This version of the form is not currently in use and is provided for reference only. Download this version of

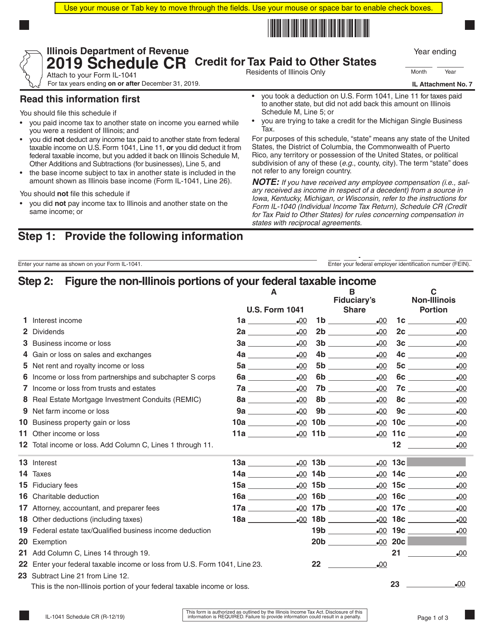

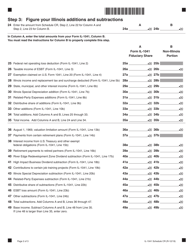

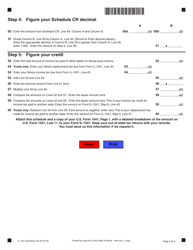

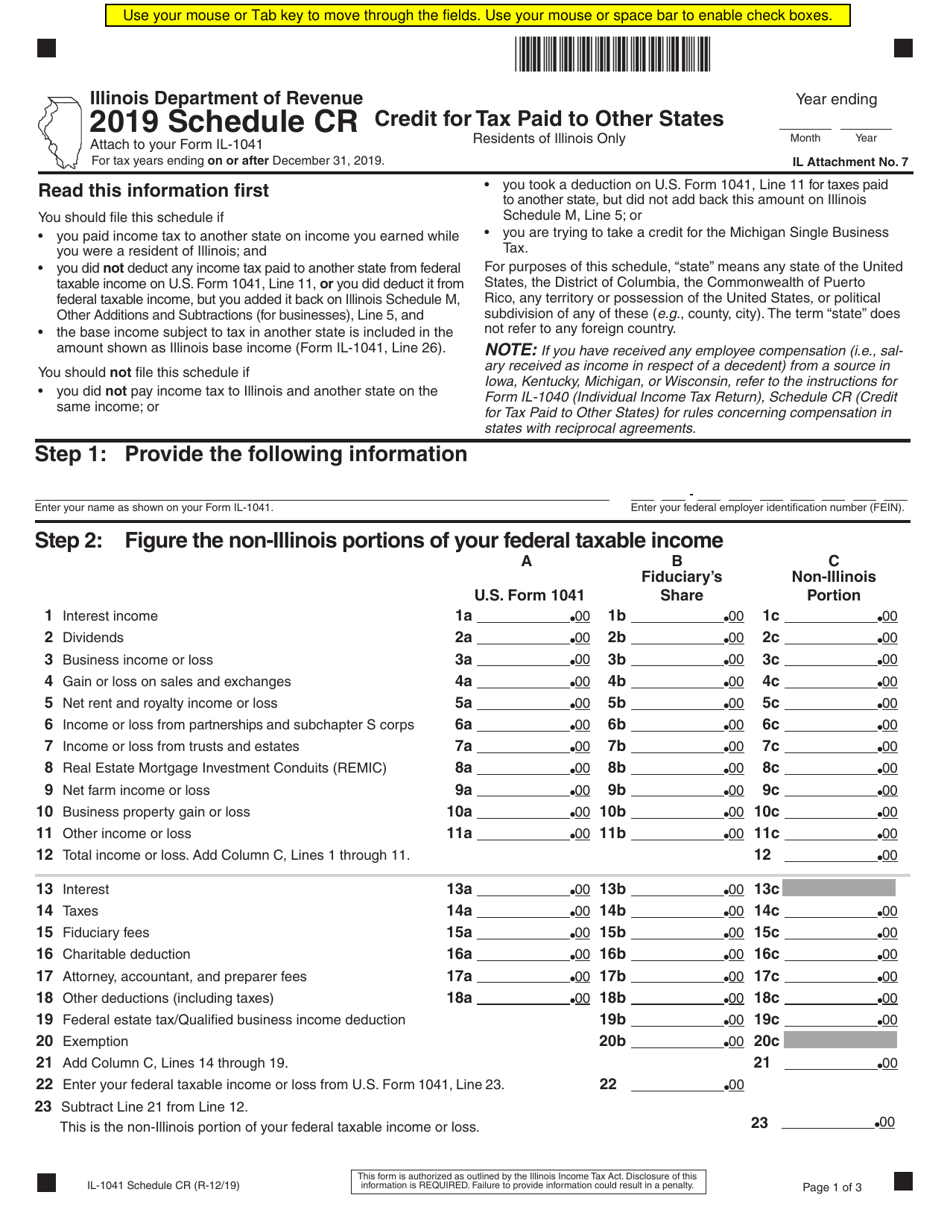

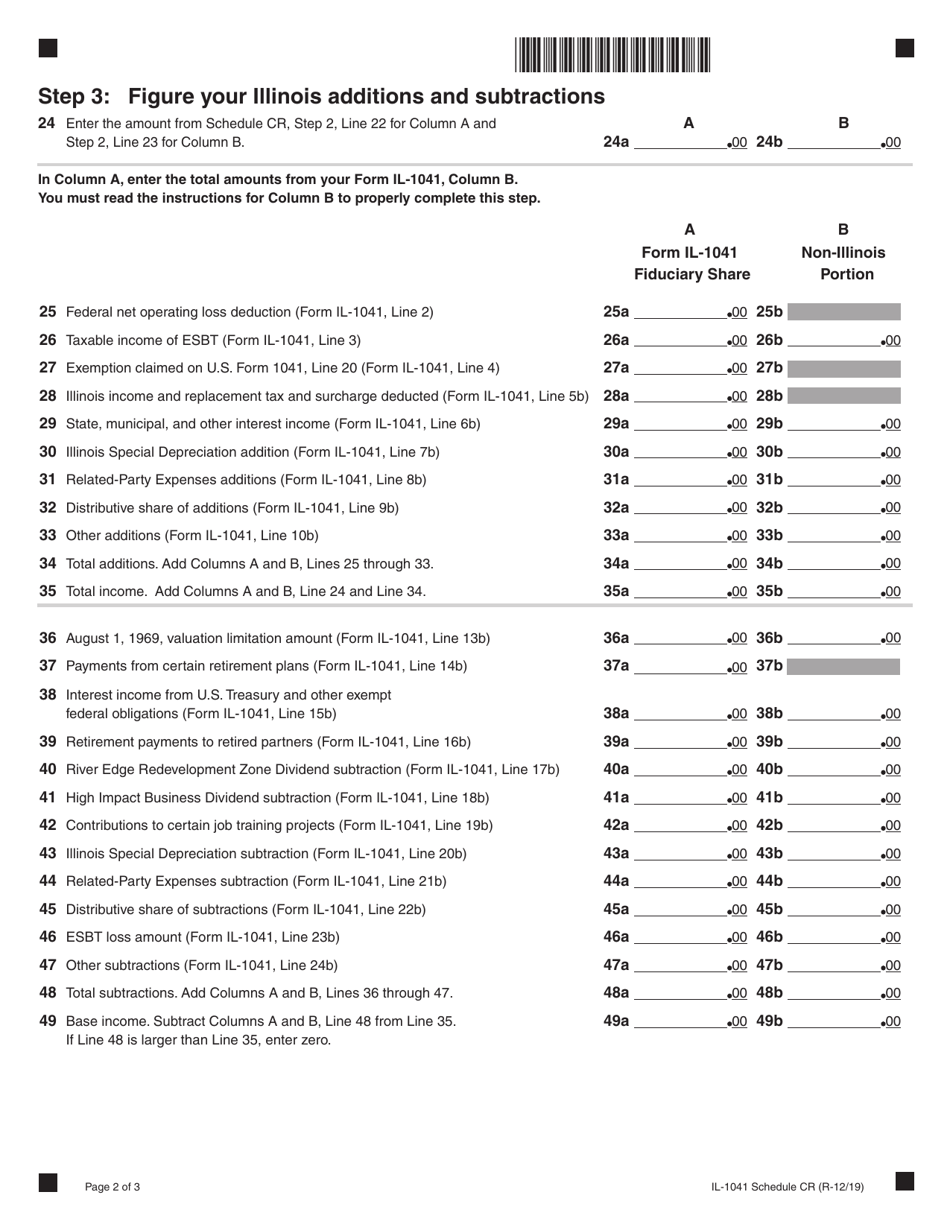

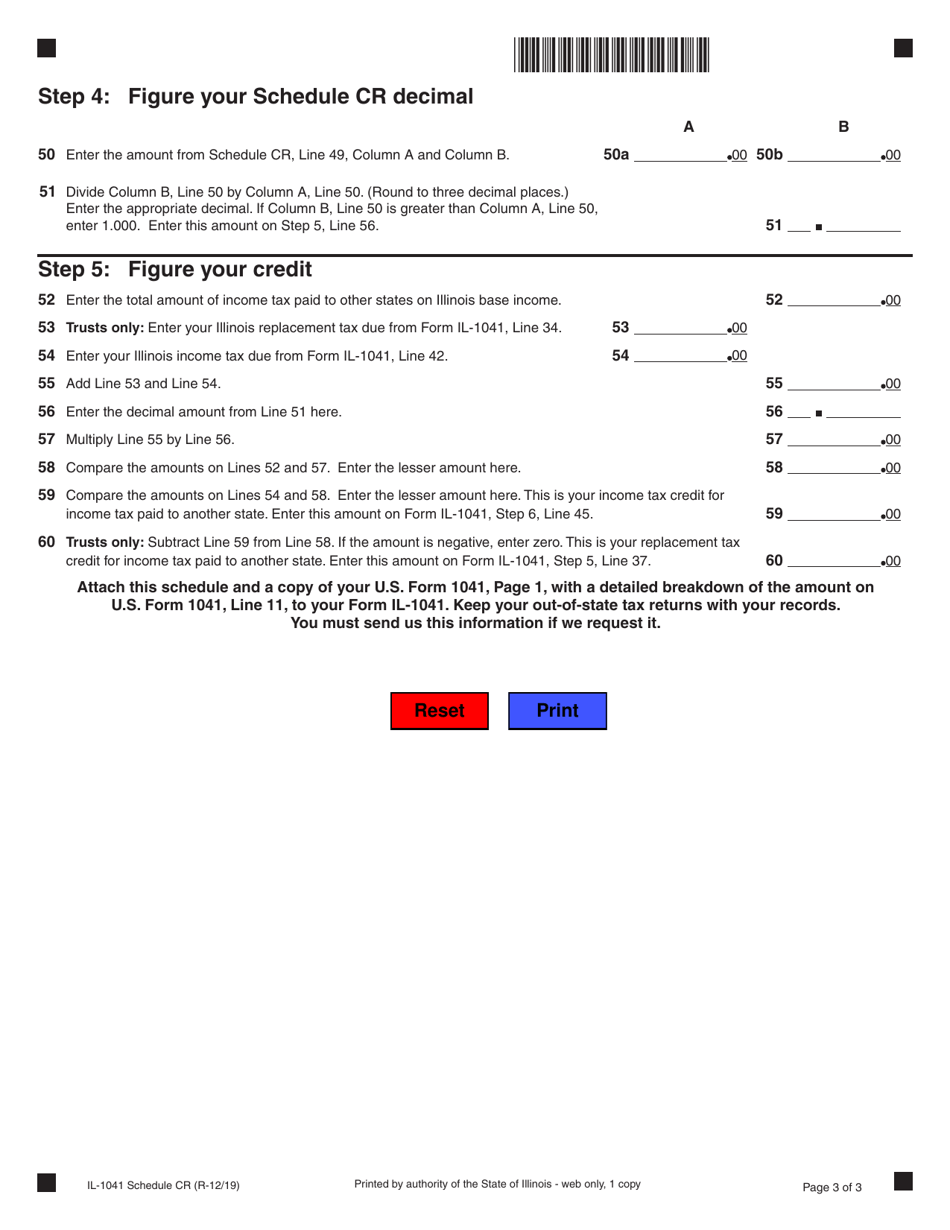

Form IL-1041 Schedule CR

for the current year.

Form IL-1041 Schedule CR Credit for Tax Paid to Other States - Illinois

What Is Form IL-1041 Schedule CR?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-1041 Schedule CR?

A: Form IL-1041 Schedule CR is a form used by residents of Illinois to claim a credit for taxes paid to other states.

Q: Who can use Form IL-1041 Schedule CR?

