This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule WC-I

for the current year.

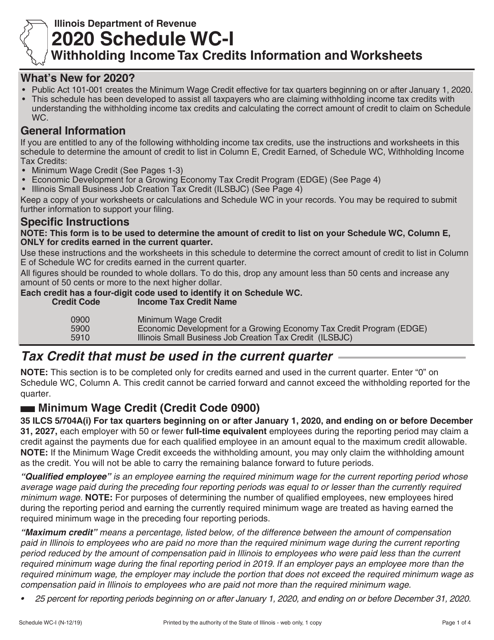

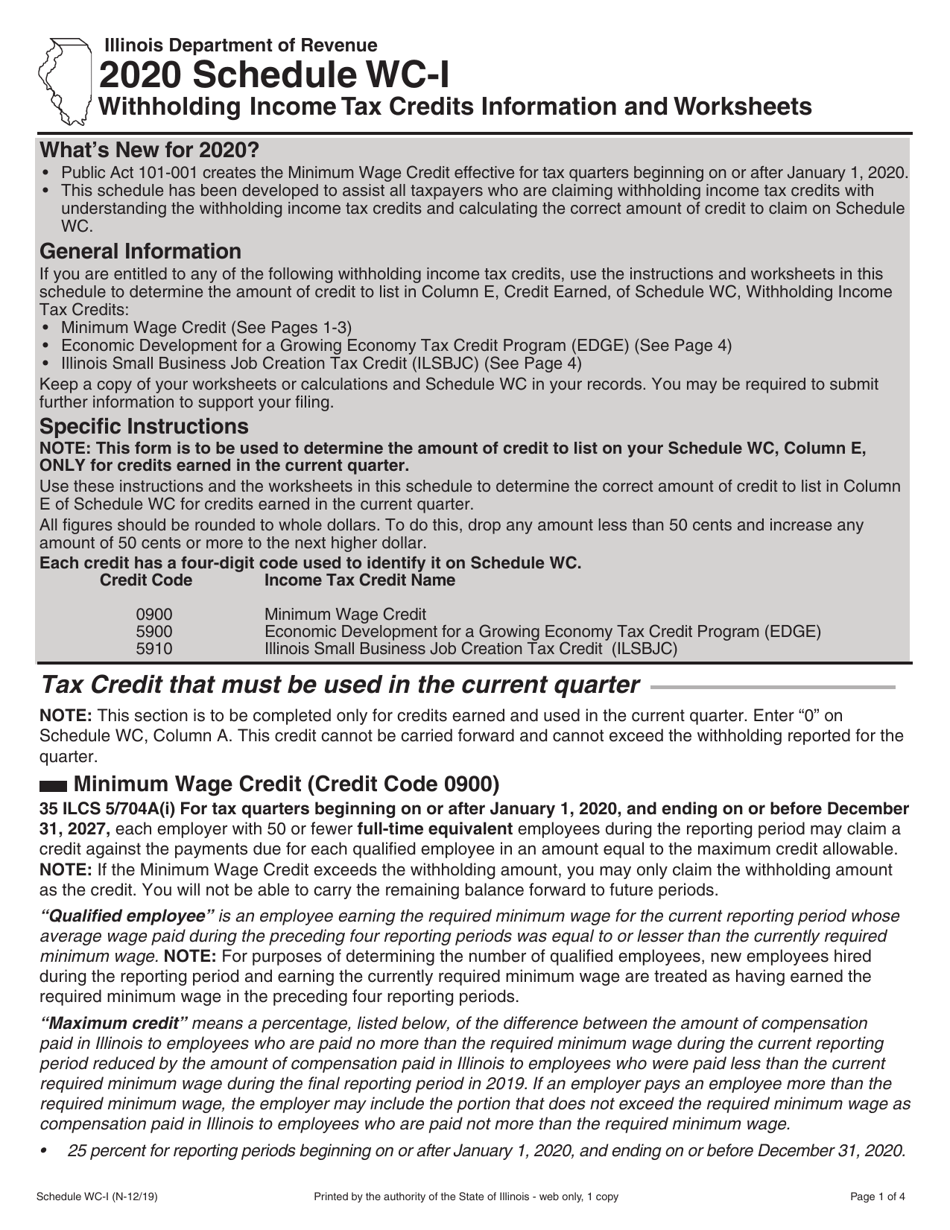

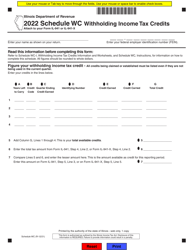

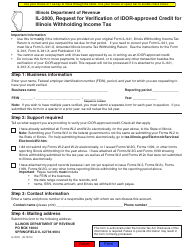

Schedule WC-I Withholding Income Tax Credits Information and Worksheets - Illinois

What Is Schedule WC-I?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is WC-I?

