This version of the form is not currently in use and is provided for reference only. Download this version of

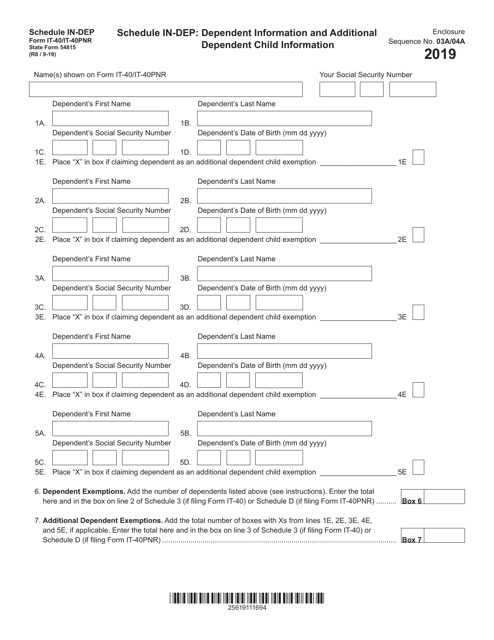

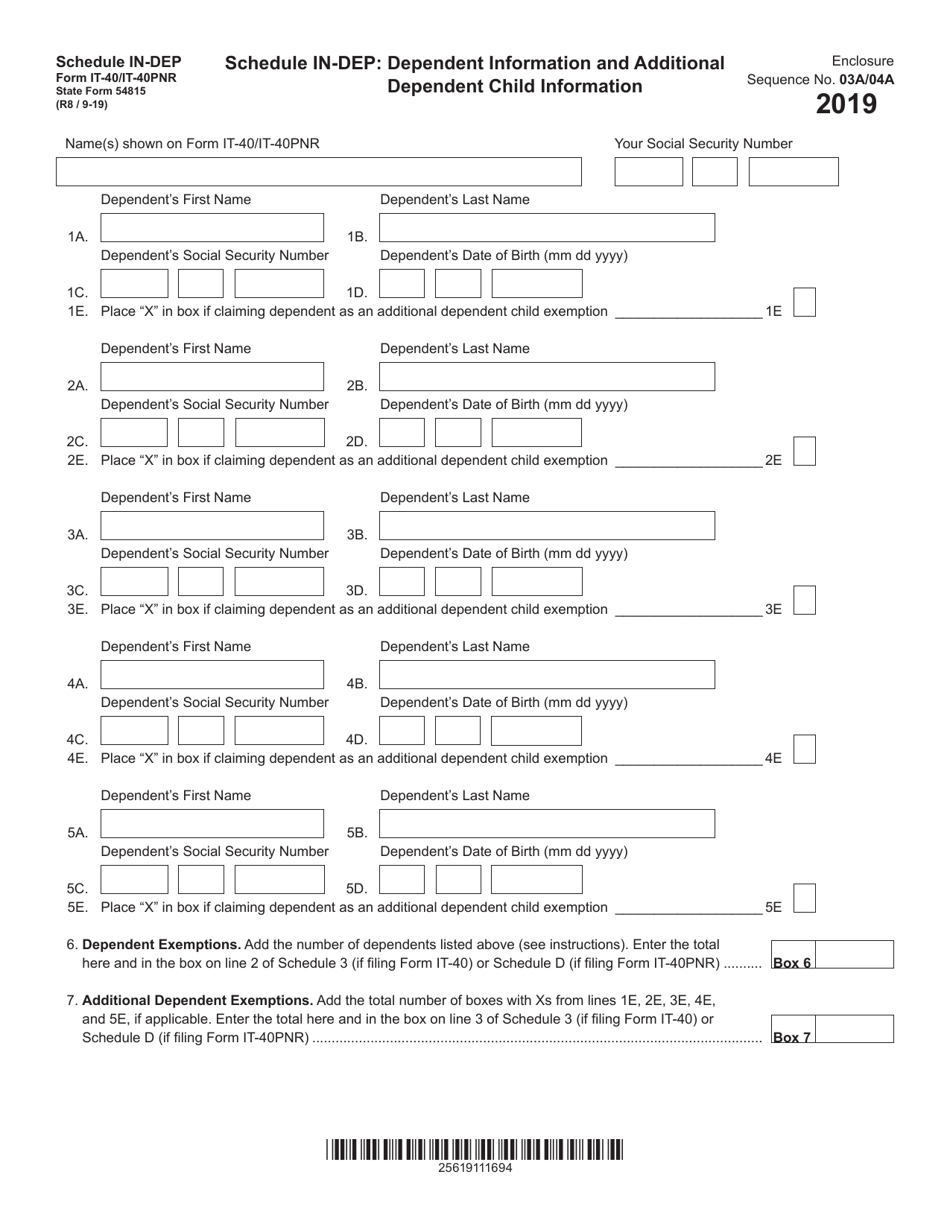

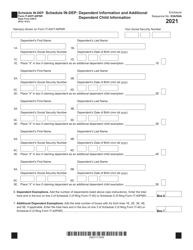

Form IT-40 (IT-40PNR; State Form 54815) Schedule IN-DEP

for the current year.

Form IT-40 (IT-40PNR; State Form 54815) Schedule IN-DEP Dependent Information and Additional Dependent Child Information - Indiana

What Is Form IT-40 (IT-40PNR; State Form 54815) Schedule IN-DEP?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form IT-40PNR, Indiana Part-Year or Full-Year Nonresident Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40?

A: Form IT-40 is a tax form used by residents of Indiana to file their state income tax return.

Q: What is IT-40PNR?

A: IT-40PNR is a version of Form IT-40 for non-residents of Indiana who have income from Indiana sources.

Q: What is Schedule IN-DEP?

A: Schedule IN-DEP is a schedule that provides space for taxpayers to provide information about their dependents on their Indiana state tax return.

Q: What information is required on Schedule IN-DEP?

A: Schedule IN-DEP requires information about each dependent, including their name, Social Security number, relationship to the taxpayer, and whether they qualify for certain tax benefits.

Q: What is Additional Dependent Child Information?

A: Additional Dependent Child Information is a section on Schedule IN-DEP that provides space for taxpayers to provide additional information about their dependent children, such as their residency status and whether they are a full-time student.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40 (IT-40PNR; State Form 54815) Schedule IN-DEP by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.