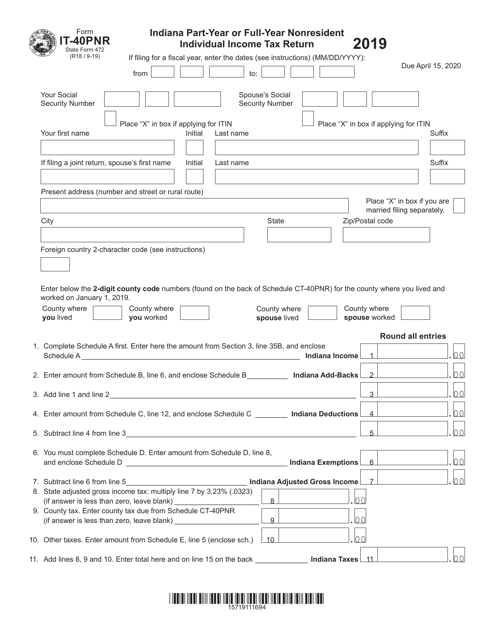

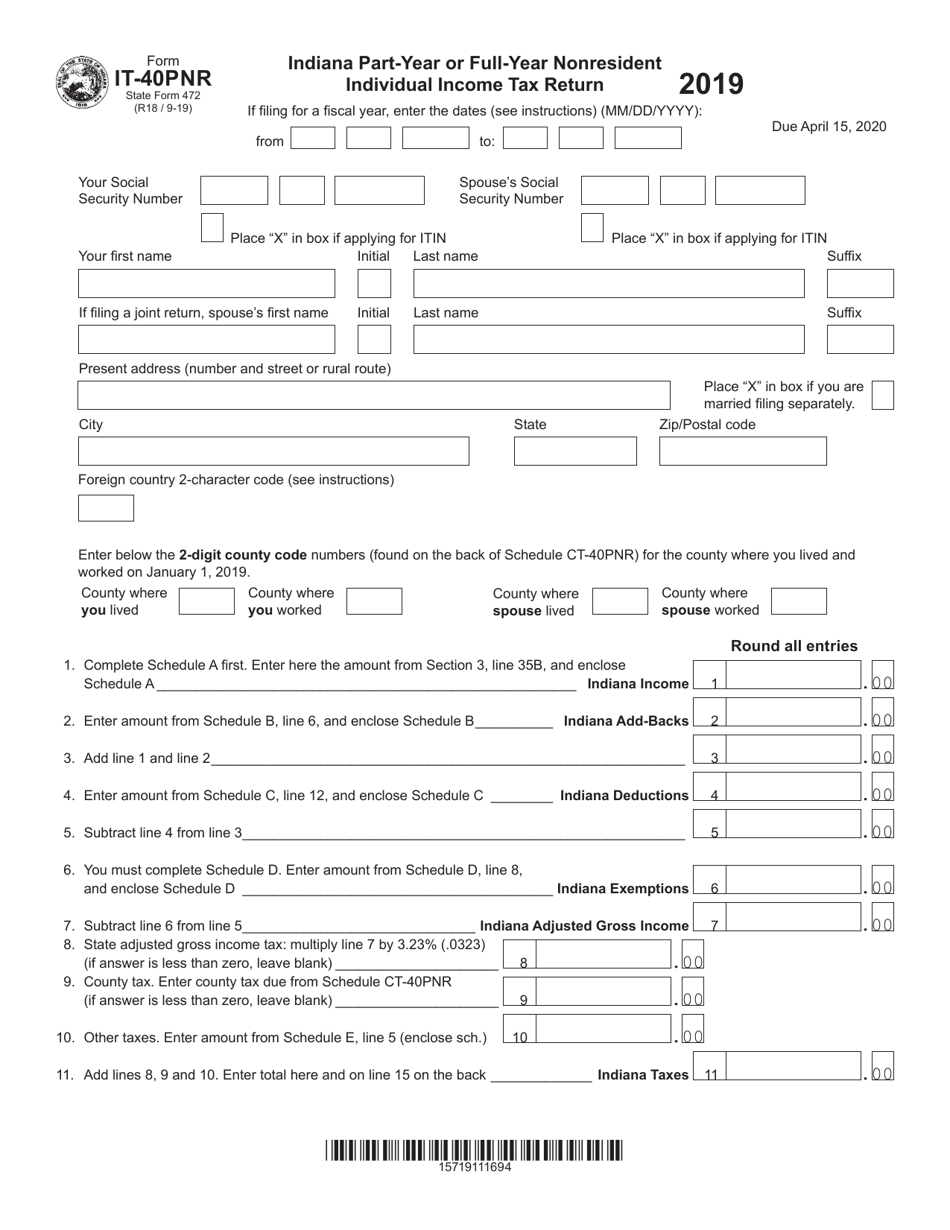

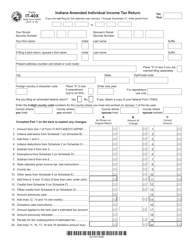

This version of the form is not currently in use and is provided for reference only. Download this version of

