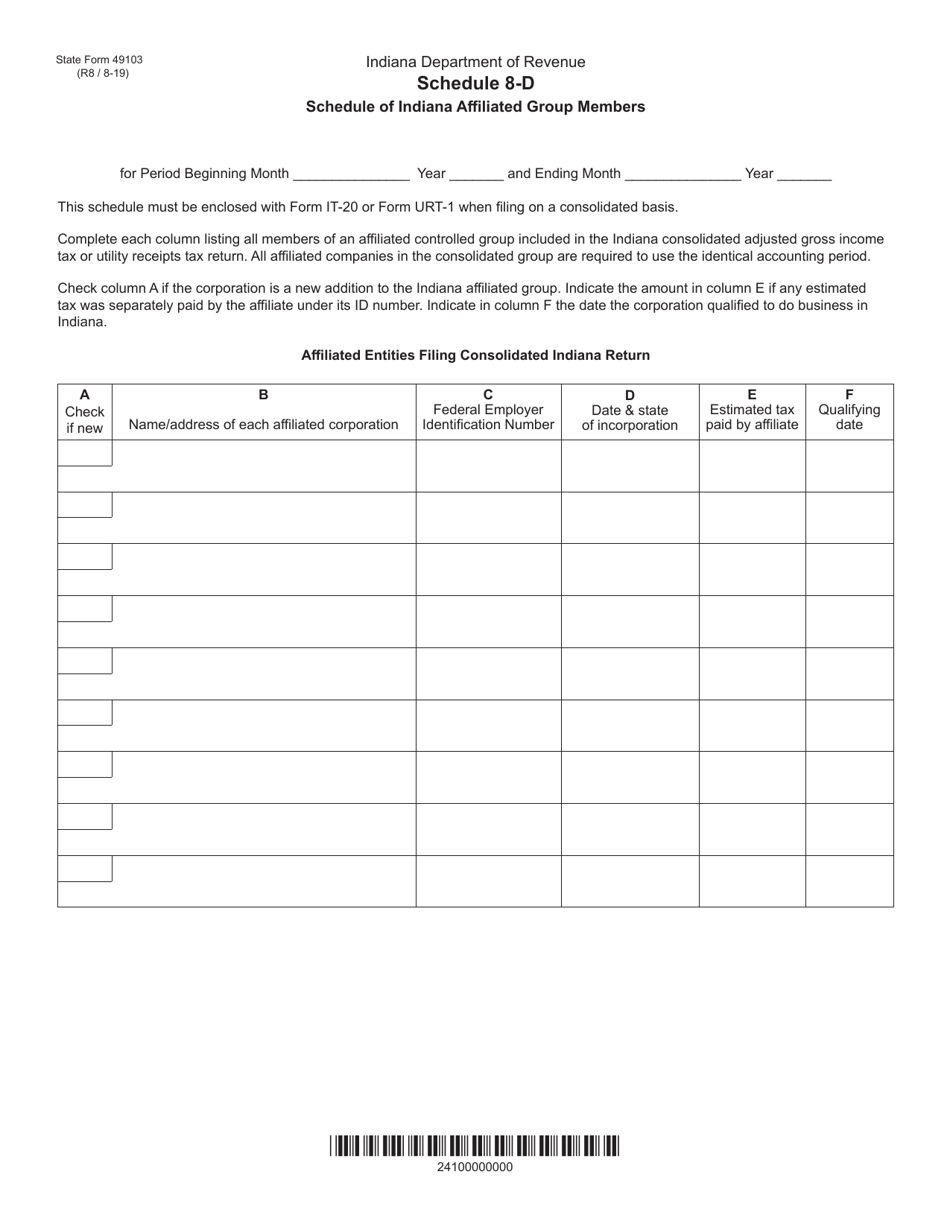

State Form 49103 Schedule 8-D

for the current year.