A: Residents of Illinois who have paid taxes to another state can use Form IL-1041 Schedule CR.

Q: What is the purpose of Form IL-1041 Schedule CR?

A: The purpose of Form IL-1041 Schedule CR is to allow residents of Illinois to avoid double taxation by claiming a credit for taxes paid to another state.

Q: What information do I need to complete Form IL-1041 Schedule CR?

A: To complete Form IL-1041 Schedule CR, you will need information about the taxes paid to another state, including the amount and the state in which they were paid.

Q: Is there a deadline for filing Form IL-1041 Schedule CR?

A: The deadline for filing Form IL-1041 Schedule CR is the same as the deadline for filing your Illinois income tax return, which is typically April 15th.

Q: Can I e-file Form IL-1041 Schedule CR?

A: Yes, you can e-file Form IL-1041 Schedule CR if you are filing your Illinois income tax return electronically.

Q: Are there any penalties for not filing Form IL-1041 Schedule CR?

A: Failure to file Form IL-1041 Schedule CR may result in the denial of the tax credit and potential penalties or interest.

Q: Can I claim a credit for taxes paid to any state on Form IL-1041 Schedule CR?

A: No, you can only claim a credit for taxes paid to another state if that state has a reciprocal agreement with Illinois.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1041 Schedule CR by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.