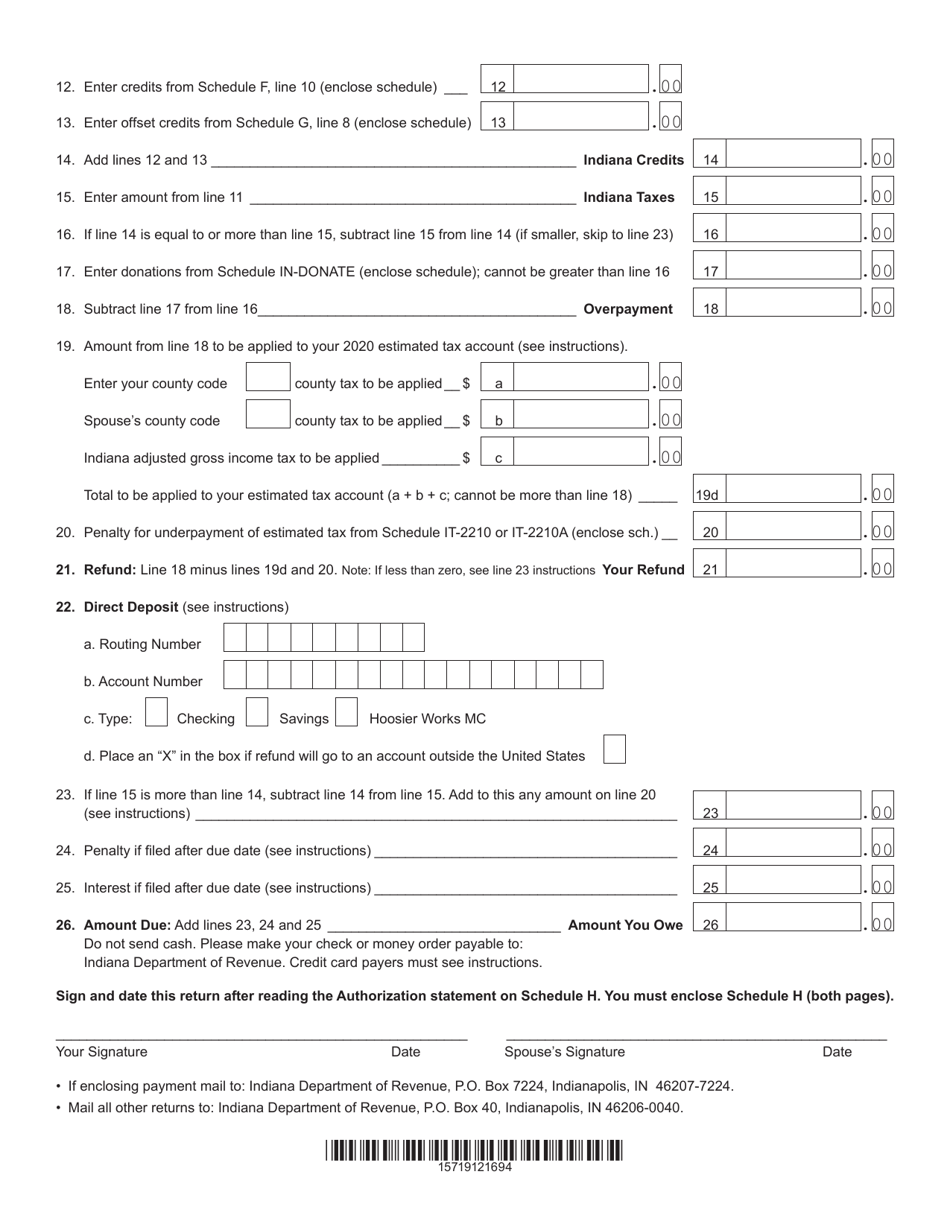

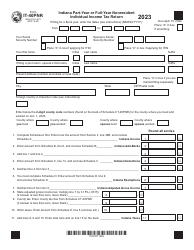

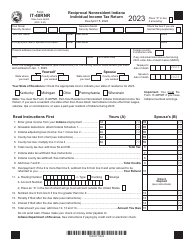

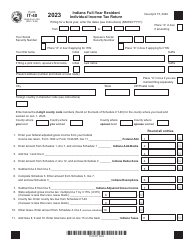

Form IT-40PNR (State Form 472)

for the current year.

Form IT-40PNR (State Form 472) Indiana Part-Year or Full-Year Nonresident Individual Income Tax Return - Indiana

What Is Form IT-40PNR (State Form 472)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40PNR?

A: Form IT-40PNR is the Indiana Part-Year or Full-Year Nonresident Individual Income Tax Return.

Q: Who should file Form IT-40PNR?

A: Form IT-40PNR should be filed by individuals who are nonresidents of Indiana but have income from Indiana sources or who have moved into or out of Indiana during the year.

Q: What is the purpose of Form IT-40PNR?

A: The purpose of Form IT-40PNR is to report and pay Indiana state income tax for nonresident individuals.

Q: When is Form IT-40PNR due?

A: Form IT-40PNR is due on or before April 15th of the following year, or the same filing deadline as the federal tax return, whichever is later.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40PNR (State Form 472) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.