A: WC-I stands for the Schedule for Withholding IncomeTax Credits.

Q: What is the purpose of WC-I?

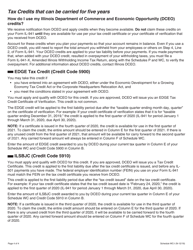

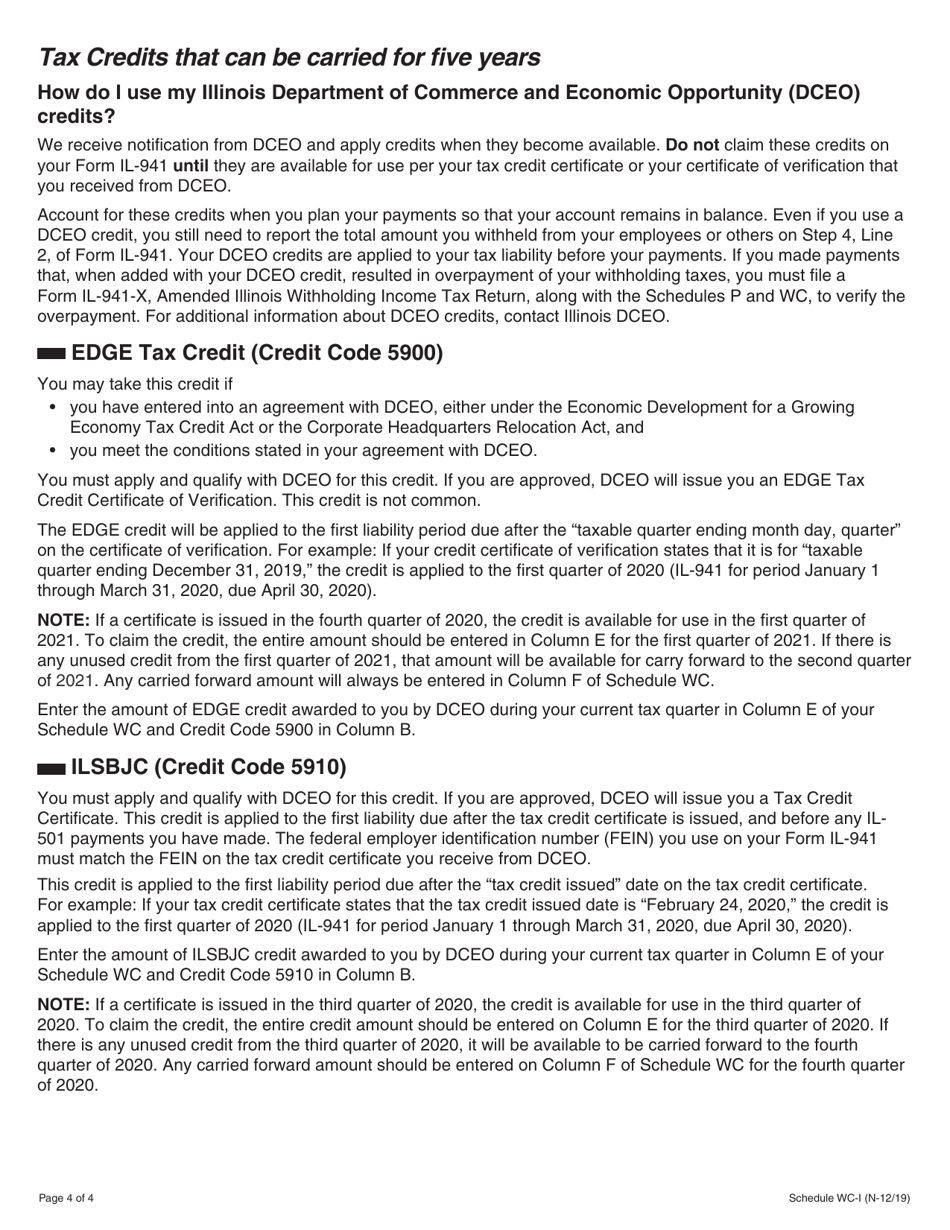

A: WC-I is used to calculate the amount of income tax credits that can be applied against the amount of tax withheld from your wages.

