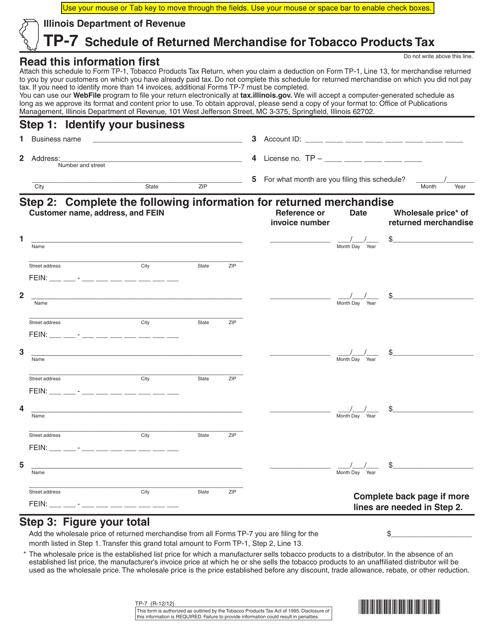

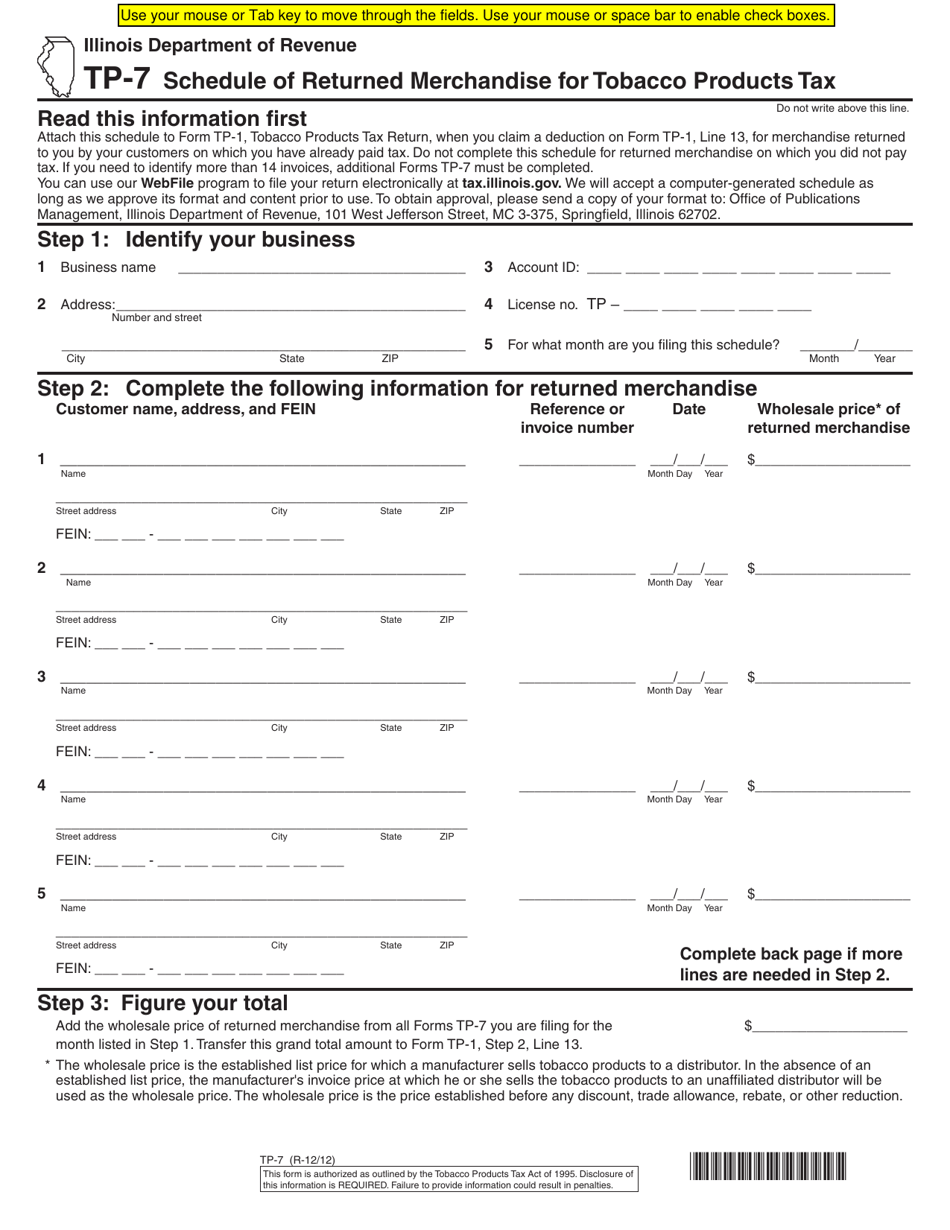

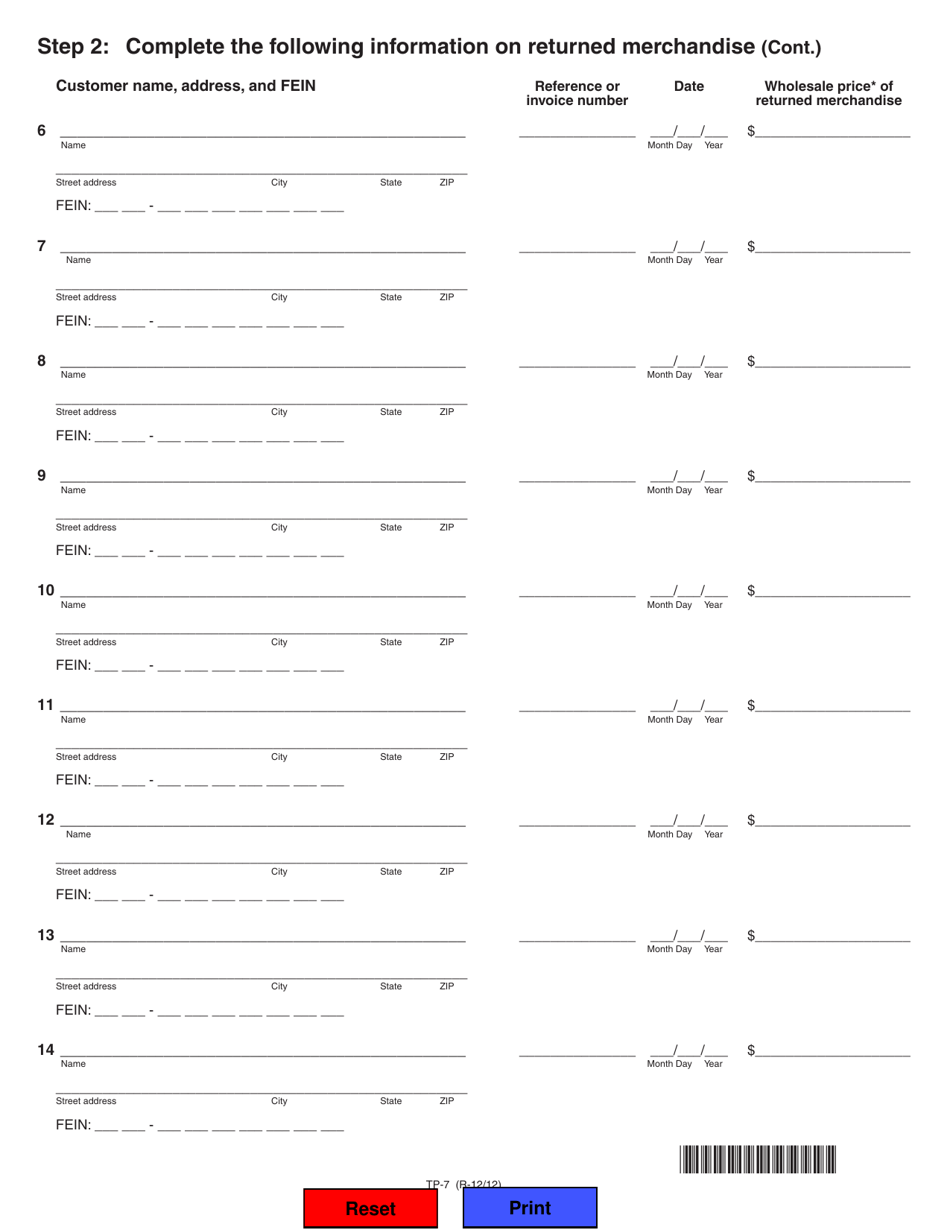

Schedule TP-7 Schedule of Returned Merchandise for Tobacco Products Tax - Illinois

What Is Schedule TP-7?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule TP-7?

A: Schedule TP-7 is a form used for reporting the returned merchandise for tobacco products tax in Illinois.

Q: Who needs to file Schedule TP-7?

A: Any distributor or wholesaler of tobacco products in Illinois who has returned merchandise eligible for a tax credit must file Schedule TP-7.

Q: What is the purpose of Schedule TP-7?

A: Schedule TP-7 is used to calculate the tax credit for returned merchandise of tobacco products.

Q: How often should Schedule TP-7 be filed?

A: Schedule TP-7 should be filed on a monthly basis.

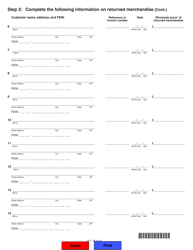

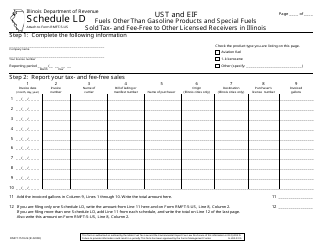

Q: What information is required to complete Schedule TP-7?

A: You will need to provide details of the returned merchandise, including brand, quantity, date of return, and original invoice number.

Q: Is there a deadline for filing Schedule TP-7?

A: Yes, Schedule TP-7 must be filed by the 20th day of the month following the month in which the returns were made.

Q: Are there any penalties for late filing of Schedule TP-7?

A: Yes, late filing may result in penalties and interest charges.

Q: Can Schedule TP-7 be filed electronically?

A: Yes, Schedule TP-7 can be electronically filed through the Illinois Department of Revenue's MyTax Illinois portal.

Form Details:

- Released on December 1, 2012;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule TP-7 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.