This version of the form is not currently in use and is provided for reference only. Download this version of

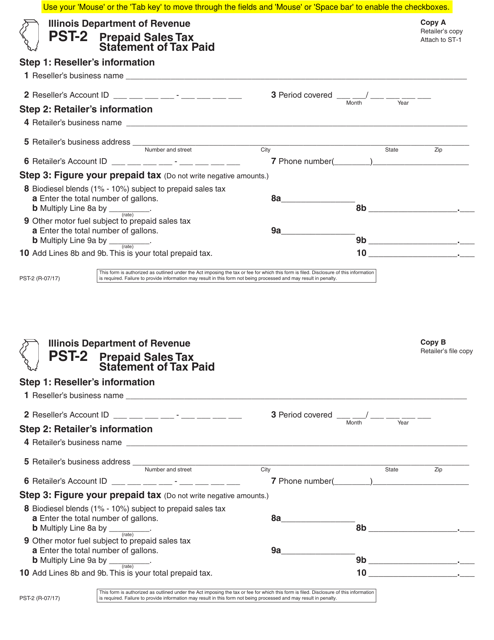

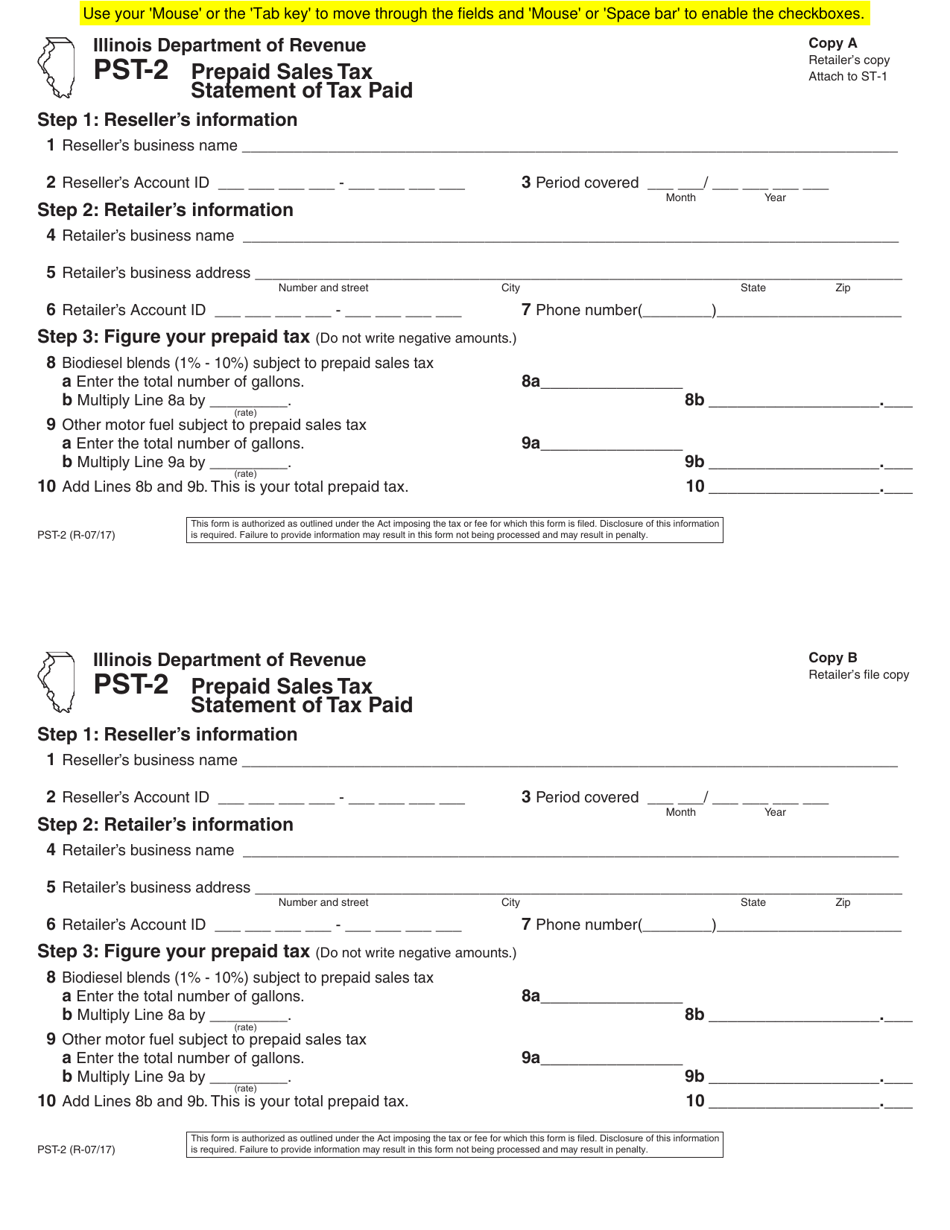

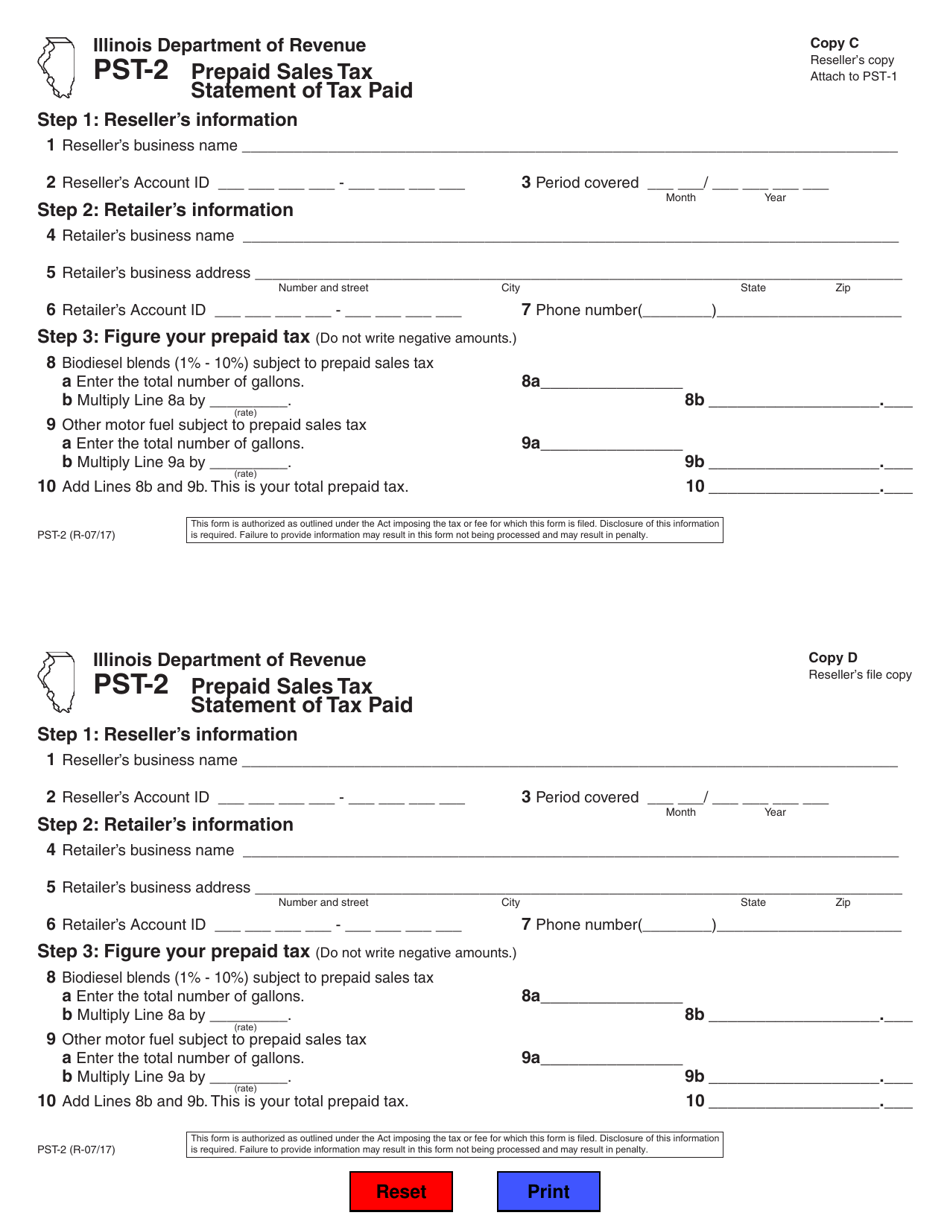

Form PST-2

for the current year.

Form PST-2 Prepaid Sales Tax Statement of Tax Paid - Illinois

What Is Form PST-2?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PST-2?

A: Form PST-2 is the Prepaid Sales Tax Statement of Tax Paid in Illinois.

Q: What is the purpose of Form PST-2?

A: The purpose of Form PST-2 is to report and remit prepaid sales tax that has been collected.

Q: Who needs to file Form PST-2?

A: Businesses in Illinois that have collected prepaid sales tax must file Form PST-2.

Q: When is Form PST-2 due?

A: Form PST-2 is due on the 20th day of the month following the end of the reporting period.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PST-2 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.