Q: Who should use WC-I?

A: WC-I should be used by individuals who want to claim income tax credits on their Illinois withholding.

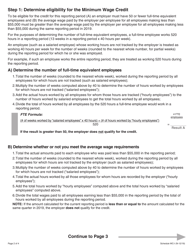

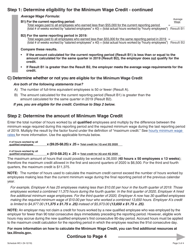

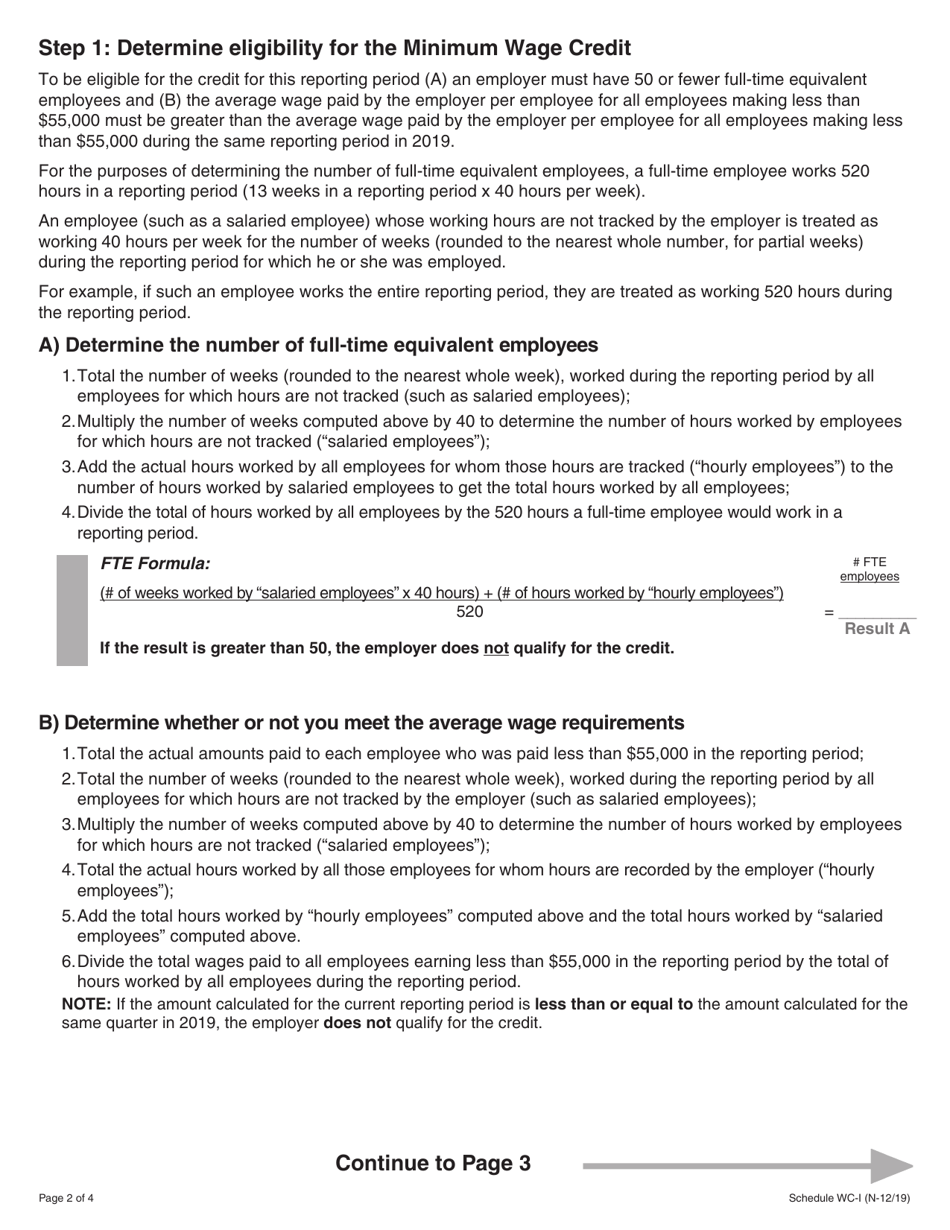

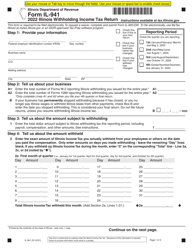

Q: What information is needed to complete WC-I?

A: You will need your personal information, total wages earned, total income tax credits, and the amount of tax withheld from your wages.

