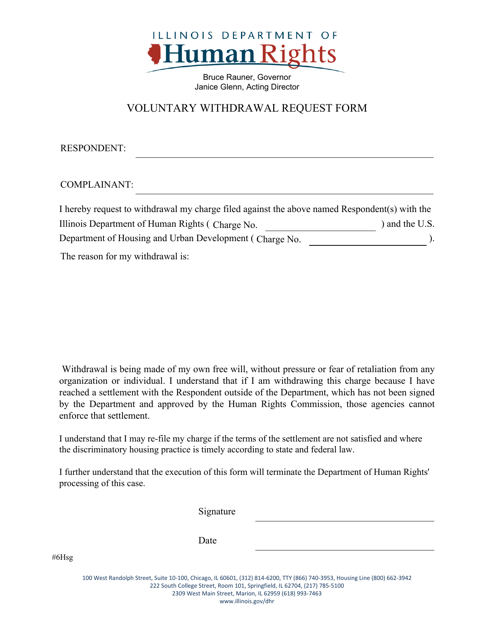

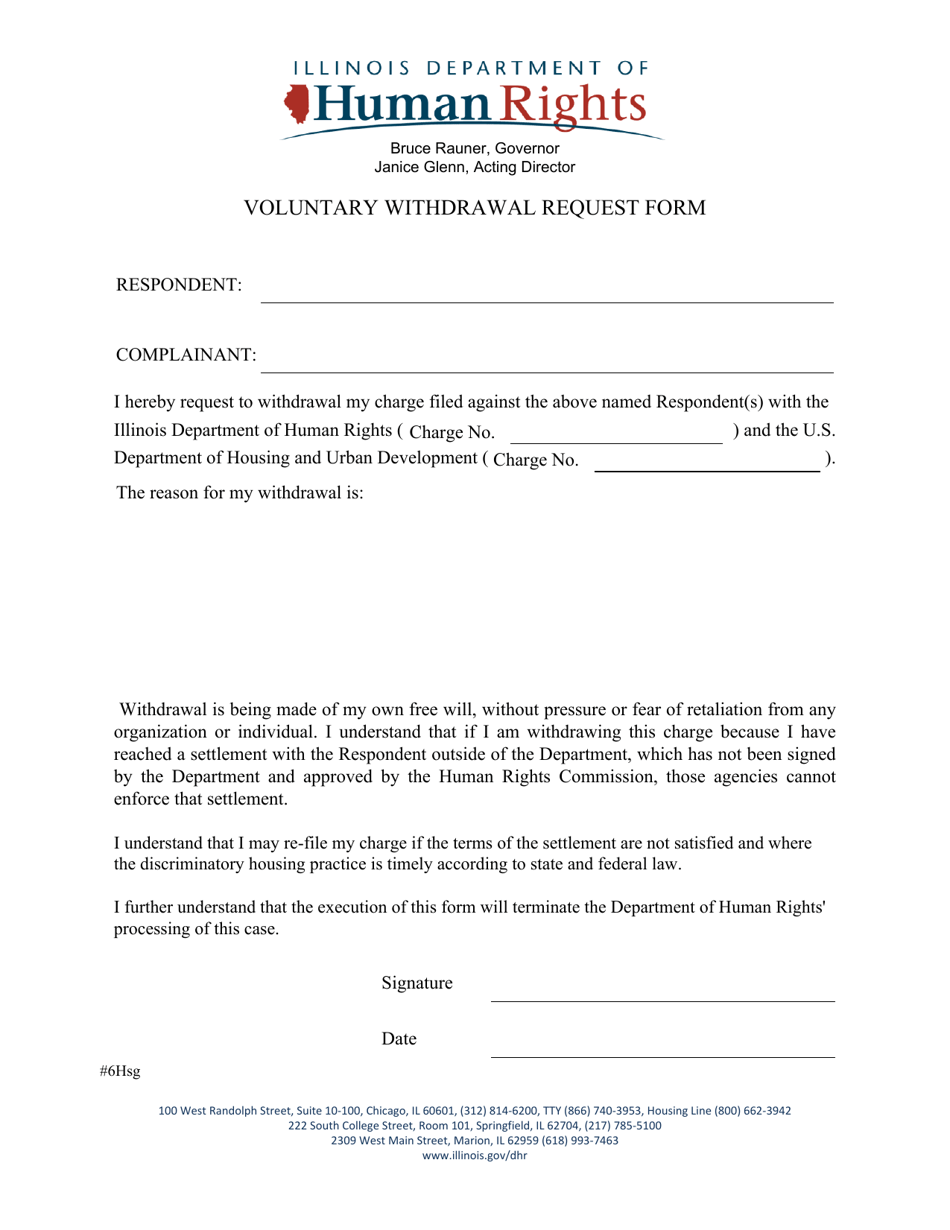

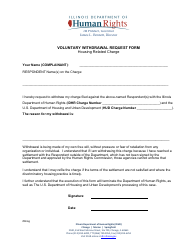

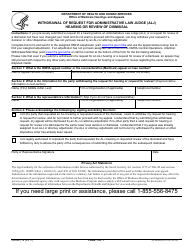

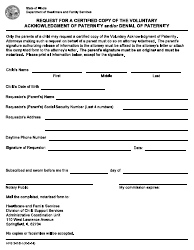

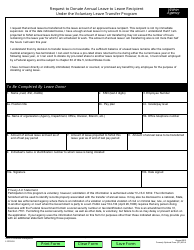

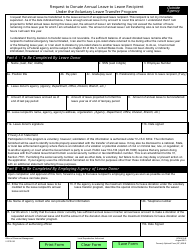

Voluntary Withdrawal Request Form - Illinois

Voluntary Withdrawal Request Form is a legal document that was released by the Illinois Department of Human Rights - a government authority operating within Illinois.

FAQ

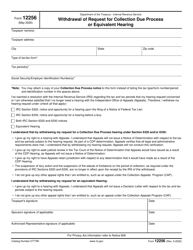

Q: What is the Voluntary Withdrawal Request Form?

A: The Voluntary Withdrawal Request Form is a document used in Illinois to request the voluntary withdrawal of a business entity.

Q: Who can use the Voluntary Withdrawal Request Form?

A: Any business entity registered in Illinois can use the Voluntary Withdrawal Request Form to request the voluntary withdrawal.

Q: What is the purpose of the Voluntary Withdrawal Request Form?

A: The purpose of the Voluntary Withdrawal Request Form is to formally request the voluntary withdrawal of a business entity from the state of Illinois.

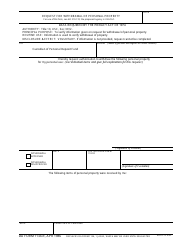

Q: What information is required on the Voluntary Withdrawal Request Form?

A: The Voluntary Withdrawal Request Form typically requires information such as the name of the business entity, its identification number, and the date of the voluntary withdrawal.

Q: Are there any fees associated with submitting the Voluntary Withdrawal Request Form?

A: There may be fees associated with submitting the Voluntary Withdrawal Request Form. It is advisable to check with the Illinois Secretary of State's office for the exact fee amount.

Q: What happens after I submit the Voluntary Withdrawal Request Form?

A: After you submit the Voluntary Withdrawal Request Form, the Illinois Secretary of State's office will process your request and update the status of your business entity accordingly.

Q: Can I change my mind after submitting the Voluntary Withdrawal Request Form?

A: Once the Voluntary Withdrawal Request Form is submitted and processed, it may be difficult to reverse the withdrawal. It is advisable to consult with a legal professional if you have changed your mind.

Q: Is the Voluntary Withdrawal Request Form the same as dissolution?

A: No, the Voluntary Withdrawal Request Form is not the same as dissolution. The Voluntary Withdrawal Request Form is specific to the withdrawal of a business entity from the state of Illinois.

Q: Are there any tax obligations after submitting the Voluntary Withdrawal Request Form?

A: There may still be tax obligations even after submitting the Voluntary Withdrawal Request Form. It is important to consult with a tax professional to understand your tax obligations.

Form Details:

- The latest edition currently provided by the Illinois Department of Human Rights;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Illinois Department of Human Rights.