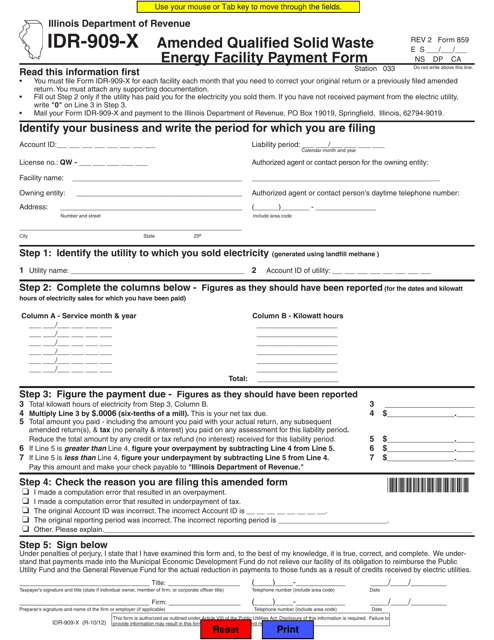

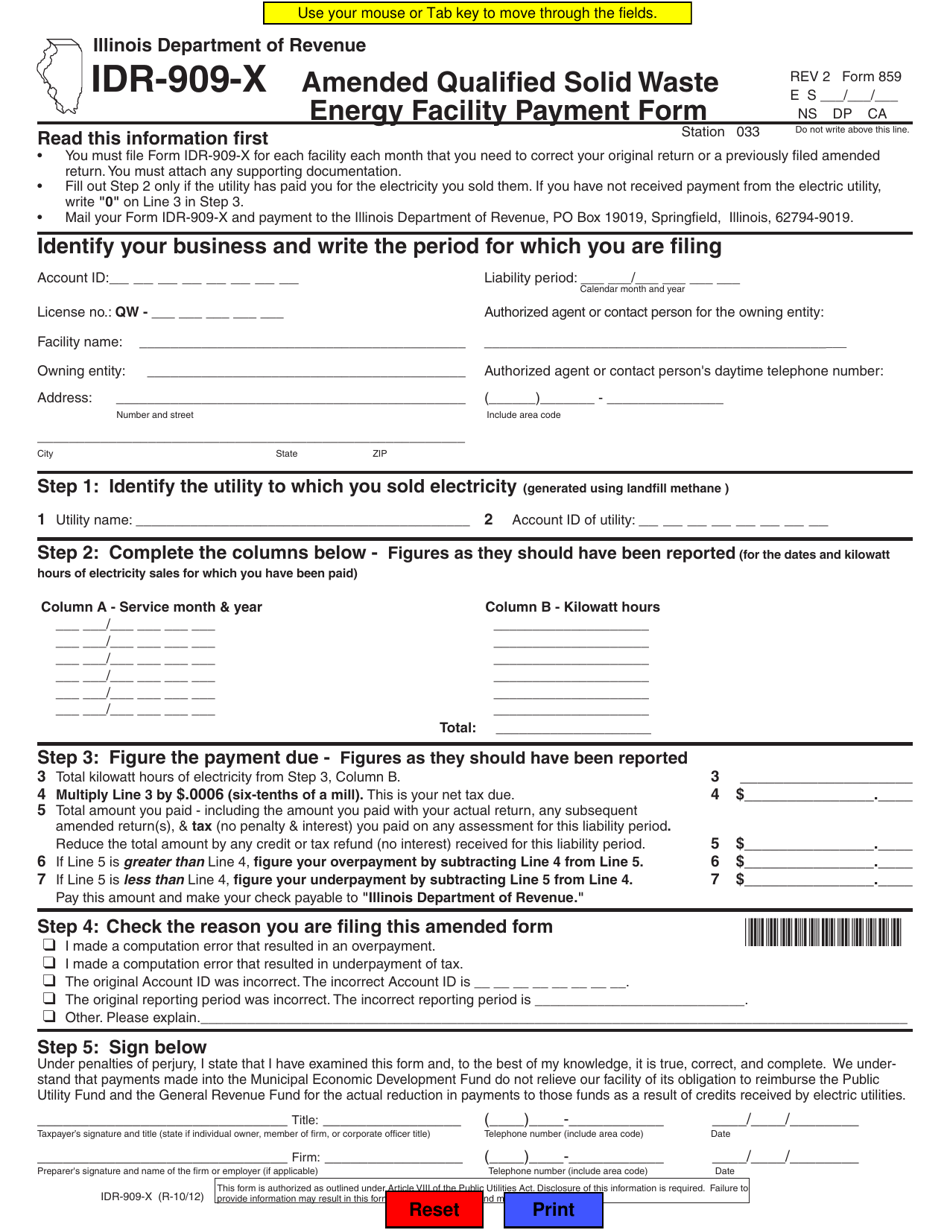

Form IDR-909-X (859) Amended Qualified Solid Waste Energy Facility Payment Form - Illinois

What Is Form IDR-909-X (859)?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IDR-909-X (859) Amended Qualified Solid Waste Energy Facility Payment Form?

A: Form IDR-909-X (859) is a document used in Illinois for amending the Qualified Solid Waste Energy Facility Payment Form.

Q: What is the purpose of Form IDR-909-X (859)?

A: The purpose of Form IDR-909-X (859) is to amend a previously filed Qualified Solid Waste Energy Facility Payment Form.

Q: When should Form IDR-909-X (859) be used?

A: Form IDR-909-X (859) should be used when there is a need to make changes or corrections to a previously filed Qualified Solid Waste Energy Facility Payment Form.

Q: Is Form IDR-909-X (859) specific to Illinois?

A: Yes, Form IDR-909-X (859) is specific to Illinois and is used for amending the Qualified Solid Waste Energy Facility Payment Form in the state.

Q: Are there any fees associated with filing Form IDR-909-X (859)?

A: There are no fees associated with filing Form IDR-909-X (859) in Illinois.

Q: What information is required on Form IDR-909-X (859)?

A: The form requires information such as the taxpayer's name, address, tax identification number, and details of the changes or corrections being made.

Q: Is there a deadline for filing Form IDR-909-X (859)?

A: The deadline for filing Form IDR-909-X (859) depends on the original due date of the Qualified Solid Waste Energy Facility Payment Form that is being amended.

Form Details:

- Released on October 1, 2012;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IDR-909-X (859) by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.