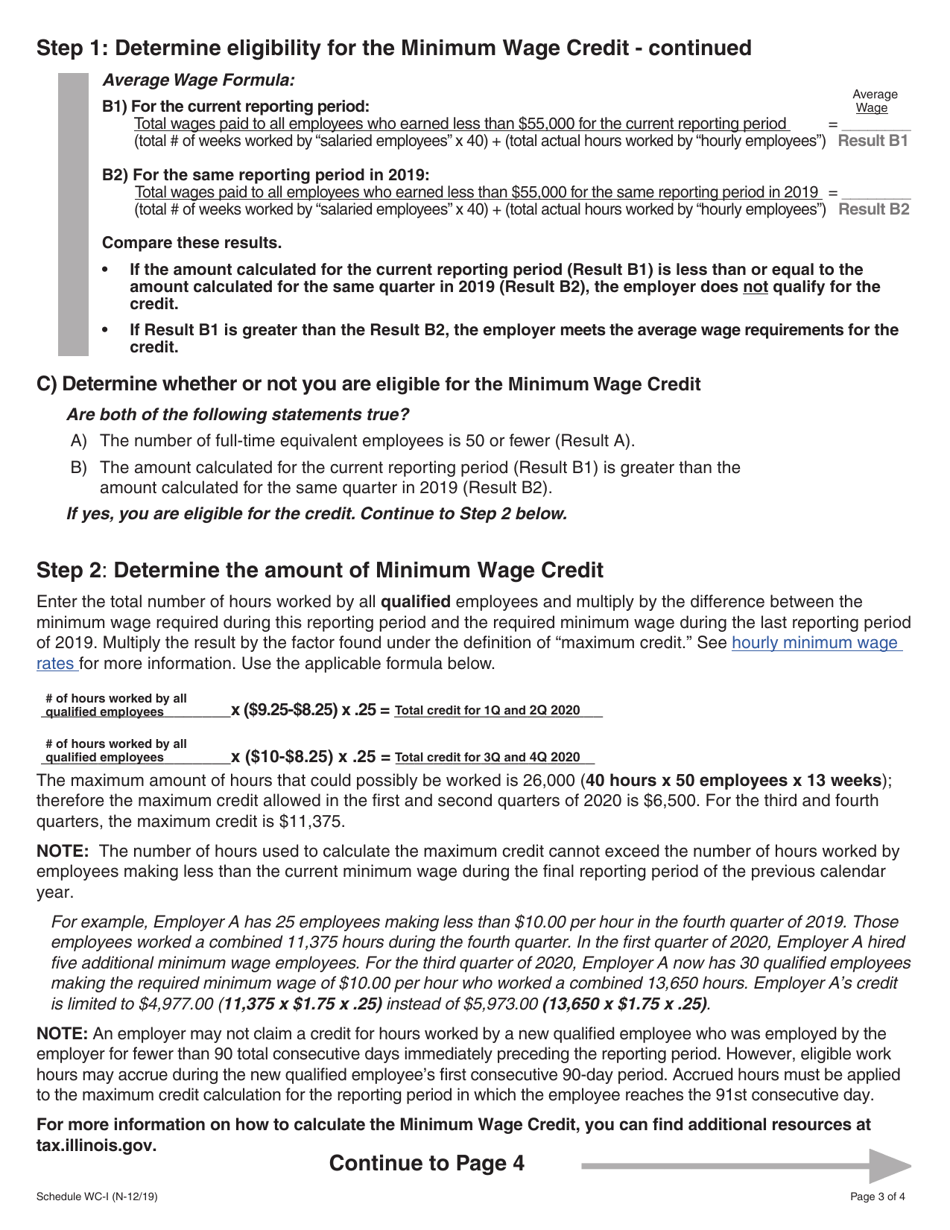

Q: How do I calculate my income tax credits?

A: You can calculate your income tax credits by referring to the instructions provided with WC-I or consulting with a tax professional.

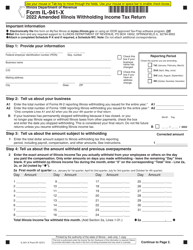

Q: Can I claim both federal and state income tax credits?

A: Yes, you can claim both federal and state income tax credits on WC-I.

Q: When is the deadline to file WC-I?

A: The deadline to file WC-I is typically the same as the deadline to file your annual state tax return.

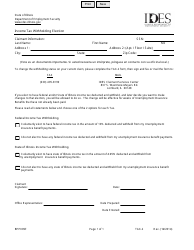

Q: What should I do with WC-I once completed?

A: You should submit WC-I to your employer or include it with your state tax return.

Q: Are there any penalties for not filing WC-I?

A: Failure to file WC-I may result in the loss of potential income tax credits.

Q: Can I amend WC-I if I made a mistake?

A: Yes, you can amend WC-I if you made a mistake. Contact the Illinois Department of Revenue for instructions on how to do so.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule WC-I by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.