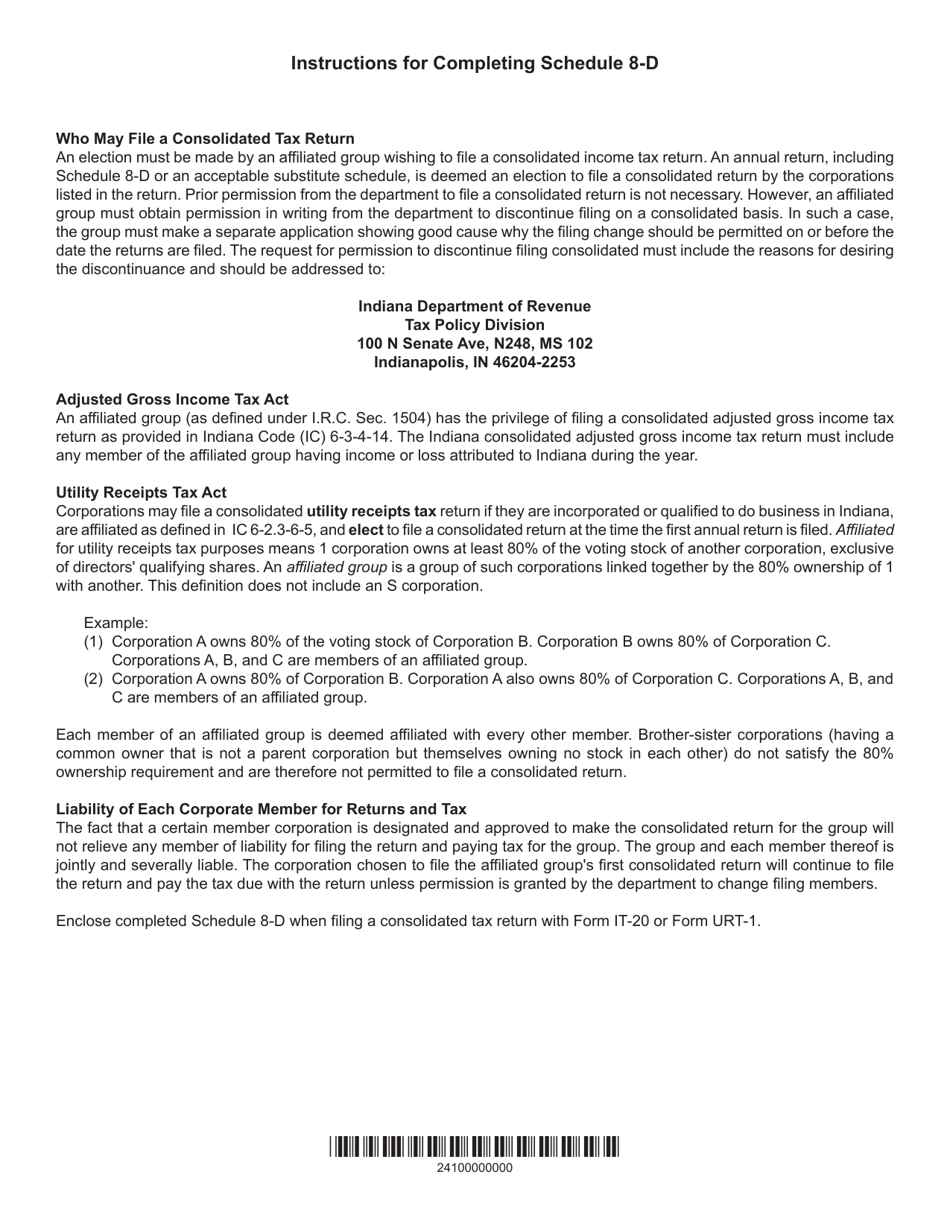

State Form 49103 Schedule 8-D Schedule of Indiana Affiliated Group Members - Indiana

What Is State Form 49103 Schedule 8-D?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 49103 Schedule 8-D?

A: State Form 49103 Schedule 8-D is a schedule used in Indiana for reporting the affiliated group members of a corporation.

Q: What is an Indiana Affiliated Group?

A: An Indiana Affiliated Group is a group of corporations that are connected through ownership or control.

Q: Why is it important to report the Indiana Affiliated Group Members?

A: Reporting the Indiana Affiliated Group Members is important for tax purposes, as it helps determine the proper allocation of income and expenses among the affiliated group.

Q: How do I fill out State Form 49103 Schedule 8-D?

A: You need to provide the relevant information about each affiliated group member, such as their name, address, federal employer identification number, and ownership or control percentage.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 49103 Schedule 8-D by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.