This version of the form is not currently in use and is provided for reference only. Download this version of

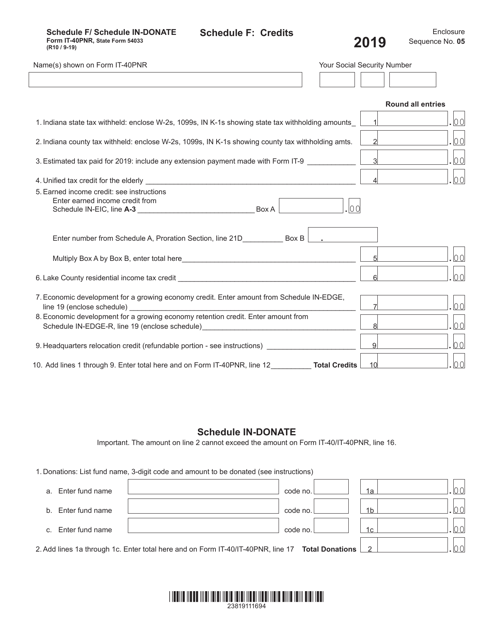

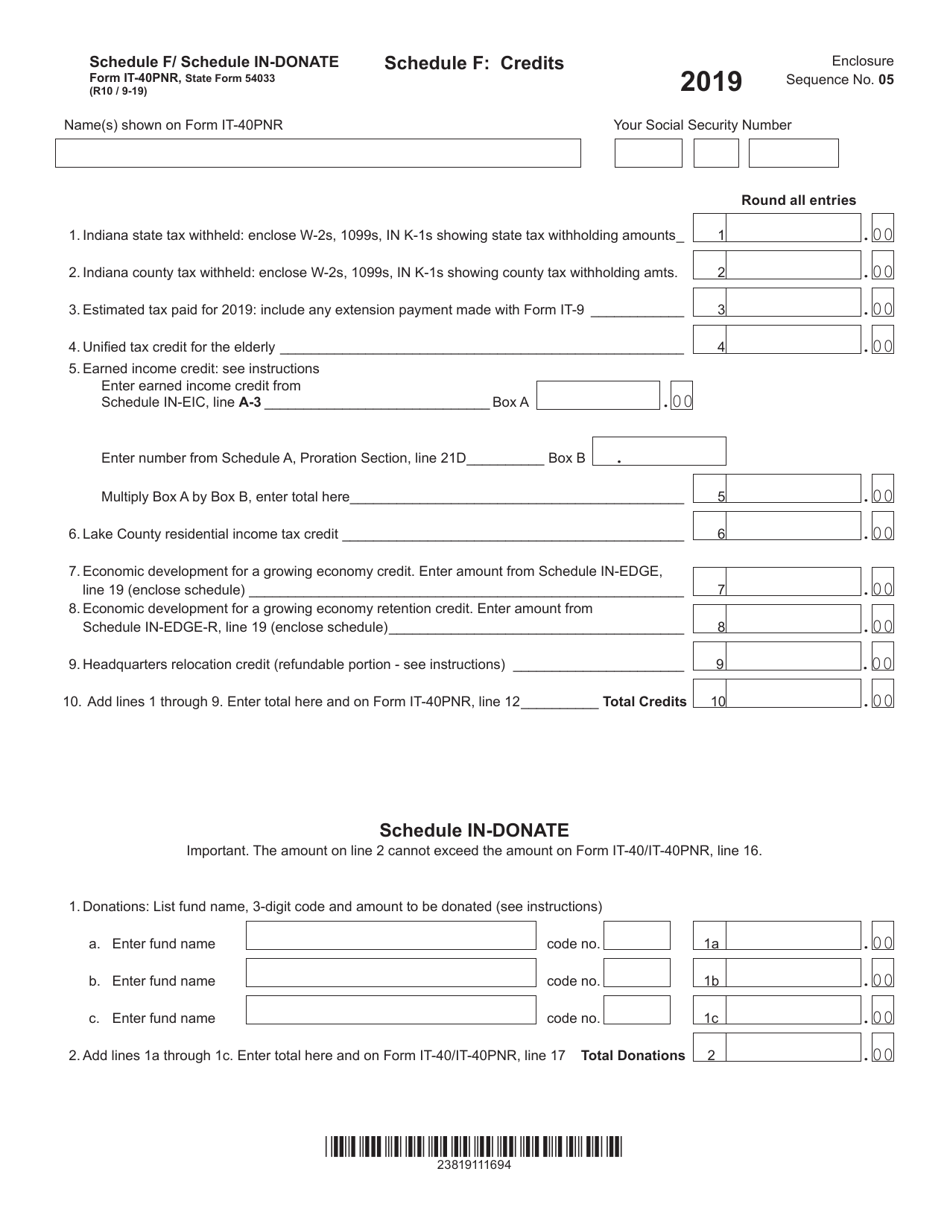

Form IT-40PNR (State Form 54033) Schedule F, IN-DONATE

for the current year.

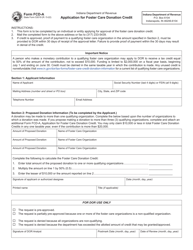

Form IT-40PNR (State Form 54033) Schedule F, IN-DONATE Credits / Donations - Indiana

What Is Form IT-40PNR (State Form 54033) Schedule F, IN-DONATE?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form IT-40PNR, Indiana Part-Year or Full-Year Nonresident Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40PNR?

A: Form IT-40PNR is a state tax form used in Indiana.

Q: What is Schedule F?

A: Schedule F is a section of Form IT-40PNR specifically for IN-DONATE credits/donations.

Q: What are IN-DONATE credits/donations?

A: IN-DONATE credits/donations are tax credits or donations made in Indiana.

Q: What should I use Schedule F for?

A: You should use Schedule F to report your IN-DONATE credits/donations on your state tax return.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40PNR (State Form 54033) Schedule F, IN-DONATE by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.